Minnesota Form M1Pr 2021

Minnesota Form M1Pr 2021 - You will not receive a refund. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. Schedule m1pr is filed separately from the individual income tax form. Pdf use our library of forms to quickly fill and sign your minnesota department of revenue forms online. Web refund claims are filed using minnesota department of revenue (dor) schedule m1pr. We'll make sure you qualify, calculate your minnesota. Web property taxes or rent paid on your primary residence in minnesota. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund:

If the result is less than $12,525 and you had amounts withheld or paid. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Schedule m1pr is filed separately from the individual income. Complete, edit or print tax forms instantly. Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax refund *215811* you will need the 2021 form m1pr instructions, including. Get ready for tax season deadlines by completing any required tax forms today. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. We'll make sure you qualify, calculate your minnesota.

Web how are claims filed? We'll make sure you qualify, calculate your minnesota. Web refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Web revised 7/16/21 2 do i qualify? Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web country of origin: Web up to $40 cash back the m1pr form is typically used to report property tax refunds in minnesota. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: In minnesota, if the m1pr form is filed after the due date, a penalty of 5% of the. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

When Are Minnesota Property Tax Refunds Sent Out uukumdesigns

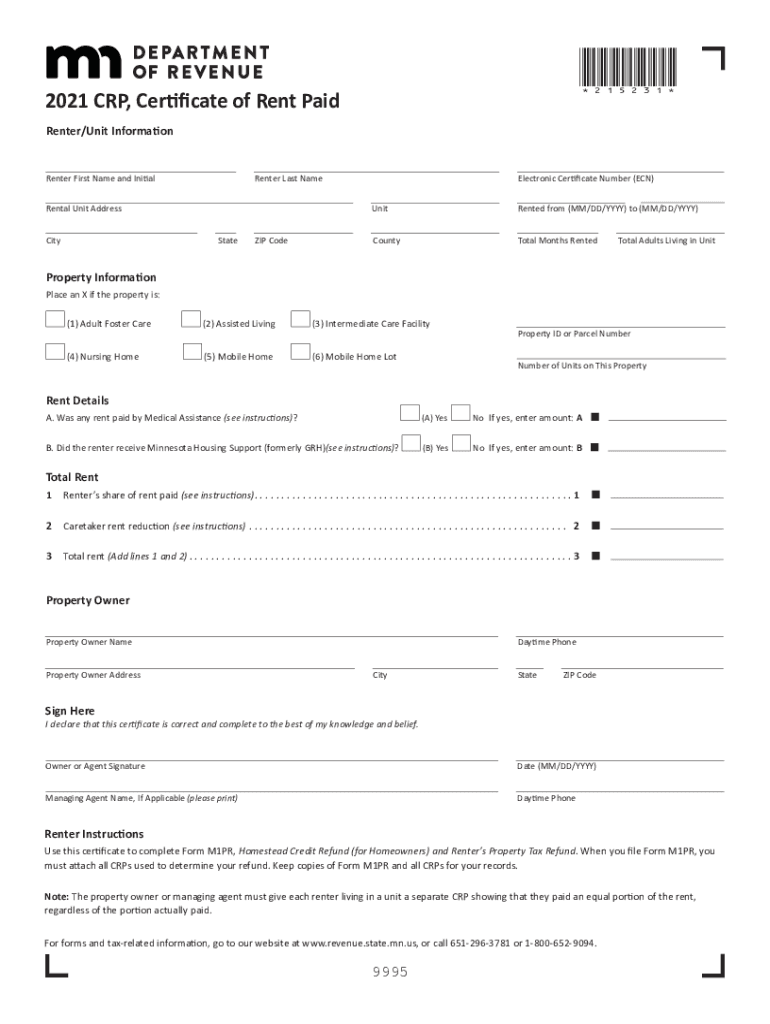

Web how are claims filed? Pdf use our library of forms to quickly fill and sign your minnesota department of revenue forms online. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web if the total is $12,525 or more, you must file a minnesota income.

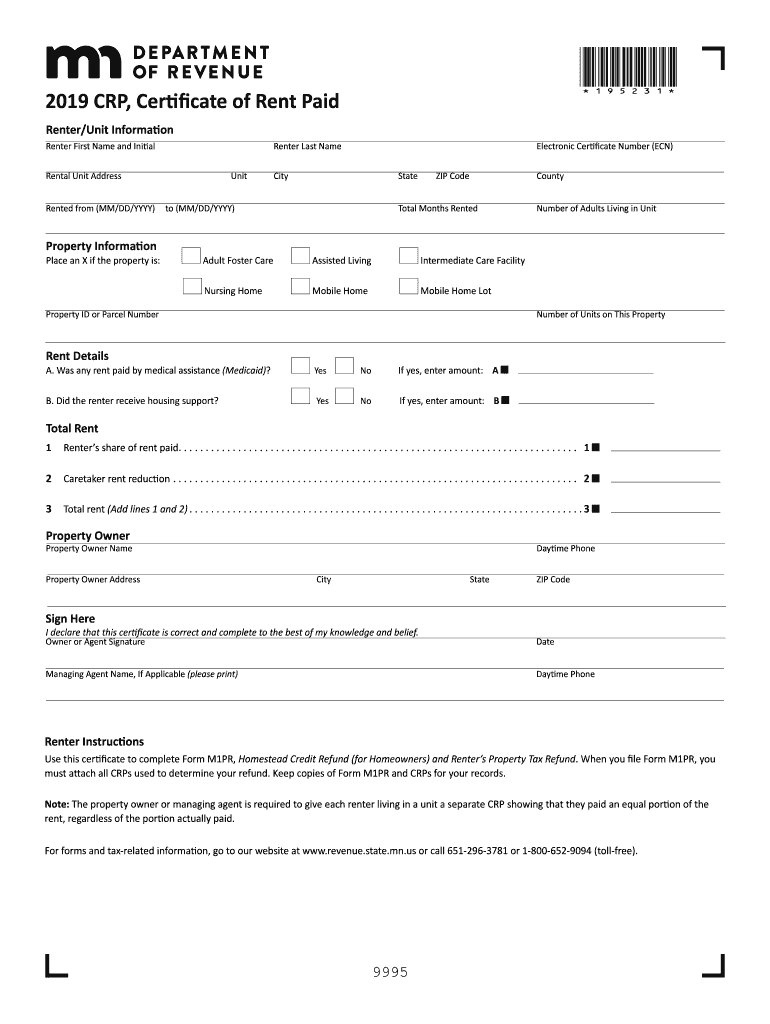

Crp forms for 2018 Fill out & sign online DocHub

Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax refund *215811* you will need the 2021 form m1pr instructions, including. Schedule m1pr is filed separately from the individual income tax form..

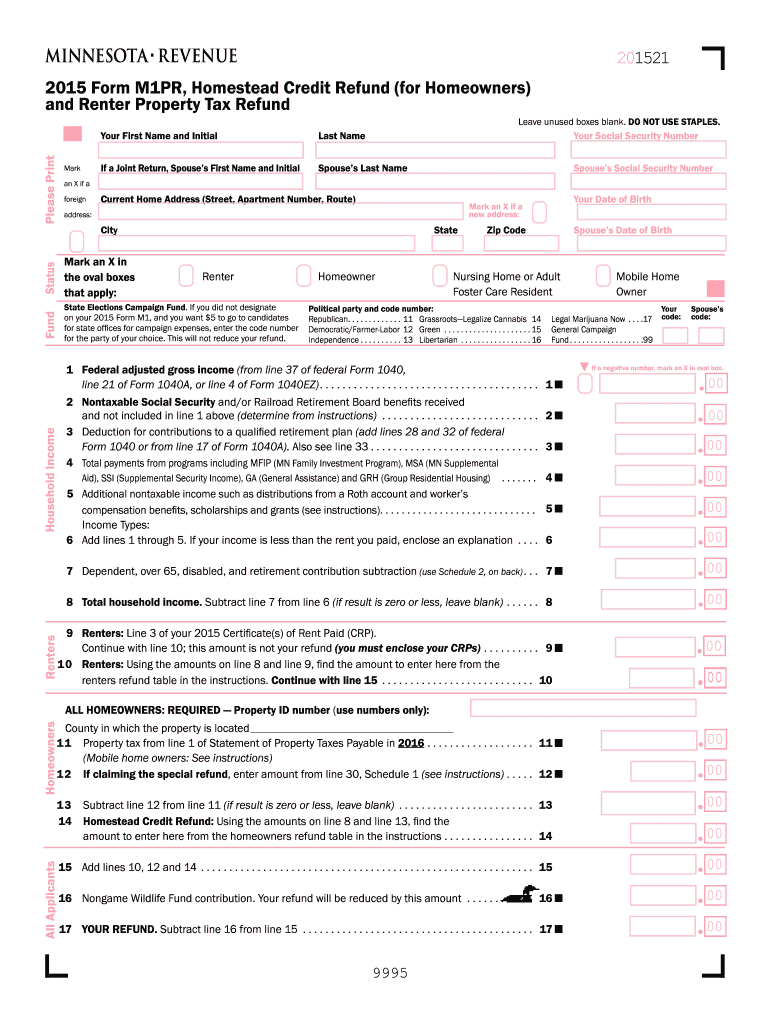

M1pr 2015 form Fill out & sign online DocHub

You may be eligible for a refund based on your household income (see page 8) and the property taxes or rent paid on your primary residence in. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date.

2011 minnesota form Fill out & sign online DocHub

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web country of origin: In minnesota, if the m1pr form is filed after the due date, a penalty of 5% of the. Get ready for tax season deadlines by completing any required tax forms today. Web 2021.

2012 Form MN DoR CRP Fill Online, Printable, Fillable, Blank pdfFiller

Schedule m1pr is filed separately from the individual income. If you are filing as a renter, include any certificates of. Web country of origin: Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a.

Renters Rebate Mn Form Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web how are claims filed? Schedule m1pr is filed separately from the individual income tax form. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Fill Free fillable Minnesota Department of Revenue PDF forms

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web revised 7/16/21 2 do i qualify? Web file by august 13, 2021 your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your.

Mn Tax Forms 2021 Printable Printable Form 2022

Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web how are claims filed? Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. If you are filing.

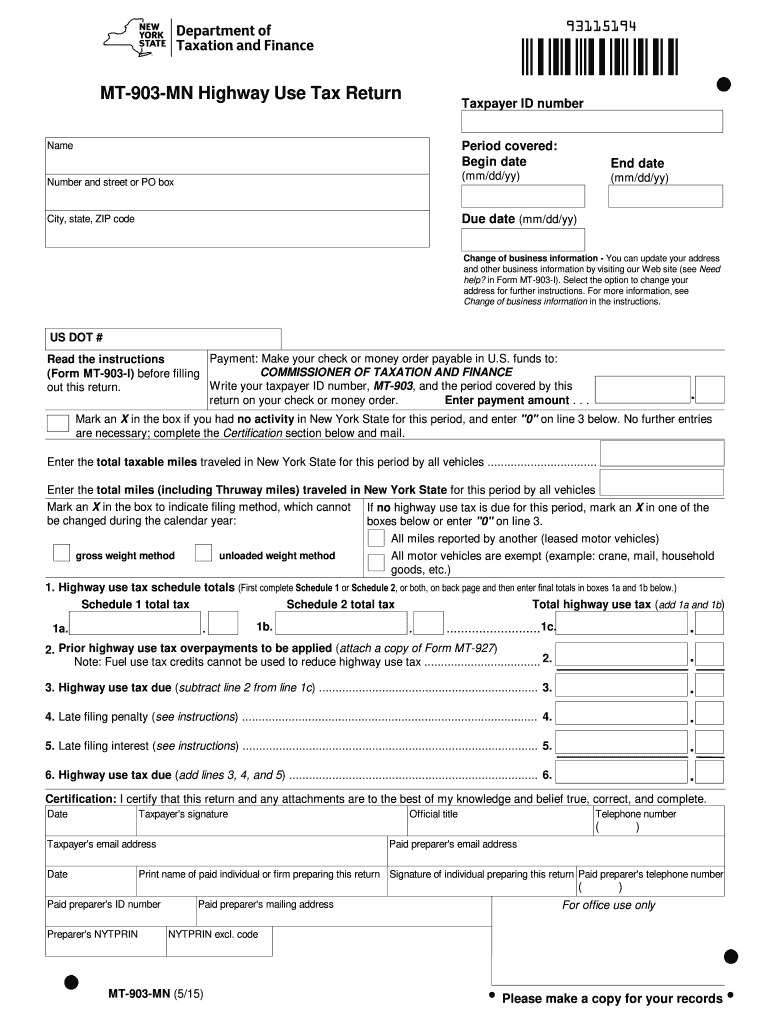

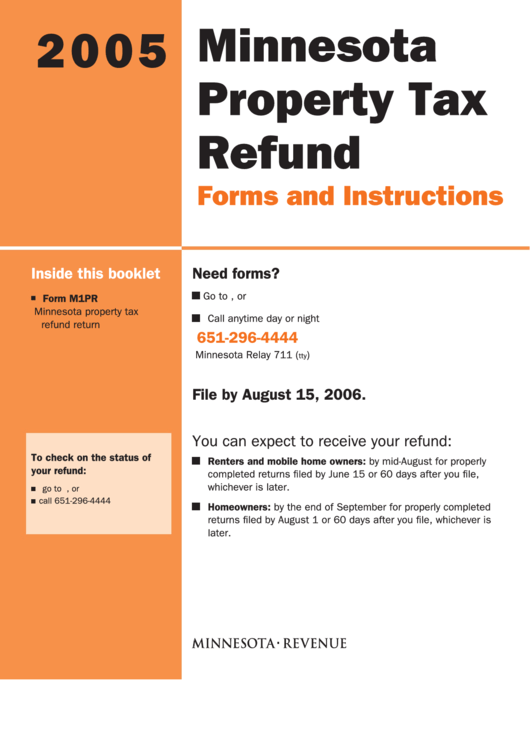

Form M1pr Minnesota Property Tax Refund Return Instructions 2005

Web property taxes or rent paid on your primary residence in minnesota. Complete, edit or print tax forms instantly. You will not receive a refund. Web how are claims filed? Web the last day you can file your 2021 m1pr return is august 15, 2023.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web how are claims filed? Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Get ready for tax season deadlines by completing any required tax forms today. If the result is less than $12,525 and you had amounts withheld or paid. Refund claims are filed using minnesota department of revenue (dor) schedule.

You Will Not Receive A Refund.

Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. Web refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Get ready for tax season deadlines by completing any required tax forms today.

You May Be Eligible For A Refund Based On Your Household Income (See Page 8) And The Property Taxes Or Rent Paid On Your Primary Residence In.

Schedule m1pr is filed separately from the individual income tax form. We'll make sure you qualify, calculate your minnesota. Pdf use our library of forms to quickly fill and sign your minnesota department of revenue forms online. Complete, edit or print tax forms instantly.

Web 2020 Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax Refund 9995 *205211* Your Code Spouse’s Code State Elections Campaign Fund:

Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax refund *215811* you will need the 2021 form m1pr instructions, including. Web revised 7/16/21 2 do i qualify? Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. If the result is less than $12,525 and you had amounts withheld or paid.

Complete, Edit Or Print Tax Forms Instantly.

Web how are claims filed? Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web country of origin: