Irs Installment Agreement While In Chapter 13

Irs Installment Agreement While In Chapter 13 - Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Web the irs and the bankruptcy court will not allow you to honor and continue living with that installment plan after you file chapter 13. The irs offers formal payment plans, also known as installment agreements, when repayment will take more than 180 days. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time. To qualify for chapter 13, you must have regular income, have filed all. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored installment agreements, independent review and appeals. Web one option is to file a chapter 13 bankruptcy in order to repay the irs (as well as other debts you might have) because unless the irs filed a tax lien against equity assets, then it cannot charge penalty and interest during the chapter 13 process. Web a payment plan is an agreement with the irs to pay the taxes you owe within an extended timeframe. The form 9465 can be filed with a tax return.

Web before you consider filing a chapter 13 here are some things you should know: You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. That gives you a little more time than the 36 or 60 months you have for a chapter 13 payment plan. If paying the entire tax debt all at once is not possible, an installment. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored installment agreements, independent review and appeals. Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Because interest and penalties will apply, however, the irs encourages taxpayers to pay taxes immediately. What you pay does not double by tax law, but can be reduced. Web understand how an irs installment agreement works in a chapter 13 bankruptcy.

Chapter 7 or 13 bankruptcy. To qualify for chapter 13, you must have regular income, have filed all. In fact, many people enter into agreements. If i have an installment agreement with the irs… Chapter 7 bankruptcy is an option if your tax debt. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. Web in most cases, the chapter 13 bankruptcy results in you paying back much less than what you would in an irs installment agreement. Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time. See how income taxes are handled and what you can do.

The Three Types of IRS Installment Agreement Law Offices of Darrin T

Prior to agreeing to an installment agreement… To qualify for chapter 13, you must have regular income, have filed all. Instead you must pay all of your priority tax debt in full through the plan. If paying the entire tax debt all at once is not possible, an installment. But working with these professionals can make the process easier and.

IRS Installment Agreement Form

Web explore our free tool in a nutshell the most common of all of debts owed to the irs is unpaid income taxes, sometimes called back taxes. See how income taxes are handled and what you can do. Interest and penalties can equal 8% to 10% per year. If i have an installment agreement with the irs… Chapter 7 or.

Beautiful Photo of Irs Instalment Agreement Form letterify.info

Chapter 7 or 13 bankruptcy. Interest and penalties can equal 8% to 10% per year. Web a payment plan is an agreement with the irs to pay the taxes you owe within an extended timeframe. In fact, many people enter into agreements. If i have an installment agreement with the irs…

What Is A Streamlined Installment Agreement With The Irs Ethel

Web partial payment installment agreement. In this article, you'll learn about irs payment plans that can help you wipe out your tax debt. If i have an installment agreement with the irs… But working with these professionals can make the process easier and improve your chances of the irs. Chapter 7 bankruptcy is an option if your tax debt.

Are you looking for an IRS Installment Agreement? The Experts understand!

Web explore our free tool in a nutshell the most common of all of debts owed to the irs is unpaid income taxes, sometimes called back taxes. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored installment agreements, independent review and appeals. In this article, you'll learn about irs payment plans that.

Interest Rates For Irs Installment Agreements Rating Walls

Chapter 7 bankruptcy is an option if your tax debt. Usually trustees (and the irs) do not go along with these installment plans because priority tax claims need to be paid in full over the life of the chapter 13 plan. But working with these professionals can make the process easier and improve your chances of the irs. Installment agreement.

What is an IRS Installment Agreement and How do I Pay? McCauley Law

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time. 3.) if the irs agrees to an installment agreement… The irs offers formal payment plans, also known as installment agreements, when repayment will take more than 180 days. You must file all required tax returns for tax.

Can You Have Two Installment Agreements With The IRS Polston Tax

That gives you a little more time than the 36 or 60 months you have for a chapter 13 payment plan. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. See how income taxes are handled and what you can do. Chapter 7 bankruptcy is an option if your tax debt..

How To Add To Existing Irs Installment Agreement Armando Friend's

But working with these professionals can make the process easier and improve your chances of the irs. Web one option is to file a chapter 13 bankruptcy in order to repay the irs (as well as other debts you might have) because unless the irs filed a tax lien against equity assets, then it cannot charge penalty and interest during.

IRS Installment Plan Wasvary Tax Services & Travel

Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. In fact, many people enter into agreements. Web before you consider filing a chapter 13 here are some things you should know: If paying the entire tax debt all at once is not possible, an installment. What you pay does not double by.

Web What You Need To Know About An Irs Installment Agreement While In Chapter 13 Paying Taxes May Be A Fact Of Life For Most Americans, But It Doesn’t Mean That Paying Them All In One Lump Sum Is Always Possible.

Chapter 7 or 13 bankruptcy. Web one option is to file a chapter 13 bankruptcy in order to repay the irs (as well as other debts you might have) because unless the irs filed a tax lien against equity assets, then it cannot charge penalty and interest during the chapter 13 process. Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Web a payment plan is an agreement with the irs to pay the taxes you owe within an extended timeframe.

You Should Request A Payment Plan If You Believe You Will Be Able To Pay Your Taxes In Full Within The Extended Time.

Web in most cases, the chapter 13 bankruptcy results in you paying back much less than what you would in an irs installment agreement. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. In this article, you'll learn about irs payment plans that can help you wipe out your tax debt. Web partial payment installment agreement.

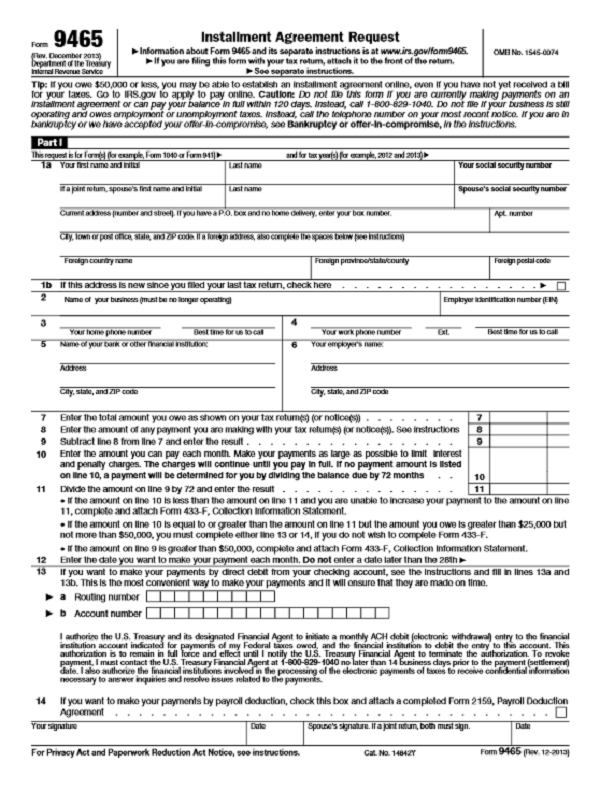

The Form 9465 Can Be Filed With A Tax Return.

Web explore our free tool in a nutshell the most common of all of debts owed to the irs is unpaid income taxes, sometimes called back taxes. Web understand how an irs installment agreement works in a chapter 13 bankruptcy. What you pay does not double by tax law, but can be reduced. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement.

Web The Internal Revenue Service (Irs) Allows Taxpayers To Pay Off Tax Debt Through An Installment Agreement.

Web the irs and the bankruptcy court will not allow you to honor and continue living with that installment plan after you file chapter 13. But working with these professionals can make the process easier and improve your chances of the irs. Usually trustees (and the irs) do not go along with these installment plans because priority tax claims need to be paid in full over the life of the chapter 13 plan. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing.