Llc Cancellation Form

Llc Cancellation Form - Before submitting the completed form, you should. Web dissolution resolution, articles of dissolution, and irs form 966 are required to cancel a llc. Currently, llcs can submit termination forms online. Web certificate of cancellation short form cancellation certificate: Finally, a dissolution form may be filed with the. Ad discover why we have been chosen for business incorporation for 40 years. Trusted by over 5,000+ businesses. The irs cannot cancel your ein. Your llc will not be. Edit, sign and save mo rescind cancellation aff form.

Go to page 2 for a list of forms to file with the sos. Follow your missouri llc operating agreement. Web use this filing to dissolve or cancel a kansas business entity, or to withdraw a foreign entity from conducting business in kansas. Web your loans must be federal direct loans. Ad discover why we have been chosen for business incorporation for 40 years. The following information is required to file online:. Edit, sign and save mo rescind cancellation aff form. Web the members need to draft a written agreement and have it signed by all members showing the agreement to dissolve the business. Ad download or email mpp forms & more fillable forms, register and subscribe now! Web the certificate of dissolution puts all on notice that the llc has elected to wind up the business of the llc and is in the process of paying liabilities and distributing assets.

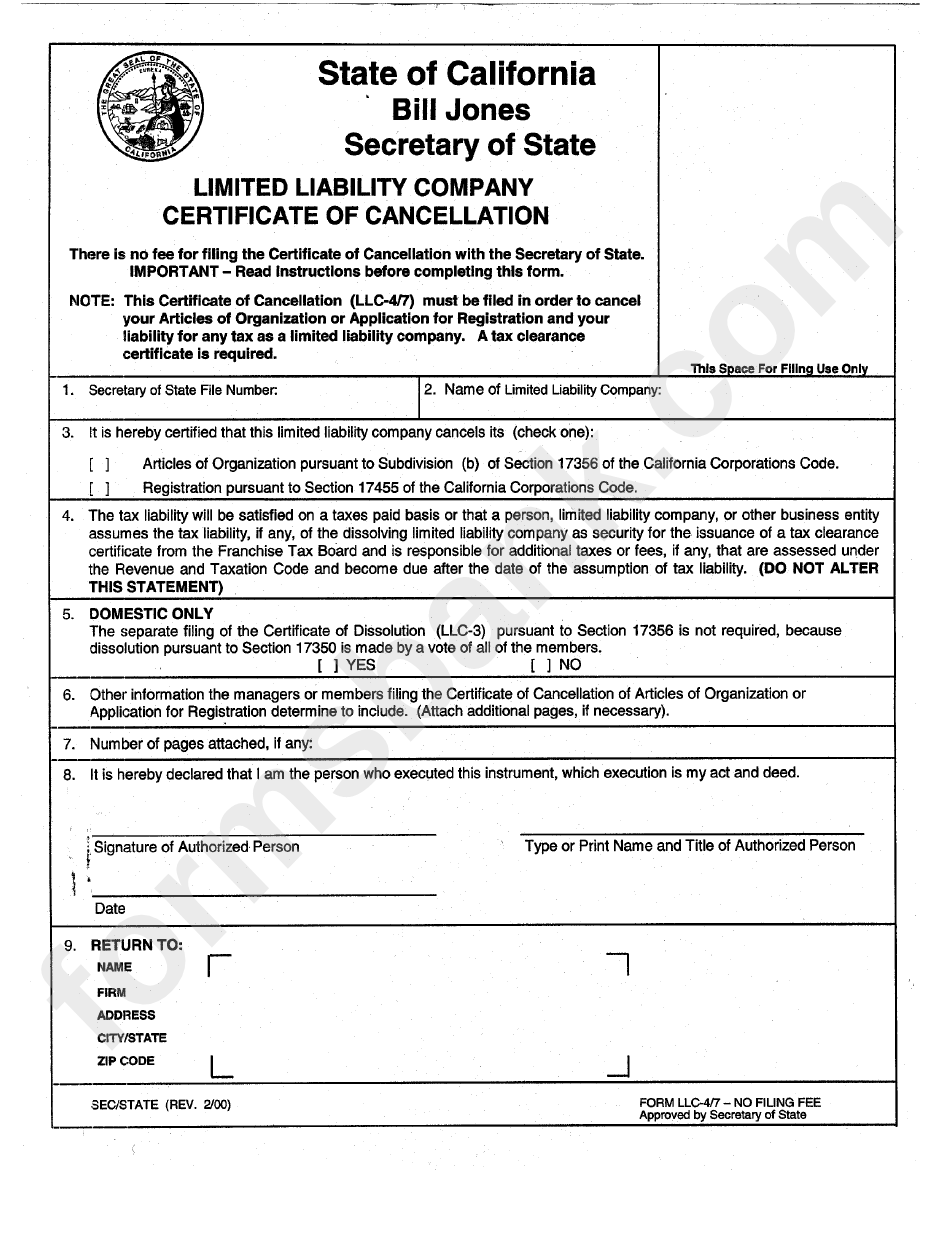

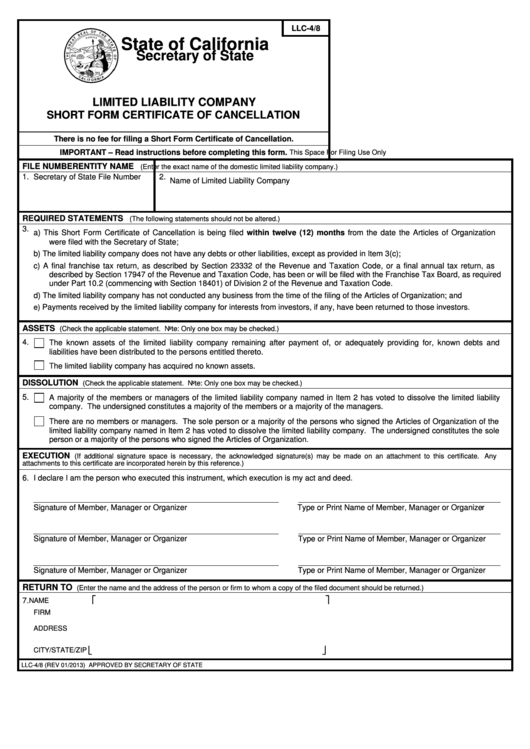

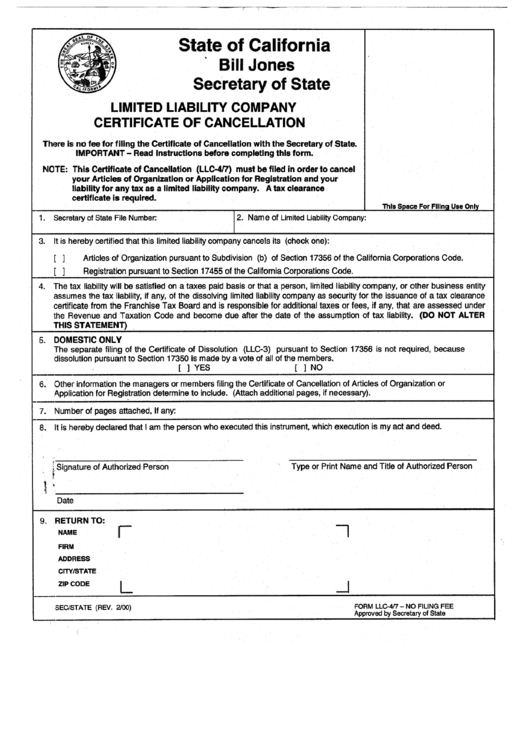

Web use this filing to dissolve or cancel a kansas business entity, or to withdraw a foreign entity from conducting business in kansas. Web the california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the formation of llcs in california. Ad download or email mpp forms & more fillable forms, register and subscribe now! Currently, llcs can submit termination forms online. Edit, sign and save mo rescind cancellation aff form. Once an ein has been assigned to a business entity, it becomes the permanent federal. Web this short form certificate of cancellation is being filed within twelve (12) months from the date the articles of organization were filed with the california secretary of state; Web dissolution resolution, articles of dissolution, and irs form 966 are required to cancel a llc. The name of the limited liability company as it appears on the records: Web in order to file for a dissolution or cancellation of a corporation in the state of delaware you need to download and fill out the appropriate form on this page.

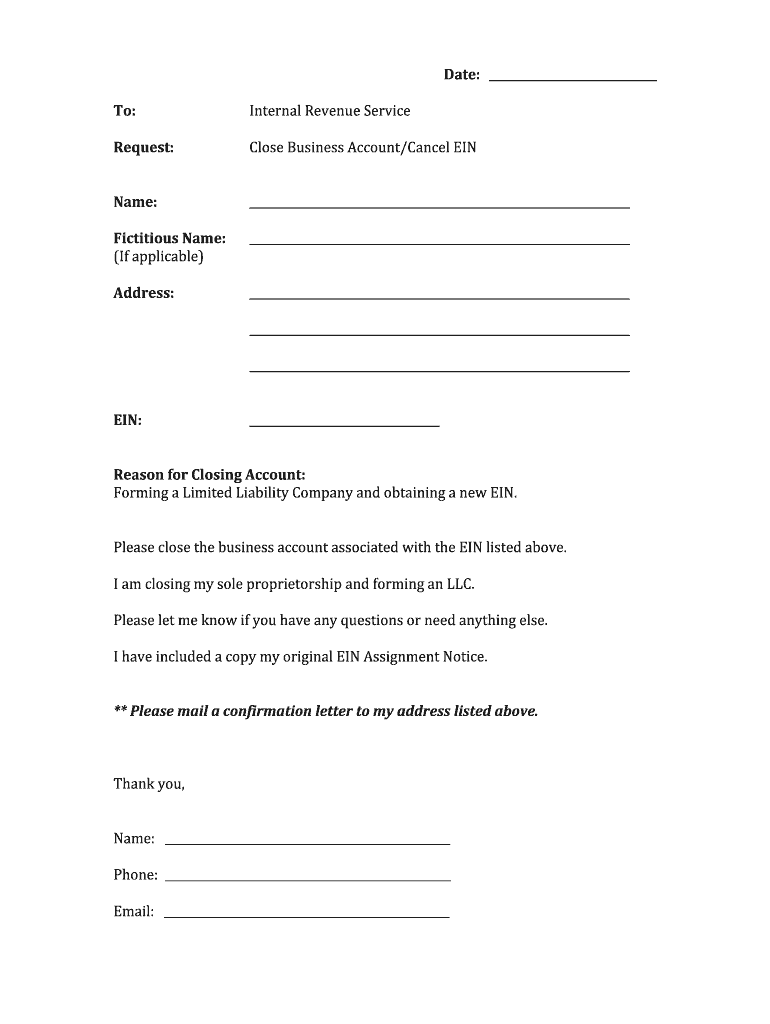

Irs Name Change Letter Sample Ein Comprehensive Guide Freshbooks

Web the california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the formation of llcs in california. Web this short form certificate of cancellation is being filed within twelve (12) months from the date the articles of organization were filed with the california secretary of state; Receive personal attention from a knowledgeable business incorporation.

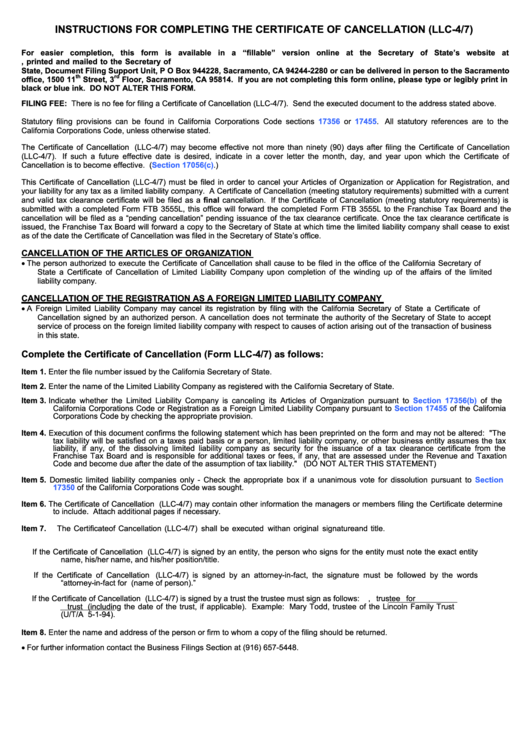

Form Llc4/7 Limited Liability Company Certificate Of Cancellation

The following information is required to file online:. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Web use this filing to dissolve or cancel a kansas business entity, or to withdraw a foreign entity from conducting business in kansas. Before submitting the completed form, you should. Web resignation of.

Fillable Form Llc4/8 Limited Liability Company Short Form

Ad download or email mpp forms & more fillable forms, register and subscribe now! Finally, a dissolution form may be filed with the. Once an ein has been assigned to a business entity, it becomes the permanent federal. Your llc will not be. The following information is required to file online:.

Form Llc4/7 Limited Liability Company Certificate Of Cancellation

The irs cannot cancel your ein. Follow your missouri llc operating agreement. Web dissolution resolution, articles of dissolution, and irs form 966 are required to cancel a llc. Easy with a few clicks. Finally, a dissolution form may be filed with the.

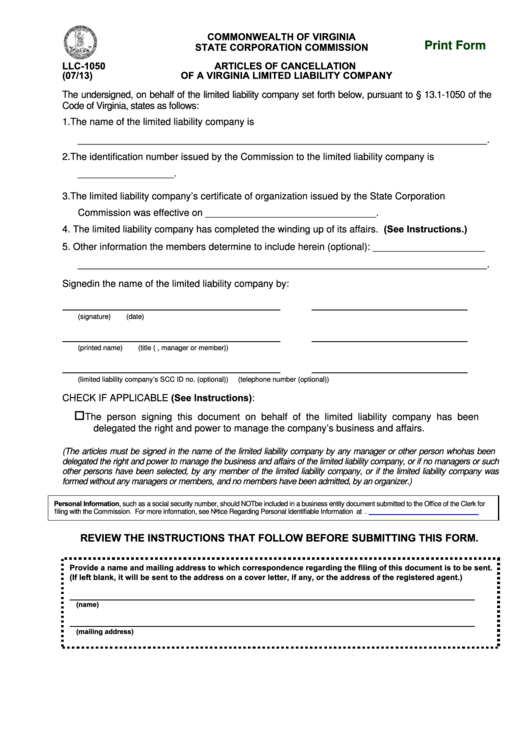

Fillable Form Llc1050 Articles Of Cancellation Of A Va Llc printable

The following information is required to file online:. Register and subscribe now to work on your mo affidavit to rescind cancellation of llc/lp Ad download or email mpp forms & more fillable forms, register and subscribe now! Go to page 2 for a list of forms to file with the sos. Trusted by over 5,000+ businesses.

Form Llc4/7 Instructions For Completing The Certificate Of

Currently, llcs can submit termination forms online. Web the california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the formation of llcs in california. The irs cannot cancel your ein. Once an ein has been assigned to a business entity, it becomes the permanent federal. Web the certificate of dissolution puts all on notice.

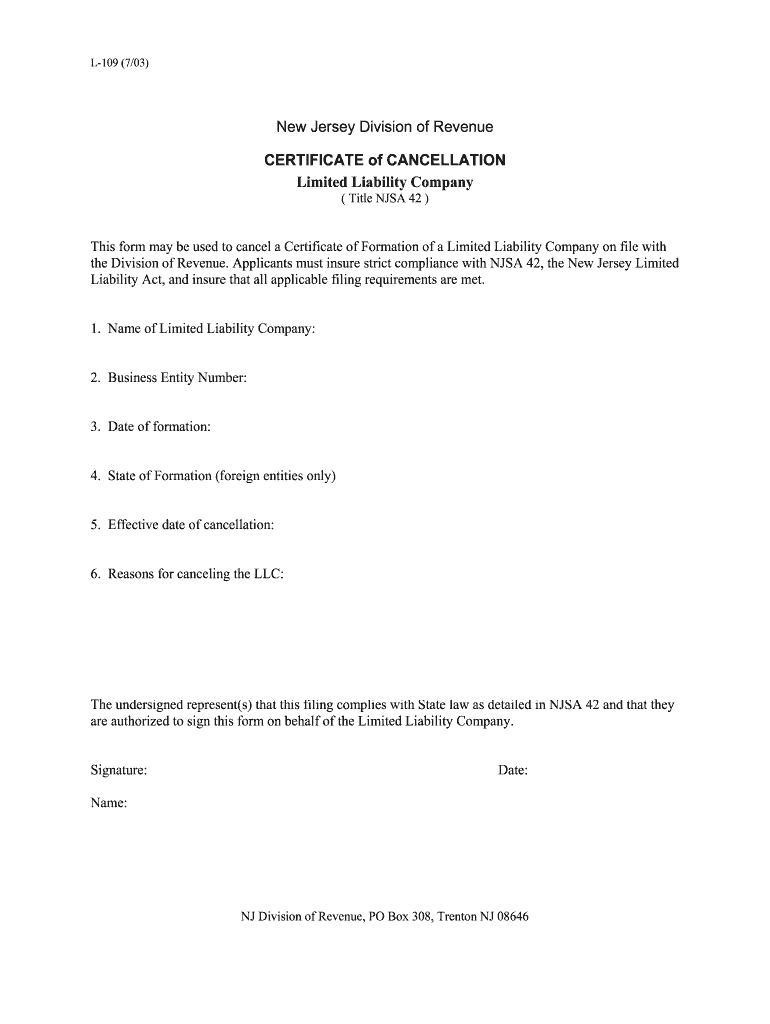

Nj L Llc Fill Out and Sign Printable PDF Template signNow

Web this short form certificate of cancellation is being filed within twelve (12) months from the date the articles of organization were filed with the california secretary of state; Web the california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the formation of llcs in california. The following information is required to file online:..

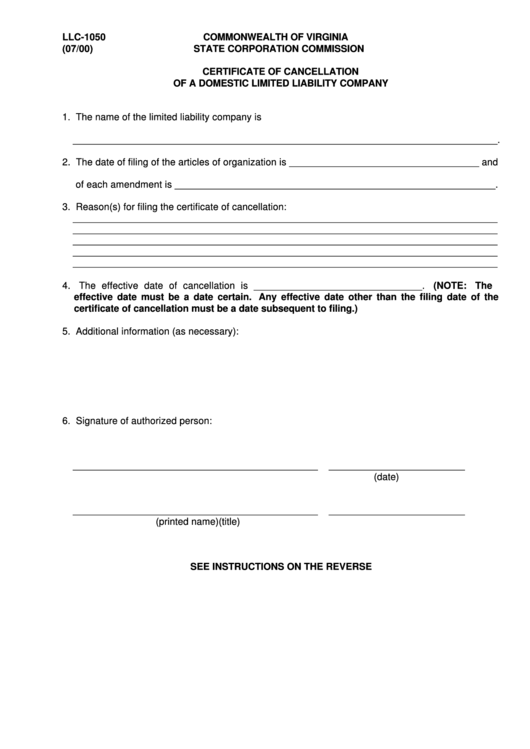

Fillable Form Llc1050 Certificate Of Cancellation Of A Domestic

Ad discover why we have been chosen for business incorporation for 40 years. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. Web certificate of cancellation short form cancellation certificate: Finally, a dissolution form may be filed with the. The irs cannot cancel your ein.

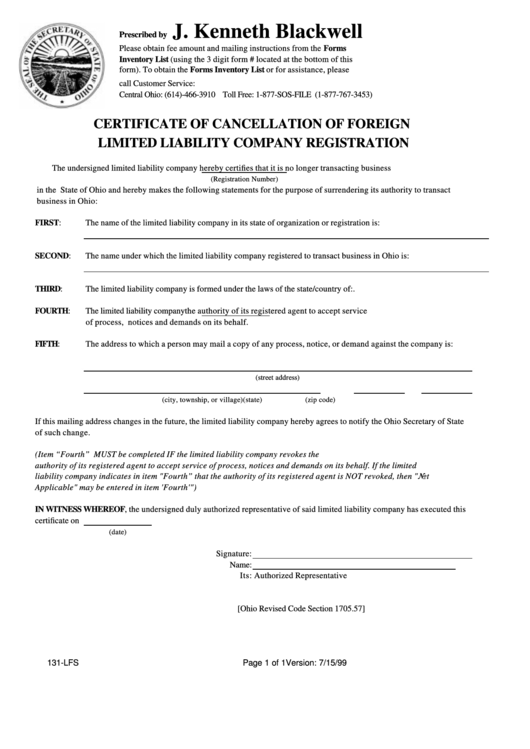

Certificate Of Cancellation Of Foreign Limited Liability Company

Follow your missouri llc operating agreement. Web this short form certificate of cancellation is being filed within twelve (12) months from the date the articles of organization were filed with the california secretary of state; Go to page 2 for a list of forms to file with the sos. Web the certificate of dissolution puts all on notice that the.

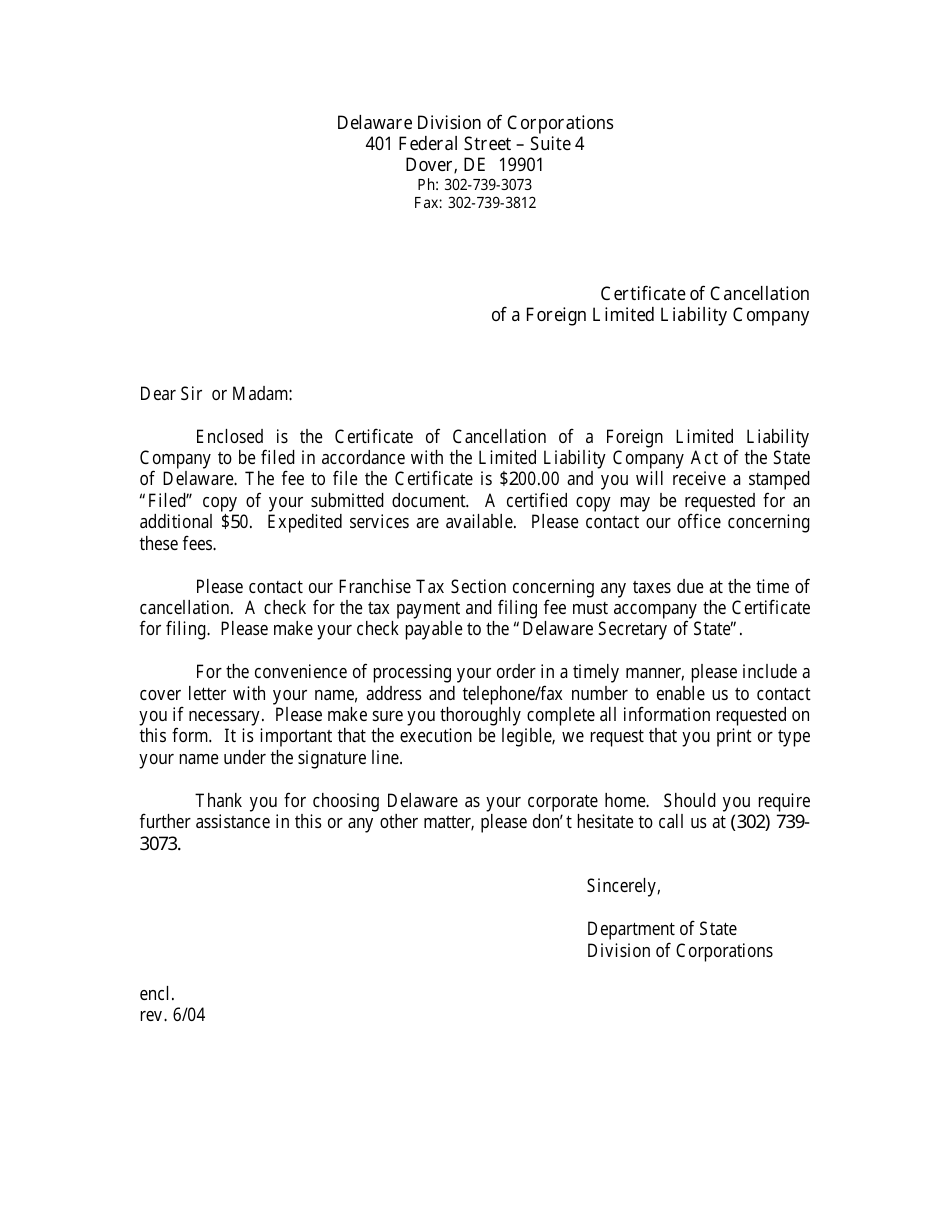

Delaware Certificate of Cancellation of a Foreign Limited Liability

Your llc will not be. Web certificate of cancellation short form cancellation certificate: Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. Currently, llcs can submit termination forms online. Ad discover why we have been chosen for business incorporation for 40 years.

Web Use This Filing To Dissolve Or Cancel A Kansas Business Entity, Or To Withdraw A Foreign Entity From Conducting Business In Kansas.

Before submitting the completed form, you should. Web your loans must be federal direct loans. Receive personal attention from a knowledgeable business incorporation expert. The following information is required to file online:.

Edit, Sign And Save Mo Rescind Cancellation Aff Form.

Trusted by over 5,000+ businesses. The irs cannot cancel your ein. Follow your missouri llc operating agreement. Your llc will not be.

Web This Package Provides All The Forms Needed To Dissolve An Llc In Your State, Saving You Precious Time And Money.

Pdffiller allows users to edit, sign, fill and share their all type of documents online Web the members need to draft a written agreement and have it signed by all members showing the agreement to dissolve the business. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Web the certificate of dissolution puts all on notice that the llc has elected to wind up the business of the llc and is in the process of paying liabilities and distributing assets.

Web File The Appropriate Dissolution, Surrender, Or Cancellation Form (S) With The Sos Within 12 Months Of Filing Your Final Tax Return.

Once an ein has been assigned to a business entity, it becomes the permanent federal. Read our step by step process below and get help from an upcounsel. Ad discover why we have been chosen for business incorporation for 40 years. For most llcs, the steps for dissolution will be outlined in the operating agreement.