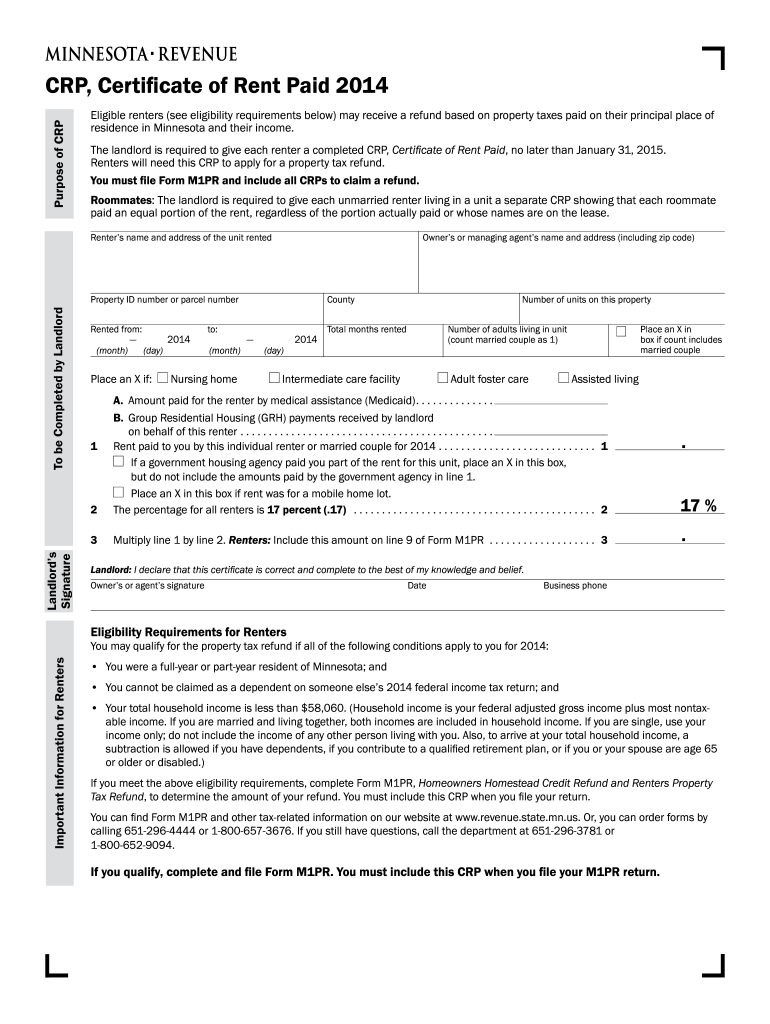

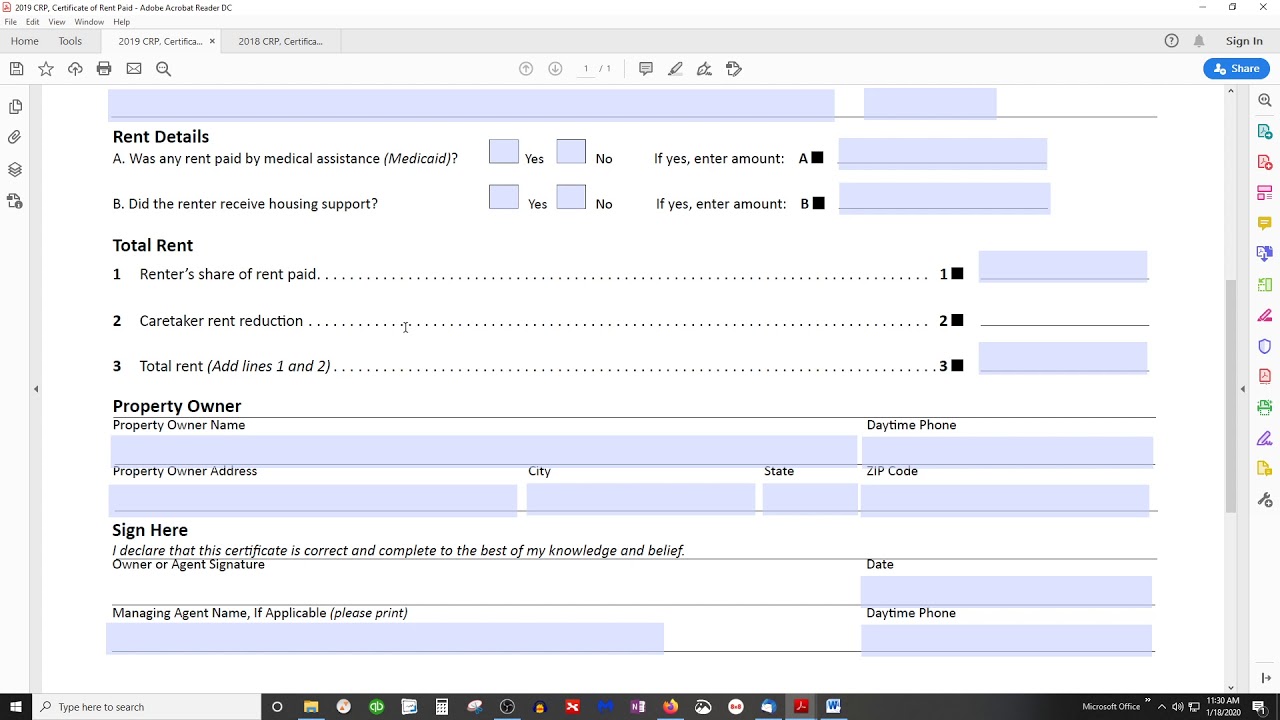

Mn Crp Form 2022

Mn Crp Form 2022 - Start completing the fillable fields and. It is due august 15, 2022. Web • create your own crps. Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord. Do i need to issue crps? We last updated minnesota form crp instructions in february 2023 from the minnesota department of revenue. Web *225211* 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund:. Web the 2022 general crp signup runs from jan. Try it for free now! Upload, modify or create forms.

If you own or manage property and rent living space to someone, you must issue crps to your. Upload, modify or create forms. Into the search box to learn how to create your own crps. If you own, use your property tax statement. If you own rental property and rent livable space, you or your managing agent must issue a crp each and. Web • if you want to file by regular mail, fill out the form, attach the crp if you rent, and send it. Assuming you are referring to the certificate of rent paid (crp), this entry would appear in the state tax return section. Minnesota property tax refund st. Web march 6, 2023 4:50 pm. Go to www.revenue.state.mn.us and type.

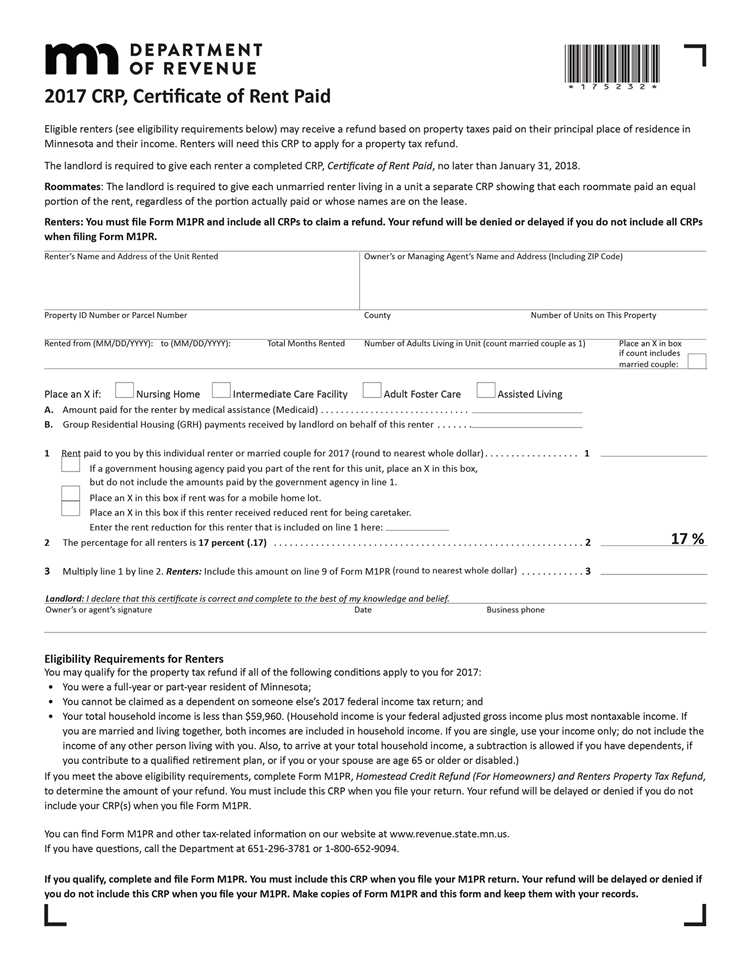

A portion of your rent is used to pay property taxes. You may qualify for a renter's property tax refund depending on your income and rent paid. Do i need to issue crps? Web if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2023. Web a managing agent acts on behalf of the property owner. If you own or manage a rental property and rent living space to someone, you must provide a crp to each renter if either of these. Your landlord is required to. Use get form or simply click on the template preview to open it in the editor. Upload, modify or create forms. Start completing the fillable fields and.

Renter's Property Tax Refund Minnesota Department Of Revenue Fill Out

Upload, modify or create forms. Download this form print this form more. If you own or manage property and rent living space to someone, you must issue crps to your. Web the 2022 general crp signup runs from jan. Get the tax form called the 2022.

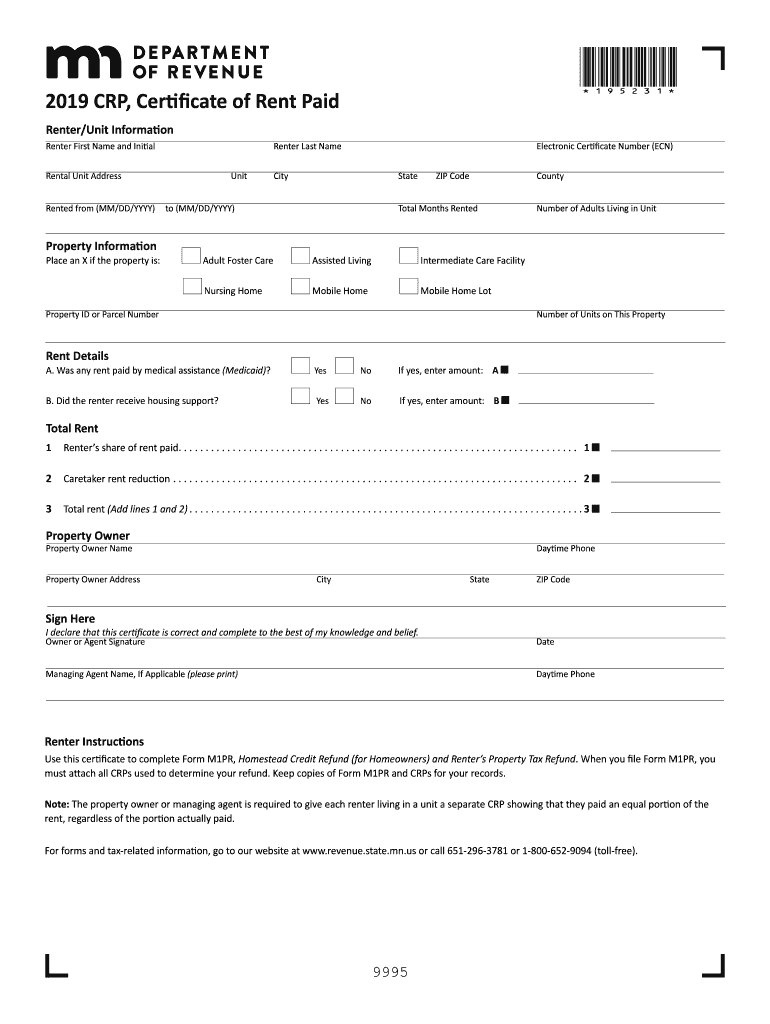

2019 Crp Form Fill Out and Sign Printable PDF Template signNow

Try it for free now! Use get form or simply click on the template preview to open it in the editor. Web the 2022 general crp signup runs from jan. Web the 2022 version of crp gen is now available. If you own or manage a rental property and rent living space to someone, you must provide a crp to.

MN CRP Form How To Write A Certificate of Rent Paid

Web *225211* 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund:. Start completing the fillable fields and. 31, 2022 to march 11, 2022, and the 2022 grassland crp signup runs from april 4, 2022 to may 13, 2022. You may qualify for a renter's property tax refund.

2019 MN CRP Forms Are Due By Jan 31, 2020 YouTube

Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord. Assuming you are referring to the certificate of rent paid (crp), this entry would appear in the state tax return section. As a minnesota landlord, managing agent or nursing home administrator, the minnesota department.

Fill Free fillable Minnesota Department of Revenue PDF forms

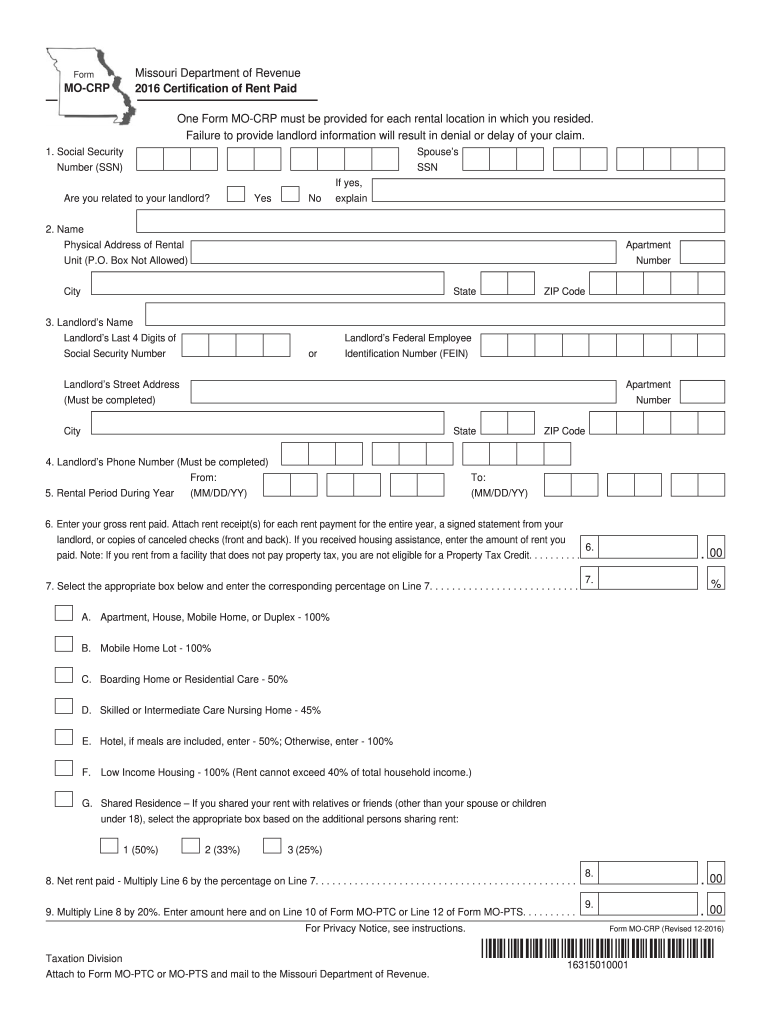

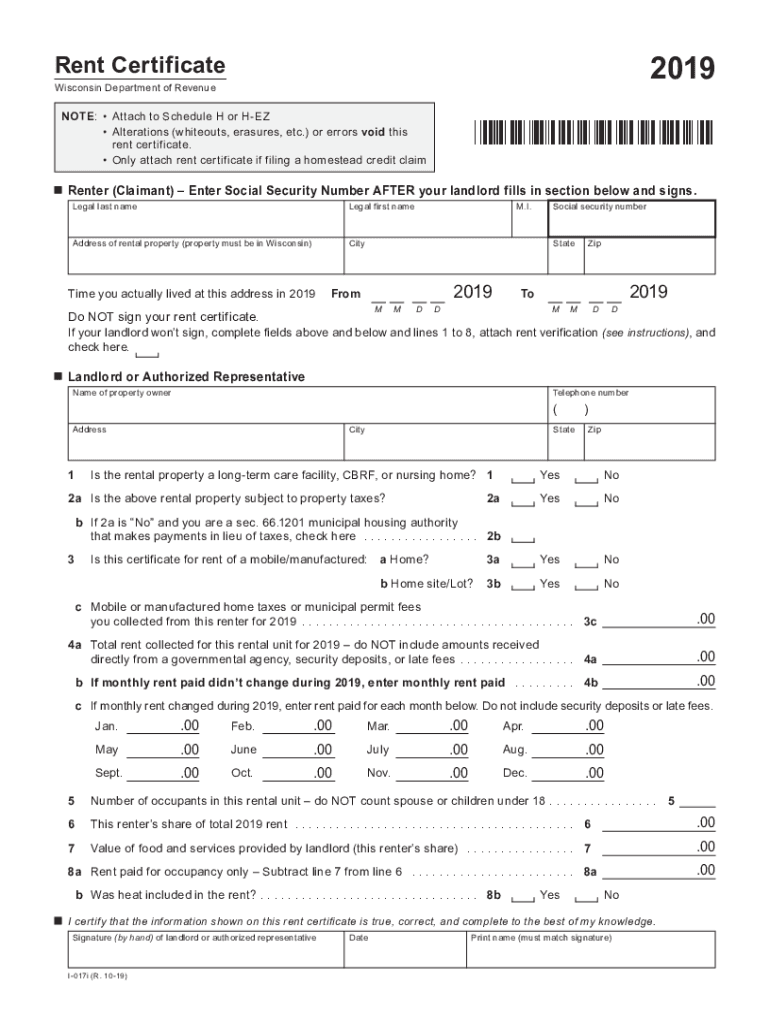

If you own, use your property tax statement. Web certificate of rent paid file formats | minnesota department of revenue certificate of rent paid file formats you can bulk upload certificate of rent paid (crp). Web what is the crp minnesota & what is it for? A certificate of rent paid, also known as the crp form, is a document.

WI I017i 2019 Fill and Sign Printable Template Online US Legal Forms

Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord. Web a managing agent acts on behalf of the property owner. Start completing the fillable fields and. Ad download or email mn crp form & more fillable forms, register and subscribe now! Save or.

2021 Rent Certificate Form Fillable Printable Pdf Forms Handypdf Porn

We last updated minnesota form crp instructions in february 2023 from the minnesota department of revenue. Web the 2022 version of crp gen is now available. If you own or manage a rental property and rent living space to someone, you must provide a crp to each renter if either of these. Your landlord is required to. Web what is.

Crp forms for 2018 Fill out & sign online DocHub

Web what is the crp minnesota & what is it for? You must send samples to the. Do i need to issue crps? You may qualify for a renter's property tax refund depending on your income and rent paid. Web renter’s property tax refund.

Fillable Form Crp Certificate Of Rent Paid 2013 Printable Pdf Download

Your landlord is required to. Try it for free now! Web • create your own crps. Do i need to issue crps? Web the 2022 general crp signup runs from jan.

Fill Free fillable Minnesota Department of Revenue PDF forms

As a minnesota landlord, managing agent or nursing home administrator, the minnesota department of revenue requires that you. Easily fill out pdf blank, edit, and sign them. We last updated minnesota form crp instructions in february 2023 from the minnesota department of revenue. Ad download or email mn crp form & more fillable forms, register and subscribe now! Your landlord.

If You Own Or Manage A Rental Property And Rent Living Space To Someone, You Must Provide A Crp To Each Renter If Either Of These.

Do i need to issue crps? A certificate of rent paid, also known as the crp form, is a document that residential landlords are required to. Assuming you are referring to the certificate of rent paid (crp), this entry would appear in the state tax return section. Easily fill out pdf blank, edit, and sign them.

Download This Form Print This Form More.

We last updated minnesota form crp instructions in february 2023 from the minnesota department of revenue. You must send samples to the. If you own rental property and rent livable space, you or your managing agent must issue a crp each and. Web • if you want to file by regular mail, fill out the form, attach the crp if you rent, and send it.

If You Own Or Manage Property And Rent Living Space To Someone, You Must Issue Crps To Your.

Web certificate of rent paid file formats | minnesota department of revenue certificate of rent paid file formats you can bulk upload certificate of rent paid (crp). Save or instantly send your ready documents. Web this is the minnesota certificate of rent paid (crp). Get the tax form called the 2022.

A Portion Of Your Rent Is Used To Pay Property Taxes.

Upload, modify or create forms. Web a managing agent acts on behalf of the property owner. Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord. If you own, use your property tax statement.