Kiddie Tax Form

Kiddie Tax Form - Form 8814, or any tax from the recapture of an education credit. For tax years 2018 and 2019, you can elect to calculate the tax on the unearned income of certain children using either the brackets and rates for estates and trusts or. If the qualified dividends and capital gain tax worksheet, schedule d tax worksheet. The child had more than $2,300 of unearned income. The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. Web the kiddie tax is reported on your child's return (or yours, if specific conditions listed below are met). Web form 8615 is used to make the child's tax calculations for this income. Attach form 8615 to the child’s tax return if all of the following conditions are met. Election to tax the unearned income of certain children at the parent’s tax rate. Web the kiddie tax is the tax levied on the portion of your child's unearned income that exceeds $2,300.

The child's unearned income was more than $2,300. Under age 18 at year’s end, age 18 and did not have earned income more than half of their support Attach form 8615 to the child’s tax return if all of the following conditions are met. Form 8814, or any tax from the recapture of an education credit. If the qualified dividends and capital gain tax worksheet, schedule d tax worksheet. Web the kiddie tax rules apply to any child who: But investment income is a more complicated formula. Web the kiddie tax is the tax levied on the portion of your child's unearned income that exceeds $2,300. Web form 8615 is used to make the child's tax calculations for this income. Web use form 8615 pdf to figure the child's tax on unearned income over $2,300 if the child is under age 18, and in certain situations if the child is older (see below).

If the qualified dividends and capital gain tax worksheet, schedule d tax worksheet. The child is required to file a tax return. Web form 8615 is used to make the child's tax calculations for this income. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form 1040. Was under age 18 at the end of 2022, b. Web the kiddie tax is the tax levied on the portion of your child's unearned income that exceeds $2,300. The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. Web earned income will be taxed at the child's rate above their applicable standard deduction, which is equal to their earned income plus $400 (or $1,250, whichever is greater), up to a maximum of $13,850 in 2023. But investment income is a more complicated formula. All these conditions must be met:

2022 Child Tax Credits Form Fillable, Printable PDF & Forms Handypdf

Has more than $2,200 of unearned income has at least one living parent doesn’t file a joint return is required to file a tax return is one of the following: Web the kiddie tax rules apply to any child who: Web form 8615 is used to make the child's tax calculations for this income. The child had more than $2,300.

4 ways the ‘Kiddie Tax’ can work for you and your family WTOP News

If the qualified dividends and capital gain tax worksheet, schedule d tax worksheet. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form 1040. Web the kiddie tax rules apply to any child who: For tax years 2018 and 2019, you can elect to calculate the tax.

Understanding the new kiddie tax Additional examples Journal of

The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. The child is required to file a tax return. For tax years 2018 and 2019, you can elect to calculate the tax on the unearned income of certain children using either the brackets and rates for estates.

The kiddie tax trap

Election to tax the unearned income of certain children at the parent’s tax rate. The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form.

Child Tax Release Form f8332 Tax Exemption Social Security Number

Under what conditions can i include my child's income on my return? But investment income is a more complicated formula. Web the kiddie tax is reported on your child's return (or yours, if specific conditions listed below are met). The child had more than $2,300 of unearned income. Web kiddie tax is reported on form 8615 (tax for certain children.

Understanding the new kiddie tax Additional examples Journal of

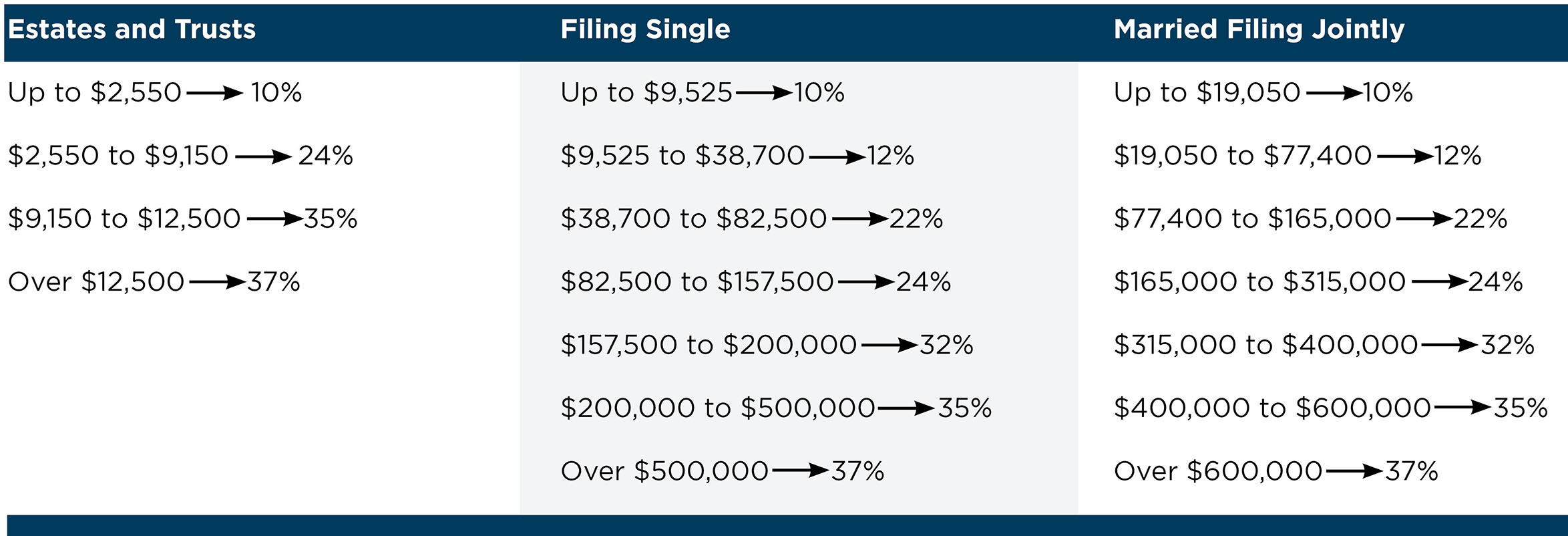

Treatment of unearned income click to expand unearned income unearned income is income gained from a source other than employment, work, or other business activity. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form 1040. For tax years 2018 and 2019, you can elect to calculate.

Tax Reform Kiddie Tax Ohio Tax Planning Columbus CPA

Was under age 18 at the end of 2022, b. The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. Has more than $2,200 of unearned income has at least one living parent doesn’t file a joint return is required to file a tax return is one.

Child Tax Application Form Fill Out and Sign Printable PDF Template

Web the kiddie tax rules apply to any child who: Election to tax the unearned income of certain children at the parent’s tax rate. Table of contents unearned income who's required to file form 8615? The child had more than $2,300 of unearned income. Web the kiddie tax is the tax levied on the portion of your child's unearned income.

Changes to the Kiddie Tax Randell W Martin CPA PLLC

Form 8814, or any tax from the recapture of an education credit. The child is required to file a tax return. Web earned income will be taxed at the child's rate above their applicable standard deduction, which is equal to their earned income plus $400 (or $1,250, whichever is greater), up to a maximum of $13,850 in 2023. Web the.

June 17th 2Q Estimated Tax Payment Due Matthews, Carter & Boyce

Web form 8615 is used to make the child's tax calculations for this income. Web form 8615 must be filed for any child who meets all of the following conditions. Has more than $2,200 of unearned income has at least one living parent doesn’t file a joint return is required to file a tax return is one of the following:.

When Choosing To Report It On Your Child's Return, We'll Need Info From One Of The Parents:

But investment income is a more complicated formula. Has more than $2,200 of unearned income has at least one living parent doesn’t file a joint return is required to file a tax return is one of the following: Attach form 8615 to the child’s tax return if all of the following conditions are met. Web form 8615 is used to make the child's tax calculations for this income.

Web Earned Income Will Be Taxed At The Child's Rate Above Their Applicable Standard Deduction, Which Is Equal To Their Earned Income Plus $400 (Or $1,250, Whichever Is Greater), Up To A Maximum Of $13,850 In 2023.

Election to tax the unearned income of certain children at the parent’s tax rate. Treatment of unearned income click to expand unearned income unearned income is income gained from a source other than employment, work, or other business activity. Was under age 18 at the end of 2022, b. Web the kiddie tax is the tax levied on the portion of your child's unearned income that exceeds $2,300.

Under Age 18 At Year’s End, Age 18 And Did Not Have Earned Income More Than Half Of Their Support

Web use form 8615 pdf to figure the child's tax on unearned income over $2,300 if the child is under age 18, and in certain situations if the child is older (see below). Form 8814, or any tax from the recapture of an education credit. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form 1040. All these conditions must be met:

Under What Conditions Can I Include My Child's Income On My Return?

For tax years 2018 and 2019, you can elect to calculate the tax on the unearned income of certain children using either the brackets and rates for estates and trusts or. The child had more than $2,300 of unearned income. The parent's taxpayer identification number (tin) must be included on the child's return, and the parent must provide the number to the child. Web the kiddie tax is reported on your child's return (or yours, if specific conditions listed below are met).