Irs Form 8919 Instructions

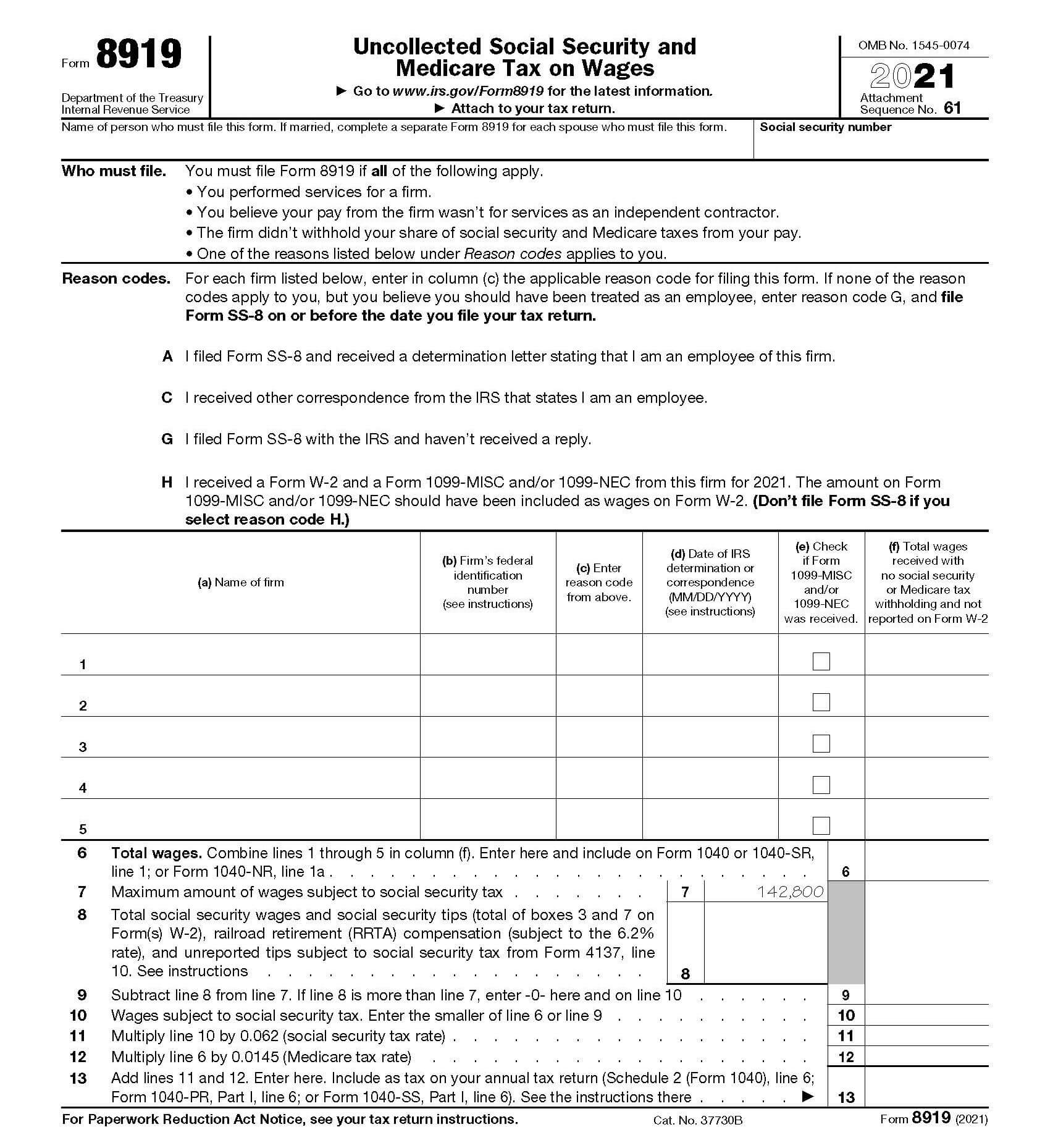

Irs Form 8919 Instructions - Attach to your tax return. Filing form 8919 correctly ensures that your social security and medicare taxes are accurately reported. Web taxpayers who meet all four of the following qualifications must file irs form 8919 to report their tax information to the irs: Web to complete form 8919 in the taxact program: Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web form 8819 is used to elect the u.s. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s.

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Meet irs form 8919 jim buttonow, cpa, citp. If married, complete a separate form 8919 for each spouse who must file this form. Attach to your tax return. Web name of person who must file this form. Web taxpayers who meet all four of the following qualifications must file irs form 8919 to report their tax information to the irs: The taxpayer performed services for an individual or a firm. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true:

Web form 8819 is used to elect the u.s. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. File this form if you want the irs to determine whether you are. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Attach to your tax return. Web to complete form 8919 in the taxact program: Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year. Web information about form 8919 and its instructions is at www.irs.gov/form8919. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. They must report the amount on irs form 8919.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Meet irs form 8919.

Irs Form 668 Wc) Instructions Form Resume Examples MoYolrmVZB

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. From within your taxact return ( online or desktop), click federal. Meet irs form 8919 jim buttonow, cpa, citp. Depending on your circumstances and the. Web form 8919 department of the treasury internal revenue service uncollected.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Meet irs form 8919 jim buttonow, cpa, citp. They must report the amount on irs form 8919. The taxpayer performed services for an individual or a firm. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year. A firm paid.

About Lori DiMarco CPA, PLLC

The taxpayer performed services for an individual or a firm. A firm paid them for services provided. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year. Attach to your tax return. If married, complete a separate form 8919 for.

When to Use IRS Form 8919

Web to complete form 8919 in the taxact program: Depending on your circumstances and the. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program.

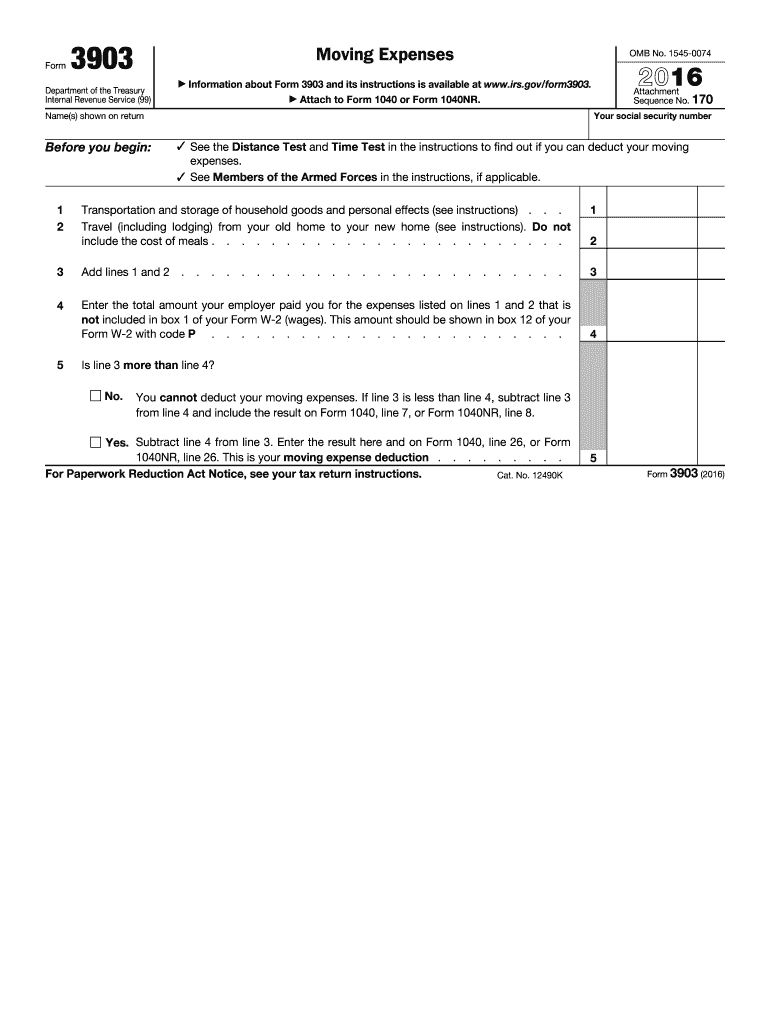

2016 Form IRS 3903 Fill Online, Printable, Fillable, Blank pdfFiller

Web to complete form 8919 in the taxact program: Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web information about form 8919 and its instructions is at www.irs.gov/form8919. Meet irs form 8919 jim buttonow, cpa, citp. Web form 8919 department of the treasury internal.

1040x2.pdf Irs Tax Forms Social Security (United States)

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web to complete form 8919 in the taxact program: The taxpayer performed services for an individual or a firm. Meet irs form 8919 jim buttonow, cpa, citp. Web 1 best answer.

Irs Form 2290 Instructions 2017 Universal Network

Filing form 8919 correctly ensures that your social security and medicare taxes are accurately reported. Depending on your circumstances and the. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: If married, complete a separate form 8919 for each spouse who must file this form. They.

How to Generate 2011 IRS Schedule D and Form 8949 using www.form8949

Web name of person who must file this form. Web taxpayers who meet all four of the following qualifications must file irs form 8919 to report their tax information to the irs: Web form 8819 is used to elect the u.s. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8819 is used to elect the u.s. Web to complete form 8919 in the taxact program: Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year. Web how to file form 8919. Web department of the treasury internal.

Web Form 8819 Is Used To Elect The U.s.

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web to complete form 8919 in the taxact program: They must report the amount on irs form 8919. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes.

Web Form 8919 Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest.

Web how to file form 8919. If married, complete a separate form 8919 for each spouse who must file this form. Depending on your circumstances and the. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach.

Web General Instructions Purpose Of Form Use Form 8959 To Figure The Amount Of Additional Medicare Tax You Owe And The Amount Of Additional Medicare Tax Withheld By Your.

Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year. Attach to your tax return. Web taxpayers who meet all four of the following qualifications must file irs form 8919 to report their tax information to the irs: From within your taxact return ( online or desktop), click federal.

Web Information About Form 8919 And Its Instructions Is At Www.irs.gov/Form8919.

Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Filing form 8919 correctly ensures that your social security and medicare taxes are accurately reported. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. File this form if you want the irs to determine whether you are.