Maryland Form 504 Instructions 2021

Maryland Form 504 Instructions 2021 - There's no reason to continue reading! 1999 maryland fiduciary tax return page 2 fiduciary’sshareofmarylandmodifications. Print using blue or black ink only or fiscal year. Concerned parties names, places of residence and phone numbers. Web maryland tax, you must also file form 505. Return taxpayer who moved into or out of. Enter all required information in the. Marinate your chicken in it. Web i claim exemption from withholding because i do not expect to owe maryland tax. Sharma, ph.d., chief, office of size standards, 409 third.

Is required to file a federal fiduciary income tax return or is exempt from tax. Web follow the instructions for submitting comments; 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Concerned parties names, places of residence and phone numbers. $ nonresident beneficiary deduction complete this area only if any beneficiaries are. Form and instructions for amending any item of a maryland. Enter all required information in the. See instructions and check boxes that apply. Add ingredients into a bowl. Web get the maryland form 504 you require.

Last year i did not owe any maryland income. Web get the maryland form 504 you require. Web maryland form 504e application for extension to file fiduciary income tax return instructions 2021 general instructions purpose of form use. Web maryland tax, you must also file form 505. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Form for filing a maryland fiduciary tax return if the fiduciary: Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. Web i claim exemption from withholding because i do not expect to owe maryland tax. $ nonresident beneficiary deduction complete this area only if any beneficiaries are.

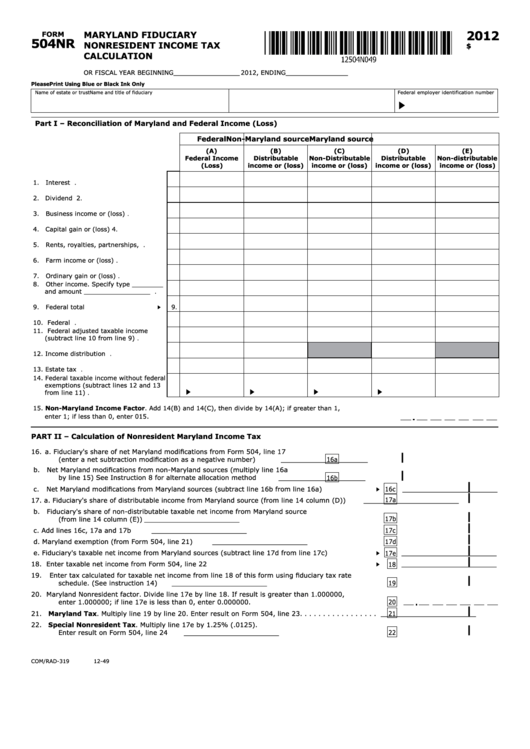

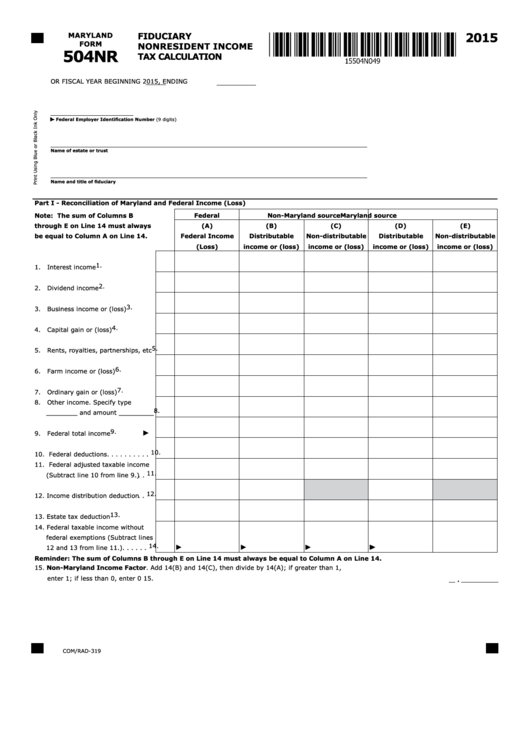

Fillable Form 504nr Maryland Fiduciary Nonresident Tax

See instructions and check boxes that apply. Add ingredients into a bowl. Form and instructions for amending any item of a maryland. If any due date falls on a saturday, sunday or legal holiday, the return must be filed by the next business day. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs.

Maryland Form 202 20202022 Fill and Sign Printable Template Online

2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Sharma, ph.d., chief, office of size standards, 409 third. Open it using the online editor and start editing. Web maryland form 504e application for extension to file fiduciary income tax return instructions 2021 general instructions purpose of form use. Web maryland form 504cr.

Maryland Printable Tax Forms Printable Form 2022

Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. Web maryland tax, you must also file form 505. Concerned parties names, places of residence and phone numbers. There's no reason to continue reading! Open it using the online.

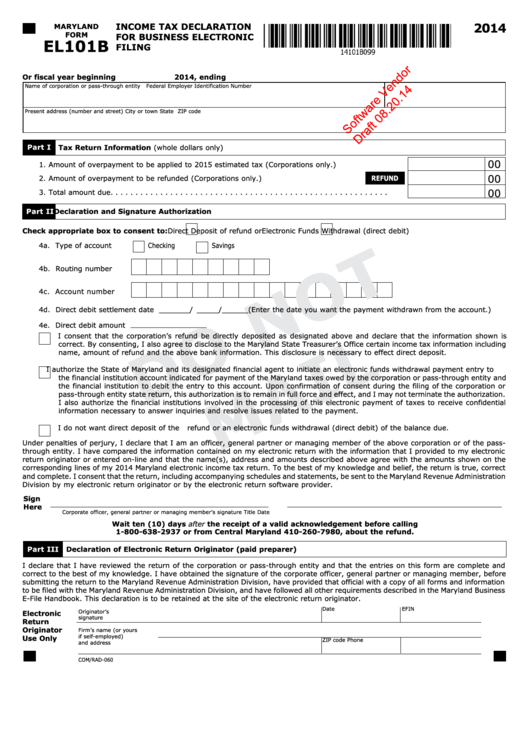

Maryland Form El101b Draft Tax Declaration For Business

Open it using the online editor and start editing. Enter all required information in the. Web fiduciary (enter here and on line 5 of form 504.) $ 10g. Fill out the empty areas; Return taxpayer who moved into or out of.

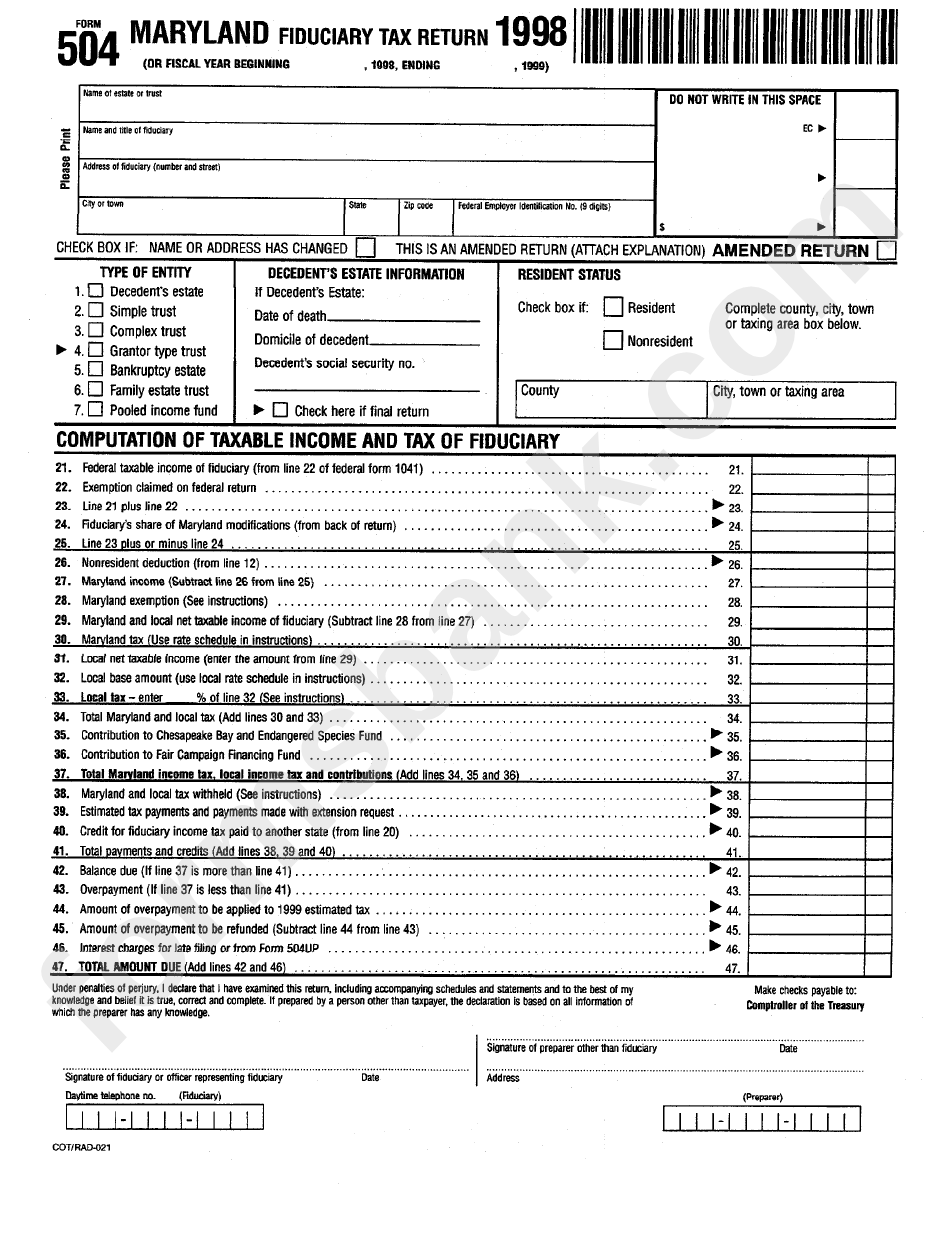

Fillable Form 504 Maryland Fiduciary Tax Return 1998 printable pdf

Concerned parties names, places of residence and phone numbers. 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Web follow the instructions for submitting comments; Return taxpayer who moved into or out of. 1999 maryland fiduciary tax return page 2 fiduciary’sshareofmarylandmodifications.

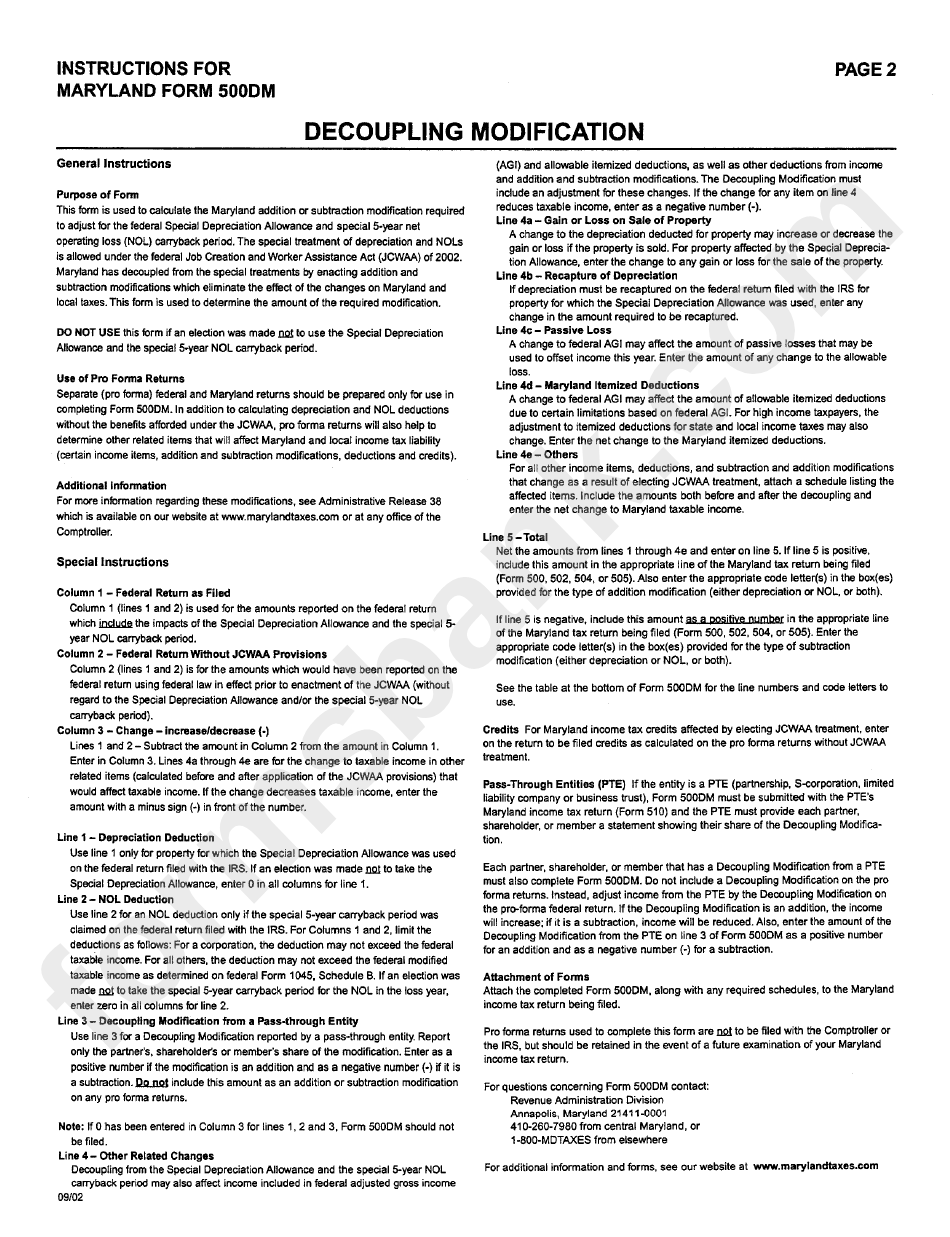

Instructions For Maryland Form 500dm printable pdf download

Concerned parties names, places of residence and phone numbers. Marinate your chicken in it. Web we last updated the maryland instructions for fiduciaries in january 2023, so this is the latest version of fiduciary booklet, fully updated for tax year 2022. 1999 maryland fiduciary tax return page 2 fiduciary’sshareofmarylandmodifications. Web when to file form 504e file form 504e by april.

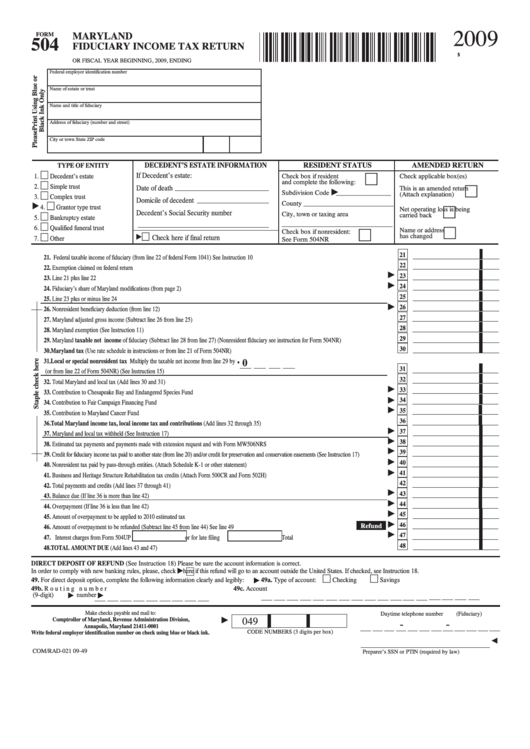

Fillable Form 504 Maryland Fiduciary Tax Return 2009

Web fiduciary (enter here and on line 5 of form 504.) $ 10g. Form for filing a maryland fiduciary tax return if the fiduciary: Last year i did not owe any maryland income. Web maryland form 504cr business income tax credits for fiduciaries attach to form 504. Web when to file form 504e file form 504e by april 15, 2021.

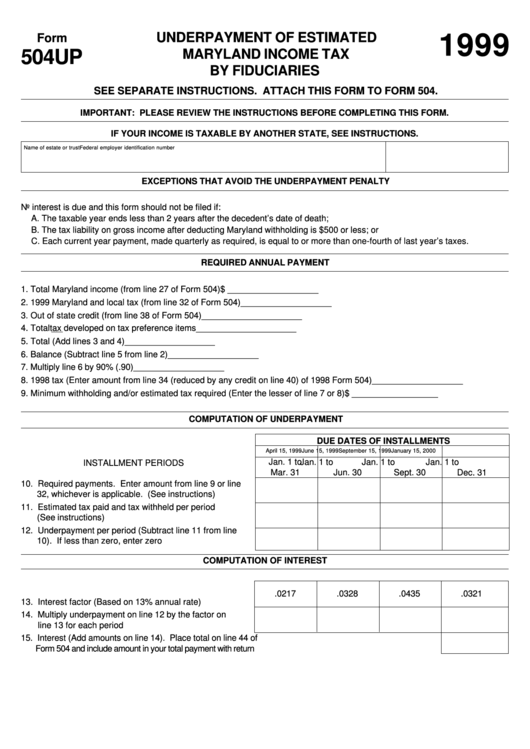

Form 504up Underpayment Of Estimated Maryland Tax By

Add ingredients into a bowl. 2019 fiduciary income tax return maryland (comptroller of maryland) comptroller of maryland endowments of maryland historically black. Web maryland form 504cr business income tax credits for fiduciaries attach to form 504. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Is required to file a federal fiduciary income tax.

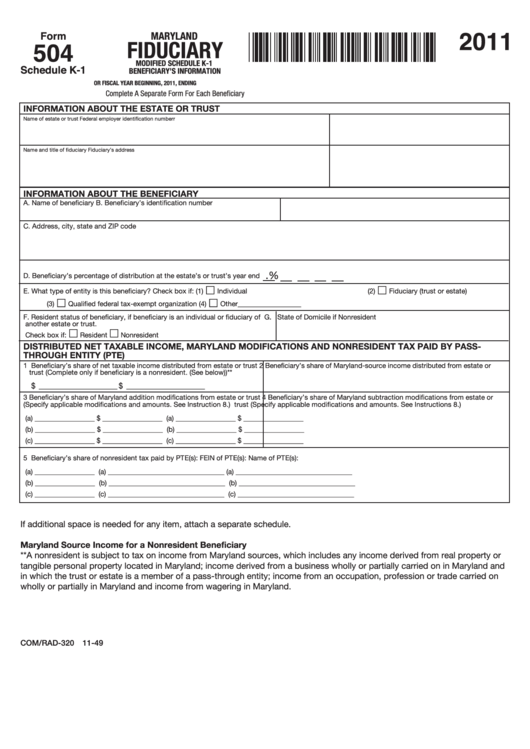

Fillable Form 504 (Schedule K1) Maryland Fiduciary Modified Schedule

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Enter all required information in the. Marinate your chicken in it. Web when to file form 504e file form 504e by april 15, 2021. Web maryland tax, you must also file form 505.

Fillable Maryland Form 504nr Fiduciary Nonresident Tax

Open it using the online editor and start editing. Web maryland form 504cr business income tax credits for fiduciaries attach to form 504. There's no reason to continue reading! Web fiduciary (enter here and on line 5 of form 504.) $ 10g. Concerned parties names, places of residence and phone numbers.

Form For Filing A Maryland Fiduciary Tax Return If The Fiduciary:

Return taxpayer who moved into or out of. Web follow the instructions for submitting comments; Web get the maryland form 504 you require. See instructions and check boxes that apply.

Web Maryland Tax, You Must Also File Form 505.

Web fiduciary (enter here and on line 5 of form 504.) $ 10g. Concerned parties names, places of residence and phone numbers. $ nonresident beneficiary deduction complete this area only if any beneficiaries are. Print using blue or black ink only or fiscal year.

Web Comptroller Of Maryland's Www.marylandtaxes.gov All The Information You Need For Your Tax Paying Needs.

Fill out the empty areas; Add ingredients into a bowl. Open it using the online editor and start editing. Web maryland form 504cr business income tax credits for fiduciaries attach to form 504.

Web Section 504 Of The Rehabilitation Act Of 1973 Is A Federal Law That Prohibits Organizations That Receive Federal Money From Discriminating Against A Person On The Basis Of A Disability.

Is required to file a federal fiduciary income tax return or is exempt from tax. Form and instructions for amending any item of a maryland. If any due date falls on a saturday, sunday or legal holiday, the return must be filed by the next business day. Sharma, ph.d., chief, office of size standards, 409 third.