Itemized Deductions Template Excel

Itemized Deductions Template Excel - You have the name of the deduction in the first column of the template, the items. Margin interest) medical expenses exceeding the 10% amount of your agi dental. A taxpayer needs to set between. Web these templates include simple tax estimator, itemized deduction calculator, schedule b calculator, section 179 deduction calculator and much more. If you're not completely satisfied with our excel tax calculator, we'll send you a full refund. Add the amounts in far right column for lines 4 through 16. Web at simpleplanning, we guarantee it. Web itemized deduction calculator particulars amount interest paid on investments. It aids the taxpayer go please between standard furthermore itemize deductions. It will typically include an itemized list of expenses along with a.

Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web itemized deductions calculator is an excel template. Web depending on your business needs, an expense report may be lengthy and detailed or a simple form. A taxpayer needs to set between. If you're not completely satisfied with our excel tax calculator, we'll send you a full refund. You have the name of the deduction in the first column of the template, the items. Web start at the top of your opened document and take a look at how the information is setup. It aids the taxpayer go please between standard furthermore itemize deductions. Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. Web itemized deduction calculator particulars amount interest paid on investments.

Web itemized deduction calculator particulars amount interest paid on investments. It will typically include an itemized list of expenses along with a. Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web at simpleplanning, we guarantee it. Web start at the top of your opened document and take a look at how the information is setup. Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. Add the amounts in far right column for lines 4 through 16. Web itemized deductions calculator is an excel template. It aids the taxpayer go please between standard furthermore itemize deductions. A taxpayer needs to set between.

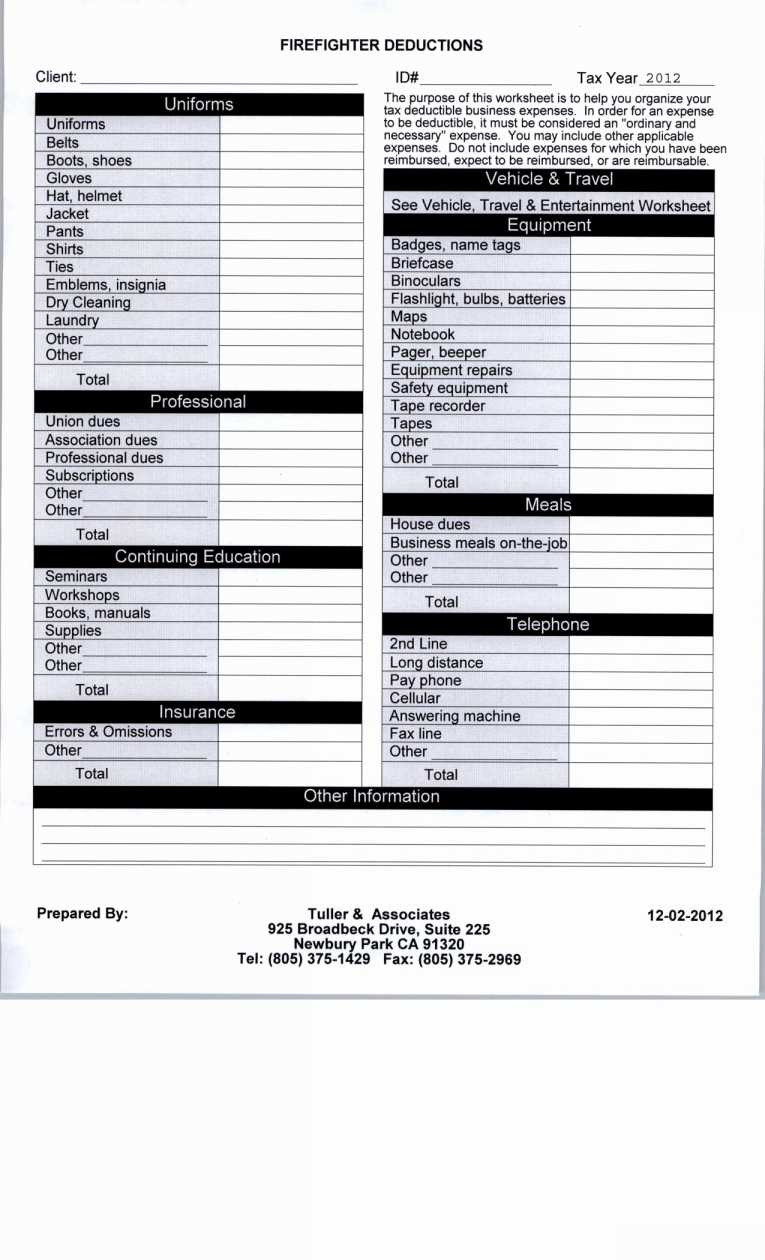

Itemized Security Deposit Deduction Form

Web these templates include simple tax estimator, itemized deduction calculator, schedule b calculator, section 179 deduction calculator and much more. Web start at the top of your opened document and take a look at how the information is setup. Web at simpleplanning, we guarantee it. It will typically include an itemized list of expenses along with a. Add the amounts.

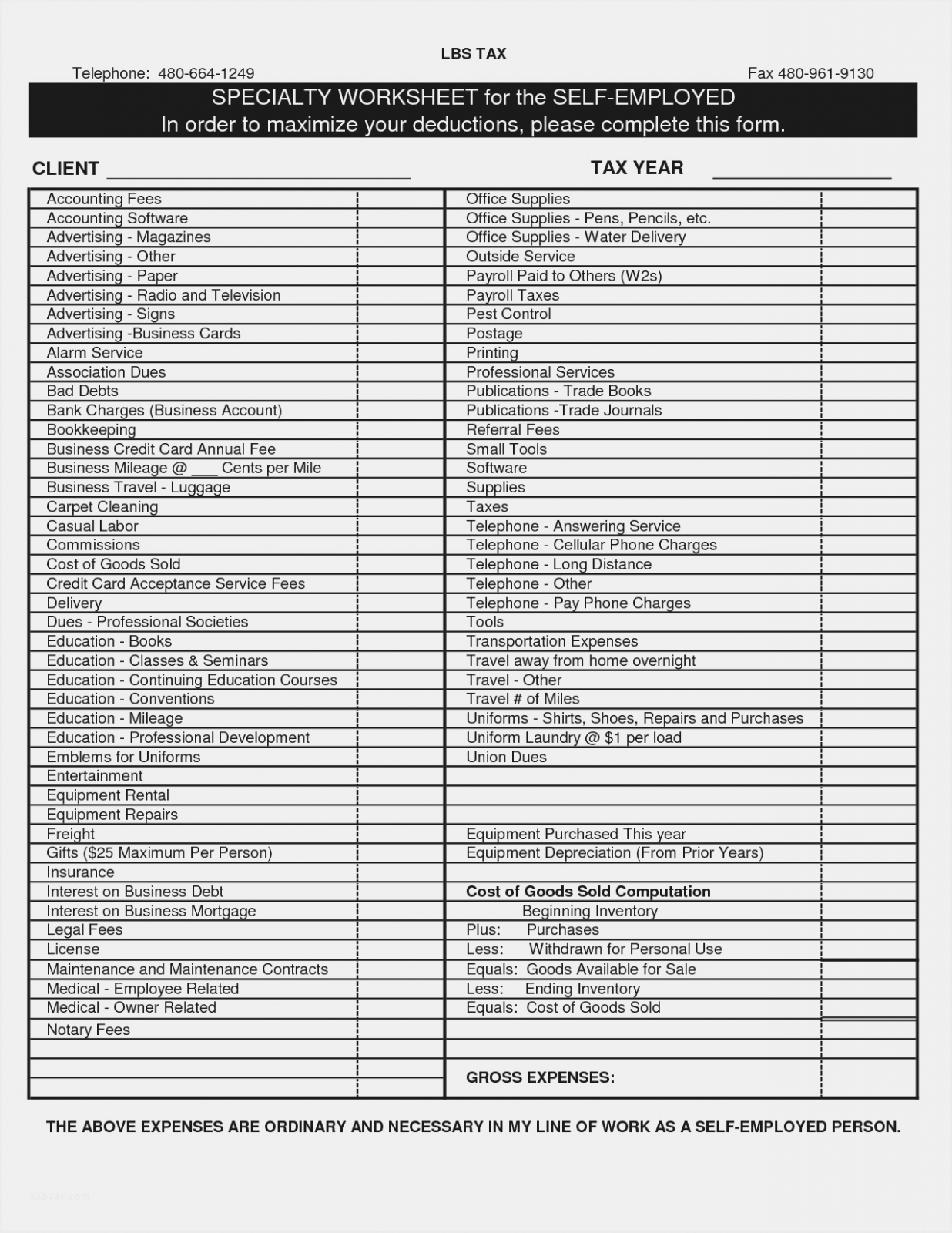

Tax Worksheet Pdf Best Self Employed Tax Deductions —

Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. Web start at the top of your opened document and take a look at how the information is setup. A taxpayer needs to set between. It aids the taxpayer go please between standard furthermore itemize.

7 Itemized Deductions Worksheet Excel 07001 FabTemplatez

It will typically include an itemized list of expenses along with a. You have the name of the deduction in the first column of the template, the items. It aids the taxpayer go please between standard furthermore itemize deductions. Web at simpleplanning, we guarantee it. Web itemized deduction calculator excel template in addition to the above, you can also download.

Itemized Security Deposit Deduction Form in 2020 Being a landlord

Add the amounts in far right column for lines 4 through 16. Web itemized deduction calculator particulars amount interest paid on investments. Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web depending on your business needs, an expense report may be lengthy and detailed or a simple form. Web these templates include simple tax estimator, itemized.

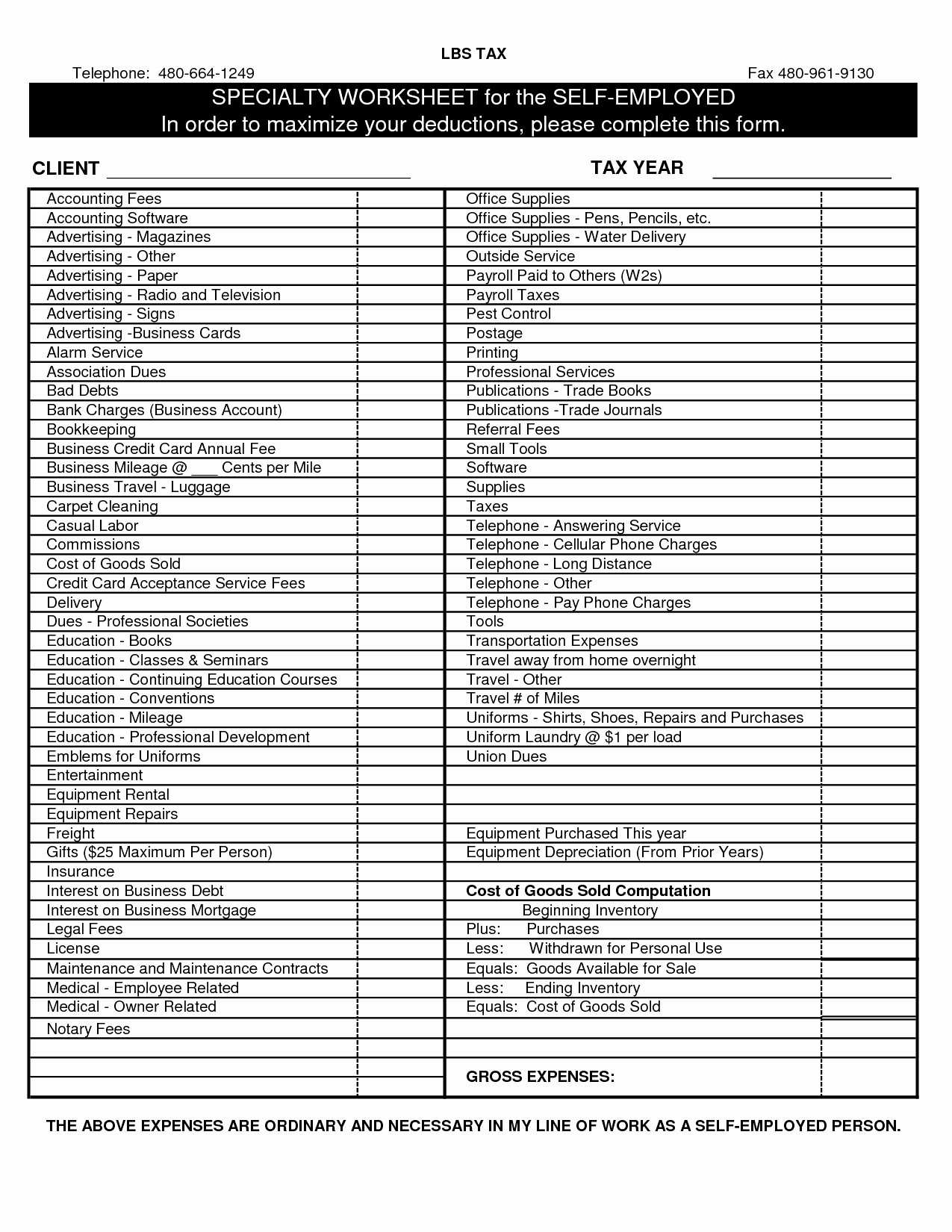

Tax Deduction Ecklist Itemized Worksheet E2 80 93 —

Add the amounts in far right column for lines 4 through 16. It aids the taxpayer go please between standard furthermore itemize deductions. Web itemized deductions calculator is an excel template. A taxpayer needs to set between. Web at simpleplanning, we guarantee it.

2018 Itemized Deduction Worksheet Excel acquit 2019 Worksheet

Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. Web itemized deductions calculator is an excel template. Web at simpleplanning, we guarantee it. Web start at the top of your opened document and take a look at how the information is setup. If you're.

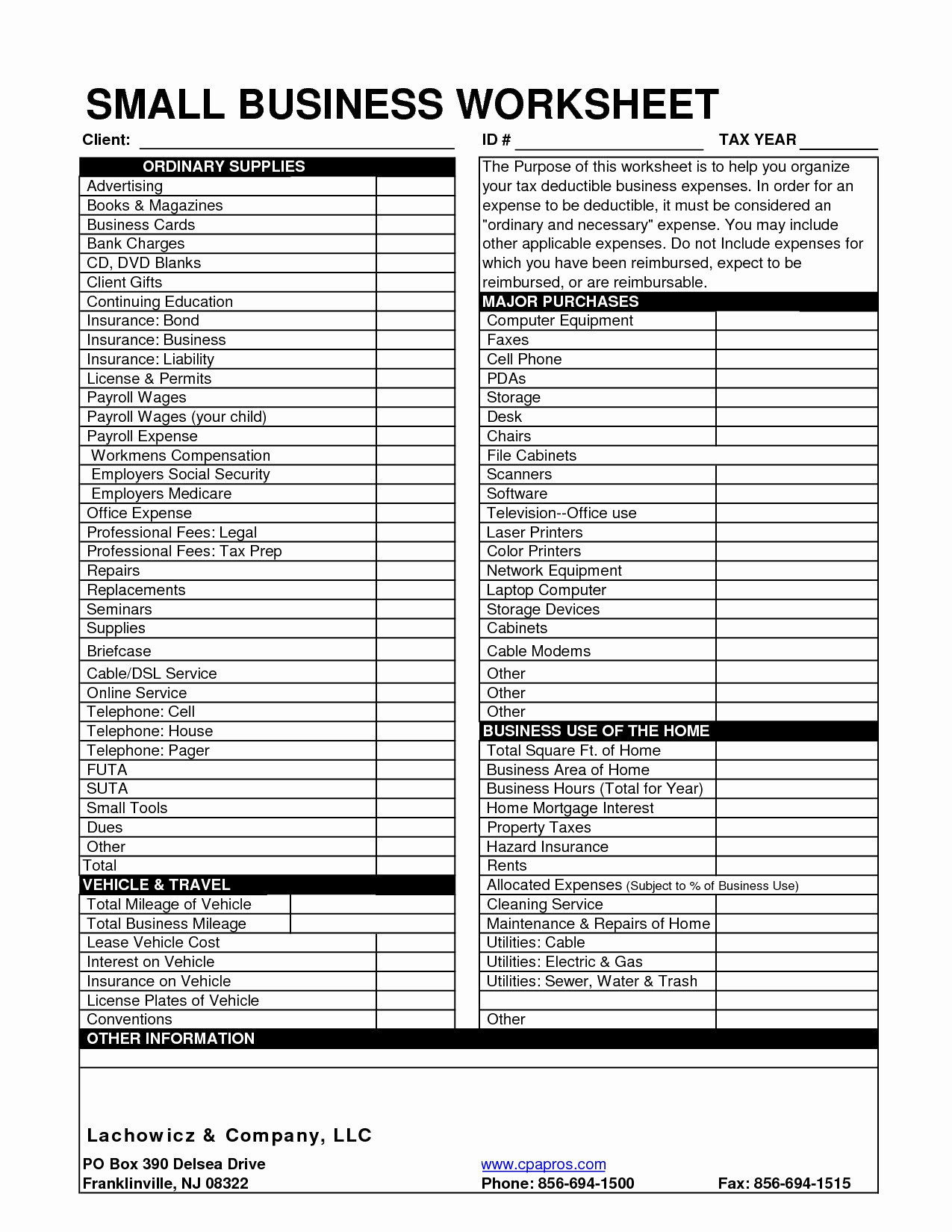

List Of Itemized Deductions Worksheet Kidz Activities Document Small

A taxpayer needs to set between. Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. Add the amounts in far right column for lines 4 through 16. It will typically include an.

Tax Deduction Spreadsheet Then Small Business Tax Deductions —

Web these templates include simple tax estimator, itemized deduction calculator, schedule b calculator, section 179 deduction calculator and much more. A taxpayer needs to set between. Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web itemized deductions calculator is an excel template. You have the name of the deduction in the first column of the template,.

6 Itemized Deductions Spreadsheet 84476 FabTemplatez

Margin interest) medical expenses exceeding the 10% amount of your agi dental. Web depending on your business needs, an expense report may be lengthy and detailed or a simple form. Add the amounts in far right column for lines 4 through 16. Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates.

Download File PDF itemized deduction worksheet (PDF) vcon.duhs.edu.pk

You have the name of the deduction in the first column of the template, the items. Add the amounts in far right column for lines 4 through 16. Web start at the top of your opened document and take a look at how the information is setup. Web these templates include simple tax estimator, itemized deduction calculator, schedule b calculator,.

Web Depending On Your Business Needs, An Expense Report May Be Lengthy And Detailed Or A Simple Form.

Web start at the top of your opened document and take a look at how the information is setup. You have the name of the deduction in the first column of the template, the items. Web at simpleplanning, we guarantee it. Margin interest) medical expenses exceeding the 10% amount of your agi dental.

Web Itemized Deductions Calculator Is An Excel Template.

Web these templates include simple tax estimator, itemized deduction calculator, schedule b calculator, section 179 deduction calculator and much more. Web itemized deduction calculator particulars amount interest paid on investments. Web itemized deduction calculator excel template in addition to the above, you can also download other numbers templates like simple tax estimator and section 179. If you're not completely satisfied with our excel tax calculator, we'll send you a full refund.

It Will Typically Include An Itemized List Of Expenses Along With A.

Add the amounts in far right column for lines 4 through 16. It aids the taxpayer go please between standard furthermore itemize deductions. A taxpayer needs to set between.