Irs Form 6198

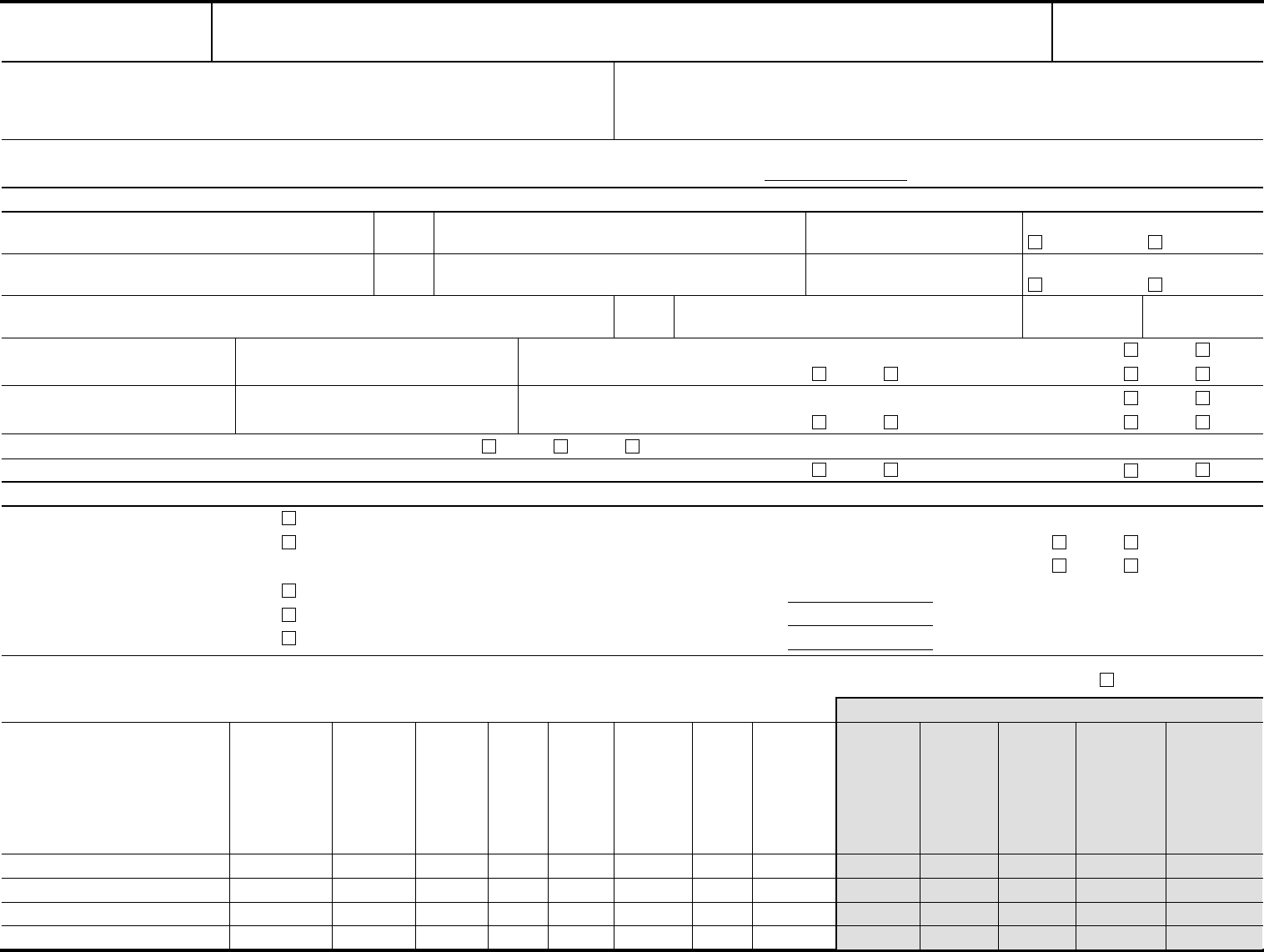

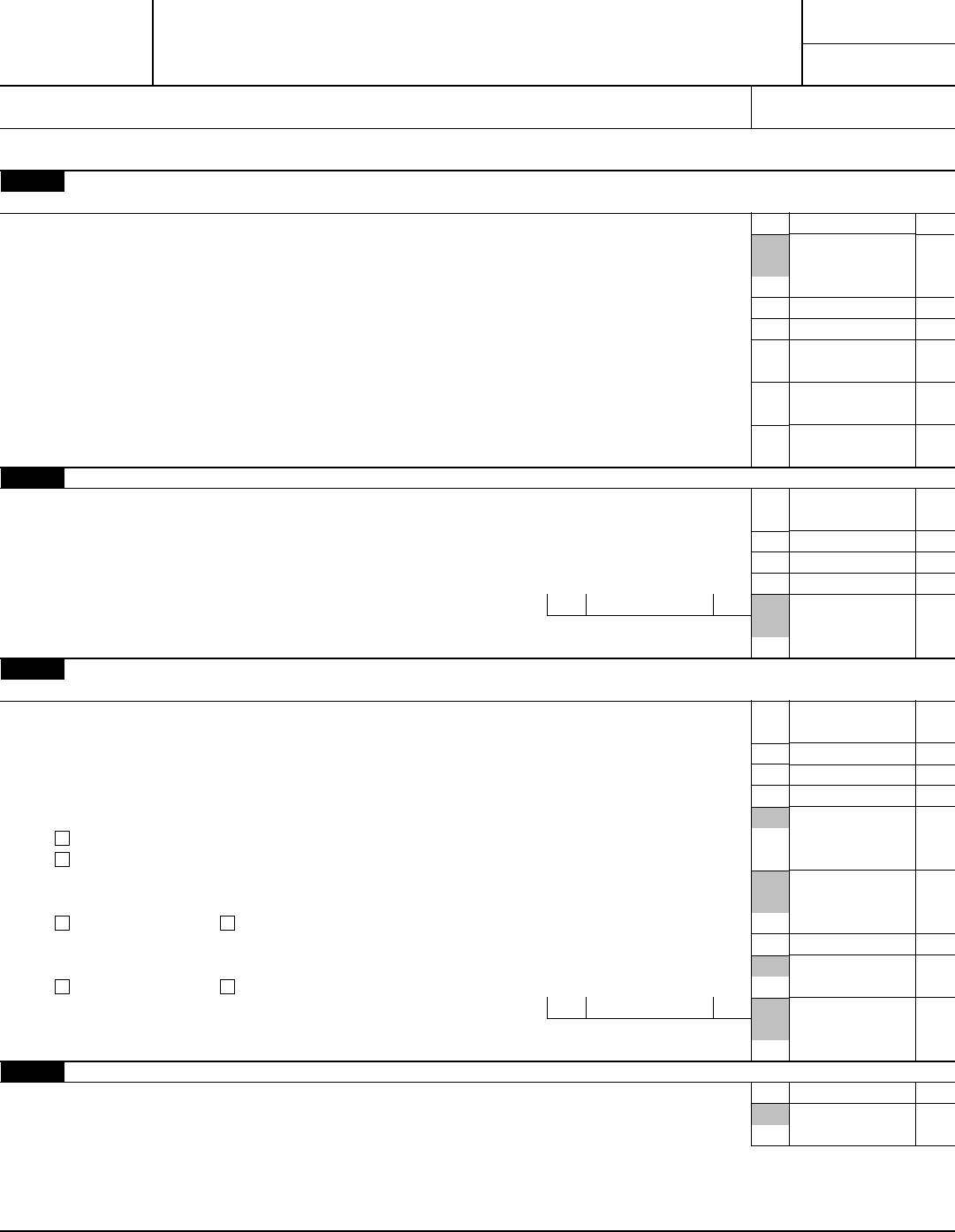

Irs Form 6198 - So if ending capital is negative you're not at. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. We have no way of telling if this is the case. Determine losses for the present year. For instructions and the latest information. To www.irs.gov/form6198 for instructions and the latest information. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Most investors go into business expecting to make a profit. Attach to your tax return.

December 2020) department of the treasury internal revenue service. We have no way of telling if this is the case. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. For instructions and the latest information. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Attach to your tax return. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. So if ending capital is negative you're not at. Most investors go into business expecting to make a profit. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no.

Most investors go into business expecting to make a profit. Determine losses for the present year. December 2020) department of the treasury internal revenue service. To www.irs.gov/form6198 for instructions and the latest information. We have no way of telling if this is the case. So if ending capital is negative you're not at. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining.

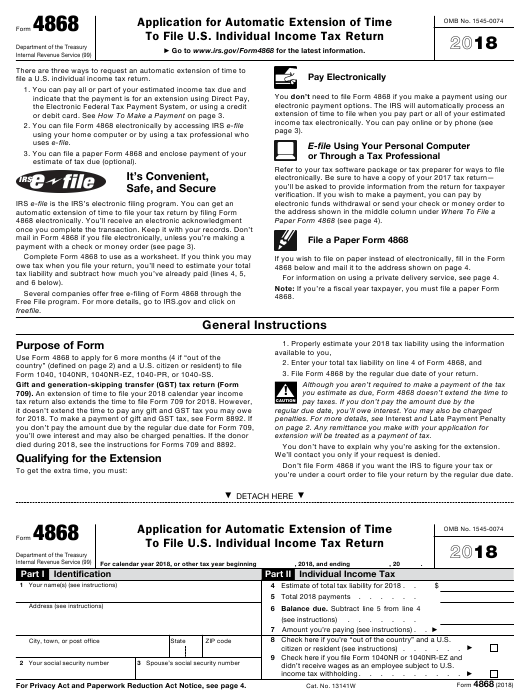

Free Printable Irs Form 4868 Printable Form 2022

December 2020) department of the treasury internal revenue service. Attach to your tax return. For instructions and the latest information. We have no way of telling if this is the case. Determine losses for the present year.

Download IRS Form 5498 for Free FormTemplate

Most investors go into business expecting to make a profit. To www.irs.gov/form6198 for instructions and the latest information. Description of activity (see instructions) part i Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at.

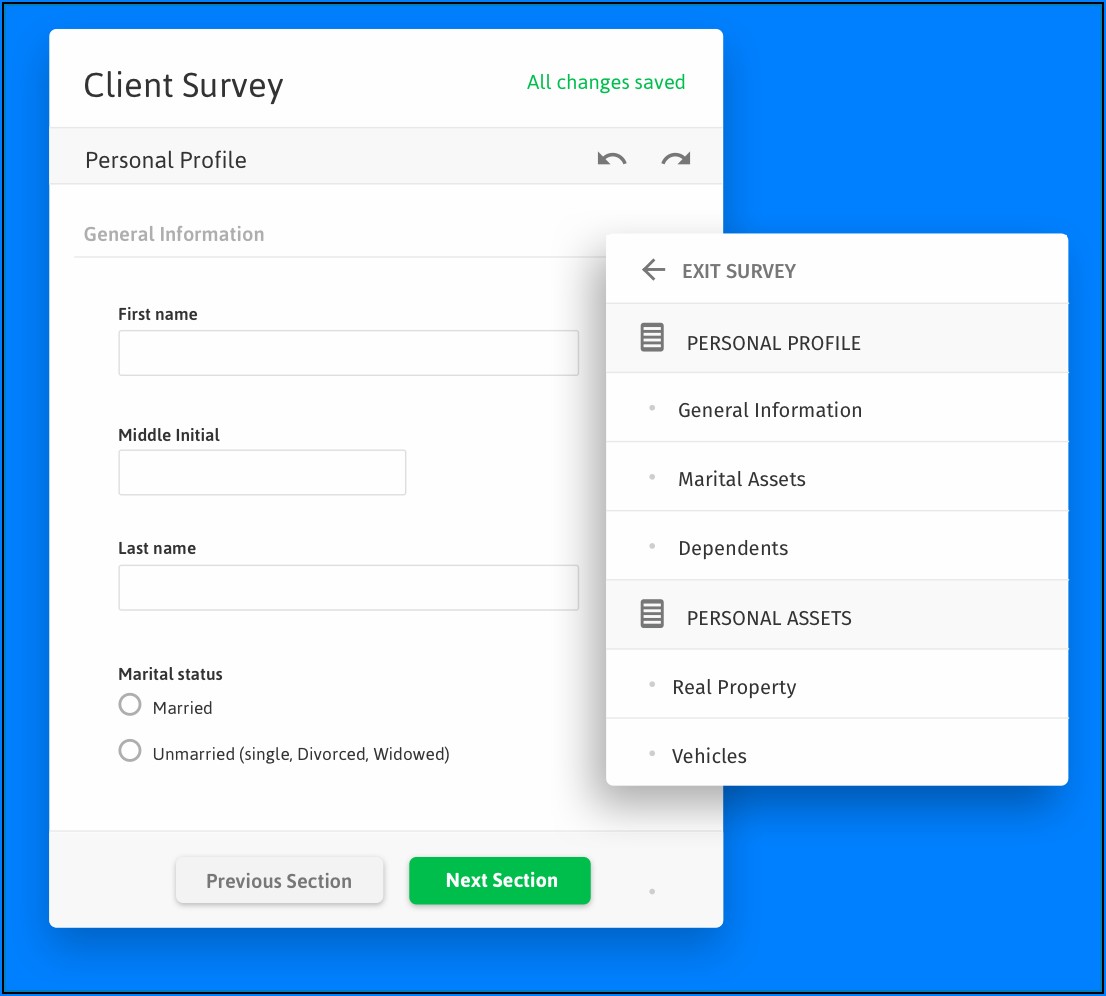

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. December 2020) department of the treasury internal revenue service. Attach to your tax return. Description of activity.

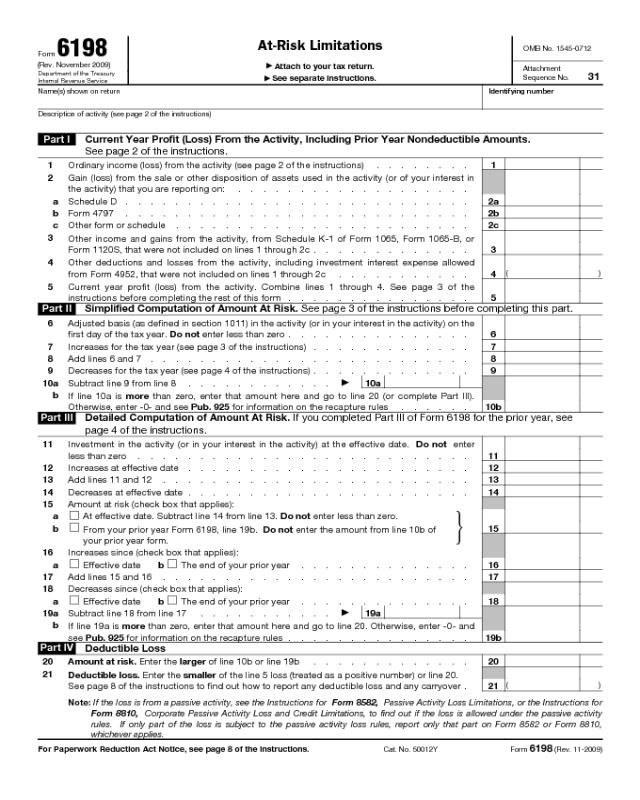

IRS Form 6198 Download Fillable PDF or Fill Online AtRisk Limitations

Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. December 2020) department of the treasury internal revenue.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

For instructions and the latest information. Estimate the amount at risk within the business. December 2020) department of the treasury internal revenue service. Most investors go into business expecting to make a profit. Description of activity (see instructions) part i

Form 13614C Edit, Fill, Sign Online Handypdf

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Description of activity (see instructions) part i Most investors go into business expecting to make a profit. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year..

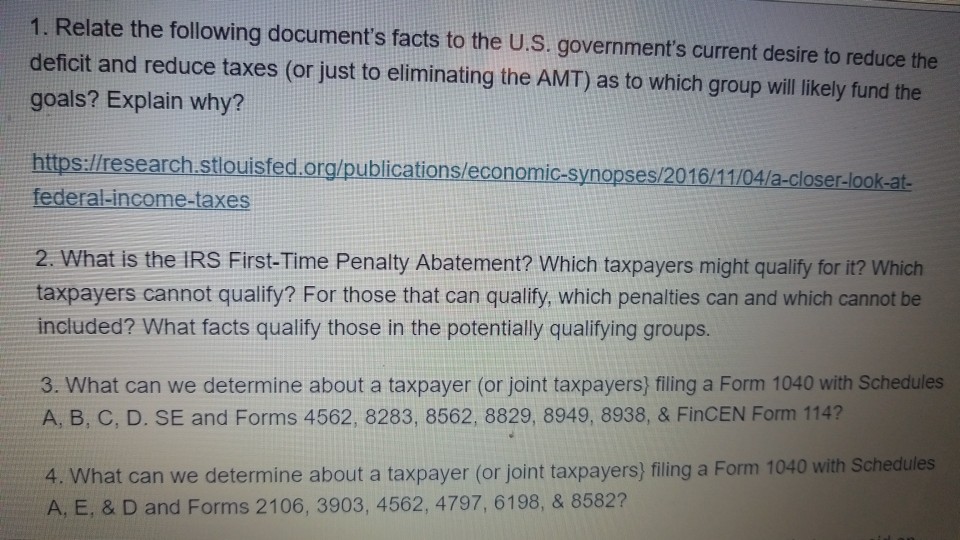

Solved 1. Relate the following document's facts to the U.S.

For instructions and the latest information. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. December 2020) department of the treasury internal revenue service. Estimate the amount at risk.

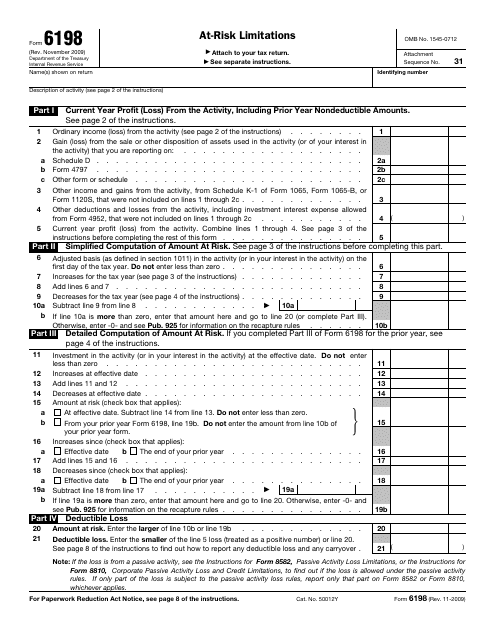

Form 6198 Edit, Fill, Sign Online Handypdf

Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. For instructions and the latest information. To www.irs.gov/form6198 for instructions and the latest information. December 2020) department of the treasury internal revenue service name(s).

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

December 2020) department of the treasury internal revenue service. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. We have no way of telling if this is the case. So if ending capital is negative you're not at. But, when business expenses exceed profits and.

IRS Tax Form 6198 Guide TFX.tax

Determine losses for the present year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. To www.irs.gov/form6198.

But, When Business Expenses Exceed Profits And A Loss Occurs, A Tax Deduction May Be The Only Silver Lining.

Attach to your tax return. December 2020) department of the treasury internal revenue service. Estimate the amount at risk within the business. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year.

Description Of Activity (See Instructions) Part I

Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. We have no way of telling if this is the case. So if ending capital is negative you're not at. Determine losses for the present year.

For Instructions And The Latest Information.

Most investors go into business expecting to make a profit. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. To www.irs.gov/form6198 for instructions and the latest information.