Mo Gas Tax Refund Form

Mo Gas Tax Refund Form - Web number of gallons purchased and charged missouri fuel tax, as a separate item. Web motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between oct. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. The request for mail order forms may be used to order one copy or. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Drivers can claim a refund on last year's $0.025 gas tax increase. For additional information about the fuel tax refunds visit the missouri department of revenue. The increases were approved in senate.

Following the gas tax increase in october, missouri’s motor fuel tax rate. If you are hoping to cash in on the missouri gas tax. Check out our pick for best. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web a refund claim form is expected be available on the department’s website prior to july 1. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement.

Web file a motor fuel consumer refund for highway use claim using excel upload you may also upload your motor fuel consumer refund highway use claim as an excel. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web number of gallons purchased and charged missouri fuel tax, as a separate item. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or. However, the receipts from fueling stations. Web 9 rows resources forms and manuals find your form to search, type a keyword in. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for. The request for mail order forms may be used to order one copy or. There is a way for missourians to get a refund by. Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item.

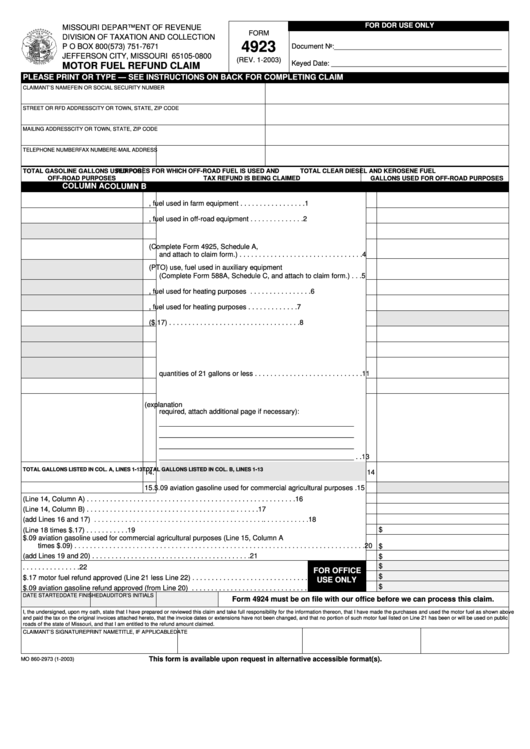

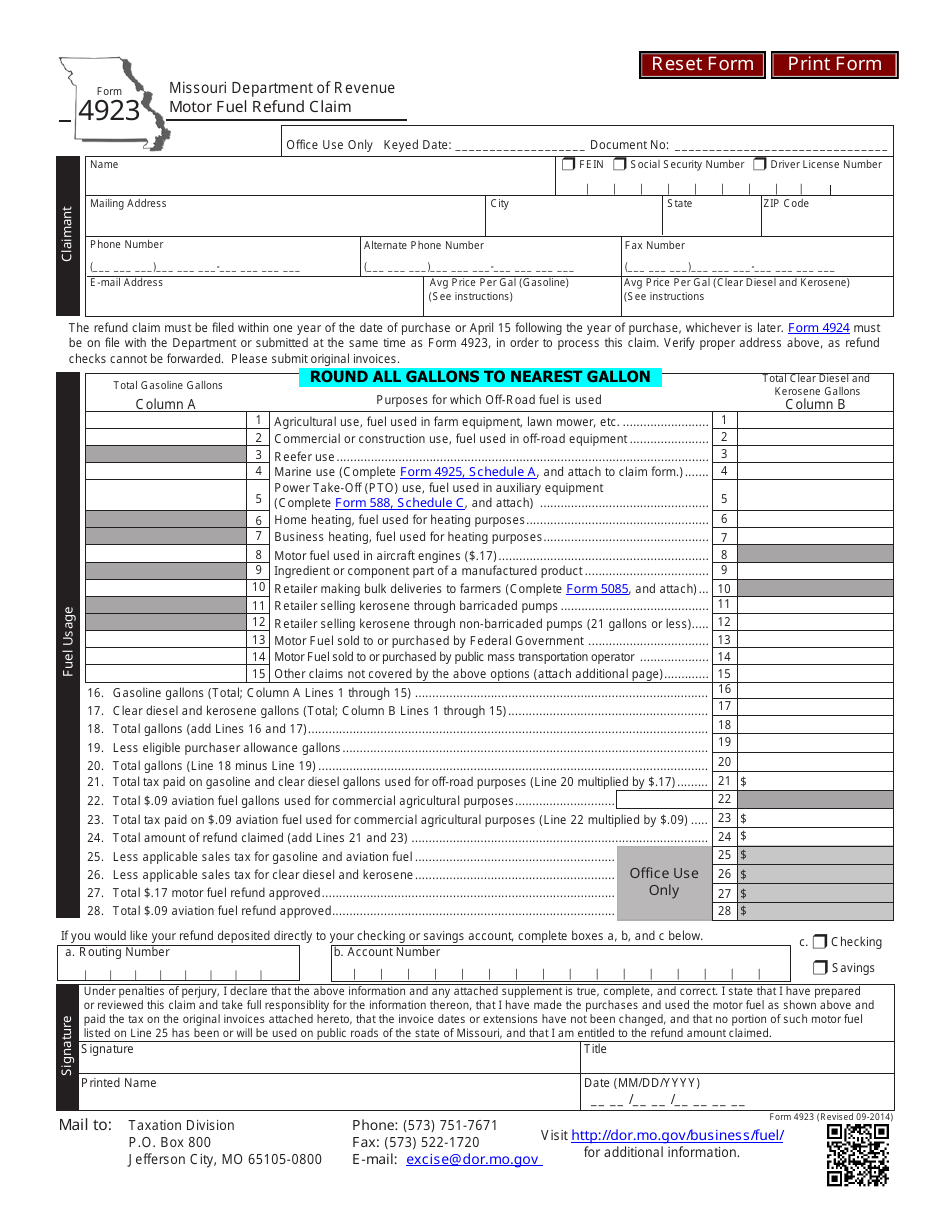

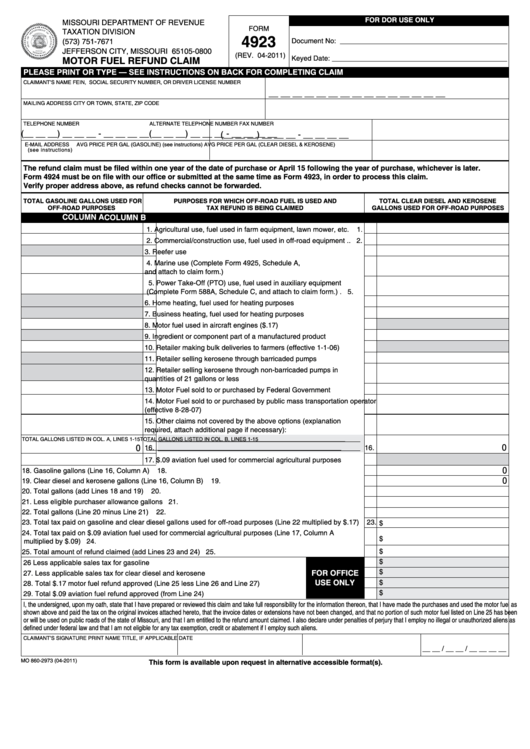

Fillable Form 4923 Motor Fuel Refund Claim Missouri Department Of

Bulletins & faqs rate increase motor fuel transport. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for. For additional information about the fuel tax refunds visit the missouri department of revenue. The request for mail order forms may be.

Military Journal Missouri 500 Tax Refund If the total amount of

The request for mail order forms may be used to order one copy or. 26, 2022 at 2:44 am pdt springfield, mo. Following the gas tax increase in october, missouri’s motor fuel tax rate. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each.

Fillable Form 4923 Motor Fuel Refund Claim printable pdf download

Web key points missouri residents are now paying a higher gas tax. If you are hoping to cash in on the missouri gas tax. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. Web the.

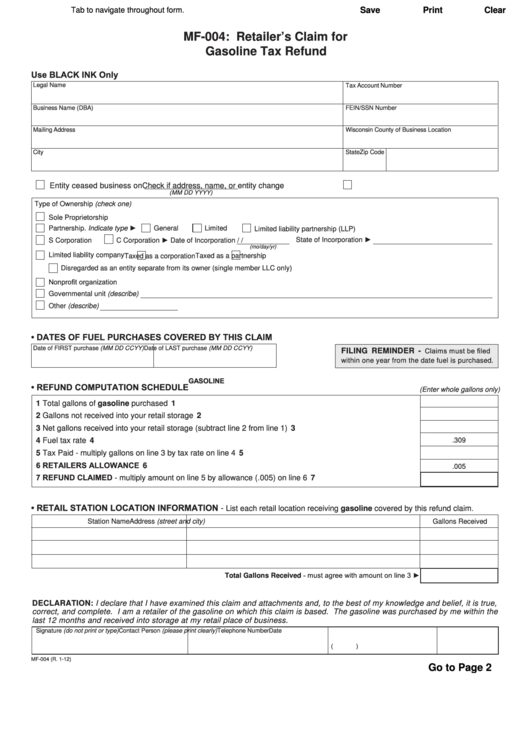

Fillable Form Mf004 Retailers Claim For Gasoline Tax Refund

Claims must be postmarked between july 1 and. Web form 588a should be completed for motor fuel purchased before october 1, 2021. There is a way for missourians to get a refund by. Refund claims can be submitted from july 1, 2022, to sept. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect,.

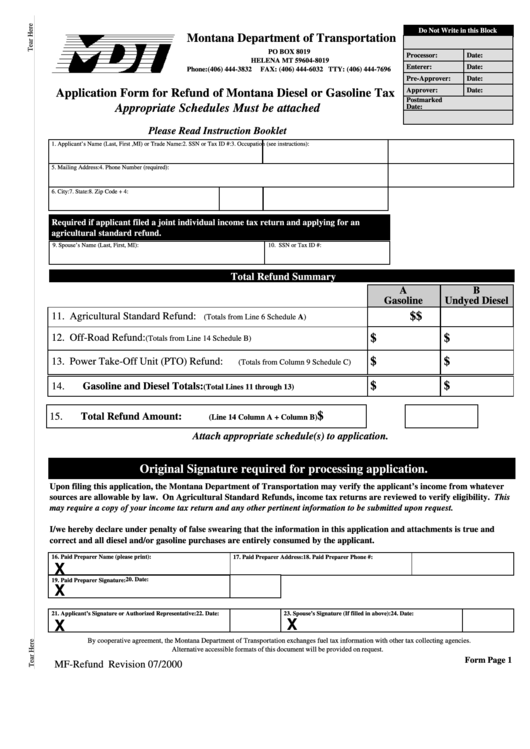

Application Form For Refund Of Montana Diesel Or Gasoline Tax Form

Bulletins & faqs rate increase motor fuel transport. Refund claims can be submitted from july 1, 2022, to sept. Following the gas tax increase in october, missouri’s motor fuel tax rate. Web form 588a should be completed for motor fuel purchased before october 1, 2021. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax.

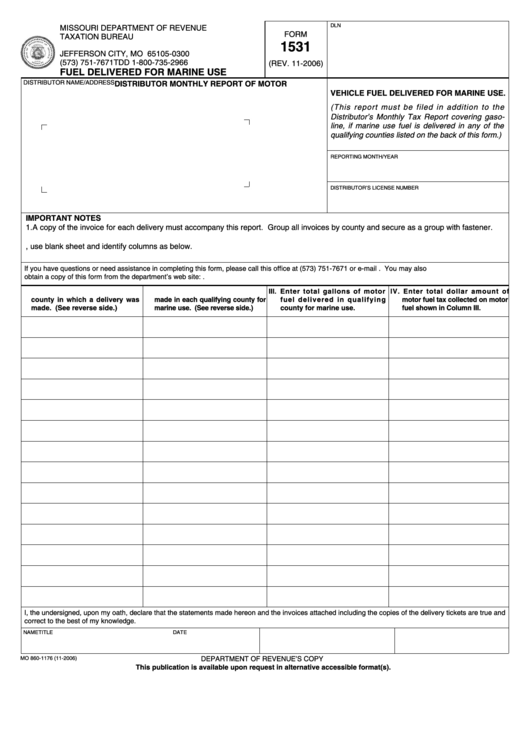

Fillable Form 1531 Missouri Department Of Revenue Taxation Bureau

Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. 26, 2022 at 2:44 am pdt springfield, mo. Web sep 26, 2022 friday will be the last day to submit receipts to collect gas tax refunds in missouri. Web key points missouri residents are.

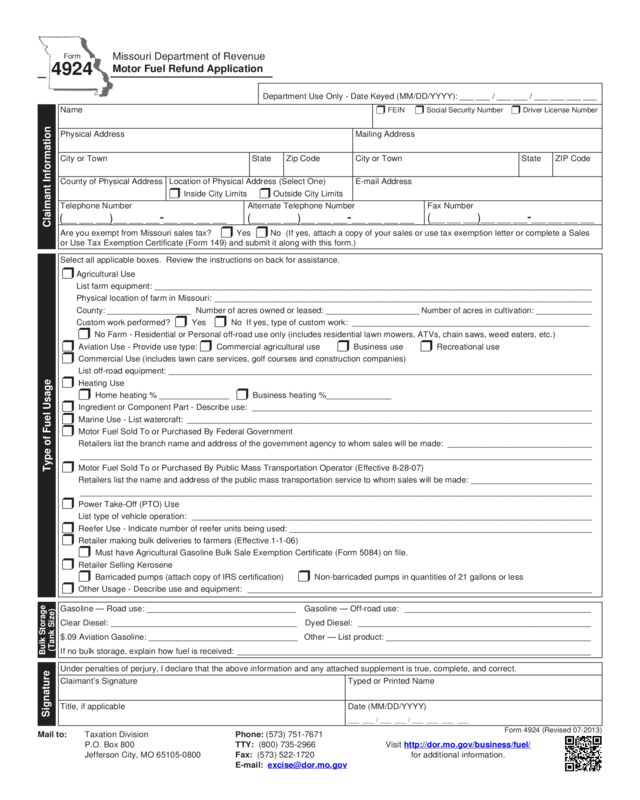

Form 4924 Motor Fuel Refund Application Edit, Fill, Sign Online

Web click here for the missouri fuel tax refund claim form. Web a refund claim form is expected be available on the department’s website prior to july 1. Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item. Web sep 26, 2022 friday will be.

missouri gas tax refund spreadsheet Unperformed LogBook Diaporama

Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for. Bulletins & faqs rate increase.

20152022 Form MO DoR MOMWP Fill Online, Printable, Fillable, Blank

Web motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between oct. Check out our pick for best. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. Claims must be postmarked between july 1 and. However,.

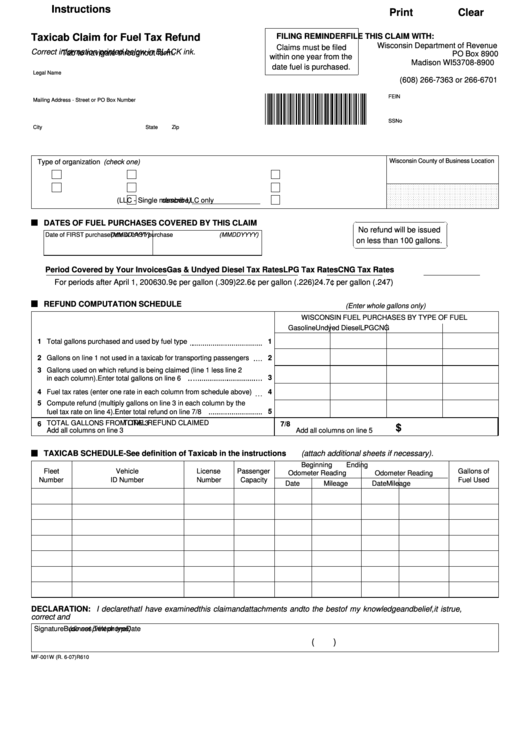

Fillable Form Mf001w Taxicab Claim For Fuel Tax Refund printable pdf

Web click here for the missouri fuel tax refund claim form. Drivers can claim a refund on last year's $0.025 gas tax increase. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between.

Web According To The Legislation, Missourians Seeking An Exemption And Refund For The Fuel Tax Are Required To Provide The Missouri Department Of Revenue A Statement.

Web a refund claim form is expected be available on the department’s website prior to july 1. Check out our pick for best. Bulletins & faqs rate increase motor fuel transport. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025.

Web Key Points Missouri Residents Are Now Paying A Higher Gas Tax.

Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item. Web 9 rows resources forms and manuals find your form to search, type a keyword in. Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. In october 2021, missouri's motor fuel tax rose to 19.5 cents per.

Web Use This Form To File A Refund Claim For The Missouri Motor Fuel Tax Increase(S) Paid Beginning October 1, 2021, Through June 30, 2022, For Motor Fuel Used For On Road.

Web the department’s motor fuel tax refund claim forms require the amount of missouri motor fuel tax paid to be listed as a separate item. Web number of gallons purchased and charged missouri fuel tax, as a separate item. 26, 2022 at 2:44 am pdt springfield, mo. However, the receipts from fueling stations.

Web Since The Gas Tax Was Increased In October From 17 Cents To 19.5, This Year People Will Be Able To Claim 2.5 Cents On Each Gallon Of Gas Bought In Missouri Over The.

Web form 588a should be completed for motor fuel purchased before october 1, 2021. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. The increases were approved in senate. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or.