Irs Form 870

Irs Form 870 - Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment. Web at that point the taxpayer has the option of filing a petition with the united states tax court, or paying the tax and filing a claim for refund, followed by a suit in u.s. Web irs 870 is form: Ad get ready for tax season deadlines by completing any required tax forms today. Web settlement amounts are usually reached verbally and then transcribed onto irs form 870: Waiver of restrictions on assessment and collection of deficiency in. Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on. Web a taxpayer is generally required to notify the state if there has been a change in federal taxable income that was reported on a previously filed return. Web get federal tax return forms and file by mail.

Ad access irs tax forms. Once you sign the form you are agreeing that you have a tax deficiency and the additional tax penalties. Web employer's quarterly federal tax return. Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on. Waiver of restrictions on assessment and collection of deficiency in. Get the current filing year’s forms, instructions, and publications for free from the irs. Web get federal tax return forms and file by mail. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Web at that point the taxpayer has the option of filing a petition with the united states tax court, or paying the tax and filing a claim for refund, followed by a suit in u.s.

Web at that point the taxpayer has the option of filing a petition with the united states tax court, or paying the tax and filing a claim for refund, followed by a suit in u.s. Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web settlement amounts are usually reached verbally and then transcribed onto irs form 870: Web the examiner may offer a taxpayer a form 870 or other form consenting to the assessment of the tax liability rather than being requested to sign the prepared tax return. Web a process that reopens your irs audit. Refund claims in tax court — irs jun 21, 2023 — the irs can deny a refund claim for a tax deficiency if the taxpayer files a form 870. Web irs 870 is form: Ad access irs tax forms. Web employer's quarterly federal tax return.

Top 15 Irs Form 870 Templates free to download in PDF format

Web get federal tax forms. Web get federal tax return forms and file by mail. Ad access irs tax forms. Complete, edit or print tax forms instantly. In any of the four situations below, you can request an audit reconsideration you have new information to show the irs.

AF Form 870 Download Fillable PDF or Fill Online U.S. Government Motor

Refund claims in tax court — irs jun 21, 2023 — the irs can deny a refund claim for a tax deficiency if the taxpayer files a form 870. Waiver of restrictions on assessment and collection of deficiency in. Get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by.

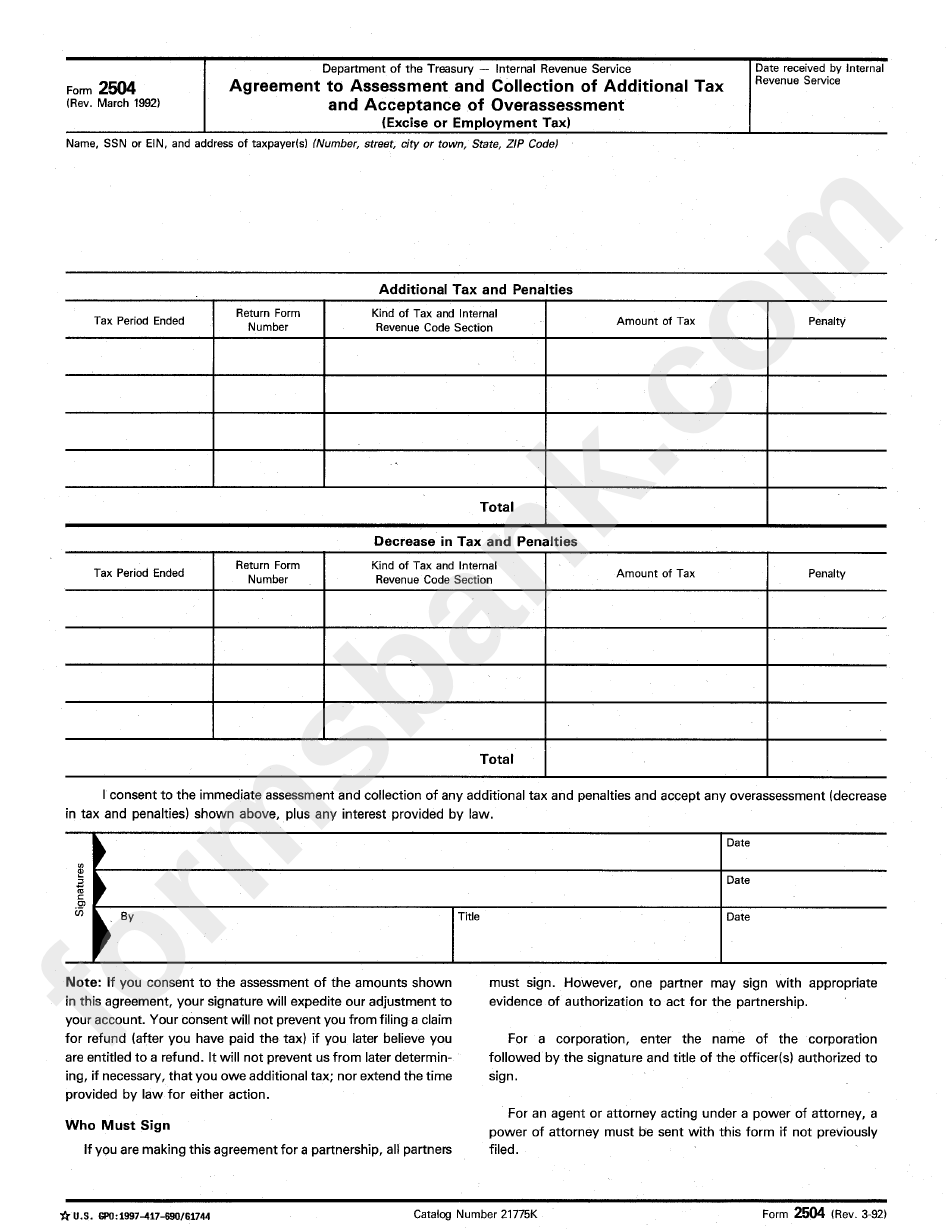

Form 2504 Agreement To Assessment And Collection Of Additional Tax

Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. Web at that point the taxpayer has the option of filing a petition with the united states tax court, or paying the tax and filing a claim for refund, followed by a suit in u.s. Get the current filing.

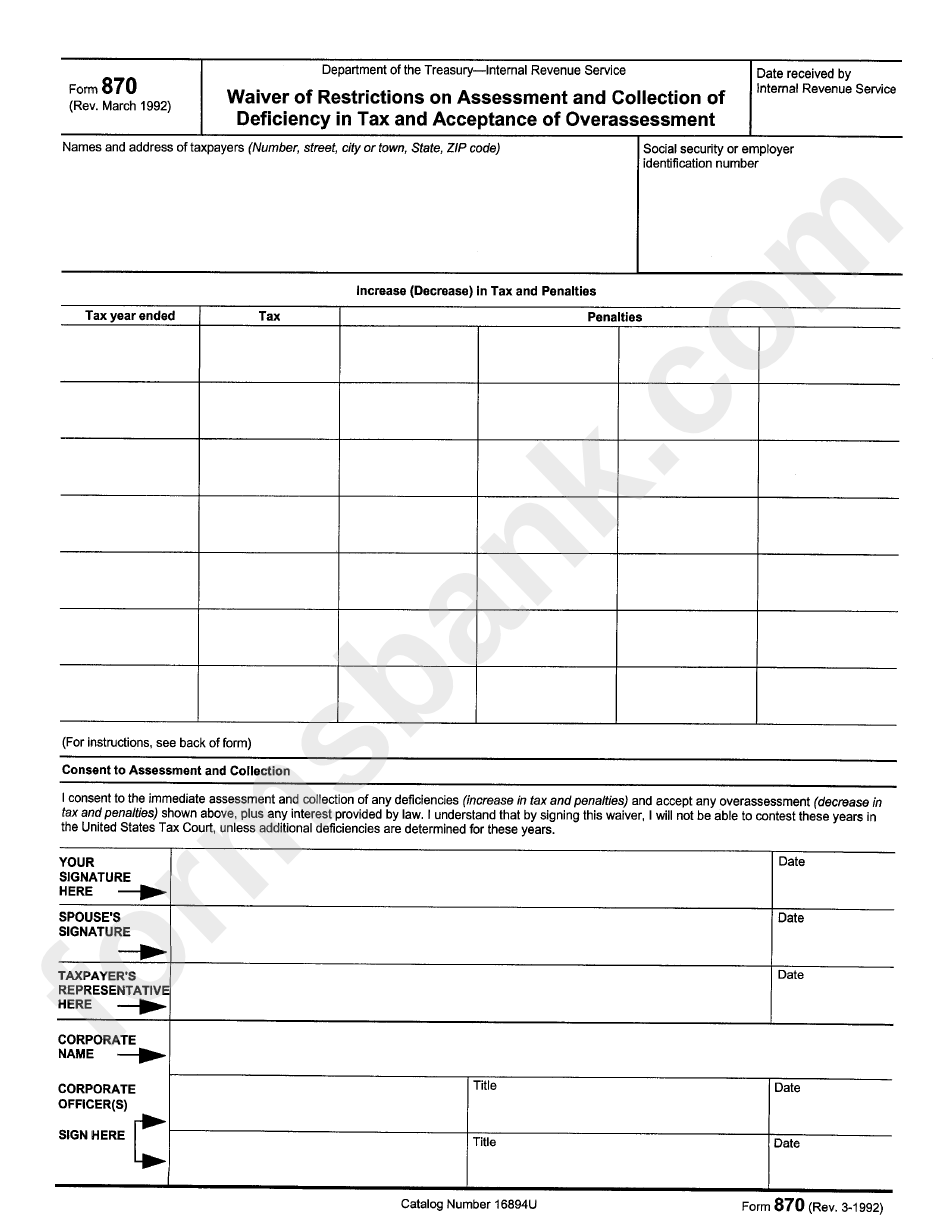

Form 870 Waiver Of Restrictions On Assessment And Collection Of

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web irs 870 is form: Ad access irs tax forms. Web a process that reopens your irs audit. In any of the four situations below, you can request an audit reconsideration you have new information to show the irs.

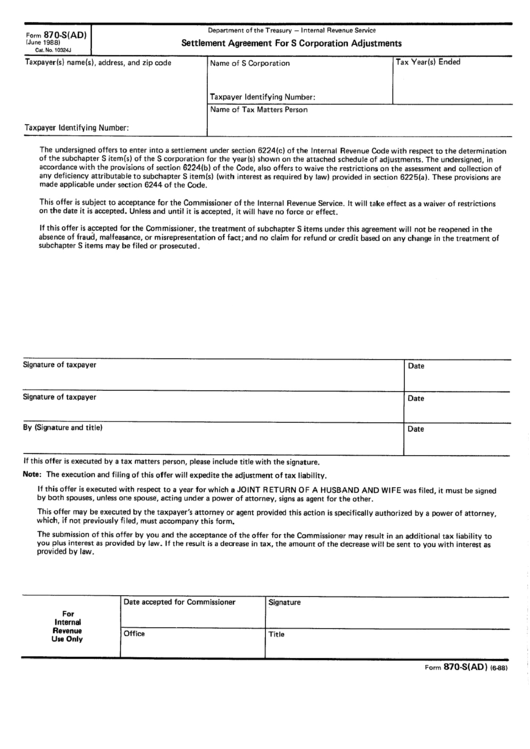

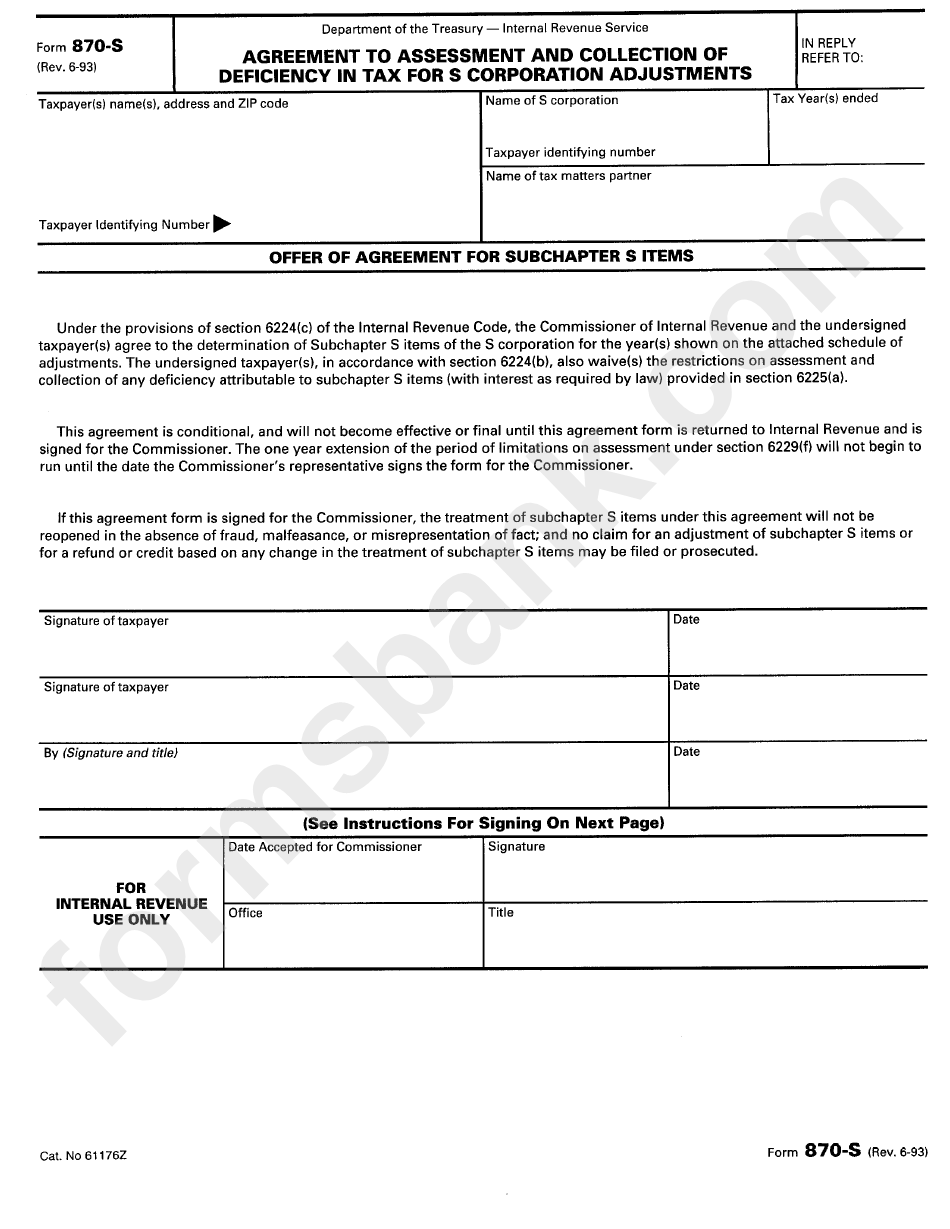

Form 870S(Ad) Settlement Agreement For S Corporation Adjustments

Web form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment. Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Get ready for tax season deadlines by completing any required tax forms today. Waiver of restrictions on assessment.

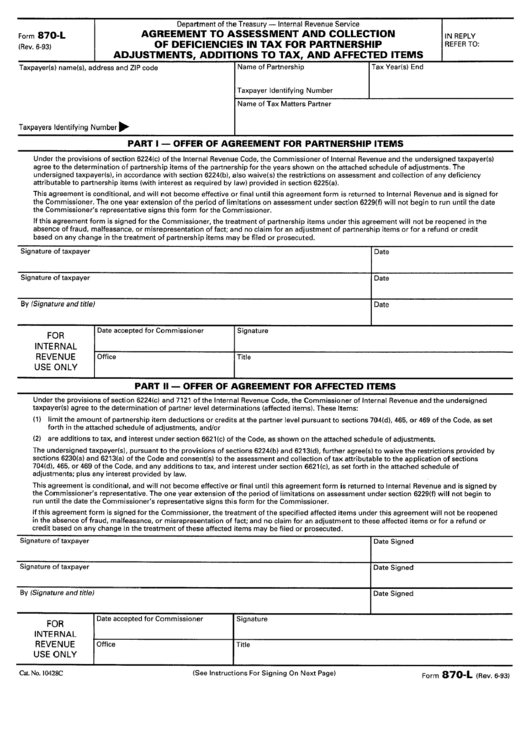

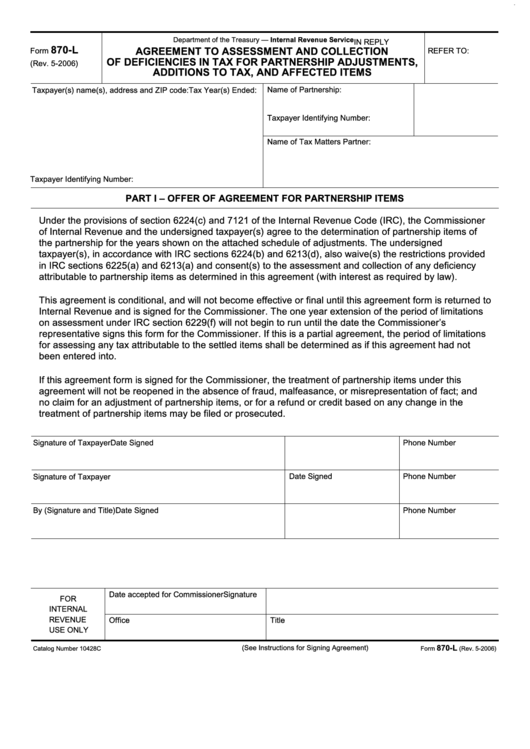

Fillable Form 870L Agreement To Assessment And Collection Of

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Refund claims in tax court — irs jun 21, 2023 — the irs can deny a refund claim for a tax deficiency if the taxpayer files a form 870. (revised april, 1992) this offer must be accepted for the. Web employer's quarterly.

Form 870S Agreement To Assessment And Collection Of Deficiency In

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web a process that reopens your irs audit. Web irs form 870 is the consent to proposed tax adjustment. Web form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment. Web get federal tax forms.

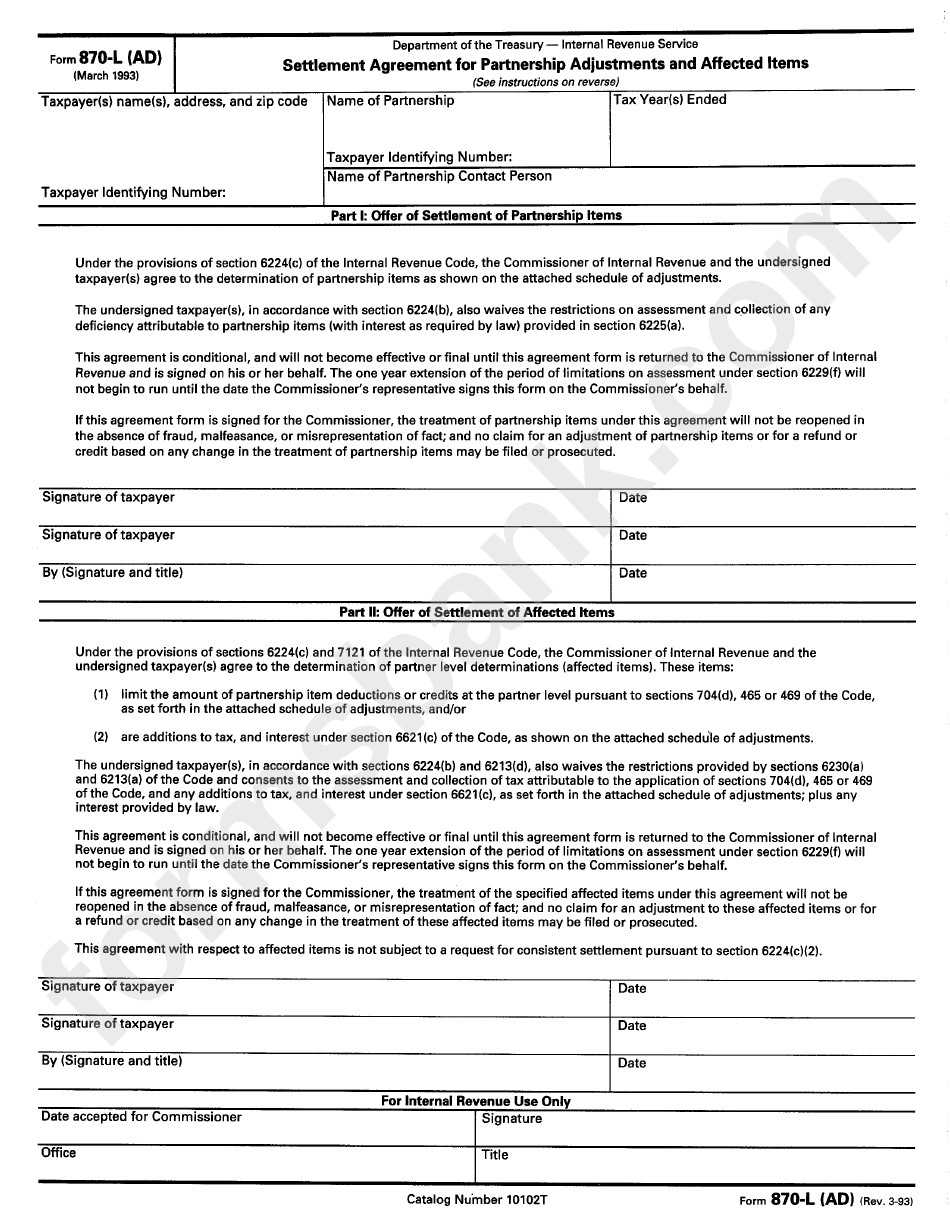

Form 870L(Ad) Settlement Agreement For Partnership Adjustment And

Web get federal tax return forms and file by mail. Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. Refund claims in tax court — irs jun 21, 2023 — the irs can deny a refund claim for a tax deficiency if the taxpayer files a form 870..

8.19.11 Agreed TEFRA Partnership Cases Internal Revenue Service

In any of the four situations below, you can request an audit reconsideration you have new information to show the irs. Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Web in howe v. Web at that point the taxpayer has the option of filing.

Refund Claims In Tax Court — Irs Jun 21, 2023 — The Irs Can Deny A Refund Claim For A Tax Deficiency If The Taxpayer Files A Form 870.

Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Web a taxpayer is generally required to notify the state if there has been a change in federal taxable income that was reported on a previously filed return. Web at that point the taxpayer has the option of filing a petition with the united states tax court, or paying the tax and filing a claim for refund, followed by a suit in u.s. (revised april, 1992) this offer must be accepted for the.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad access irs tax forms. Web irs 870 is form: Web employer's quarterly federal tax return. Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on.

Web The Examiner May Offer A Taxpayer A Form 870 Or Other Form Consenting To The Assessment Of The Tax Liability Rather Than Being Requested To Sign The Prepared Tax Return.

Web settlement amounts are usually reached verbally and then transcribed onto irs form 870: Web in howe v. In any of the four situations below, you can request an audit reconsideration you have new information to show the irs. Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web irs form 870 is the consent to proposed tax adjustment. Web get federal tax forms. Web form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment.