Michigan Sales Tax Exemption Form

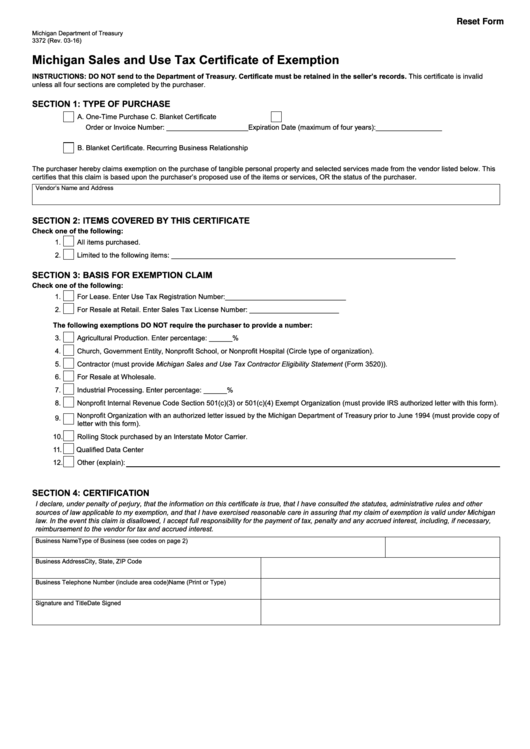

Michigan Sales Tax Exemption Form - It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Tax exemption certificate for donated motor. However, if provided to the purchaser in electronic format, a signature is not required. Web download a copy of the michigan general sales tax exemption form and return it to: It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Web printable michigan sales and use tax certificate of exemption (form 3372), for making sales tax free purchases in michigan. Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. All claims are subject to audit. Web the customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. Exemption is allowed in michigan on the sale of rolling stock purchased by an.

Michigan sales and use tax contractor eligibility statement: If you discover that your account should have been tax exempt, you may be entitled to a credit. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. All claims are subject to. Web how to use sales tax exemption certificates in michigan. Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. All claims are subject to audit. Web important note tax forms are tax year specific. Please make sure to complete the form entirely and include all documentation with your request. Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury.

Web how to use sales tax exemption certificates in michigan. Michigan sales and use tax contractor eligibility statement: Producers will note on item 4, in section 3, that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would. Web the customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. In order to be exempt from michigan sales or use tax certain criteria must be met. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to audit. All claims are subject to. Web printable michigan sales and use tax certificate of exemption (form 3372), for making sales tax free purchases in michigan. We require one form per account.

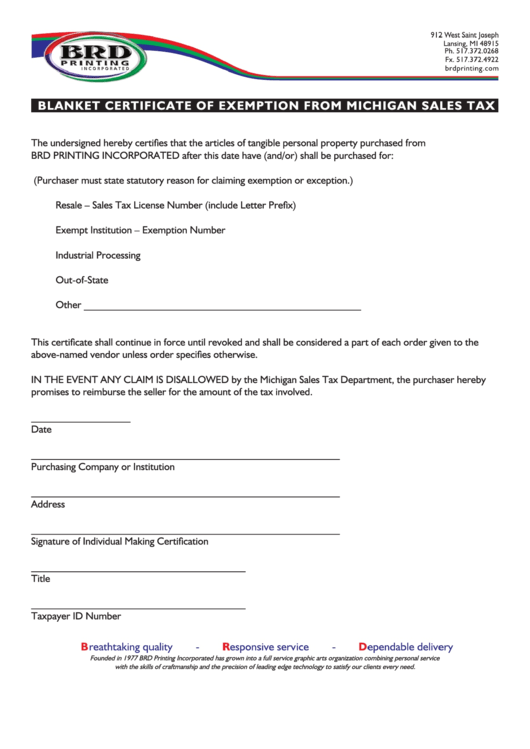

Blank Michigan Sales Tax Exempt Form

Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on.

MICHIGAN SALES AND USE TAX CERTIFICATE OF EXEMPTION

Web sales and use tax exemption for transformational brownfield plans. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form 3372. Producers will note on item 4, in section 3, that you are to indicate the percentage of the purchase item is for agricultural.

Michigan certificate of tax exemption from 3372 Fill out & sign online

Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form 3372. Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. If you discover that your account should have been tax exempt, you may be entitled to a credit. We require one form per account. Please make sure to complete.

VA Tax Exemption Form Use Tax Packaging And Labeling

If you discover that your account should have been tax exempt, you may be entitled to a credit. All claims are subject to audit. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Exemption is allowed in michigan.

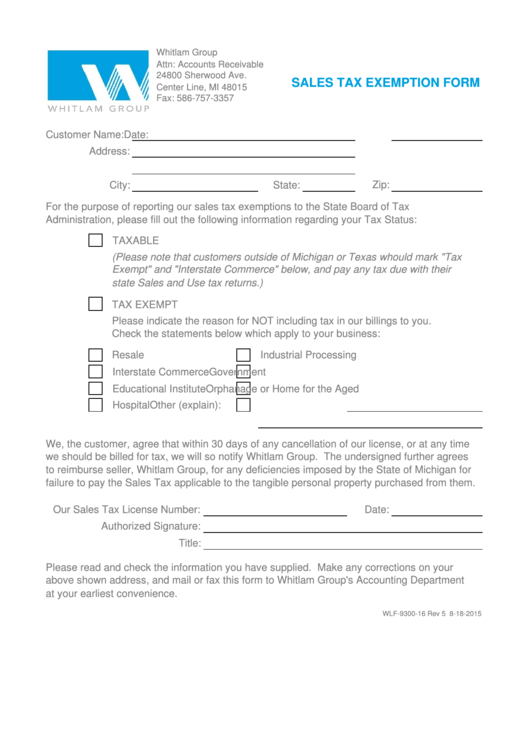

MISalesTaxExemptionFORM Tech Spec Inc.

Exemption is allowed in michigan on the sale of rolling stock purchased by an. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form 3372. It is the purchaser’s responsibility.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Web how to use sales tax exemption certificates in michigan. We require one form per account. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Tax exemption certificate for donated motor. Web the certificate that qualifying agricultural producers,.

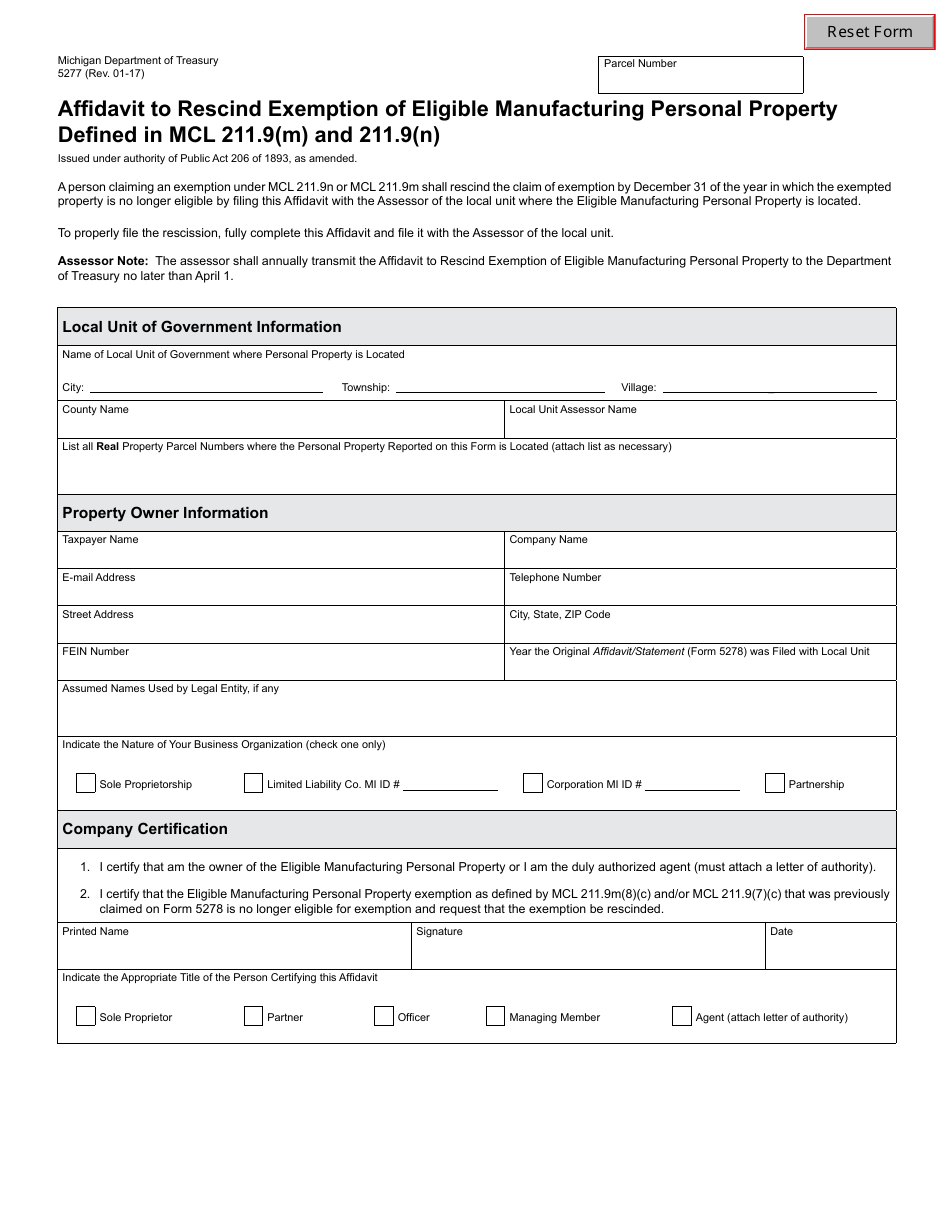

michigan sales tax exemption rolling stock Shelby Belanger

Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. We require one form per account. Tax exemption certificate for donated motor. Michigan sales and use tax contractor eligibility statement: It is the purchaser’s responsibility to.

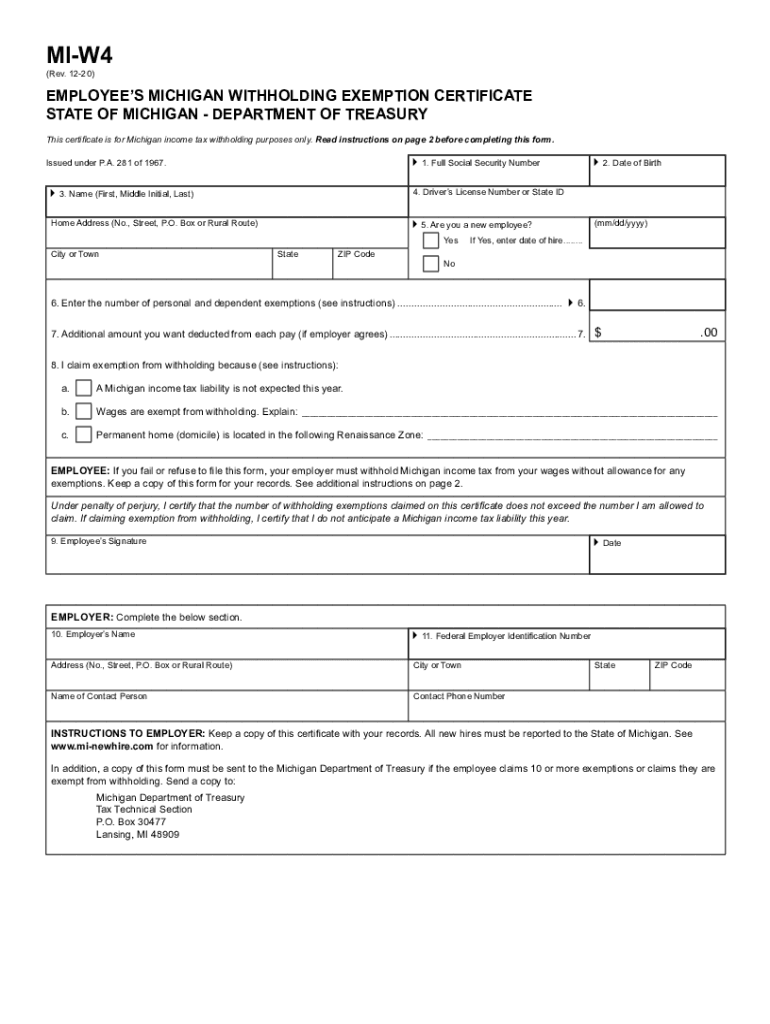

Michigan W4 Fill Out and Sign Printable PDF Template signNow

Web the customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. All claims are subject to audit. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form.

Sales Tax Exemption Form printable pdf download

All claims are subject to audit. If you discover that your account should have been tax exempt, you may be entitled to a credit. In order to be exempt from michigan sales or use tax certain criteria must be met. Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this.

Web Important Note Tax Forms Are Tax Year Specific.

Tax exemption certificate for donated motor. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All claims are subject to audit. All claims are subject to.

Web Download A Copy Of The Michigan General Sales Tax Exemption Form And Return It To:

Web the customer must provide to the seller a completed form 3372, michigan sales and use tax certificate of exemption, or the required information in another acceptable format. If you discover that your account should have been tax exempt, you may be entitled to a credit. However, if provided to the purchaser in electronic format, a signature is not required. Exemption is allowed in michigan on the sale of rolling stock purchased by an.

Web How To Use Sales Tax Exemption Certificates In Michigan.

Please make sure to complete the form entirely and include all documentation with your request. Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Web printable michigan sales and use tax certificate of exemption (form 3372), for making sales tax free purchases in michigan.

Web Instructions For Completing Michigan Sales And Use Tax Certicate Of Exemption (Form 3372) Purchasers May Use This Form To Claim Exemption From Michigan Sales And Use Tax On Qualied Transactions.

Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form 3372. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Producers will note on item 4, in section 3, that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would.