It 203 Tax Form

It 203 Tax Form - Were not a resident of new york state and received income during the. In turbotax it will generate automatically if you need to file either. Web form it 201 or it 203 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another. Get your online template and fill it in using. This is the only return for. Web changes to your 2017 form 1040a amount due: Web find irs addresses for private delivery of tax returns, extensions and payments. Web what is it 203 tax form? Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal.

This is the only return for. Employee's withholding certificate form 941; Web find irs addresses for private delivery of tax returns, extensions and payments. Web changes to your 2017 form 1040a amount due: In turbotax it will generate automatically if you need to file either. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another. Were not a resident of new york state and received income during the. Use fill to complete blank online new york state pdf forms. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web file now with turbotax related new york individual income tax forms:

$500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another. This form is for income earned in tax year 2022, with tax. Private delivery services should not deliver returns to irs offices other than. Web find irs addresses for private delivery of tax returns, extensions and payments. 24.00 24.00 25 pensions of nys and local. Were not a resident of new york state and received income during the. Web this instruction booklet will help you to fill out and file form 203. Web file now with turbotax related new york individual income tax forms: Web form it 201 or it 203 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Get your online template and fill it in using.

2018 ny form it 203 Fill out & sign online DocHub

Web this instruction booklet will help you to fill out and file form 203. Web find irs addresses for private delivery of tax returns, extensions and payments. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments,.

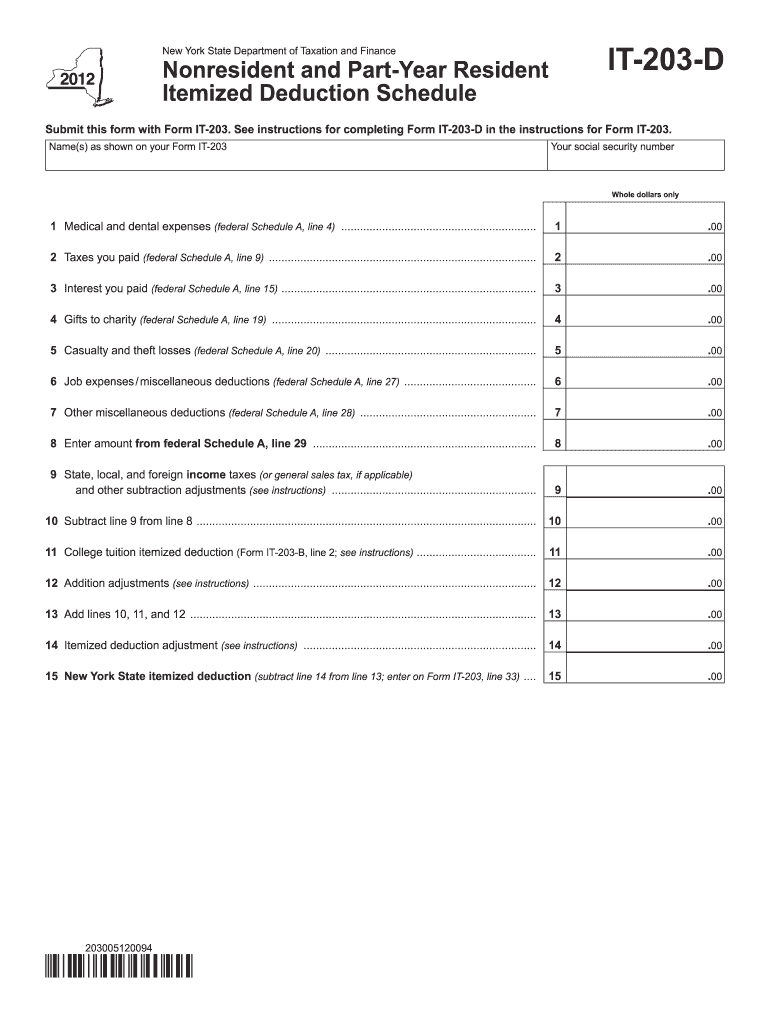

Form it 203 b instructions

$500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another. Web what is it 203 tax form? Web changes to your 2017 form 1040a amount due: Employers engaged in a trade or business who. Get your online template and fill it in using.

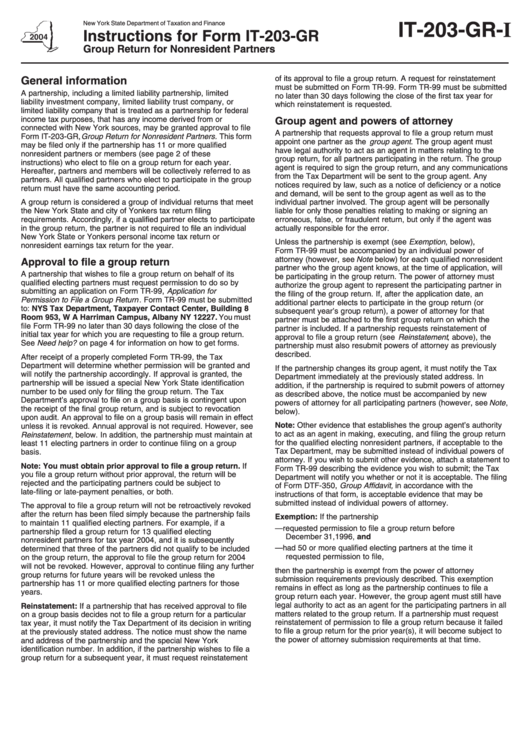

Instructions For Form It203Gr Group Return For Nonresident Partners

Employers engaged in a trade or business who. This is the only return for. Web fill online, printable, fillable, blank form 1: Private delivery services should not deliver returns to irs offices other than. Get your online template and fill it in using.

Form it 203, Nonresident and Part Year Resident Tax Return

This is the only return for. Employee's withholding certificate form 941; Were not a resident of new york state and received income during the. Get your online template and fill it in using. Web this instruction booklet will help you to fill out and file form 203.

Form IT 203 GR Group Return For Nonresident Partners Tax Year Fill

Were not a resident of new york state and received income during the. Web form it 201 or it 203 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Employers engaged in a trade or business who. Private delivery services should.

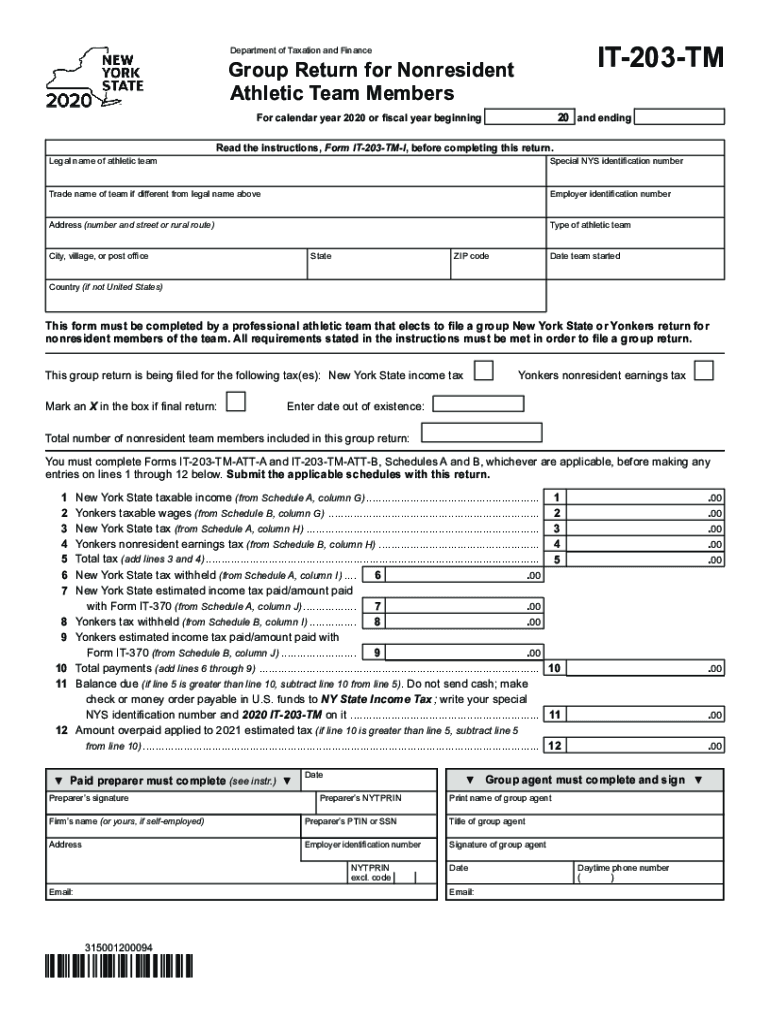

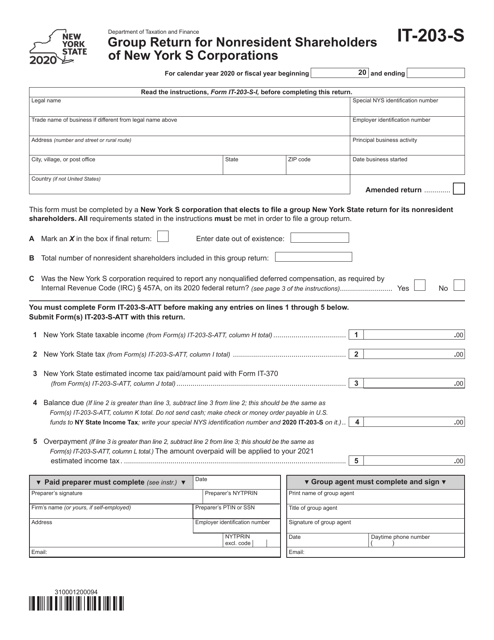

Form IT203S Download Fillable PDF or Fill Online Group Return for

This form is for income earned in tax year 2022, with tax. Web this instruction booklet will help you to fill out and file form 203. Get your online template and fill it in using. Private delivery services should not deliver returns to irs offices other than. Employers engaged in a trade or business who.

Form IT203X (2011) (Fillin) Amended Nonresident and PartYear

24.00 24.00 25 pensions of nys and local. Employers engaged in a trade or business who. Web file now with turbotax related new york individual income tax forms: This is the only return for. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another.

Form IT203B (Fillin) Nonresident and PartYear Resident

Employers engaged in a trade or business who. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form it 201 or it 203 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Web this instruction booklet.

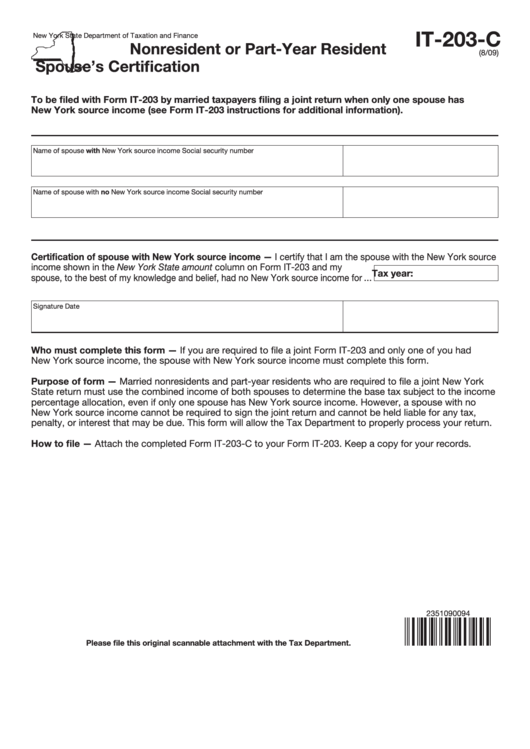

Fillable Form It203C Nonresident Or PartYear Resident Spouse'S

Employers engaged in a trade or business who. Were not a resident of new york state and received income during the. In turbotax it will generate automatically if you need to file either. Web fill online, printable, fillable, blank form 1: Web file now with turbotax related new york individual income tax forms:

Form IT 203 Nonresident and Part Year Resident Tax Return YouTube

Web this instruction booklet will help you to fill out and file form 203. Web find irs addresses for private delivery of tax returns, extensions and payments. Employers engaged in a trade or business who. Were not a resident of new york state and received income during the. $500.73 we changed your 2017 form 1040a to match our record of.

Taxformfinder Has An Additional 271 New York Income Tax Forms That You May Need, Plus All Federal.

Web file now with turbotax related new york individual income tax forms: Web fill online, printable, fillable, blank form 1: Use fill to complete blank online new york state pdf forms. Web form it 201 or it 203 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 57 votes how to fill out and sign it203 online?

Get Your Online Template And Fill It In Using.

Web what is it 203 tax form? Employers engaged in a trade or business who. Web changes to your 2017 form 1040a amount due: This is the only return for.

Web Find Irs Addresses For Private Delivery Of Tax Returns, Extensions And Payments.

Employee's withholding certificate form 941; This form is for income earned in tax year 2022, with tax. In turbotax it will generate automatically if you need to file either. Web this instruction booklet will help you to fill out and file form 203.

24.00 24.00 25 Pensions Of Nys And Local.

Private delivery services should not deliver returns to irs offices other than. Were not a resident of new york state and received income during the. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another.