Like Kind Exchange Form

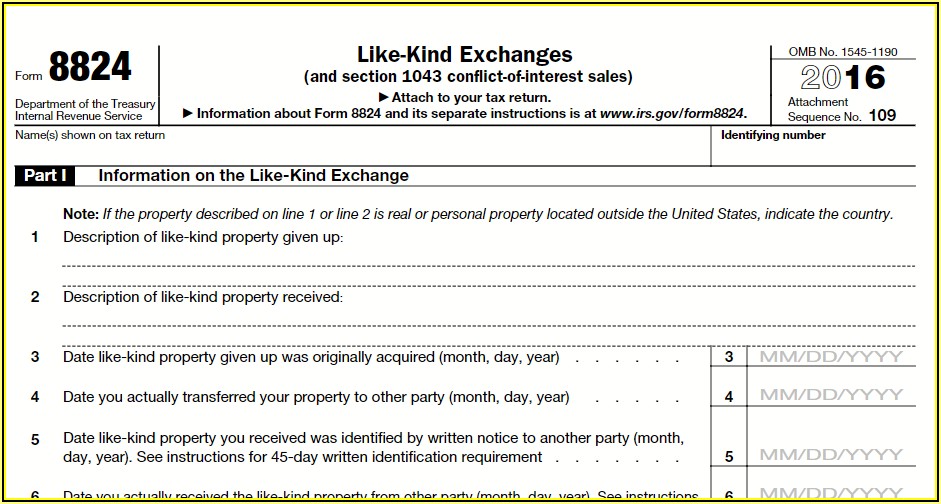

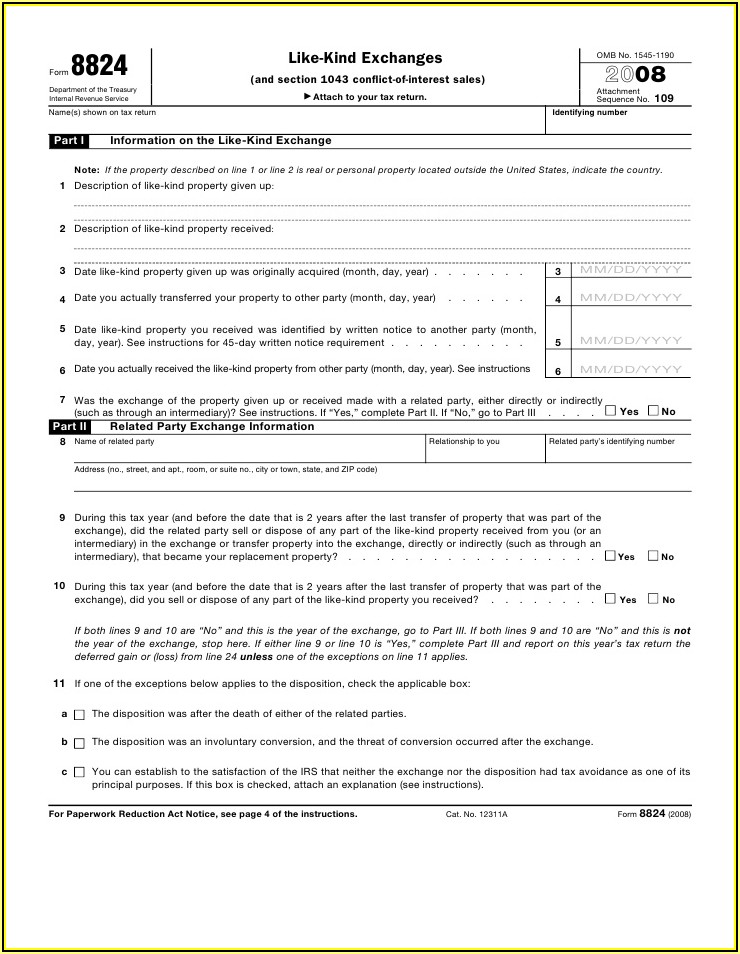

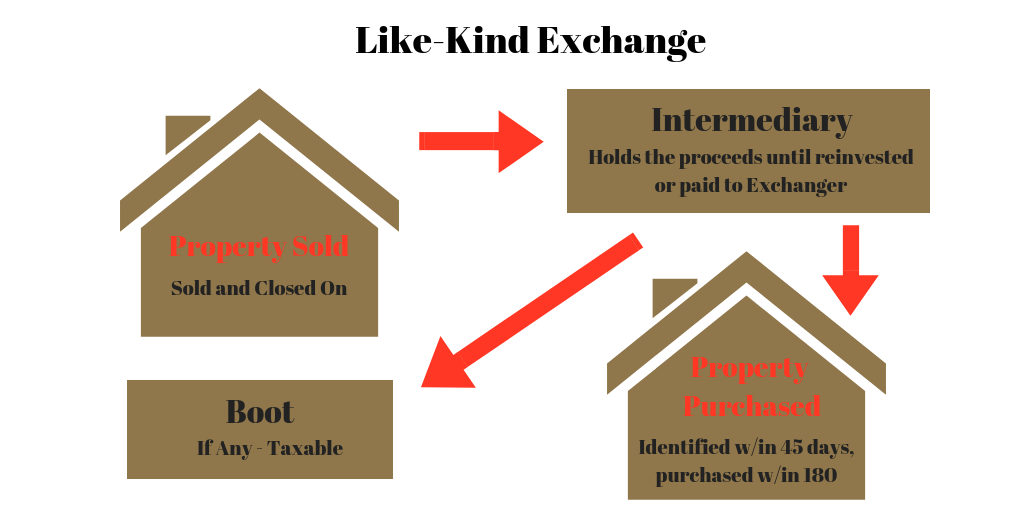

Like Kind Exchange Form - It just pushes them into the future. See here for more details. For individuals, exceptions apply based on agi limitations. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Identify the property you want to sell a 1031 exchange is generally only for business or investment properties. Also file form 8824 for the 2 years following the year of a related. An exchange of business or investment property of the same kind, class, or character and excluding securities that is made pursuant to section 1031 of the internal revenue code and is thus exempt from taxation This is a package of the necessary documents to be used in connection with a like kind exchange of properties. Web irs regulations changed effective january 1st, 2018. All three steps must be completed for the tax return to contain the correct information.

Not held for resale or flipped; See here for more details. Property for personal use — like your primary residence or a vacation. The instructions for form 8824 explain how to report the details of the exchange. See line 7, later, for details. For the calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as shown on your state tax return. An exchange of business or investment property of the same kind, class, or character and excluding securities that is made pursuant to section 1031 of the internal revenue code and is thus exempt from taxation This fact sheet, the 21. Table of contents what happens in an exchange? Who qualifies for the section 1031 exchange?

The package contains both a straightforward exchange agreement between two parties in the event a situation arises where there can be a direct exchange in such a manner, and. For individuals, exceptions apply based on agi limitations. In the same general asset class; Irs form 8824 is used to report an exchange of real property for real property of a like kind and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to. In the same general asset class; If the property described on line 1 or line 2 is real property located outside the united states, indicate the country. All three steps must be completed for the tax return to contain the correct information. Not held for resale or flipped; Web irs regulations changed effective january 1st, 2018. See instructions and r&tc section 18031.5, for more information.

Form 8824 LikeKind Exchanges (2015) Free Download

Web irs regulations changed effective january 1st, 2018. The instructions for form 8824 explain how to report the details of the exchange. This is a package of the necessary documents to be used in connection with a like kind exchange of properties. Not held for resale or flipped; This fact sheet, the 21.

1031 Like Kind Exchange Services SC Certified Public Accountant

For individuals, exceptions apply based on agi limitations. Irs form 8824 is used to report an exchange of real property for real property of a like kind and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to. If the property described on line 1 or line 2 is.

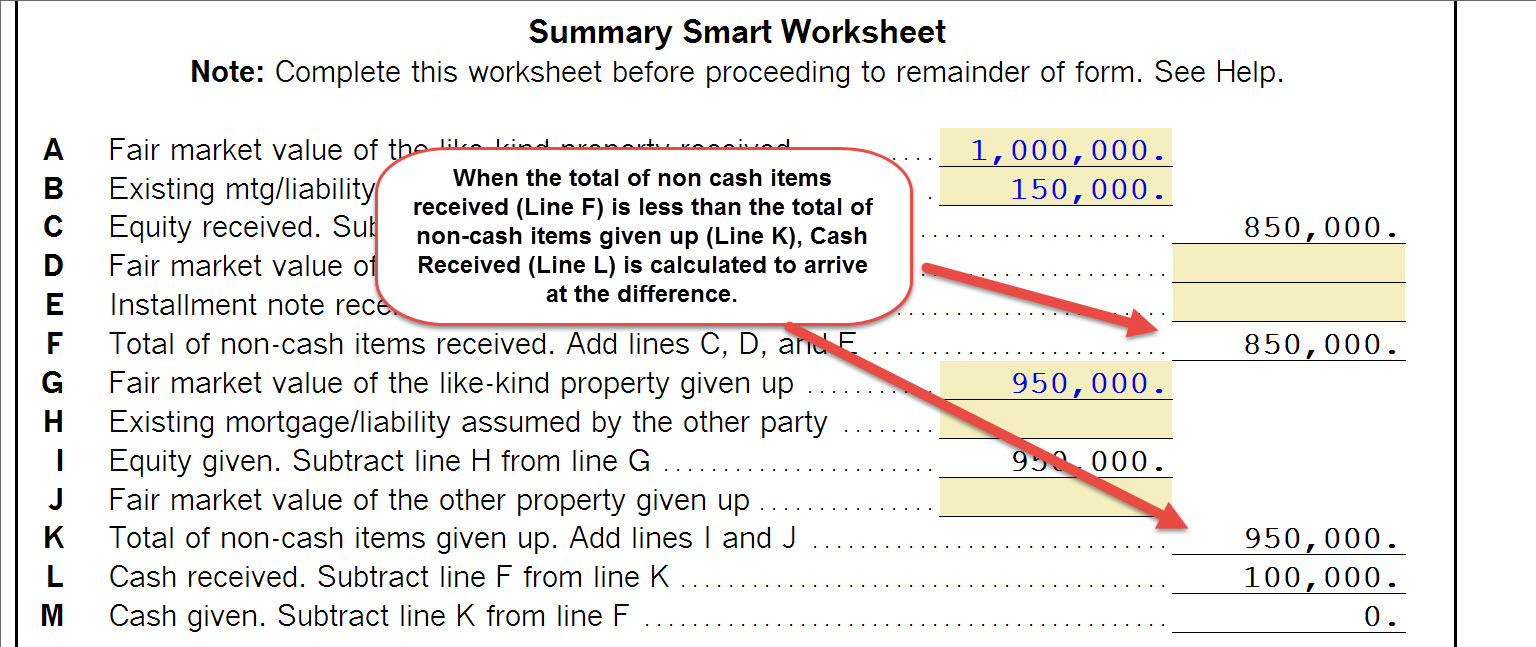

1040 Completing a LikeKind Exchange of Business Property (103

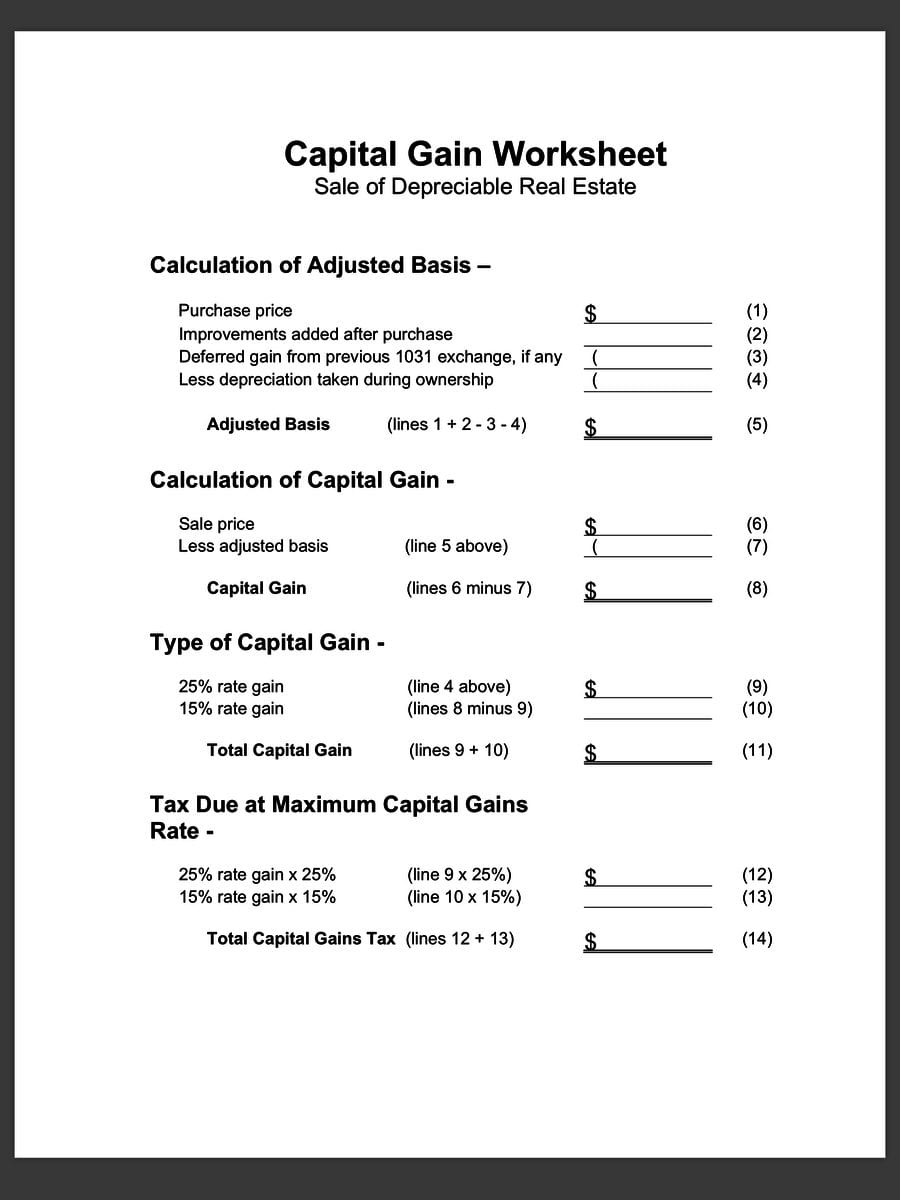

Irs form 8824 is used to report an exchange of real property for real property of a like kind and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to. Identify the property you want to sell a 1031 exchange is generally only for business or investment properties. If.

Like Kind Exchange Worksheet —

Allowable exchanges exclusions and deadlines what happens in an exchange? Also file form 8824 for the 2 years following the year of a related. In the same general asset class; Table of contents what happens in an exchange? Identify the property you want to sell a 1031 exchange is generally only for business or investment properties.

Like Kind Exchange Forms Form Resume Examples wRYPKmb94a

If the property described on line 1 or line 2 is real property located outside the united states, indicate the country. See instructions and r&tc section 18031.5, for more information. Also file form 8824 for the 2 years following the year of a related party exchange. Allowable exchanges exclusions and deadlines what happens in an exchange? Table of contents what.

Like Kind Exchange Forms Form Resume Examples wRYPKmb94a

Not held for resale or flipped; Not held for resale or flipped; See line 7, later, for details. An exchange of business or investment property of the same kind, class, or character and excluding securities that is made pursuant to section 1031 of the internal revenue code and is thus exempt from taxation Irs form 8824 is used to report.

Section 1031 Exchange The Ultimate Guide to LikeKind Exchange

See here for more details. Who qualifies for the section 1031 exchange? Irs form 8824 is used to report an exchange of real property for real property of a like kind and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to. Property for personal use — like your.

LikeKind Exchanges Defer Capital Gains Taxes on Real Estate Borchers

This fact sheet, the 21. Web irs regulations changed effective january 1st, 2018. Also file form 8824 for the 2 years following the year of a related. Identify the property you want to sell a 1031 exchange is generally only for business or investment properties. It just pushes them into the future.

Newly Proposed IRS Regulations Address LikeKind Exchanges Dallas

Disposing of the original asset Not held for resale or flipped; Property for personal use — like your primary residence or a vacation. For the calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as shown on your state tax return. The package contains both a straightforward exchange agreement between two parties in the event a.

Like Kind Exchange Form 4797 Universal Network

Also file form 8824 for the 2 years following the year of a related party exchange. Disposing of the original asset An exchange of business or investment property of the same kind, class, or character and excluding securities that is made pursuant to section 1031 of the internal revenue code and is thus exempt from taxation All three steps must.

All Three Steps Must Be Completed For The Tax Return To Contain The Correct Information.

In the same general asset class; The package contains both a straightforward exchange agreement between two parties in the event a situation arises where there can be a direct exchange in such a manner, and. Allowable exchanges exclusions and deadlines what happens in an exchange? Also file form 8824 for the 2 years following the year of a related.

Not Held For Resale Or Flipped;

Owners of investment and business property may qualify for a section 1031. See instructions and r&tc section 18031.5, for more information. For individuals, exceptions apply based on agi limitations. Irs form 8824 is used to report an exchange of real property for real property of a like kind and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to.

Use Parts I, Ii, And Iii Of Form 8824 To Report Each Exchange Of Business Or Investment Property For Property Of A Like Kind.

See here for more details. The instructions for form 8824 explain how to report the details of the exchange. It just pushes them into the future. Identify the property you want to sell a 1031 exchange is generally only for business or investment properties.

Also File Form 8824 For The 2 Years Following The Year Of A Related Party Exchange.

Web irs regulations changed effective january 1st, 2018. In the same general asset class; Only real property should be described on lines 1 and 2. This is a package of the necessary documents to be used in connection with a like kind exchange of properties.