Kentucky Tax Extension Form

Kentucky Tax Extension Form - Web extended deadline with kentucky tax extension: Web free tax return preparation; The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. General assembly passes hb 5 to allow for authorized. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. To access this form, in the kentucky state main menu,. Web june 2023 sales tax facts with guidance updates now available; Web use this form if you are requesting a kentucky extension of time to file. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to.

Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april 15). Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Taxformfinder provides printable pdf copies of 130. Download or email form 0506 & more fillable forms, register and subscribe now! Web june 2023 sales tax facts with guidance updates now available; Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web use this form if you are requesting a kentucky extension of time to file. Web amount actually paid with extension:

Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Insurance premiums tax and surcharge; Complete, edit or print tax forms instantly. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. General assembly passes hb 5 to allow for authorized. You can complete and sign the 2022 tax. Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april 15). Web june 2023 sales tax facts with guidance updates now available;

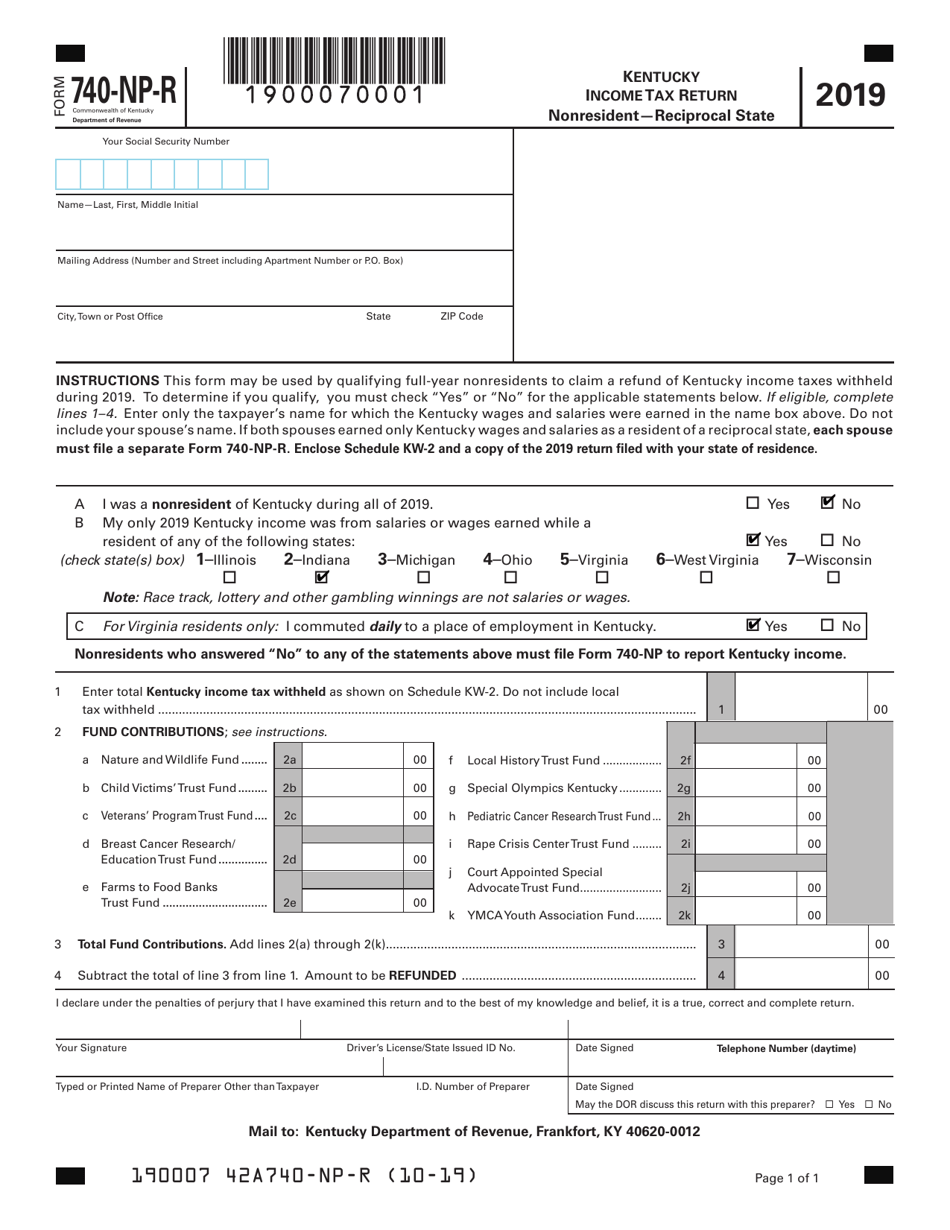

dipitdesign Kentucky Tax Form 740

Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Web corporation income and limited liability entity tax; To access this form, in the kentucky state main menu,. Web if additional tax is due or a federal extension has not been filed,.

US Kentucky 6 Sales Tax extension

Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web use this form if you are requesting a kentucky extension of time to file. Web to apply for a kentucky personal extension, you must submit a written request to the kentucky department of revenue by the original deadline of your tax return (april.

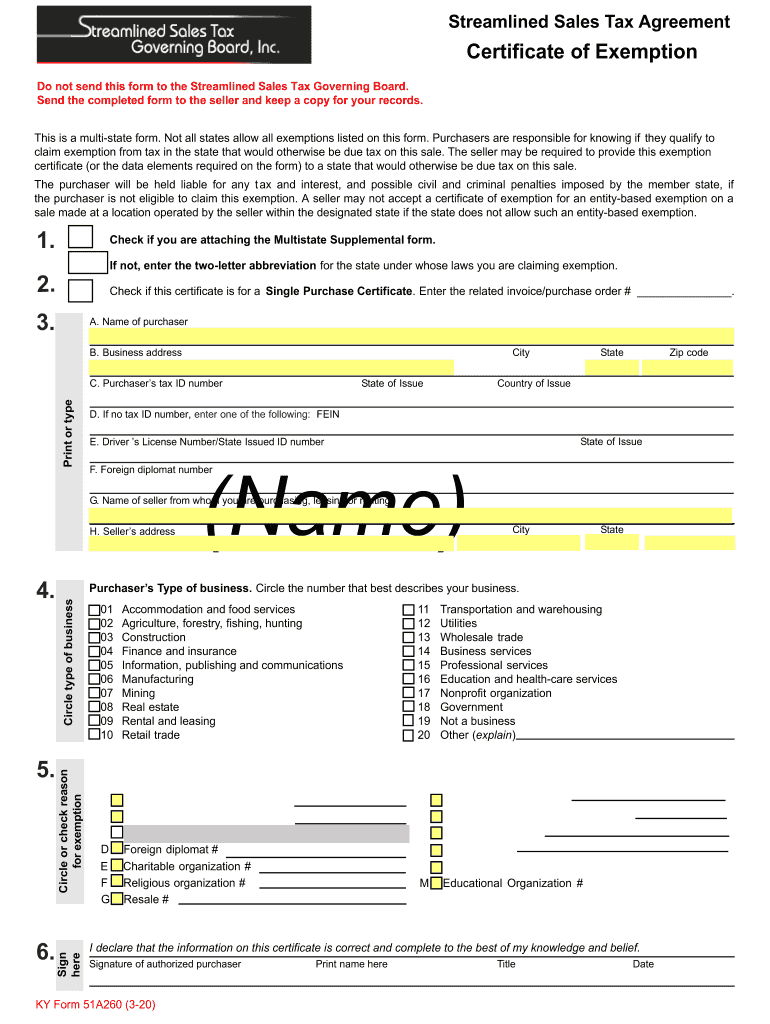

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Enter the amount on the kyext. Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they.

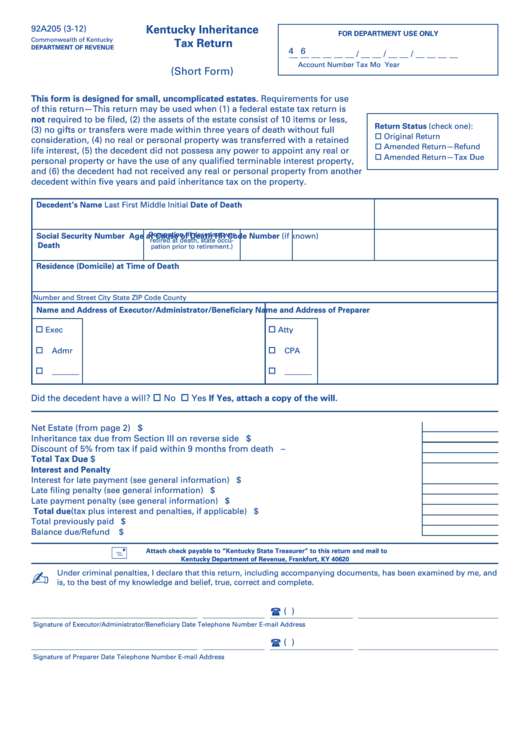

Form 92a205 Kentucky Inheritance Tax Return (Short Form) Kentucky

Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. Web use this form if you are requesting a kentucky extension of time to file. Web amount actually paid with extension: Web if additional tax is due or a federal extension has not been filed, use form 740ext.

Download Kentucky Tax Power of Attorney Form for Free TidyTemplates

Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Taxformfinder provides printable pdf copies of 130. Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax,.

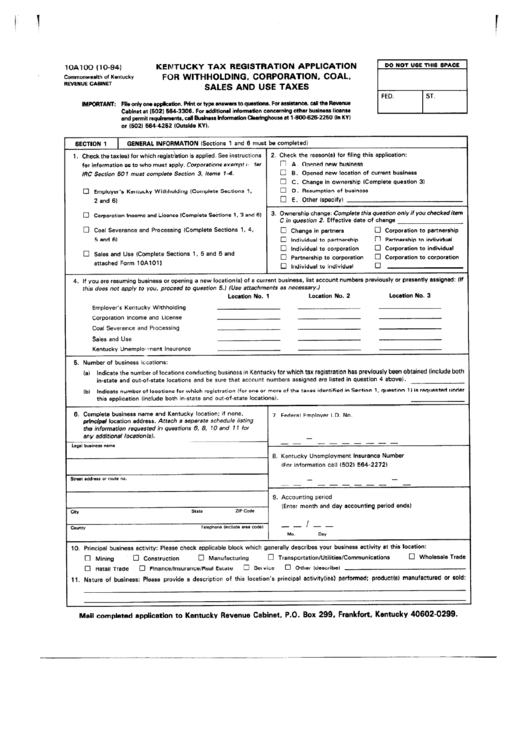

Form 10a100 Kentucky Tax Registration Application For Withholding

Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web this extension allows affected taxpayers until may 16,.

Application for Extension of Time to File Individual, General Partner…

Web free tax return preparation; Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Taxformfinder provides printable pdf copies of 130. To access the.

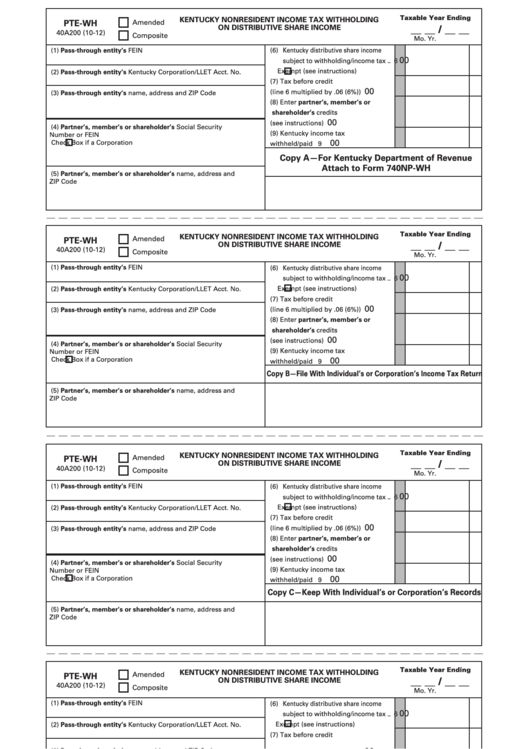

Form PteWh Kentucky Nonresident Tax Withholding On

General assembly passes hb 5 to allow for authorized. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Taxformfinder provides printable pdf copies of 130. Web to apply for a kentucky.

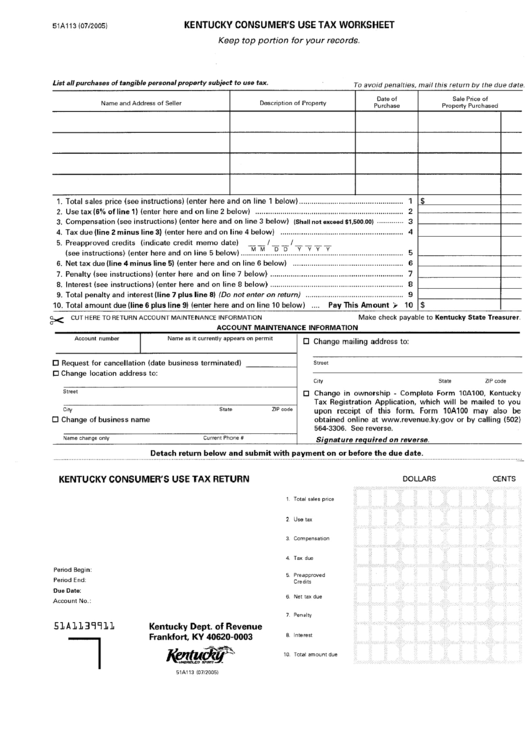

Form 51a113 Kentucky Consumer'S Use Tax Worksheet printable pdf download

Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. To access the kentucky application for. Insurance premiums tax and surcharge; Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web extended deadline with kentucky tax extension:

2019 Kentucky Tax Changes Department of Revenue

To access this form, in the kentucky state main menu,. Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue..

Taxformfinder Provides Printable Pdf Copies Of 130.

Web this extension allows affected taxpayers until may 16, 2022 to file kentucky income tax returns and submit tax payments for individual income tax, corporate income tax, income. Web amount actually paid with extension: Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months.

General Assembly Passes Hb 5 To Allow For Authorized.

Taxpayers who request a federal extension are not required to file a separate kentucky extension, unless. Web june 2023 sales tax facts with guidance updates now available; Web taxpayers who have obtained a valid federal extension (and do not need to request a separate kentucky extension) should only use form 40a102 if they need to. Web corporation income and limited liability entity tax;

Complete, Edit Or Print Tax Forms Instantly.

Web filing form 740ext allows individual taxpayers until october 15, 2021 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Download or email form 0506 & more fillable forms, register and subscribe now! Insurance premiums tax and surcharge; Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue.

Web Extended Deadline With Kentucky Tax Extension:

Web use this form if you are requesting a kentucky extension of time to file. You can complete and sign the 2022 tax. Web free tax return preparation; To access this form, in the kentucky state main menu,.