Merrill Lynch Hardship Withdrawal Form

Merrill Lynch Hardship Withdrawal Form - Web how do i withdraw money from my merrill lynch 401k. Cash management account® (cma®) working capital management account® (wcma®) individual investor account delaware (iia) limited individual investor account (liia) or make a contribution to a. The type of account and when you withdraw your funds will have a significant impact on how much you pay to access the funds. Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Web use this form to take a withdrawal from your merrill: Under withdrawals click start a withdrawal. Web benefits online | login Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra ® ), roth ira, simplified employee pension (sep) plan, or simple retirement account (sra). Web use this form to take a withdrawal (distribution) from a merrill: You must fill it out with your personal information, including your name, date of birth, phone number and merrill lynch retirement account number.

Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Web use this form to take a withdrawal from your merrill: In account summary look for actions on the page and click view your withdrawal and rollover options. Individual retirement account (ira) irra® (rollover ira) roth ira simplified employee pension (sep) plan, or simple retirement account (sra) complete, sign and send this form to the appropriate channel for processing. Web benefits online | login Web use this form to take a withdrawal (distribution) from a merrill: In order for us to process your request, we ask that you review the terms noted below and complete the authorization form located on the back of this notice. Obtain an individual distribution form from merrill lynch. Web withdrawing your retirement funds or 401,000 from your merrill lynch account is more than just an application. You must fill it out with your personal information, including your name, date of birth, phone number and merrill lynch retirement account number.

Web use this form to take a withdrawal from your merrill: In account summary look for actions on the page and click view your withdrawal and rollover options. The type of account and when you withdraw your funds will have a significant impact on how much you pay to access the funds. Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra ® ), roth ira, simplified employee pension (sep) plan, or simple retirement account (sra). Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Web how do i withdraw money from my merrill lynch 401k. In order for us to process your request, we ask that you review the terms noted below and complete the authorization form located on the back of this notice. Cash management account® (cma®) working capital management account® (wcma®) individual investor account delaware (iia) limited individual investor account (liia) or make a contribution to a. Individual retirement account (ira) irra® (rollover ira) roth ira simplified employee pension (sep) plan, or simple retirement account (sra) complete, sign and send this form to the appropriate channel for processing. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not.

Fill Free fillable Merrill Lynch PDF forms

Individual retirement account (ira) irra® (rollover ira) roth ira simplified employee pension (sep) plan, or simple retirement account (sra) complete, sign and send this form to the appropriate channel for processing. Web withdrawal request thank you for your recent request to remove an unpriced position for your account. In order for us to process your request, we ask that you.

Fill Free fillable Merrill Lynch PDF forms

You must fill it out with your personal information, including your name, date of birth, phone number and merrill lynch retirement account number. To start your withdrawal youll need a one time distribution form from merrill lynch. Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra.

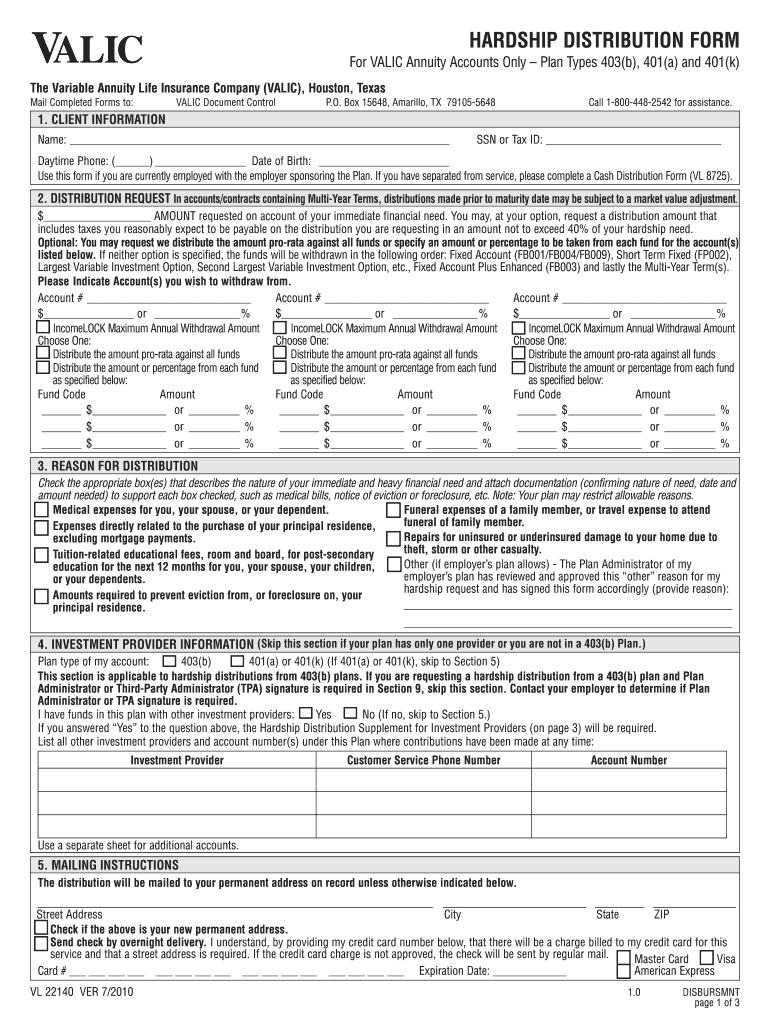

Valic Hardship Withdrawal Fill and Sign Printable Template Online

Web use this form to take a withdrawal (distribution) from a merrill: Web how do i withdraw money from my merrill lynch 401k. To start your withdrawal youll need a one time distribution form from merrill lynch. Individual retirement account (ira) irra® (rollover ira) roth ira simplified employee pension (sep) plan, or simple retirement account (sra) complete, sign and send.

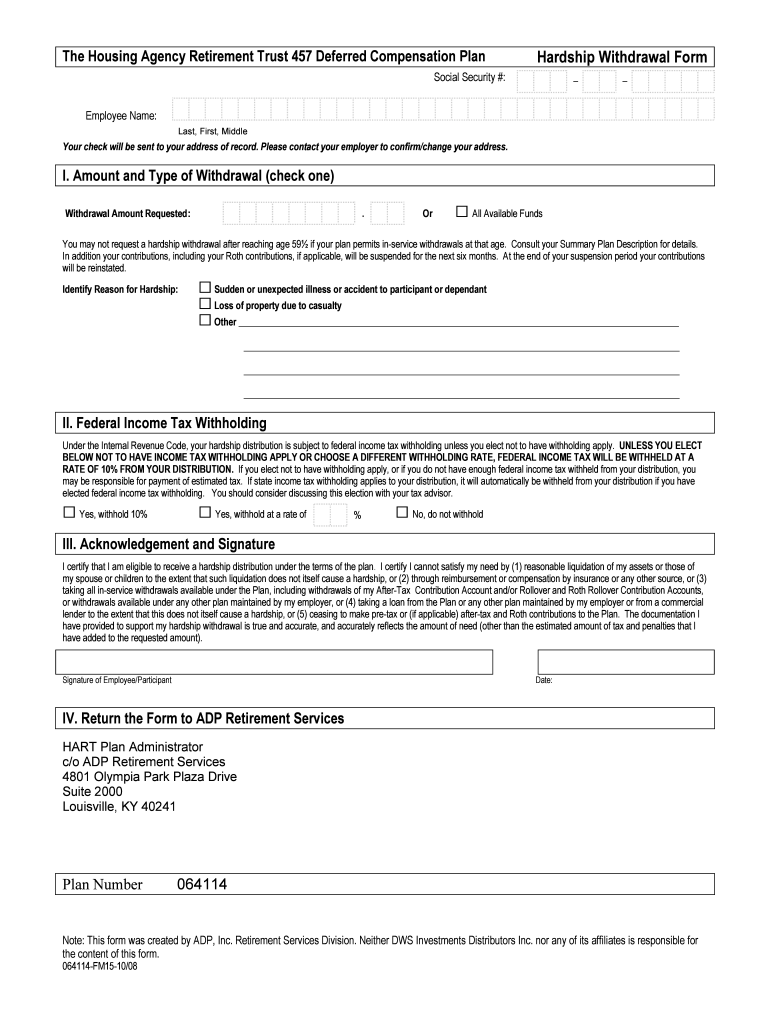

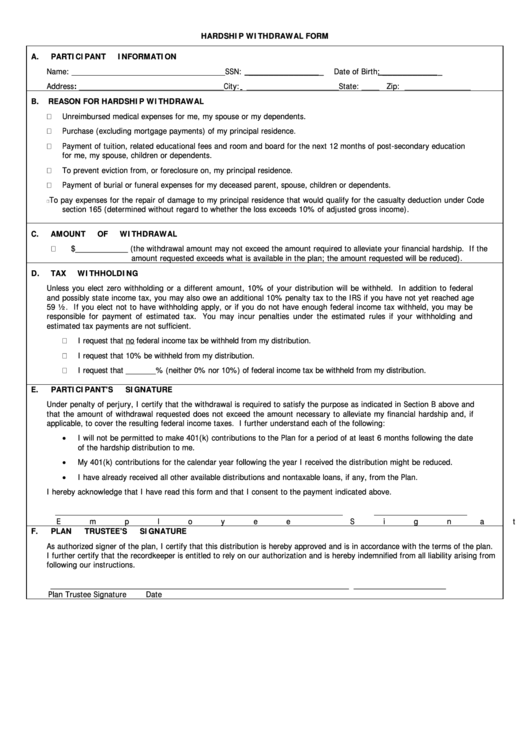

HART Hardship Withdrawal Form 20082022 Fill and Sign Printable

Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Web use this form to take a withdrawal from your merrill: Obtain an individual distribution form from merrill lynch. Web login to the website and.

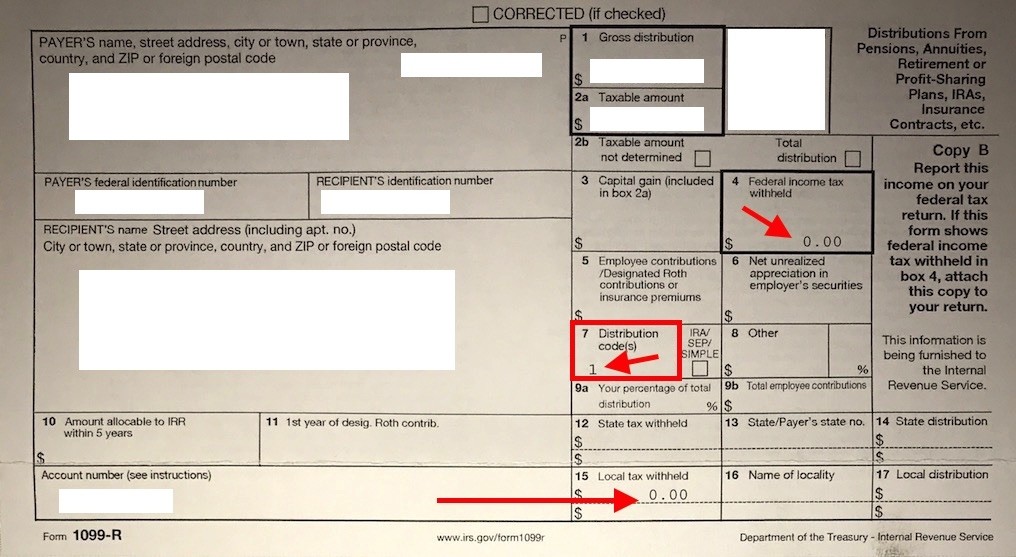

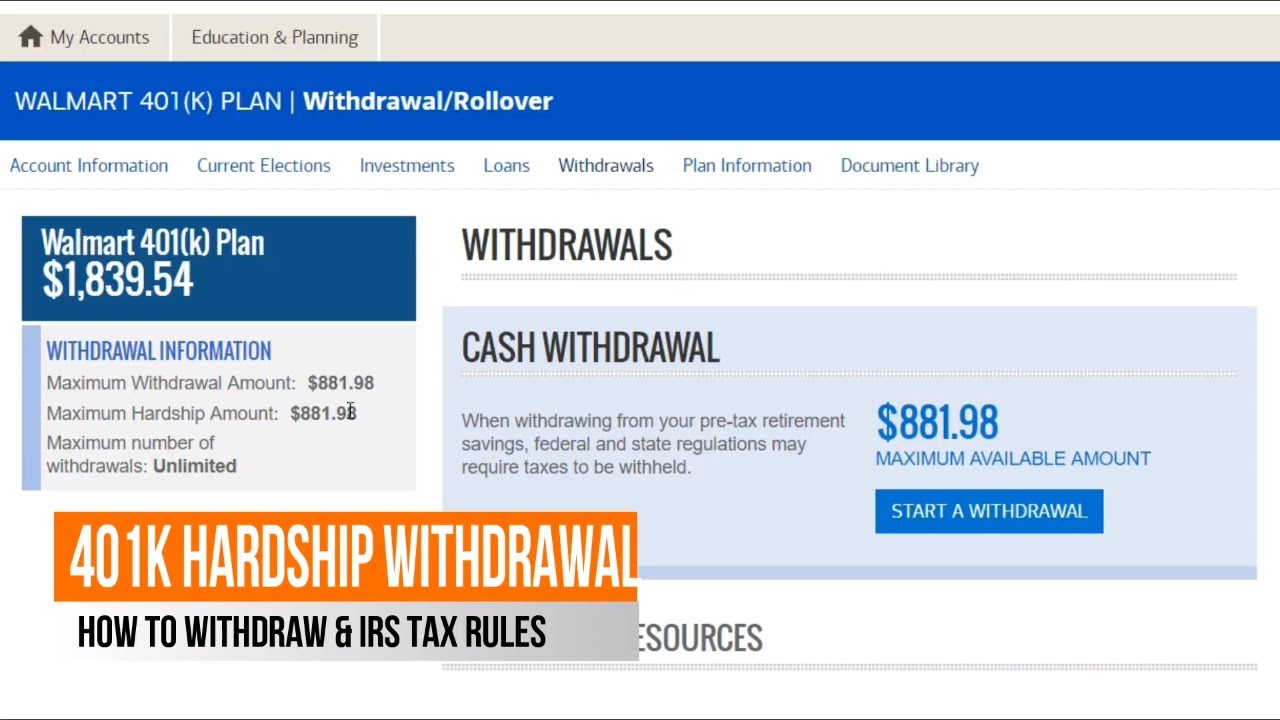

How To 401k Hardship Withdrawal Step by Step

In account summary look for actions on the page and click view your withdrawal and rollover options. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not. Web use this form to take a withdrawal (distribution) from.

Ira Withdrawal Form Merrill Lynch Universal Network

Web use this form to take a withdrawal (distribution) from a merrill: The type of account and when you withdraw your funds will have a significant impact on how much you pay to access the funds. Web login to the website and click walmart 401k plan. Web benefits online | login Web a 401 (k) hardship withdrawal is allowed by.

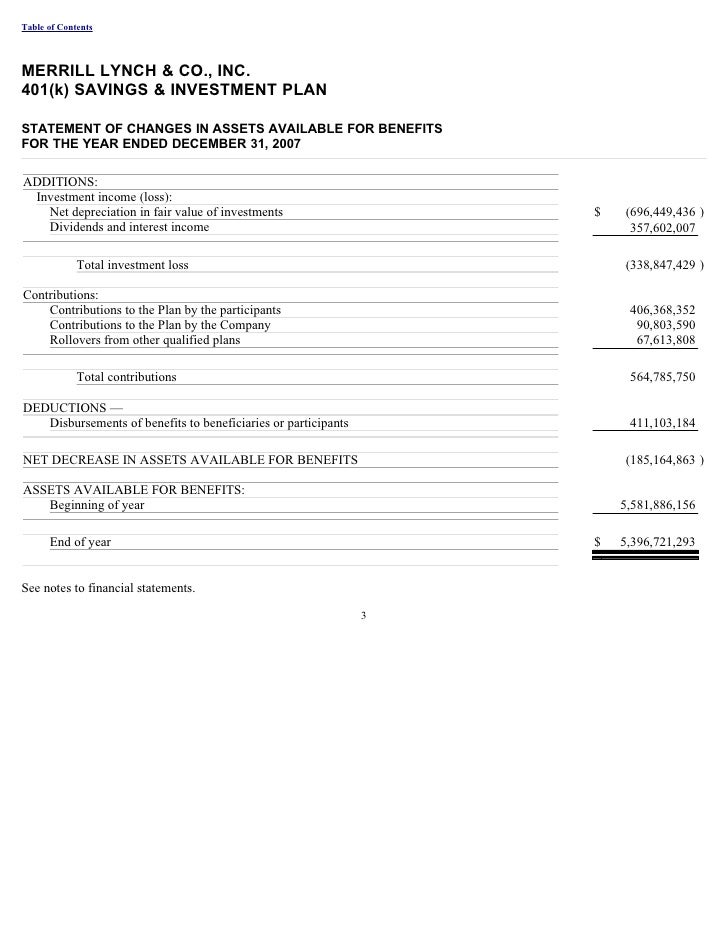

Merrill Lynch_SEC Filing_Employee Stock Purchase

Web login to the website and click walmart 401k plan. Web withdrawal request thank you for your recent request to remove an unpriced position for your account. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not..

First Time Home Buyer 401K Withdrawal 2020 Irs Goimages Ninja

In account summary look for actions on the page and click view your withdrawal and rollover options. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not. You must fill it out with your personal information, including.

Hardship Withdrawal Form printable pdf download

Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning.

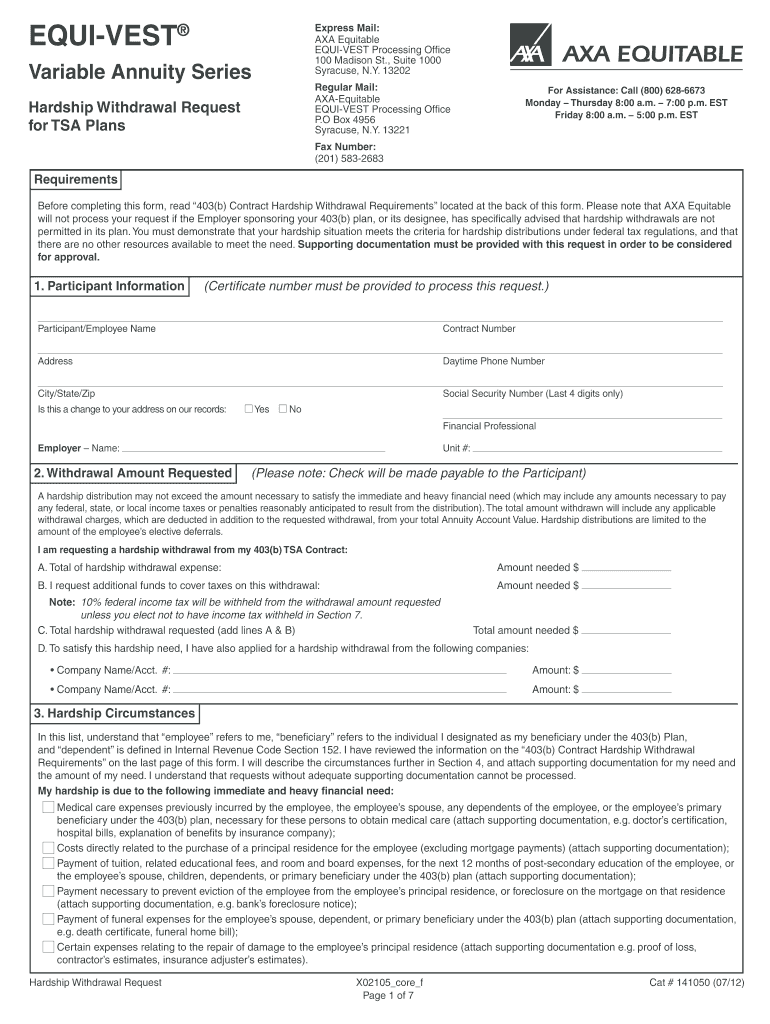

Axa Equitable Withdrawal Form Fill Out and Sign Printable PDF

Web use this form to take a withdrawal (distribution) from a merrill: Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not. Web use this form to take a withdrawal from your merrill: Web withdrawal request thank.

Web Withdrawing Your Retirement Funds Or 401,000 From Your Merrill Lynch Account Is More Than Just An Application.

Web how do i withdraw money from my merrill lynch 401k. To start your withdrawal youll need a one time distribution form from merrill lynch. Web use this form to take a withdrawal (distribution) from a merrill: The type of account and when you withdraw your funds will have a significant impact on how much you pay to access the funds.

Web Login To The Website And Click Walmart 401K Plan.

Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra ® ), roth ira, simplified employee pension (sep) plan, or simple retirement account (sra). Web withdrawal request thank you for your recent request to remove an unpriced position for your account. Individual retirement account (ira) irra® (rollover ira) roth ira simplified employee pension (sep) plan, or simple retirement account (sra) complete, sign and send this form to the appropriate channel for processing. In account summary look for actions on the page and click view your withdrawal and rollover options.

You Must Fill It Out With Your Personal Information, Including Your Name, Date Of Birth, Phone Number And Merrill Lynch Retirement Account Number.

Under withdrawals click start a withdrawal. Web use this form to take a withdrawal from your merrill: Cash management account® (cma®) working capital management account® (wcma®) individual investor account delaware (iia) limited individual investor account (liia) or make a contribution to a. Web a 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal—meaning the irs can waive penalties—but it does not.

Web Benefits Online | Login

Web a 401 (k) hardship withdrawal is allowed by the irs if you have an immediate and heavy financial need. the irs lists the following as situations that might qualify for a 401 (k) hardship. Obtain an individual distribution form from merrill lynch. In order for us to process your request, we ask that you review the terms noted below and complete the authorization form located on the back of this notice.