Montana State Tax Form

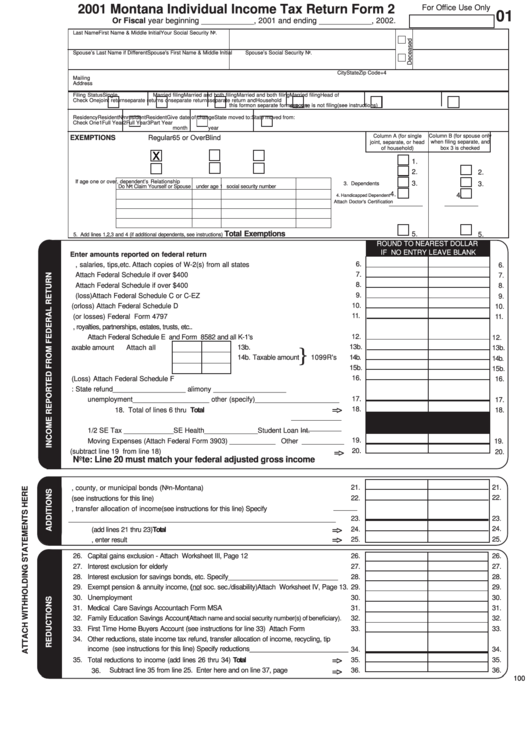

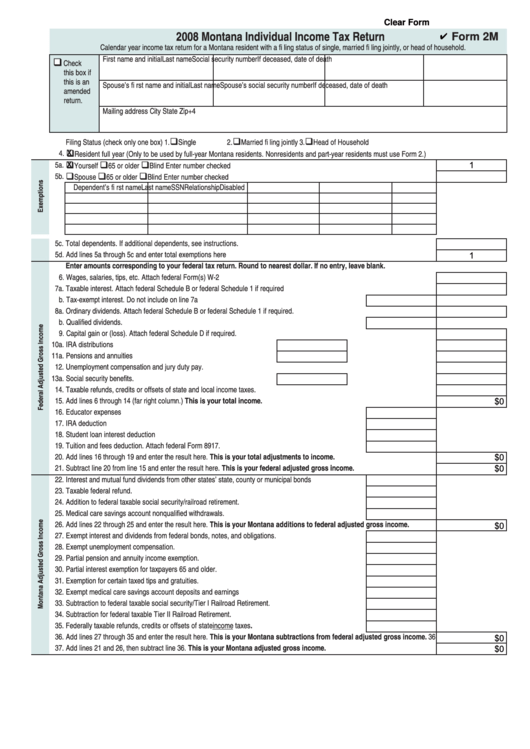

Montana State Tax Form - These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web montana has a state income tax that ranges between 1% and 6.9%, which is administered by the montana department of revenue. Detailed efile.com service overview start federal and montana tax returns prepare only a mt state return without an irs return. Javascript must be enabled for this page. Web printable montana tax forms for 2022 are available for download below on this page. The department says the income tax number used for its rebate calculations is the number on line 20 of its 2021 montana individual income tax return form. Web montana individual income tax resources the department of revenue works hard to ensure we process everyone’s return as securely and quickly as possible. Web montana individual income tax return (form 2) 2021 montana individual income tax return (form 2) 2020 montana individual income tax return (form 2) 2019 montana individual income tax return (form 2) 2018 montana individual income tax return (form 2) 2017 montana individual income tax return (form 2) 2016 montana. Be sure to verify that the form you are downloading is for the correct year. Web written authorization must be provided in order for us to provide access to the third party.

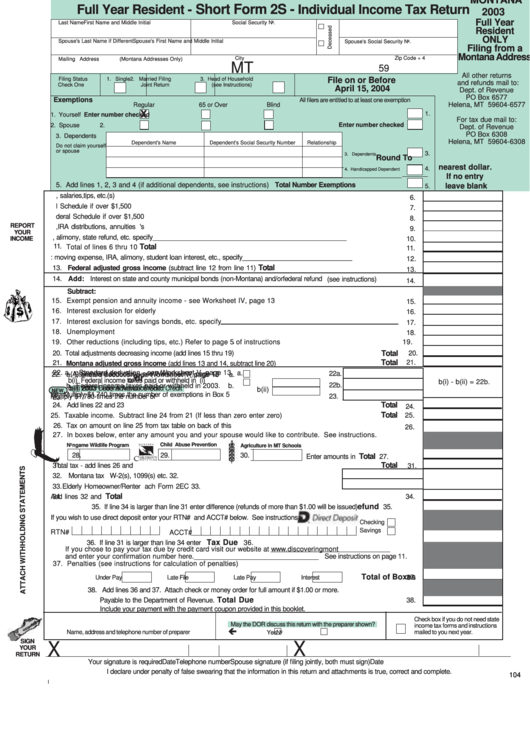

Web function description montana state income tax rate: Web montana individual income tax resources the department of revenue works hard to ensure we process everyone’s return as securely and quickly as possible. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Prepare, efile mt + irs tax return: This form includes spaces to report income from various sources, such as wages, salaries, dividends, and capital gains. Javascript must be enabled for this page. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web montana has a state income tax that ranges between 1% and 6.9%, which is administered by the montana department of revenue. Unfortunately, it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

This form includes spaces to report income from various sources, such as wages, salaries, dividends, and capital gains. These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web function description montana state income tax rate: The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. Web printable montana tax forms for 2022 are available for download below on this page. 6.9% estimate your mt income taxes now compare other state income tax rates. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Prepare, efile mt + irs tax return: Web form 2 is the montana individual income tax return form used by residents of montana to report their income earned during the tax year.

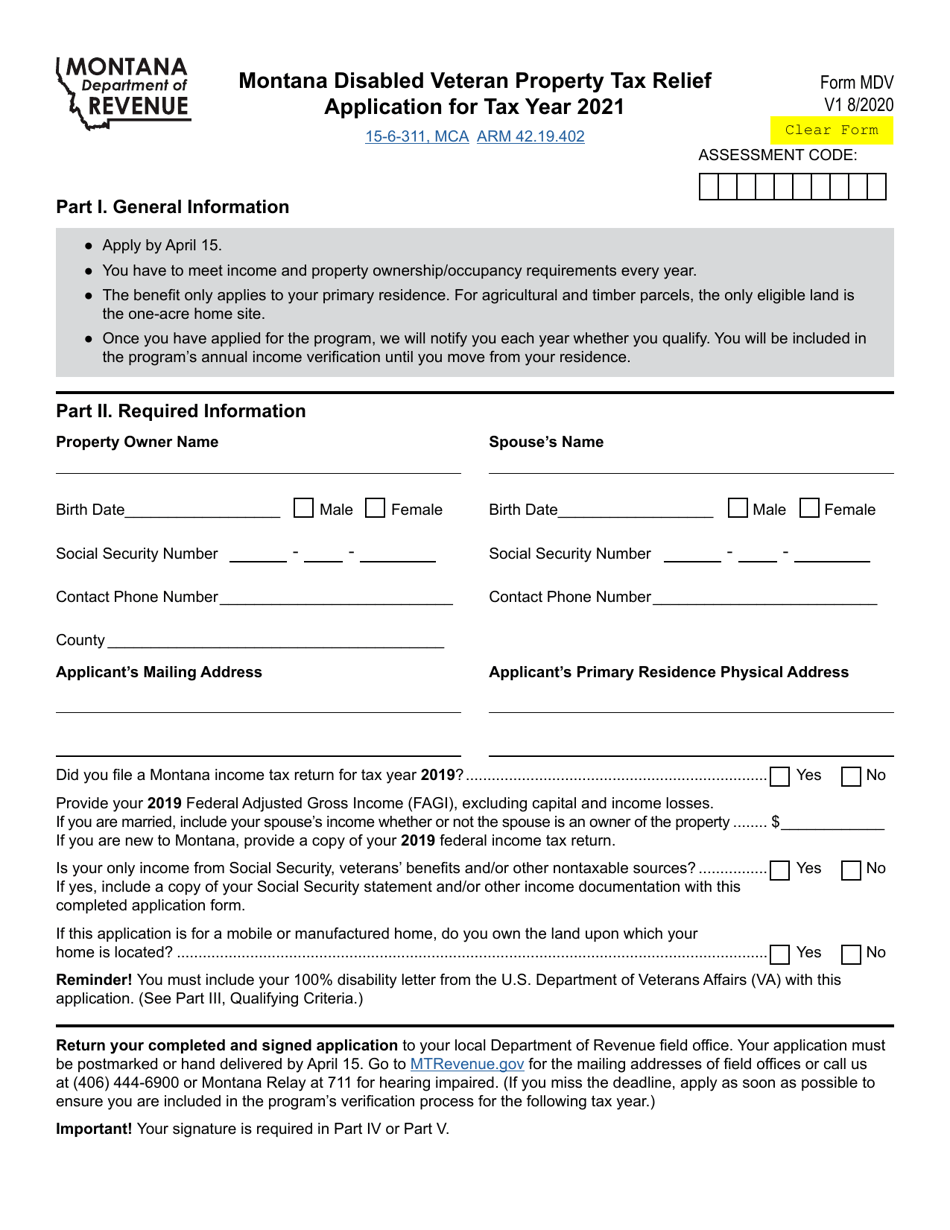

Form MDV Download Fillable PDF or Fill Online Montana Disabled Veteran

Javascript must be enabled for this page. 6.9% estimate your mt income taxes now compare other state income tax rates. Web function description montana state income tax rate: The department says the income tax number used for its rebate calculations is the number on line 20 of its 2021 montana individual income tax return form. Web printable montana tax forms.

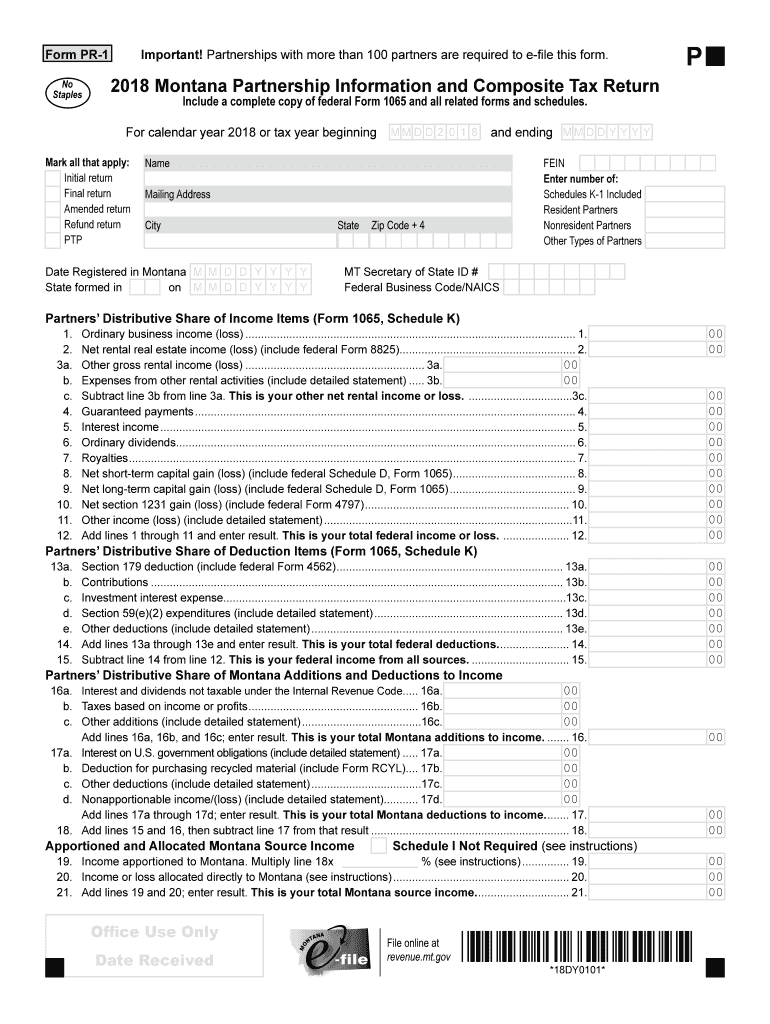

20182022 Form MT PR1 Fill Online, Printable, Fillable, Blank pdfFiller

The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Web montana individual income tax resources the department of revenue works hard to ensure we process everyone’s return as securely and quickly as possible. These are the official pdf.

Montana State Taxes Tax Types in Montana Property, Corporate

6.9% estimate your mt income taxes now compare other state income tax rates. These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web function description montana state income tax rate: Taxformfinder provides printable pdf copies of 79 current montana income tax forms. The pdf file format allows you.

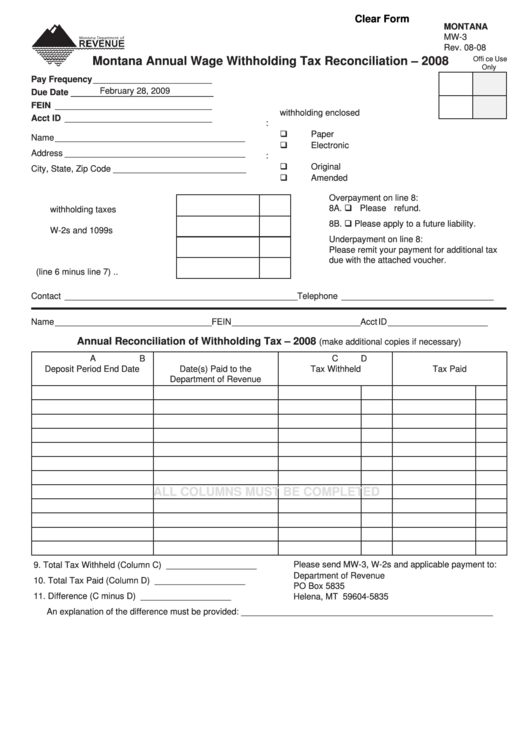

Fillable Form Mw3 Montana Annual Wage Withholding Tax Reconciliation

6.9% estimate your mt income taxes now compare other state income tax rates. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Complete and sign the third party authorization form and return it through upload into ui eservices for employers or to the ui contributions bureau. These are the official pdf files published by the montana department.

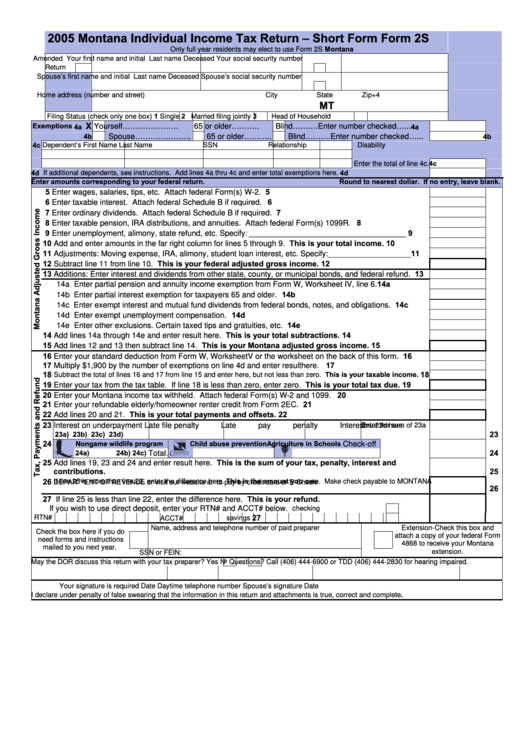

Fillable Form 2s Montana Individual Tax Return Short Form

Javascript must be enabled for this page. Web form 2 is the montana individual income tax return form used by residents of montana to report their income earned during the tax year. The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. This form includes spaces to report income from various.

Form 2 Montana Individual Tax Return 2001 printable pdf download

The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. Web printable montana tax forms for 2022 are available for download below on this page. Web written authorization must be provided in order for us to provide access to the third party. Be sure to verify that the form you are.

Montana Short Form 2s Individual Tax Return Full Year Resident

These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web written authorization must be provided in order for us to provide access to the third party. The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. The current tax.

2019 Montana PassThrough Entity Tax Return (Form PTE Fill and

The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web montana has a state income tax that ranges between 1% and 6.9%, which is administered by the montana department.

Fillable Form 2m 2008 Montana Individual Tax Return printable

These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Detailed efile.com service overview start federal and montana tax returns prepare only a mt state return without an irs return. Unfortunately, it can take up to 90 days to issue your refund and we may need to ask you.

Montana Form Clt4s Montana Small Business Corporation Tax Return

The department says the income tax number used for its rebate calculations is the number on line 20 of its 2021 montana individual income tax return form. This form includes spaces to report income from various sources, such as wages, salaries, dividends, and capital gains. The pdf file format allows you to safely print, fill in, and mail in your.

Prepare, Efile Mt + Irs Tax Return:

Taxformfinder provides printable pdf copies of 79 current montana income tax forms. Web montana individual income tax return (form 2) 2021 montana individual income tax return (form 2) 2020 montana individual income tax return (form 2) 2019 montana individual income tax return (form 2) 2018 montana individual income tax return (form 2) 2017 montana individual income tax return (form 2) 2016 montana. The pdf file format allows you to safely print, fill in, and mail in your 2022 montana tax forms. Web montana has a state income tax that ranges between 1% and 6.9%, which is administered by the montana department of revenue.

The Department Says The Income Tax Number Used For Its Rebate Calculations Is The Number On Line 20 Of Its 2021 Montana Individual Income Tax Return Form.

Web function description montana state income tax rate: Be sure to verify that the form you are downloading is for the correct year. Web form 2 is the montana individual income tax return form used by residents of montana to report their income earned during the tax year. Web printable montana tax forms for 2022 are available for download below on this page.

Detailed Efile.com Service Overview Start Federal And Montana Tax Returns Prepare Only A Mt State Return Without An Irs Return.

Keep in mind that some states will not update their tax forms for 2023 until january 2024. This form includes spaces to report income from various sources, such as wages, salaries, dividends, and capital gains. Unfortunately, it can take up to 90 days to issue your refund and we may need to ask you to verify your return. Montanalawhelp.org | free legal forms, info, and legal help in montana.

Web Written Authorization Must Be Provided In Order For Us To Provide Access To The Third Party.

These are the official pdf files published by the montana department of revenue, we do not alter them in any way. Web montana individual income tax resources the department of revenue works hard to ensure we process everyone’s return as securely and quickly as possible. Complete and sign the third party authorization form and return it through upload into ui eservices for employers or to the ui contributions bureau. 6.9% estimate your mt income taxes now compare other state income tax rates.