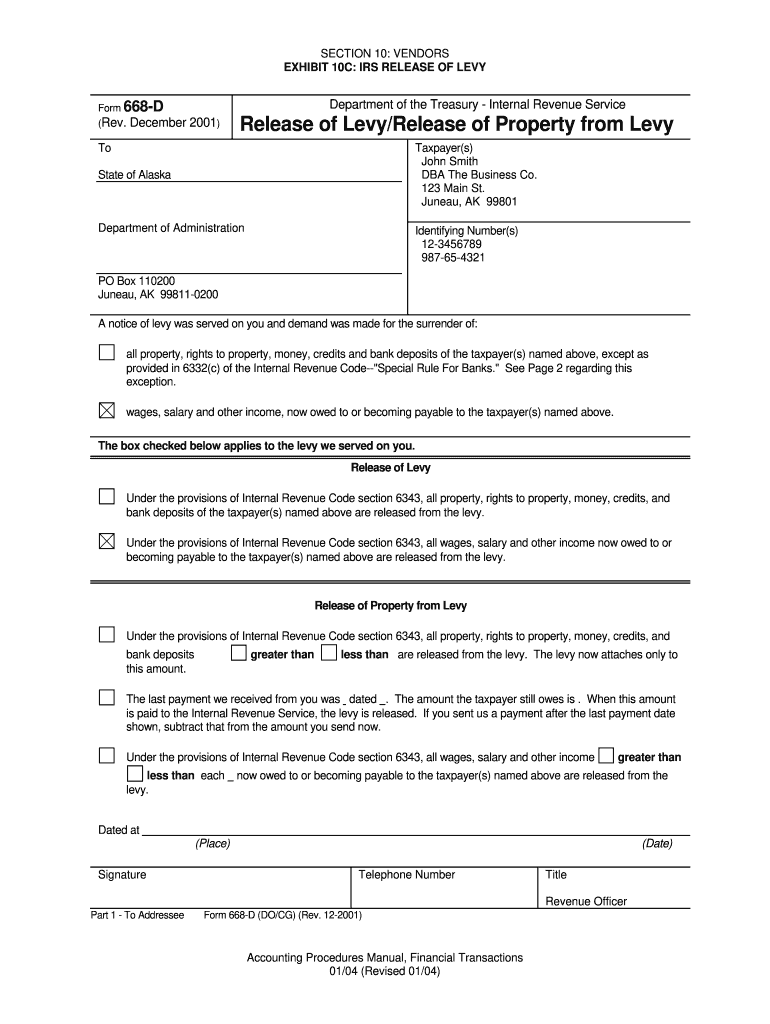

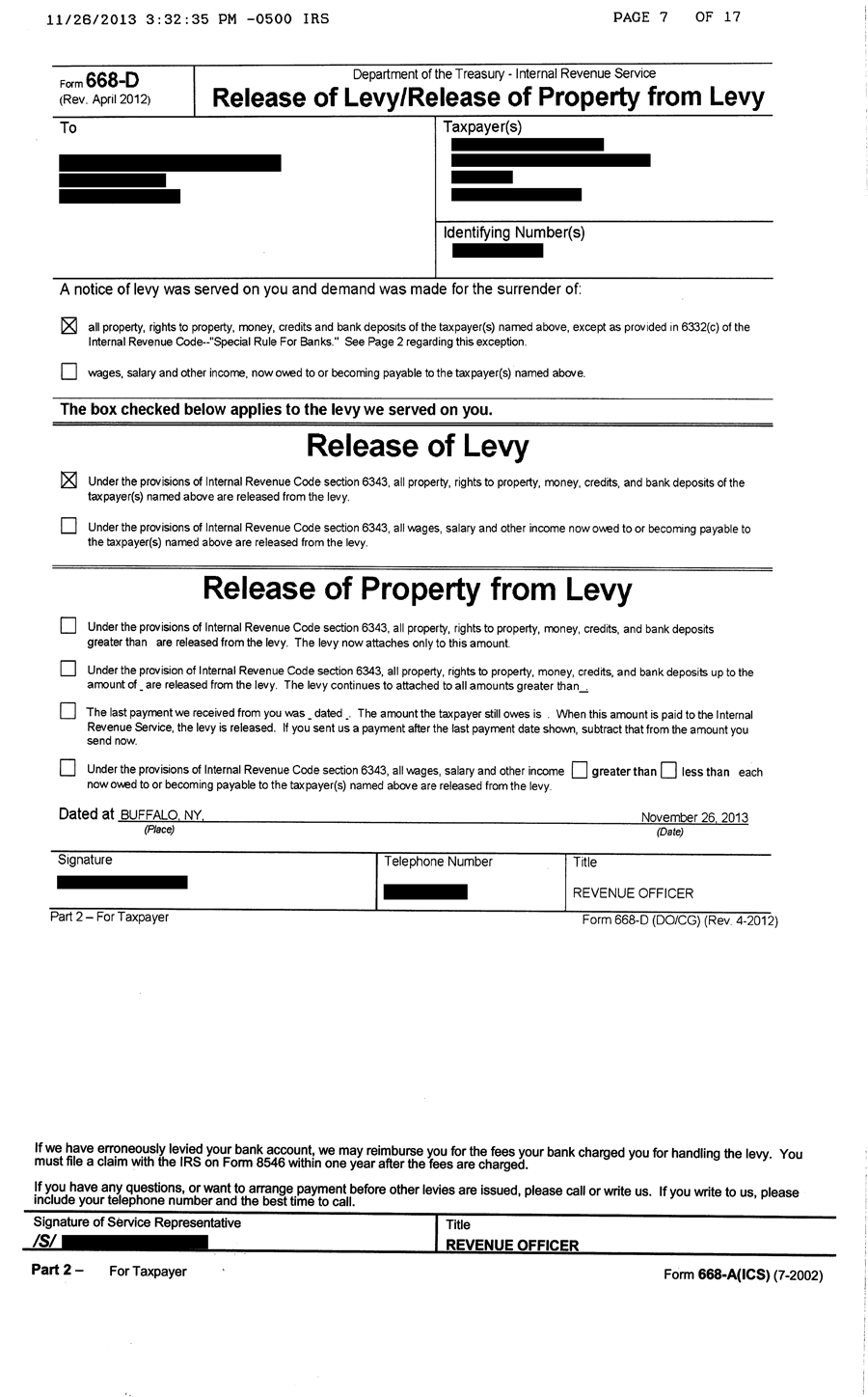

Irs Form 668 D Release Of Levy

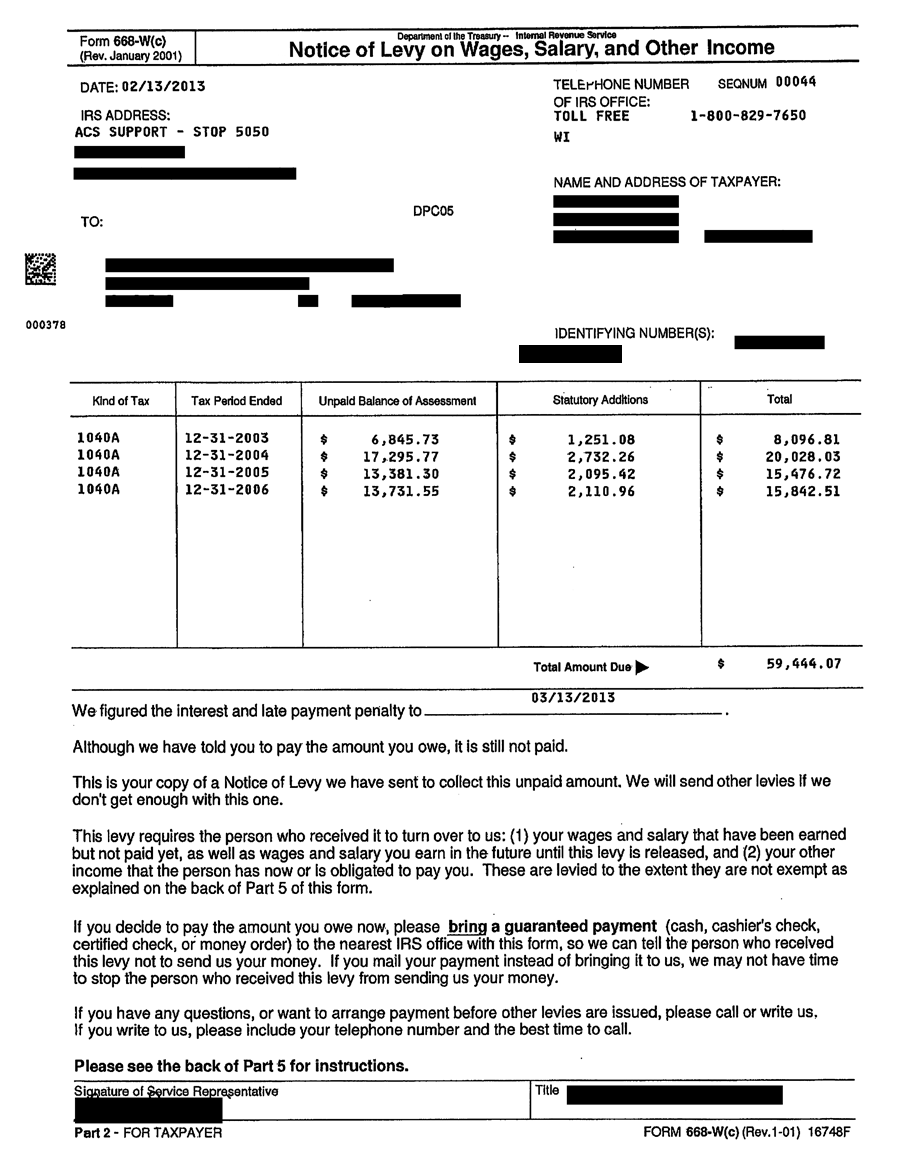

Irs Form 668 D Release Of Levy - A wage levy may last for an extended period of time. Web the irs releases your lien within 30 days after you have paid your tax debt. Release of levy under the provisions of internal revenue code section 6343, all property, rights to property,. Web once a lien arises, the irs generally can’t release it until you’ve paid the tax, penalties, interest, and recording fees in full or until the irs is no longer legally able to. Web irs form 668d is a notice that comes to inform you that your debt commitment has been fulfilled and all levies put on your assets have been lifted. The irs may also release the levy if you make. Web the box checked below applies to the levy we served on you. Web the irs issued a levy and the levied proceeds have been applied to your balance. Contact the irs immediately to resolve your tax liability and request a. Ad edit, sign and print tax forms on any device with uslegalforms.

Web irs form 668d is a notice that comes to inform you that your debt commitment has been fulfilled and all levies put on your assets have been lifted. Web once a lien arises, the irs generally can’t release it until you’ve paid the tax, penalties, interest, and recording fees in full or until the irs is no longer legally able to. Form 668w, notice of levy on. Web the irs will release the levy when you pay off your tax liability in full. When all of the tax shown underlying the levy is paid in full or the taxpayer makes. You may appeal before or. Get ready for tax season deadlines by completing any required tax forms today. Contact the irs immediately to resolve your tax liability and request a. Web find out what you need to do to resolve your tax liability and to request a levy release. Web irs can release a levy in some circumstances.

Ad edit, sign and print tax forms on any device with uslegalforms. You may appeal before or. Web release of property from levy d under the provisions of internal revenue code section 6343, all property, rights to property, money, credits, and bank deposits greater than are. Form 668w, notice of levy on. If the irs denies your request to release the levy, you may appeal this decision. Web find out what you need to do to resolve your tax liability and to request a levy release. Web the box checked below applies to the levy we served on you. When all of the tax shown underlying the levy is paid in full or the taxpayer makes. Contact the irs immediately to resolve your tax liability and request a. When conditions are in the best interest of both the government and the taxpayer, other.

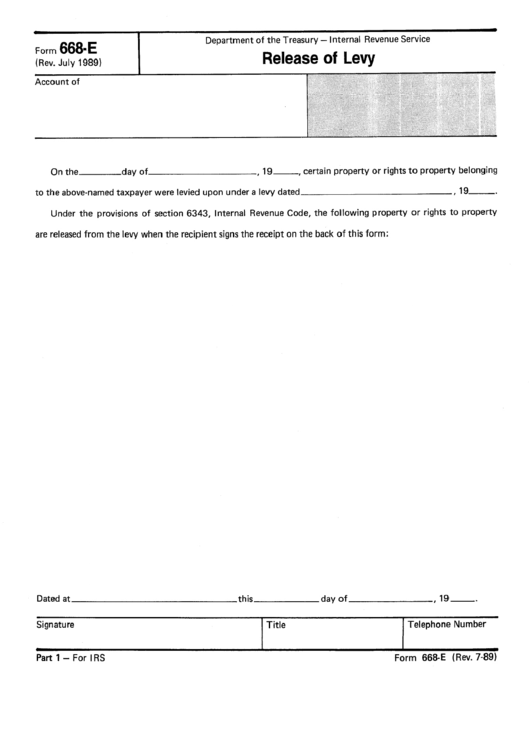

Form 668E Release Of Levy printable pdf download

When all of the tax shown underlying the levy is paid in full or the taxpayer makes. Web find out what you need to do to resolve your tax liability and to request a levy release. Form 668w, notice of levy on. If the irs denies your request to release the levy, you may appeal this decision. Web the irs.

No download needed irs form 668y pdf Fill out & sign online DocHub

Web the irs issued a levy and the levied proceeds have been applied to your balance. When all of the tax shown underlying the levy is paid in full or the taxpayer makes. Web release of property from levy d under the provisions of internal revenue code section 6343, all property, rights to property, money, credits, and bank deposits greater.

Irs Form 668 D Release Of Levy Forms OTQ5Mw Resume Examples

Make a reasonable effort to identify all property and rights to property belonging to this person. When conditions are in the best interest of both the government and the taxpayer, other. Release of levy under the provisions of internal revenue code section 6343, all property, rights to property,. Web once a lien arises, the irs generally can’t release it until.

Irs Form 668 D Release Of Levy Forms OTQ5Mw Resume Examples

Web find out what you need to do to resolve your tax liability and to request a levy release. The irs may also release the levy if you make. The irs may consider returning all or a portion of the levied proceeds if any of. Web the irs will release the levy when you pay off your tax liability in.

Tax Letters Washington Tax Services

Get ready for tax season deadlines by completing any required tax forms today. The way to fill out the ir's form 668 d release of levy on the. Web once a lien arises, the irs generally can’t release it until you’ve paid the tax, penalties, interest, and recording fees in full or until the irs is no longer legally able.

IRS Notices Colonial Tax Consultants

Get ready for tax season deadlines by completing any required tax forms today. If the irs denies your request to release the levy, you may appeal this decision. Web the box checked below applies to the levy we served on you. The irs may consider returning all or a portion of the levied proceeds if any of. Web irs can.

Irs Form 668 D Release Of Levy Forms OTQ5Mw Resume Examples

Web irs form 668d is a notice that comes to inform you that your debt commitment has been fulfilled and all levies put on your assets have been lifted. A wage levy may last for an extended period of time. Web release of property from levy d under the provisions of internal revenue code section 6343, all property, rights to.

Tax Letters Washington Tax Services

A wage levy may last for an extended period of time. Get ready for tax season deadlines by completing any required tax forms today. Web the irs issued a levy and the levied proceeds have been applied to your balance. Web irs can release a levy in some circumstances. Web the box checked below applies to the levy we served.

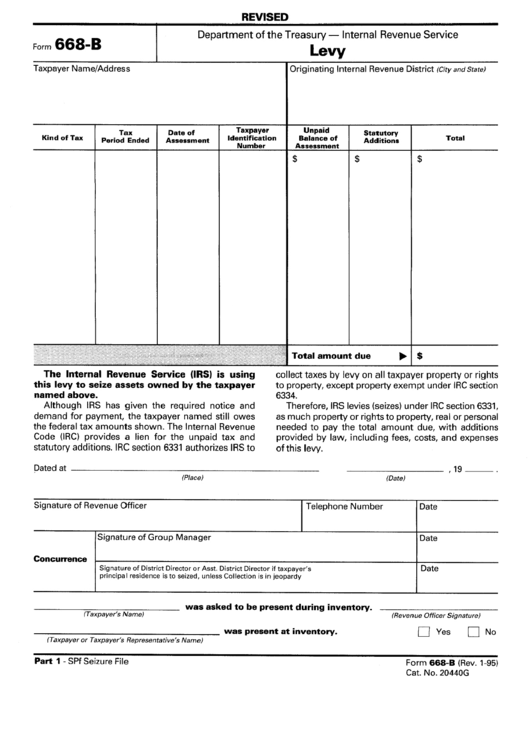

Form 668B Levy Department Of The Treasury printable pdf download

If the irs denies your request to release the levy, you may appeal this decision. When conditions are in the best interest of both the government and the taxpayer, other. The irs may also release the levy if you make. You may appeal before or. A wage levy may last for an extended period of time.

irs tax lien statute of limitations Fill Online, Printable, Fillable

Web once a lien arises, the irs generally can’t release it until you’ve paid the tax, penalties, interest, and recording fees in full or until the irs is no longer legally able to. Ad edit, sign and print tax forms on any device with uslegalforms. Web find out what you need to do to resolve your tax liability and to.

Web Irs Form 668D Is A Notice That Comes To Inform You That Your Debt Commitment Has Been Fulfilled And All Levies Put On Your Assets Have Been Lifted.

When all of the tax shown underlying the levy is paid in full or the taxpayer makes. Web the irs issued a levy and the levied proceeds have been applied to your balance. If the irs denies your request to release the levy, you may appeal this decision. Web the irs will release the levy when you pay off your tax liability in full.

Ad Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

The irs may also release the levy if you make. Web the box checked below applies to the levy we served on you. Web once a lien arises, the irs generally can’t release it until you’ve paid the tax, penalties, interest, and recording fees in full or until the irs is no longer legally able to. Web release of property from levy d under the provisions of internal revenue code section 6343, all property, rights to property, money, credits, and bank deposits greater than are.

When Conditions Are In The Best Interest Of Both The Government And The Taxpayer, Other.

The way to fill out the ir's form 668 d release of levy on the. Contact the irs immediately to resolve your tax liability and request a. You may appeal before or. Make a reasonable effort to identify all property and rights to property belonging to this person.

A Wage Levy May Last For An Extended Period Of Time.

The irs may consider returning all or a portion of the levied proceeds if any of. Release of levy under the provisions of internal revenue code section 6343, all property, rights to property,. Get ready for tax season deadlines by completing any required tax forms today. Web find out what you need to do to resolve your tax liability and to request a levy release.