Missouri Rent Rebate Form 2022

Missouri Rent Rebate Form 2022 - Multiply line 8 by 20%. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Not state the complete law. For privacy notice, see instructions. *22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. This information is for guidance only and does. Where to submit your claim. Department use only (mm/dd/yy) tenant’s name.

Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. Web 2022 property tax credit claim print in black ink only and do not staple. Department use only (mm/dd/yy) tenant’s name. Rental period during year from: Web april 10, 2022 by fredrick. Where to submit your claim. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year When to file a claim. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy.

Web verification of rent paid. Not state the complete law. A 2019 claim must be filed by july 15, 2023, or a refund will not be issued. Web 2022 certification of rent paid. Web april 10, 2022 by fredrick. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Where to submit your claim. You must provide the contact information for the individual filing this return. Multiply line 8 by 20%. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit.

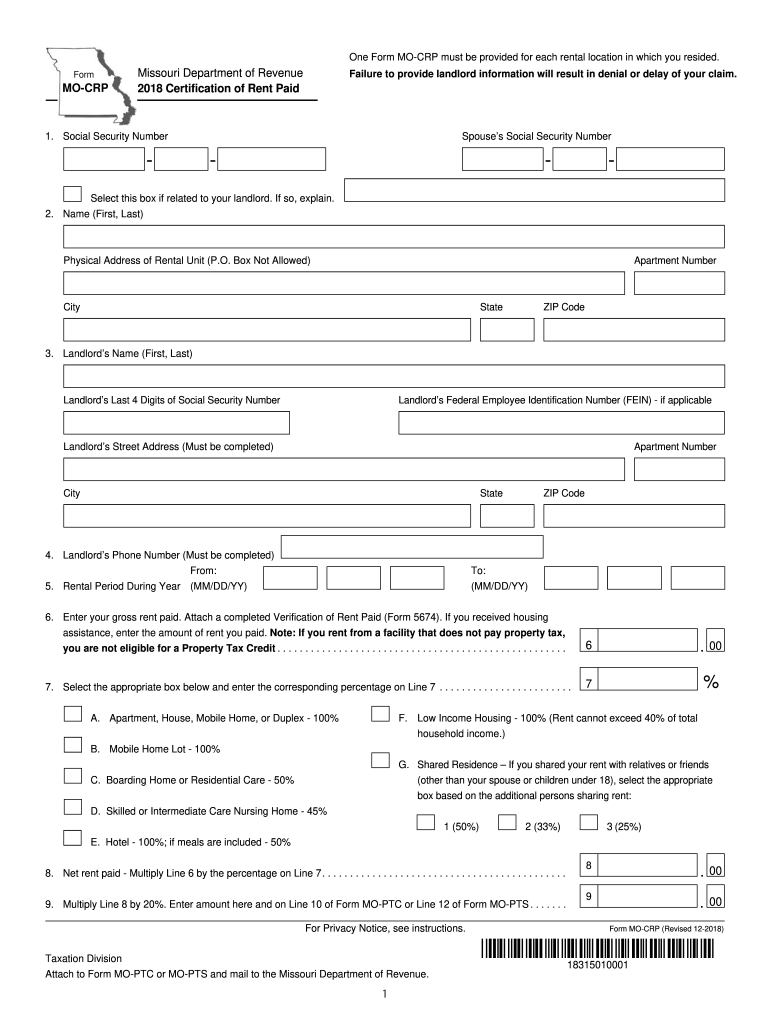

2018 Form MO MOCRP Fill Online, Printable, Fillable, Blank pdfFiller

*22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. Web certain individuals.

What do i need to do to get my missouri renters rebate back

The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Rental period during year from: For privacy notice, see instructions. *22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: You must provide the contact information for the individual filing this return.

FREE 7+ Sample Rent Rebate Forms in PDF

Where to submit your claim. A 2019 claim must be filed by july 15, 2023, or a refund will not be issued. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. Web 2022 certification of rent paid. Date and still receive your credit.

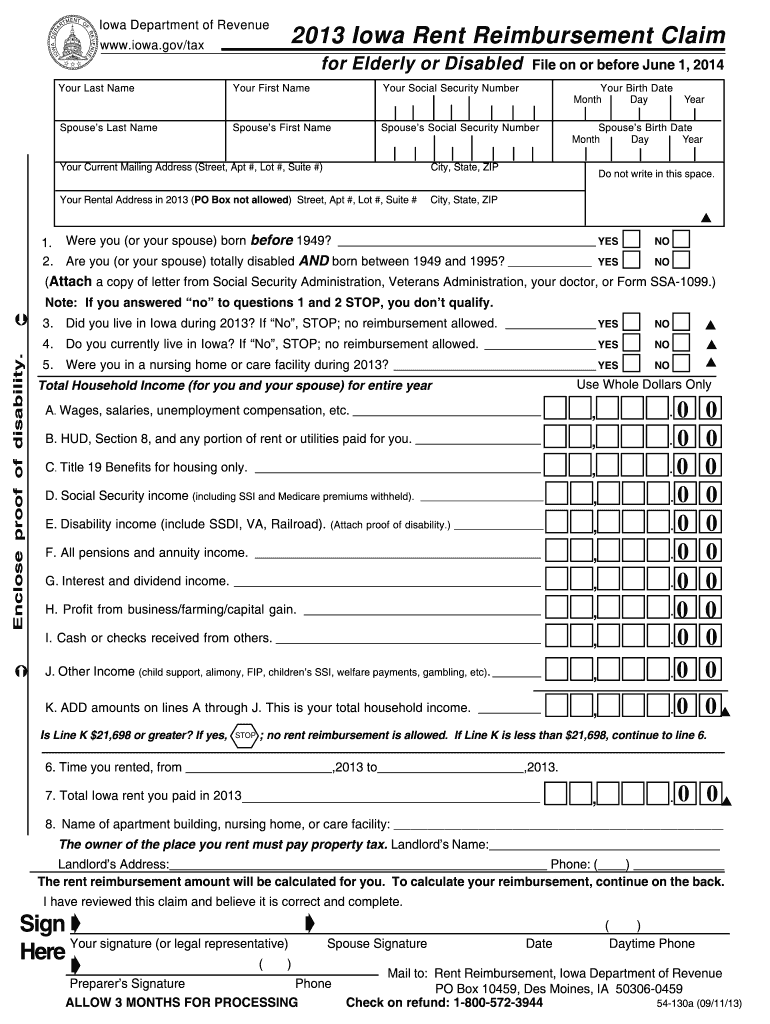

Rent Reimbursement Forms Fill Out and Sign Printable PDF Template

Date and still receive your credit. Landlord must complete this form each year. For privacy notice, see instructions. Where to submit your claim. Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750.

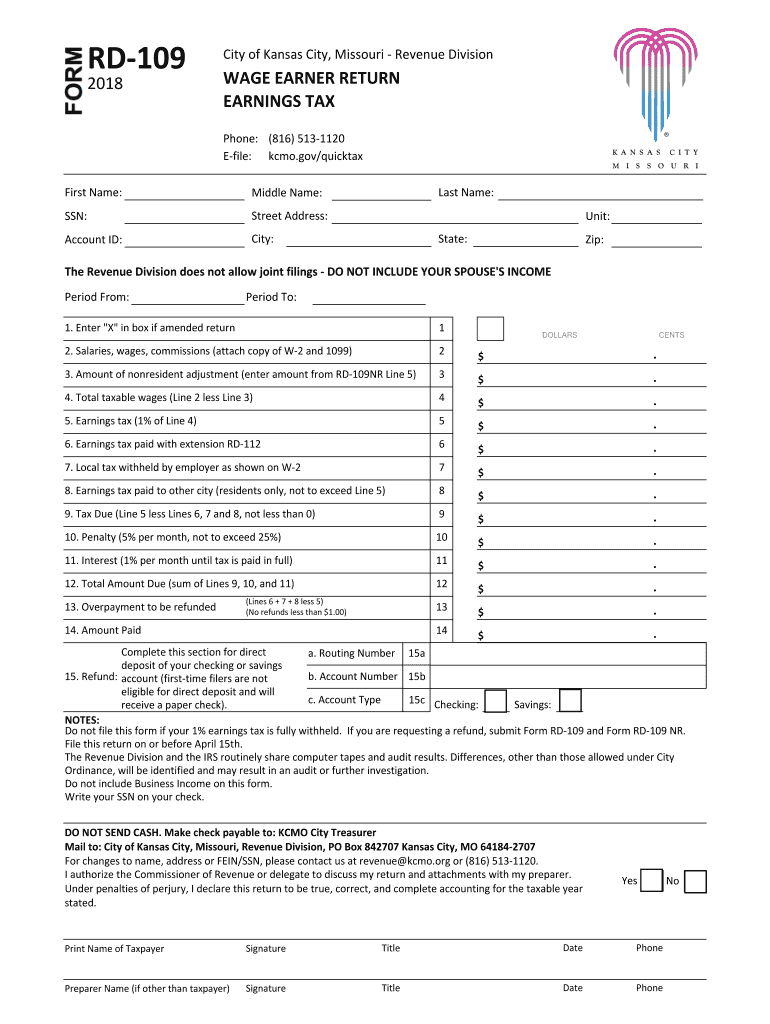

Form Rd 109 2019 Fill Out and Sign Printable PDF Template signNow

The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. This information is for guidance only and does. Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. Web certain individuals are eligible to.

FREE 7+ Sample Rent Rebate Forms in PDF

Landlord must complete this form each year. Web 2022 property tax credit claim print in black ink only and do not staple. Not state the complete law. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the.

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

For privacy notice, see instructions. Landlord must complete this form each year. Department use only (mm/dd/yy) tenant’s name. You must provide the contact information for the individual filing this return. Web 2022 certification of rent paid.

2019 Rent Rebate Form Missouri justgoing 2020

Web april 10, 2022 by fredrick. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. For privacy notice, see instructions. Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750. The credit is for a maximum of $750.

R.I.P. property tax and rent rebate The Money Edge Biz The Maine Edge

*22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Web the missouri property tax credit claim gives credit.

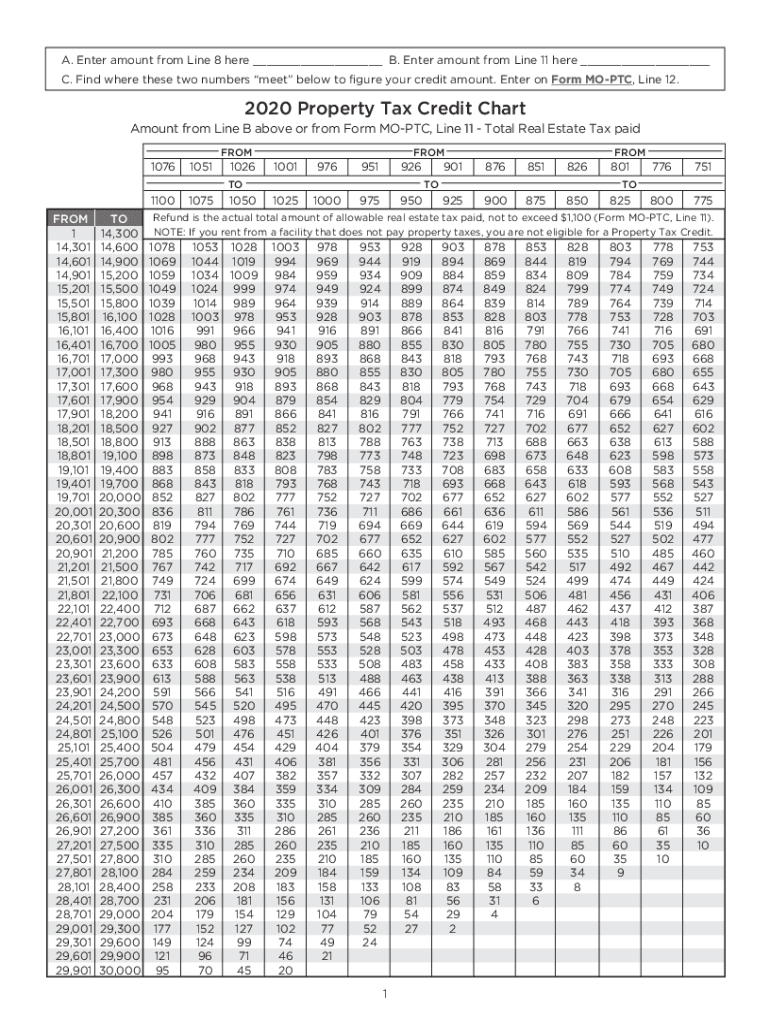

Missouri property tax credit chart Fill out & sign online DocHub

Department use only (mm/dd/yy) tenant’s name. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Web to apply for rent rebate in missouri, you will need to gather the following documents: Not state the complete law. Web verification of rent paid.

You Must Provide The Contact Information For The Individual Filing This Return.

For privacy notice, see instructions. Rental period during year from: Web verification of rent paid. Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750.

A 2019 Claim Must Be Filed By July 15, 2023, Or A Refund Will Not Be Issued.

Web 2022 certification of rent paid. This information is for guidance only and does. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. Landlord must complete this form each year.

Web Certain Individuals Are Eligible To Claim Up To $750 If They Pay Rent Or $1,100 If They Pay Real Estate Tax On The Home They Own And Occupy.

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Department use only (mm/dd/yy) tenant’s name. Date and still receive your credit. Multiply line 8 by 20%.

Web To Apply For Rent Rebate In Missouri, You Will Need To Gather The Following Documents:

Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Web 2022 property tax credit claim print in black ink only and do not staple. Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. Where to submit your claim.