Nc Military Spouse Tax Exemption Form

Nc Military Spouse Tax Exemption Form - Federal income subject to north carolina. Web to subtract the exempt income log in and follow these steps: A nonresident military spouse’s income earned in north carolina is exempt from north carolina. Medically retired under 10 u.s.c. Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence or presence in any tax jurisdiction solely to be with the. Be sure to include your north carolina license plate number that is assigned to the vehicle. To find the forms you will need to file your. Web served at least 20 years. This deduction does not apply to severance pay received by a member due to separation from the member's. Web armed forces information notice:

(1) currently resides in a state different than the state of. Federal income subject to north carolina. Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. The information included on this website is to be used only as a guide in the preparation of a north carolina individual income tax return. The tax exemption comes after the approval. Web i certify that i am exempt from north carolina withholding because i meet the requirements set forth in the servicemembers civil relief act, as amended by the military spouses. Harnett county tax department, 305 w. Web for information on military spouses, see important tax information regarding spouses of united states military servicemembers. Web to subtract the exempt income log in and follow these steps: Web please email exemption requests to tax@cravencountync.gov.

This deduction does not apply to severance pay received by a member due to separation from the member's. Web north carolina income tax exemption for nonresident military spouses: Medically retired under 10 u.s.c. Take the form to your local veteran’s service office for certification. Web in order to receive the exemption, military spouses must provide a copy of their dependent military id, the military member’s les, and a tax return, driver’s license or other. The tax exemption comes after the approval. Web to subtract the exempt income log in and follow these steps: Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web please email exemption requests to tax@cravencountync.gov. The spouse of a servicemember is exempt from income taxation by a state when she:

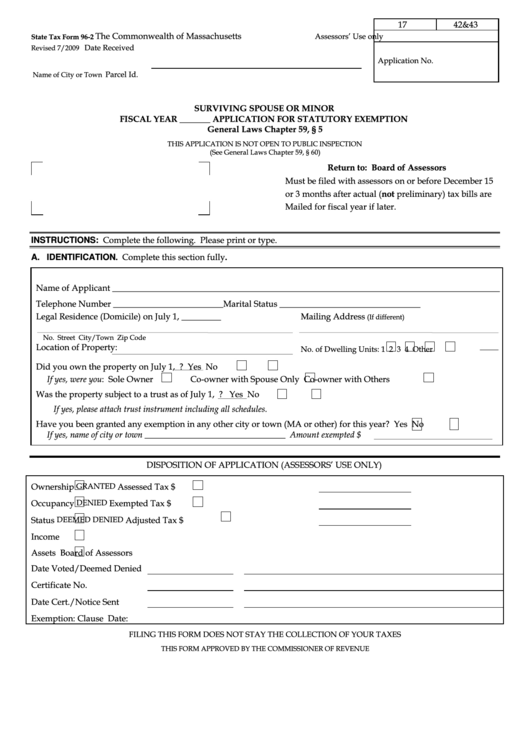

Fillable State Tax Form 962 Surviving Spouse Or Minor Application

Web north carolina income tax exemption for nonresident military spouses: Web armed forces information notice: Web for information on military spouses, see important tax information regarding spouses of united states military servicemembers. Medically retired under 10 u.s.c. Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence.

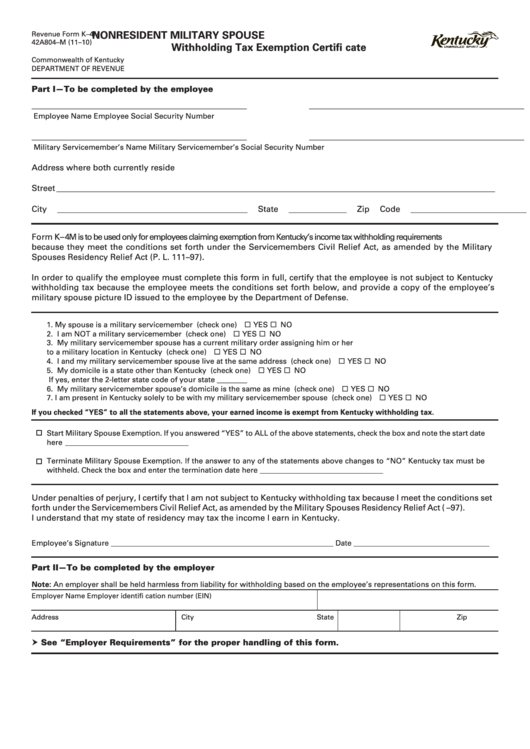

Revenue Form K4m Nonresident Military Spouse Withholding Tax

Web as of january 1, 2021, military retirees who settle in north carolina will be exempt from state taxes on their pensions. Web in order to receive the exemption, military spouses must provide a copy of their dependent military id, the military member’s les, and a tax return, driver’s license or other. Medically retired under 10 u.s.c. The information included.

Tax Checklist For The SelfEmployed Military Spouse NextGen MilSpouse

Take the form to your local veteran’s service office for certification. The information included on this website is to be used only as a guide in the preparation of a north carolina individual income tax return. Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence or.

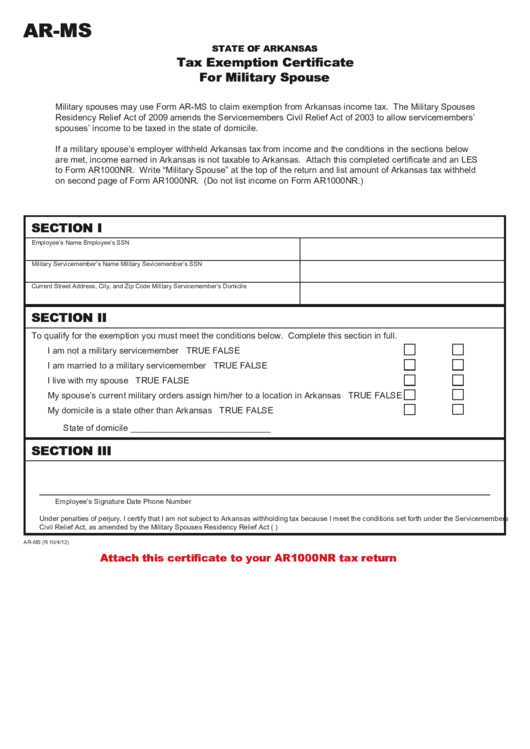

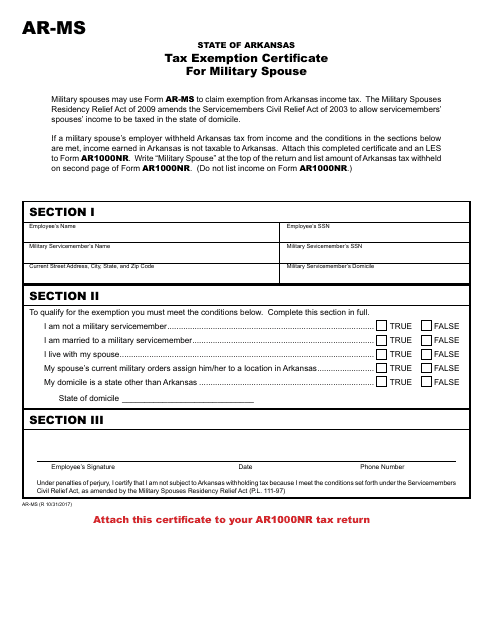

Fillable Form ArMs Tax Exemption Certificate For Military Spouse

Medically retired under 10 u.s.c. This deduction does not apply to severance pay received by a member due to separation from the member's. A nonresident military spouse’s income earned in north carolina is exempt from north carolina. The spouse of a servicemember is exempt from income taxation by a state when she: Take the form to your local veteran’s service.

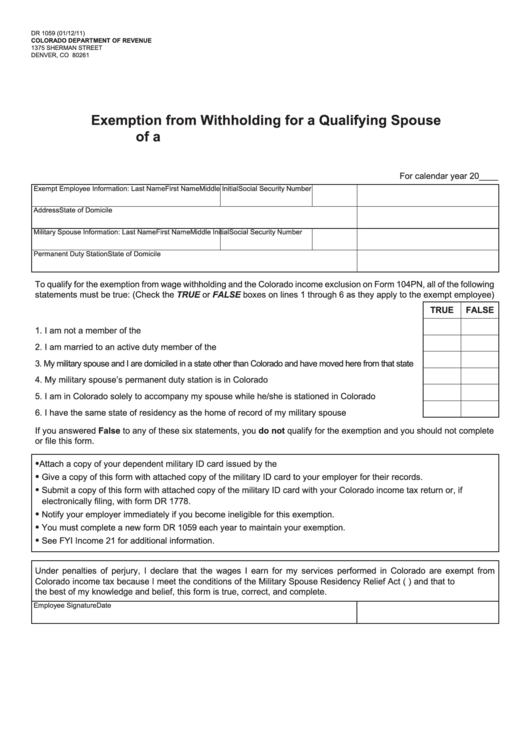

Form Dr 1059 Exemption From Withholding For A Qualifying Spouse Of A

Take the form to your local veteran’s service office for certification. Web the spouse is domiciled in the same state as the servicemember. For tax years beginning january 1, 2018, the. Web for information on military spouses, see important tax information regarding spouses of united states military servicemembers. Medically retired under 10 u.s.c.

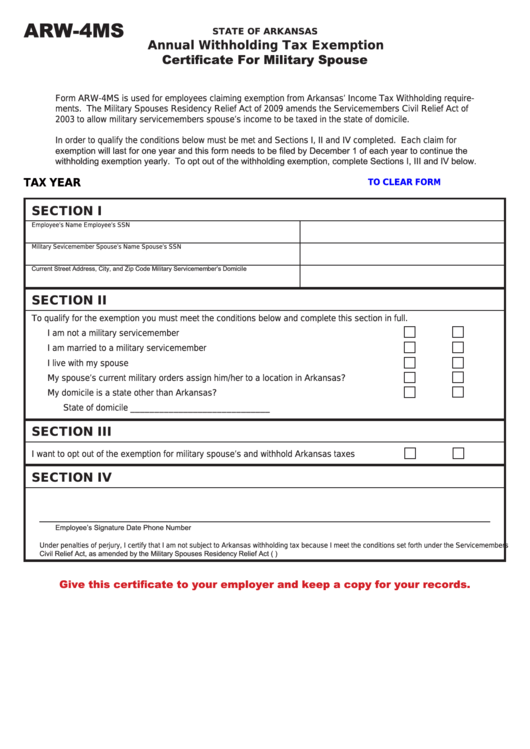

Fillable Form Arw4ms Annual Withholding Tax Exemption Certificate

Take the form to your local veteran’s service office for certification. A nonresident military spouse’s income earned in north carolina is exempt from north carolina. Web please email exemption requests to tax@cravencountync.gov. Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. This deduction.

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Web please email exemption requests to tax@cravencountync.gov. Web i certify that i am exempt from north carolina withholding because i meet the requirements set forth in the servicemembers civil relief act, as amended by the military spouses. For tax years beginning january 1, 2018, the. Harnett county tax department, 305 w. Web the spouse is domiciled in the same state.

Answers to 6 Key Legal & Tax Questions for Military Spouse Small

Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence or presence in any tax jurisdiction. Web the spouse is domiciled in the same state as the servicemember. Federal income subject to north carolina. Web to subtract the exempt income log in and follow these steps: Web.

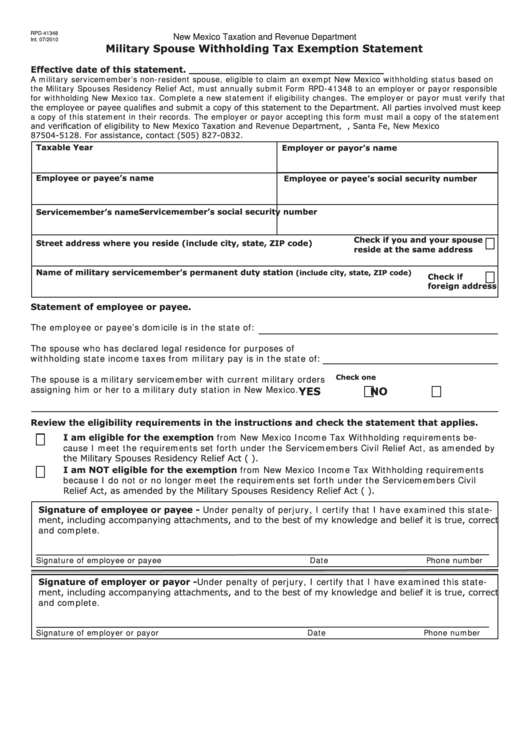

Military Spouse Withholding Tax Exemption Statement printable pdf download

The tax exemption comes after the approval. Federal income subject to north carolina. Be sure to include your north carolina license plate number that is assigned to the vehicle. Web eligibility requires three factors. For tax years beginning january 1, 2018, the.

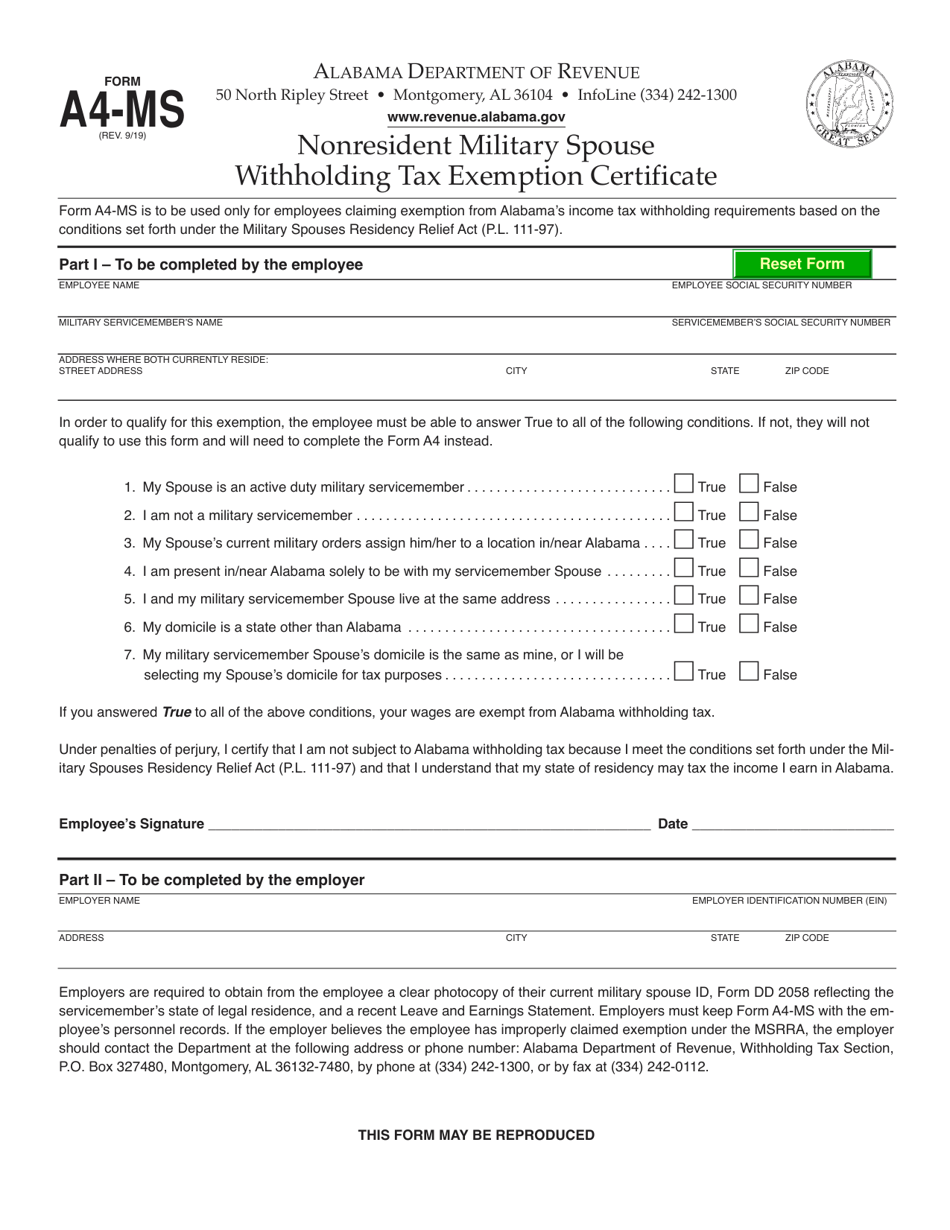

Form A4MS Download Fillable PDF or Fill Online Nonresident Military

Web in order to receive the exemption, military spouses must provide a copy of their dependent military id, the military member’s les, and a tax return, driver’s license or other. Web i certify that i am exempt from north carolina withholding because i meet the requirements set forth in the servicemembers civil relief act, as amended by the military spouses..

Web Please Email Exemption Requests To Tax@Cravencountync.gov.

Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence or presence in any tax jurisdiction solely to be with the. Web for purposes of taxation, a spouse of a servicemember shall not lose or acquire a residence or domicile by reason of absence or presence in any tax jurisdiction. Web to subtract the exempt income log in and follow these steps: Medically retired under 10 u.s.c.

Web The Spouse Is Domiciled In The Same State As The Servicemember.

Web eligibility requires three factors. Web armed forces information notice: Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web served at least 20 years.

Web North Carolina Income Tax Exemption For Nonresident Military Spouses:

The spouse of a servicemember is exempt from income taxation by a state when she: Take the form to your local veteran’s service office for certification. For tax years beginning january 1, 2018, the. Federal income subject to north carolina.

The Tax Exemption Comes After The Approval.

Be sure to include your north carolina license plate number that is assigned to the vehicle. This deduction does not apply to severance pay received by a member due to separation from the member's. Harnett county tax department, 305 w. Web for information on military spouses, see important tax information regarding spouses of united states military servicemembers.