Irs Form 9325

Irs Form 9325 - Web printing electronic filing acknowledgements (form 9325) to print an electronic file acknowledgment (form 9325), complete these steps. Go to the paid tax preparer you used. Irs form 9325 is the irs acknowledgement that they have received your electronic individual income tax return data. The electronic filing services were provided by. Click on the electronic filing status icon to open the electronic filing status dialog. Web what is irs form 9325? Common questions on form 9325 in proseries. You can print and deliver form 9325 yourself, or you can have drake automatically email it to the taxpayer. Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. You have two options in an individual return:

To print form 9325 from within a client file: Web how can i get form 9325 to them? Click on the electronic filing status icon to open the electronic filing status dialog. In either case, blocks 1 and 2 on form 9325 are completed only after the return has been accepted. Taxpayer name taxpayer address (optional) your federal income tax return for was filed electronically with the submission processing center. Acknowledgement and general information for taxpayers who file returns electronically. Web printing electronic filing acknowledgements (form 9325) to print an electronic file acknowledgment (form 9325), complete these steps. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. Web how can i find a tax filing receipt received from a tax preparer or an electronic postmark generated by a tax preparer or tax return software or a completed form 9325?

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web how can i get form 9325 to them? Taxpayer name taxpayer address (optional) your federal income tax return for was filed electronically with the submission processing center. You have two options in an individual return: Click on the electronic filing status icon to open the electronic filing status dialog. Common questions on form 9325 in proseries. Technically, your ero uses acknowledgement file information from transmitted returns to generate the form 9325. Web what is irs form 9325? Form 9325 can be used to show an electronically filed return was accepted by the irs. Acknowledgement and general information for taxpayers who file returns electronically.

Fill Free fillable Form 9325 Acknowledgement and General Information

Instructions for form 941 pdf Some preparers print this report automatically for every return and extension for their own recordkeeping purposes as well as to provide a copy to the taxpayer. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web how.

IRS Form 9325 Instructions ERO Submission Acknowledgement

Acknowledgement and general information for taxpayers who file returns electronically. Web employer's quarterly federal tax return. Click on the electronic filing status icon to open the electronic filing status dialog. The electronic filing services were provided by. Common questions on form 9325 in proseries.

Form 9325 Acknowledgement and General Information for Taxpayers Who

Web employer's quarterly federal tax return. The electronic filing services were provided by. In either case, blocks 1 and 2 on form 9325 are completed only after the return has been accepted. Acknowledgement and general information for taxpayers who file returns electronically. You have two options in an individual return:

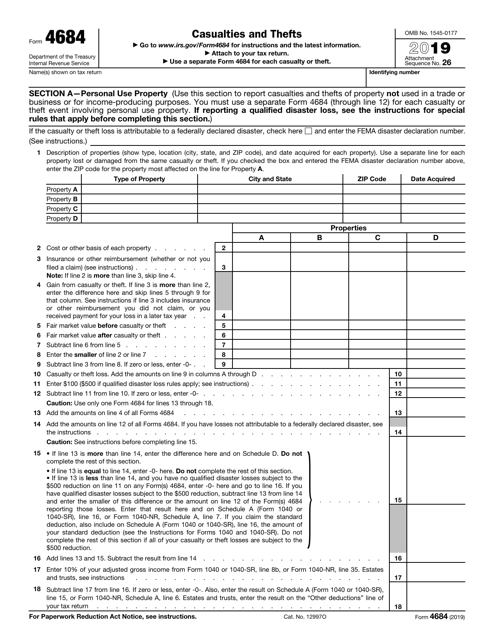

IRS Form 4684 Download Fillable PDF or Fill Online Casualties and

Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. The electronic filing services were provided by. Web how can i find a tax filing receipt received from a tax preparer or an electronic postmark generated by a tax preparer or tax return software or a completed form 9325? Irs form 9325 is the irs.

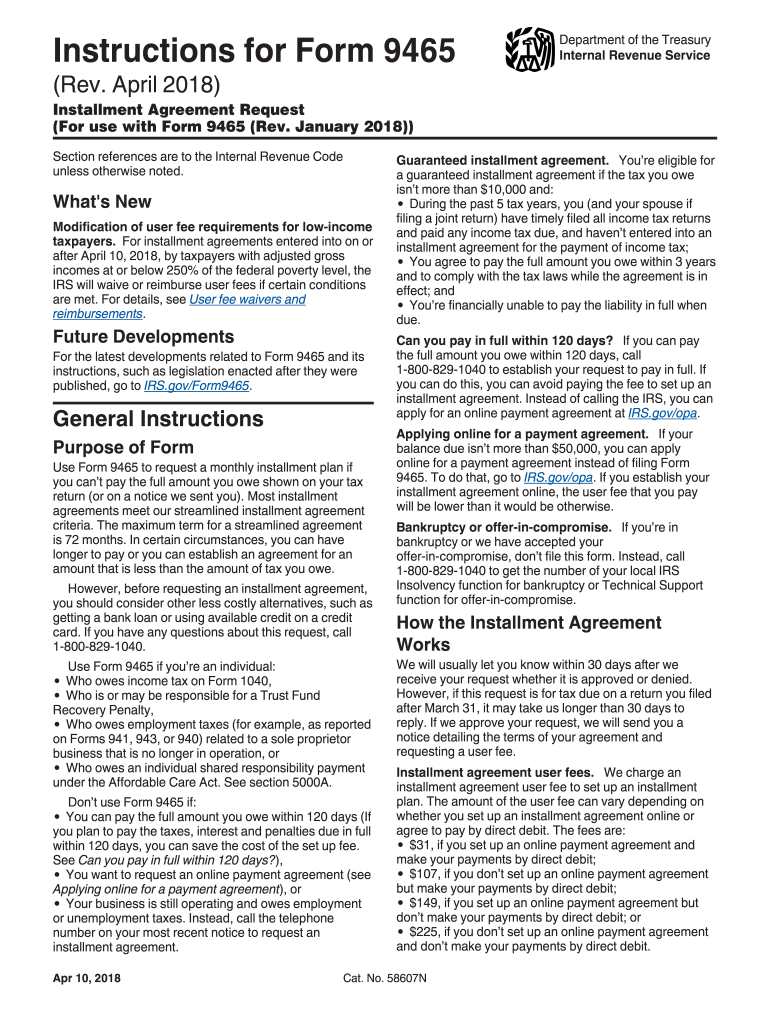

IRS 9465 Instructions 2017 Fill out Tax Template Online US Legal Forms

Taxpayer name taxpayer address (optional) your federal income tax return for was filed electronically with the submission processing center. Common questions on form 9325 in proseries. Form 9325 can be used to show an electronically filed return was accepted by the irs. Acknowledgement and general information for taxpayers who file returns electronically. In either case, blocks 1 and 2 on.

Form 9325 After IRS Acceptance Notifying the Taxpayer

Web how can i get form 9325 to them? Acknowledgement and general information for taxpayers who file returns electronically. Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. Instructions for form 941 pdf You can print and deliver form 9325 yourself, or you can have drake automatically email it to the taxpayer.

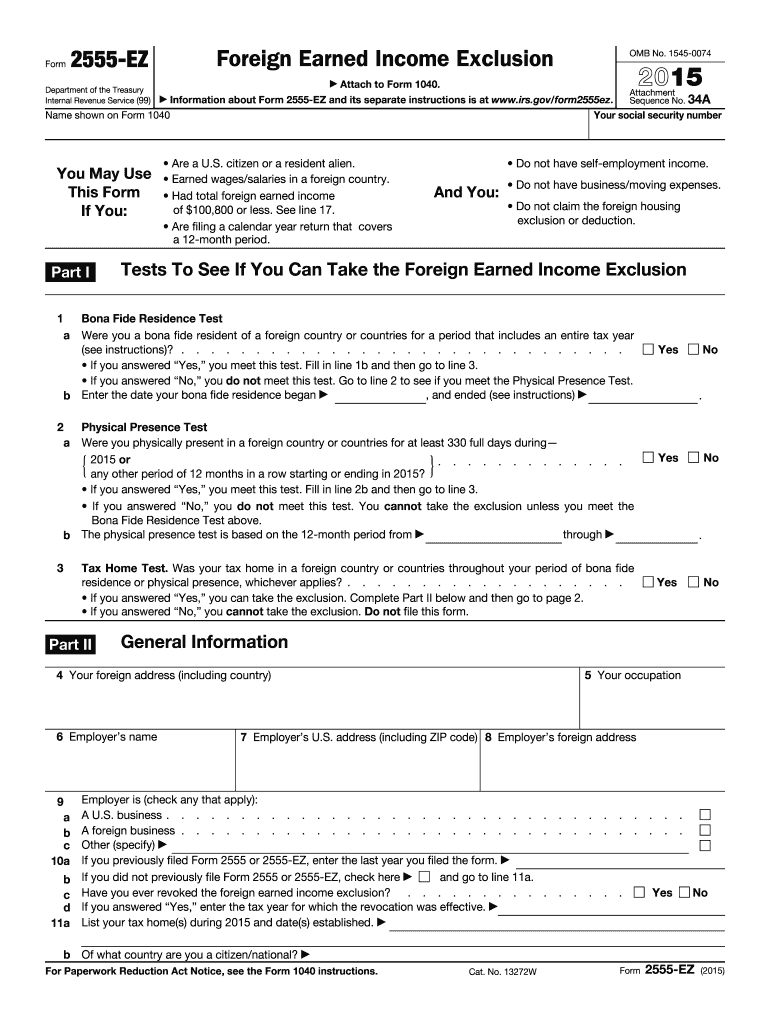

IRS 2555EZ 2015 Fill out Tax Template Online US Legal Forms

Web employer's quarterly federal tax return. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. Form 9325 can be used to show an electronically filed return was.

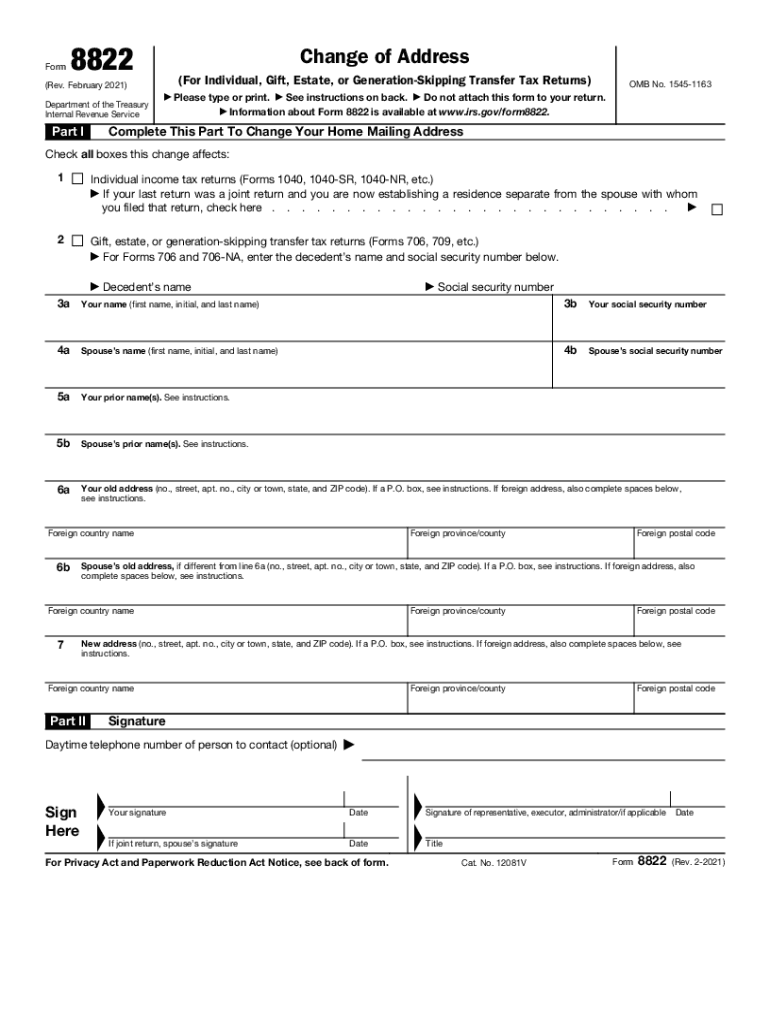

IRS 8822 20212022 Fill and Sign Printable Template Online US Legal

Irs form 9325 is the irs acknowledgement that they have received your electronic individual income tax return data. To print form 9325 from within a client file: Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. Taxpayer name taxpayer address (optional) your federal income tax return for was filed electronically with the submission processing.

Irs form 9325 Fill out & sign online DocHub

Instructions for form 941 pdf Common questions on form 9325 in proseries. Go to the paid tax preparer you used. Technically, your ero uses acknowledgement file information from transmitted returns to generate the form 9325. Irs form 9325 is the irs acknowledgement that they have received your electronic individual income tax return data.

IRS Form 9325 Instructions ERO Submission Acknowledgement

You can print and deliver form 9325 yourself, or you can have drake automatically email it to the taxpayer. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web employer's quarterly federal tax return. Go to the paid tax preparer you used..

Irs Form 9325 Is The Irs Acknowledgement That They Have Received Your Electronic Individual Income Tax Return Data.

Click on the cs connect icon and retrieve acknowledgments to ensure all acknowledgments are available. Web employer's quarterly federal tax return. Web what is irs form 9325? Go to the paid tax preparer you used.

Web How Can I Find A Tax Filing Receipt Received From A Tax Preparer Or An Electronic Postmark Generated By A Tax Preparer Or Tax Return Software Or A Completed Form 9325?

Click on the electronic filing status icon to open the electronic filing status dialog. Common questions on form 9325 in proseries. Solved•by intuit•2•updated july 13, 2022. Instructions for form 941 pdf

Employers Who Withhold Income Taxes, Social Security Tax, Or Medicare Tax From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax.

You have two options in an individual return: Web printing electronic filing acknowledgements (form 9325) to print an electronic file acknowledgment (form 9325), complete these steps. Some preparers print this report automatically for every return and extension for their own recordkeeping purposes as well as to provide a copy to the taxpayer. To print form 9325 from within a client file:

Form 9325 Can Be Used To Show An Electronically Filed Return Was Accepted By The Irs.

Acknowledgement and general information for taxpayers who file returns electronically. You can print and deliver form 9325 yourself, or you can have drake automatically email it to the taxpayer. The electronic filing services were provided by. In either case, blocks 1 and 2 on form 9325 are completed only after the return has been accepted.