Maine W-4 Form 2023

Maine W-4 Form 2023 - Get ready for tax season deadlines by completing any required tax forms today. Alphabetical listing by tax type or program name. The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns. Ad access irs tax forms. Withholding tables (pdf) withholding tables for individual income tax. Web withholding tables for 2023 individual income tax important. These are forms due for wages and other payments made during 2023. Interest rates, 1992 to present. If too much is withheld, you If too much is withheld, you will generally be due a refund.

Complete, edit or print tax forms instantly. Web withholding tables for 2023 individual income tax important. Maine revenue administers all aspects of income tax withholding. Web maine department of labor administers the unemployment insurance contributions once the quarterly report is filed. If too much is withheld, you will generally be due a refund. Ad access irs tax forms. List of forms and due dates. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns. This submission is not required if the employer reasonably expects that the employee will earn annual

Complete, edit or print tax forms instantly. Web maine department of labor administers the unemployment insurance contributions once the quarterly report is filed. List of forms and due dates. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web withholding tables for 2023 individual income tax important. Get ready for tax season deadlines by completing any required tax forms today. Maine revenue administers all aspects of income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Withholding allowance variance certificate (pdf) request to claim more personal allowances for maine withholding purposes. Withholding tables (pdf) withholding tables for individual income tax.

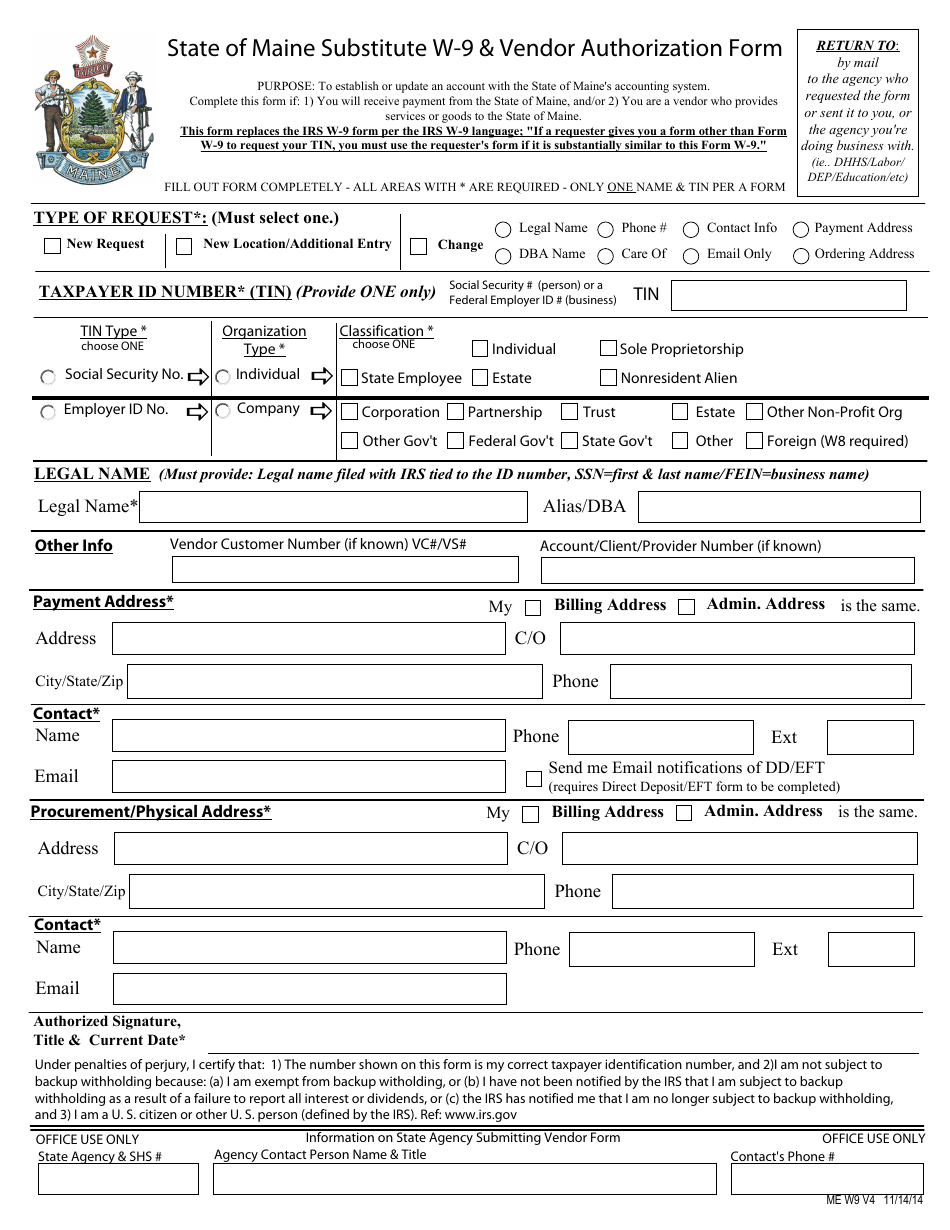

Form W9 Download Fillable PDF or Fill Online State of Maine Substitute

This submission is not required if the employer reasonably expects that the employee will earn annual If too much is withheld, you Web withholding tables for 2023 individual income tax important. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and.

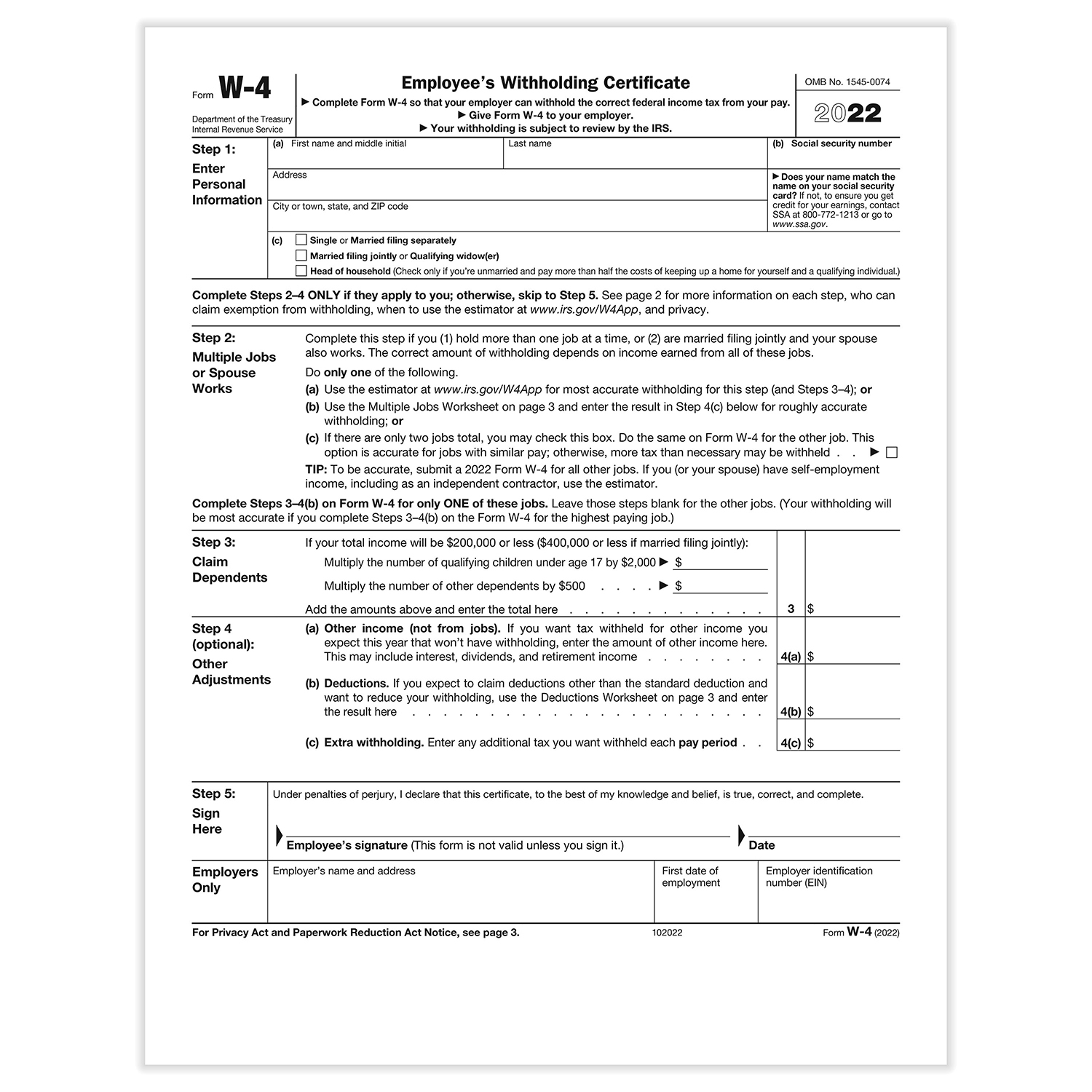

ads/responsive.txt W4 form Filled Out New Blank W4 form, picture size

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Alphabetical listing by tax type or program name. List of forms and due dates. Withholding tables (pdf) withholding tables for individual income tax. These are forms due for wages and other payments made during 2023.

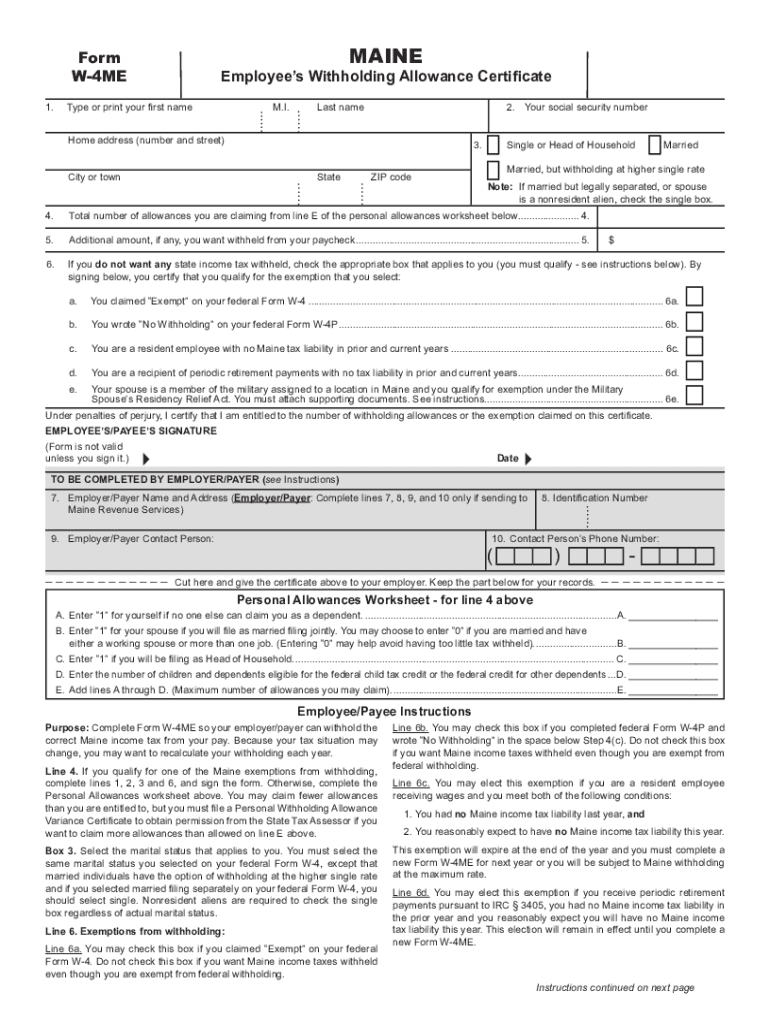

2022 Form ME W4ME Fill Online, Printable, Fillable, Blank pdfFiller

Get ready for tax season deadlines by completing any required tax forms today. If too much is withheld, you Web withholding tables for 2023 individual income tax important. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Withholding allowance variance certificate (pdf) request to claim more personal allowances.

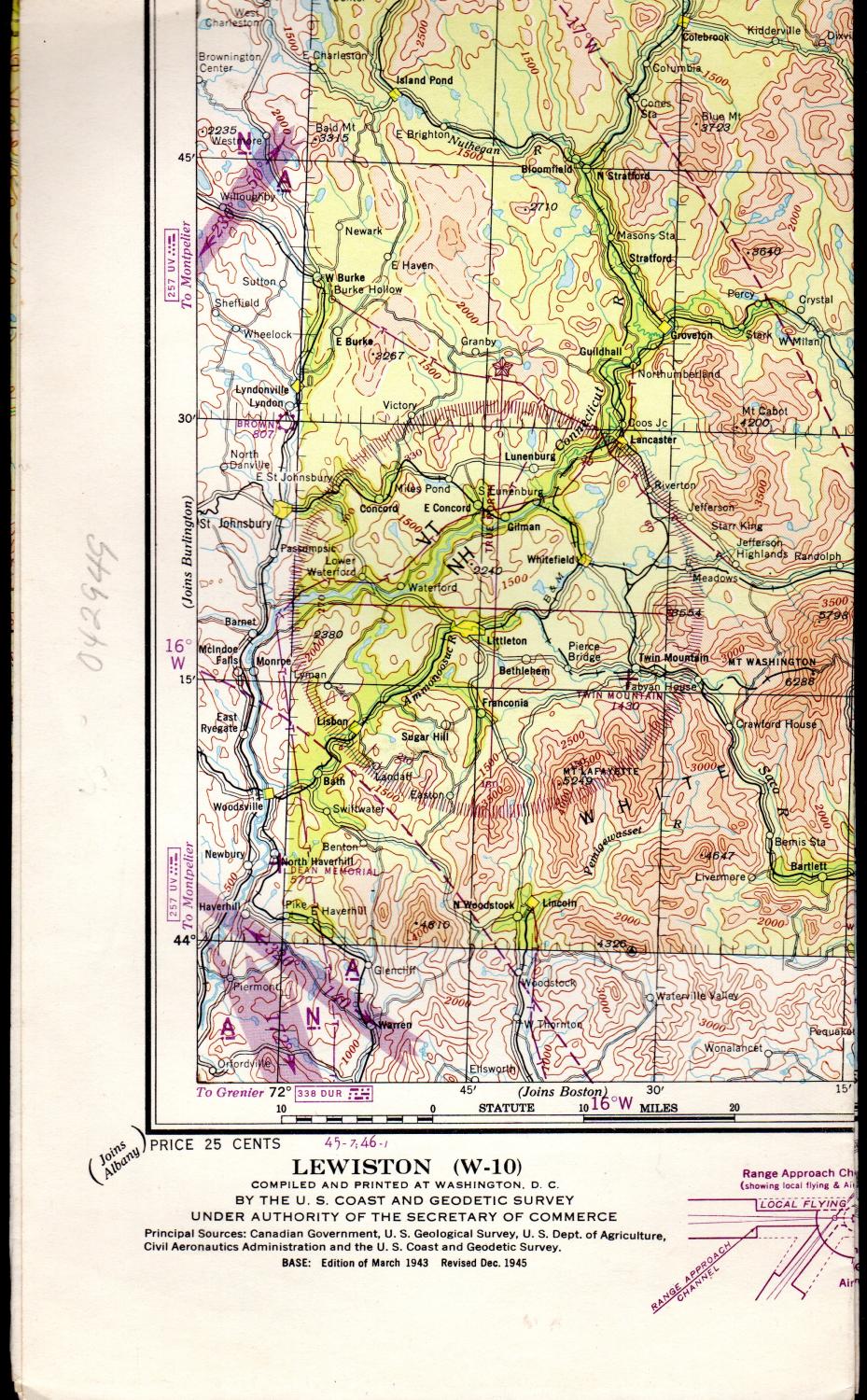

State and County Maps of Maine

Maine revenue administers all aspects of income tax withholding. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. These are forms due for wages and other payments made during 2023. If too much is withheld, you will generally be due a refund.

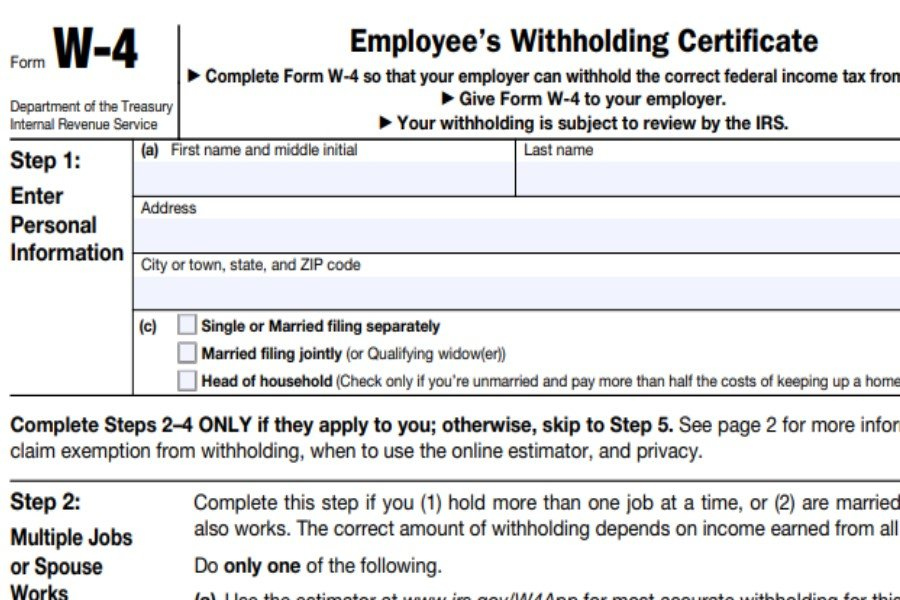

2023 IRS W 4 Form HRdirect Fillable Form 2023

Withholding allowance variance certificate (pdf) request to claim more personal allowances for maine withholding purposes. If too much is withheld, you If too much is withheld, you will generally be due a refund. Interest rates, 1992 to present. Withholding tables (pdf) withholding tables for individual income tax.

Maine W4 App

The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Withholding allowance variance certificate (pdf) request to claim more personal allowances for.

W4 Form How to Fill It Out in 2021

Web maine department of labor administers the unemployment insurance contributions once the quarterly report is filed. These are forms due for wages and other payments made during 2023. Interest rates, 1992 to present. Alphabetical listing by tax type or program name. Ad access irs tax forms.

W 4 Withholding Allowance Certificate 2021 2022 W4 Form

Alphabetical listing by tax type or program name. Interest rates, 1992 to present. Withholding allowance variance certificate (pdf) request to claim more personal allowances for maine withholding purposes. Get ready for tax season deadlines by completing any required tax forms today. The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single.

Free Printable 2023 W 4 Form IMAGESEE

Complete, edit or print tax forms instantly. Interest rates, 1992 to present. These are forms due for wages and other payments made during 2023. Web withholding tables for 2023 individual income tax important. If too much is withheld, you

MAP Lewiston (Maine) (W10) Sectional Aeronautical Chart. "Restricted

The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns. If too much is withheld, you List of forms and due dates. Withholding tables (pdf) withholding tables for individual income tax. These are forms due for wages and other payments made during 2023.

Web Withholding Tables For 2023 Individual Income Tax Important.

Withholding tables (pdf) withholding tables for individual income tax. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. List of forms and due dates.

Interest Rates, 1992 To Present.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad access irs tax forms. If too much is withheld, you will generally be due a refund.

Withholding Allowance Variance Certificate (Pdf) Request To Claim More Personal Allowances For Maine Withholding Purposes.

Web maine department of labor administers the unemployment insurance contributions once the quarterly report is filed. Maine revenue administers all aspects of income tax withholding. Alphabetical listing by tax type or program name. The 2023 maine personal exemption amount is $4,700 and the maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns.

This Submission Is Not Required If The Employer Reasonably Expects That The Employee Will Earn Annual

These are forms due for wages and other payments made during 2023. If too much is withheld, you

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)