Irs Form 8689

Irs Form 8689 - Web about form 8689, allocation of individual income tax to the u.s. Complete, edit or print tax forms instantly. Current revision publication 570 pdf ( html | ebook epub) recent. It may be used by any us citizen who pays. Get ready for tax season deadlines by completing any required tax forms today. Edit your form 8689 online type text, add images, blackout confidential details, add comments, highlights and more. Web with the internal revenue service, p.o. Citizens and residents use to prorate the amount of u.s. Ad download or email irs 8689 & more fillable forms, register and subscribe now! The irs uses the term “fiduciary income tax return” interchangeably with “form 8489”, but the form 8689.

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web with the internal revenue service, p.o. File a signed copy of your form 1040 (with all attachments, forms, and schedules, including. Web this publication discusses how to treat income received in u.s. Web there are several ways to submit form 4868. Web irs form 4868 extension to file is also known as the application of the automatic extension of time to file the us individual tax return. Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Virgin islands, is the tax form that u.s. However, if you were a u.s.

Complete, edit or print tax forms instantly. Allocation of individual income tax to the u.s. Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Ad access irs tax forms. Edit your form 8689 online type text, add images, blackout confidential details, add comments, highlights and more. Web irs form 4868 extension to file is also known as the application of the automatic extension of time to file the us individual tax return. You must specify the applicable calendar year or tax year to which your. Ad download or email irs 8689 & more fillable forms, register and subscribe now! Citizens and residents use to prorate the amount of u.s. Web turbotax does not support the form 8689, however you can enter the credit that you compute on the form 8689 (line 40) in turbotax deluxe.

IRS FORM 12257 PDF

Edit your form 8689 online type text, add images, blackout confidential details, add comments, highlights and more. Web our service offers the solution to make the mechanism of completing irs forms as simple as possible. Web turbotax does not support the form 8689, however you can enter the credit that you compute on the form 8689 (line 40) in turbotax.

Form 8689 Allocation of Individual Tax to the U.S. Virgin

However, if you were a u.s. Possessions on your income tax return. Web our service offers the solution to make the mechanism of completing irs forms as simple as possible. Taxact® does not support the returns for the u.s. Web with the internal revenue service, p.o.

No Trespassing Form Form Resume Examples 1ZV8aBkE23

However, if you were a u.s. Citizen or resident alien (other than a bona fide resident of the u.s. Individual income tax return, line 7a and. Web our service offers the solution to make the mechanism of completing irs forms as simple as possible. Citizen or resident alien and not a bona fide.

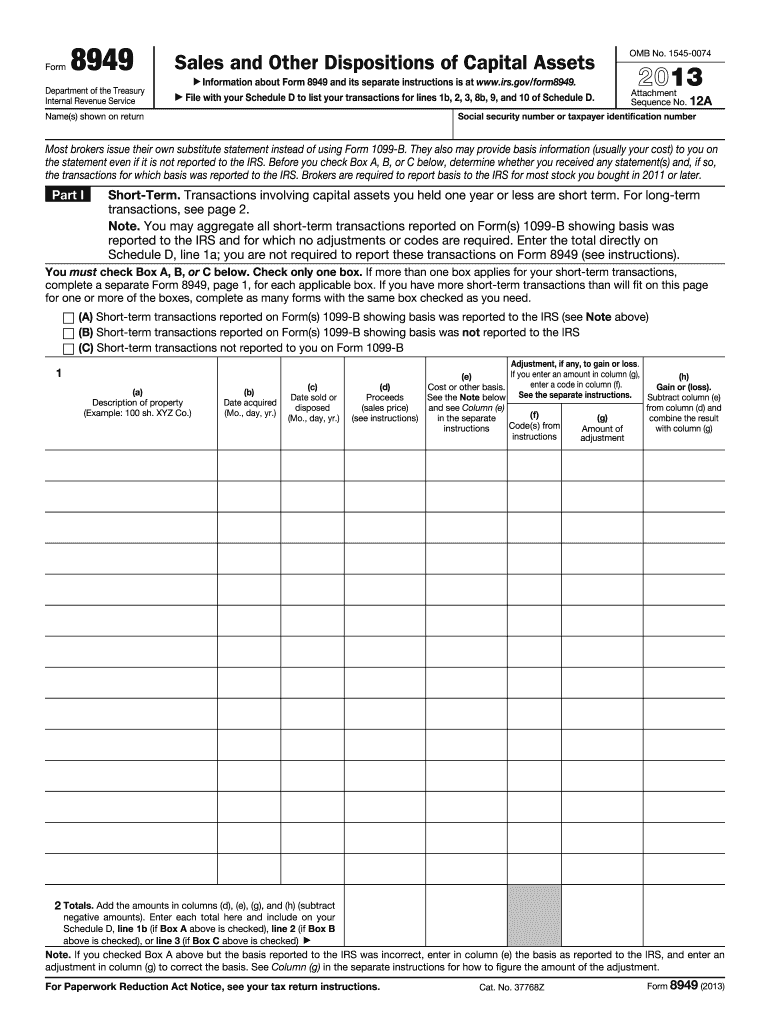

Irs Form 8949 Fill Out and Sign Printable PDF Template signNow

Allocation of individual income tax to the u.s. Ad download or email irs 8689 & more fillable forms, register and subscribe now! Web there are several ways to submit form 4868. Citizen or resident alien and not a bona fide. Web irs form 8689, allocation of individual income tax to the u.s.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Possessions on your income tax return. Individual income tax return, line 7a and. Web turbotax does not support the form 8689, however you can enter the credit that you compute on the form 8689 (line 40) in turbotax deluxe. Web form 8689 is also often called a “fiduciary income tax return” or a fifa. Taxact® does not support the returns.

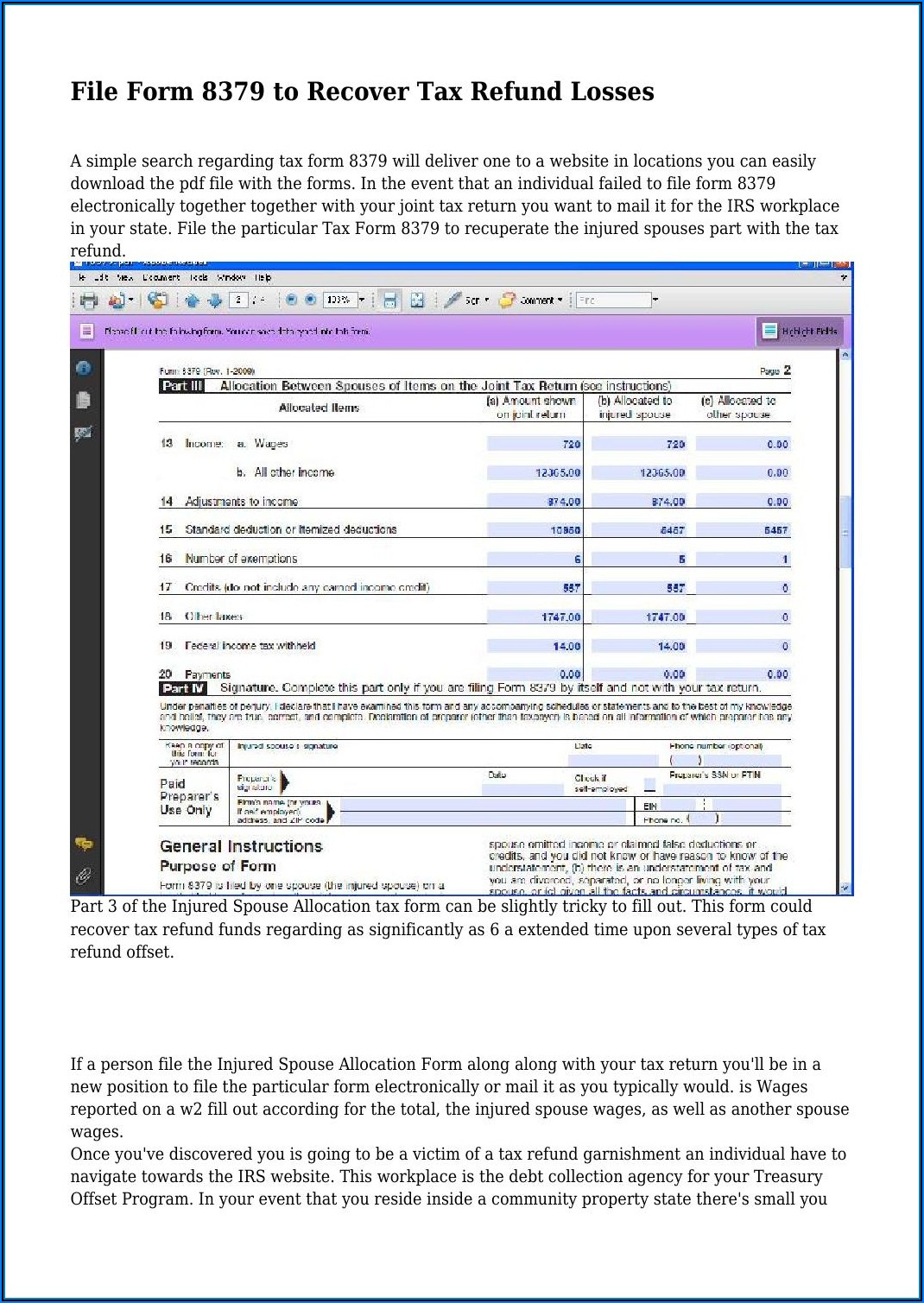

Instructions for IRS Form 8379 Injured Spouse Allocation Download

Web about form 8689, allocation of individual income tax to the u.s. Web irs form 4868 extension to file is also known as the application of the automatic extension of time to file the us individual tax return. However, if you were a u.s. Individual income tax return, line 7a and. Web our service offers the solution to make the.

IRS Form 941 Mistakes What Happens If You Mess Up?

Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Ad download or email irs 8689 & more fillable forms, register and subscribe now! Web form 8689 is also often called a “fiduciary income tax return” or a fifa. Web this publication discusses how to treat income received in u.s.

Irs Form 8379 Injured Spouse Allocation Form Resume Examples

Virgin islands, is the tax form that u.s. Web this publication discusses how to treat income received in u.s. Web irs form 4868 extension to file is also known as the application of the automatic extension of time to file the us individual tax return. Web about form 8689, allocation of individual income tax to the u.s. File a signed.

Form 8689 2020 IRS Form 8689 Fill Out Digital PDF Sample

Web about form 8689, allocation of individual income tax to the u.s. Follow this guideline to quickly and properly fill out irs 8689. Complete, edit or print tax forms instantly. Web turbotax does not support the form 8689, however you can enter the credit that you compute on the form 8689 (line 40) in turbotax deluxe. Web our service offers.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Individual income tax return, line 7a and. Follow this guideline to quickly and properly fill out irs 8689. Web our service offers the solution to make the mechanism of completing irs forms as simple as possible. Web with the internal revenue service, p.o. It may be used by any us citizen who pays.

Current Revision Publication 570 Pdf ( Html | Ebook Epub) Recent.

The irs uses the term “fiduciary income tax return” interchangeably with “form 8489”, but the form 8689. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Individual income tax return, line 7a and.

Web About Form 8689, Allocation Of Individual Income Tax To The U.s.

Follow this guideline to quickly and properly fill out irs 8689. It may be used by any us citizen who pays. Web with the internal revenue service, p.o. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Web Once You Have Entered The Applicable Information On The Form 8689, You Will See The Text Form 8689 Print Next To Form 1040 U.s.

Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Get ready for tax season deadlines by completing any required tax forms today. Allocation of individual income tax to the u.s. Web this publication discusses how to treat income received in u.s.

Web Irs Form 8689, Allocation Of Individual Income Tax To The U.s.

Possessions on your income tax return. Sign it in a few clicks draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today. Citizen or resident alien (other than a bona fide resident of the u.s.

.jpg)