Irs Form 2678

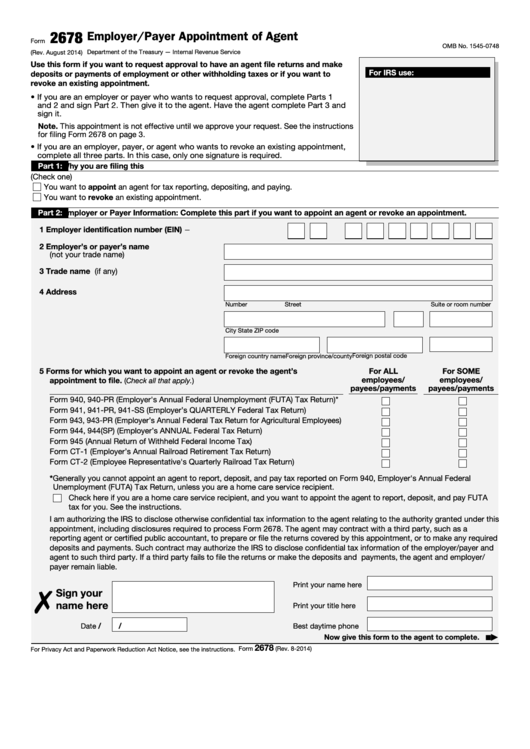

Irs Form 2678 - October 2012) department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or if you want to for irs use: Web about form 2678, employer/payer appointment of agent. By signing this form, you authorize ppl to withhold taxes from your employees’ paychecks and deposit those taxes with the irs. August 2014)department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or. August 2014) department of the treasury — internal revenue service omb no. The agent may contract with a third party, such as a reporting agent or certified public accountant, to prepare or file the returns covered by this appointment, or to make any required. With this form, you delegate the employer tax responsibility. Web we last updated the employer/payer appointment of agent in february 2023, so this is the latest version of form 2678, fully updated for tax year 2022. This form tells the irs that you give ppl permission to act as your fiscal/employment agent. Web aggregate filers appointed by an employer on irs form 2678, employer/payer appointment of agent, assume liability along with the employer for the employer’s social security, medicare, and federal income tax withholding.

Web irs form 2678 employer appointment of agent. This form tells the irs that you give ppl permission to act as your fiscal/employment agent. Web we last updated the employer/payer appointment of agent in february 2023, so this is the latest version of form 2678, fully updated for tax year 2022. Web employer/payer appointment of agent 2678 (rev. Web the notice makes clear that the common law employer is eligible to claim the credit, even though wages are paid by a certified professional employer organization (“cpeo”) or an agent of the employer designated as such on a form 2678, employer/payer appointment of agent. With this form, you delegate the employer tax responsibility. Web appointment, including disclosures required to process form 2678. Web an appointed agent acts as the employer, assuming liability along with the employer for the employer’s social security, medicare and federal income tax withholding responsibilities. The agent may contract with a third party, such as a reporting agent or certified public accountant, to prepare or file the returns covered by this appointment, or to make any required. August 2014)department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or.

October 2012) department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or if you want to for irs use: Web an appointed agent acts as the employer, assuming liability along with the employer for the employer’s social security, medicare and federal income tax withholding responsibilities. Web the notice makes clear that the common law employer is eligible to claim the credit, even though wages are paid by a certified professional employer organization (“cpeo”) or an agent of the employer designated as such on a form 2678, employer/payer appointment of agent. You can print other federal tax forms here. August 2014) department of the treasury — internal revenue service omb no. By signing this form, you authorize ppl to withhold taxes from your employees’ paychecks and deposit those taxes with the irs. Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes, railroad retirement tax act (rrta) taxes, income tax withholding (itw), or backup withholding; Web employer/payer appointment of agent 2678 (rev. Web about form 2678, employer/payer appointment of agent. Web aggregate filers appointed by an employer on irs form 2678, employer/payer appointment of agent, assume liability along with the employer for the employer’s social security, medicare, and federal income tax withholding.

Fill Free fillable F2678 Form 2678 (Rev. August 2014) PDF form

Web irs form 2678 employer appointment of agent. Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes, railroad retirement tax act (rrta) taxes, income tax withholding (itw), or backup withholding; Web an appointed agent acts as the employer, assuming liability along with the employer for the employer’s social security,.

Internal Revenue Service building Washington DC 2012 Flickr

Web irs form 2678 employer appointment of agent. October 2012) department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or if you want to for irs use: Web employer/payer appointment of agent 2678 (rev. August.

Form 2678 Employer/Payer Appointment of Agent (2014) Free Download

By signing this form, you authorize ppl to withhold taxes from your employees’ paychecks and deposit those taxes with the irs. Web aggregate filers appointed by an employer on irs form 2678, employer/payer appointment of agent, assume liability along with the employer for the employer’s social security, medicare, and federal income tax withholding. Web the notice makes clear that the.

Form 2678 Employer/Payer Appointment of Agent Stock Image Image of

Web aggregate filers appointed by an employer on irs form 2678, employer/payer appointment of agent, assume liability along with the employer for the employer’s social security, medicare, and federal income tax withholding. Web irs form 2678 employer appointment of agent. Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes,.

Form 2678 Employer/Payer Appointment of Agent (2014) Free Download

October 2012) department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or if you want to for irs use: Web aggregate filers appointed by an employer on irs form 2678, employer/payer appointment of agent, assume.

Irs Form 2290 Contact Number Universal Network

With this form, you delegate the employer tax responsibility. This form tells the irs that you give ppl permission to act as your fiscal/employment agent. Web irs form 2678 employer appointment of agent. August 2014)department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits.

Form 2678 Employer/payer Appointment Of Agent printable pdf download

Web the notice makes clear that the common law employer is eligible to claim the credit, even though wages are paid by a certified professional employer organization (“cpeo”) or an agent of the employer designated as such on a form 2678, employer/payer appointment of agent. Web employer/payer appointment of agent 2678 (rev. Web an appointed agent acts as the employer,.

IRS Form 2678 Download Fillable PDF or Fill Online Employer/Payer

August 2014) department of the treasury — internal revenue service omb no. Web about form 2678, employer/payer appointment of agent. Web we last updated the employer/payer appointment of agent in february 2023, so this is the latest version of form 2678, fully updated for tax year 2022. You can print other federal tax forms here. The agent may contract with.

IRS FORM 12257 PDF

Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes, railroad retirement tax act (rrta) taxes, income tax withholding (itw), or backup withholding; With this form, you delegate the employer tax responsibility. August 2014)department of the treasury — internal revenue service use this form if you want to request approval.

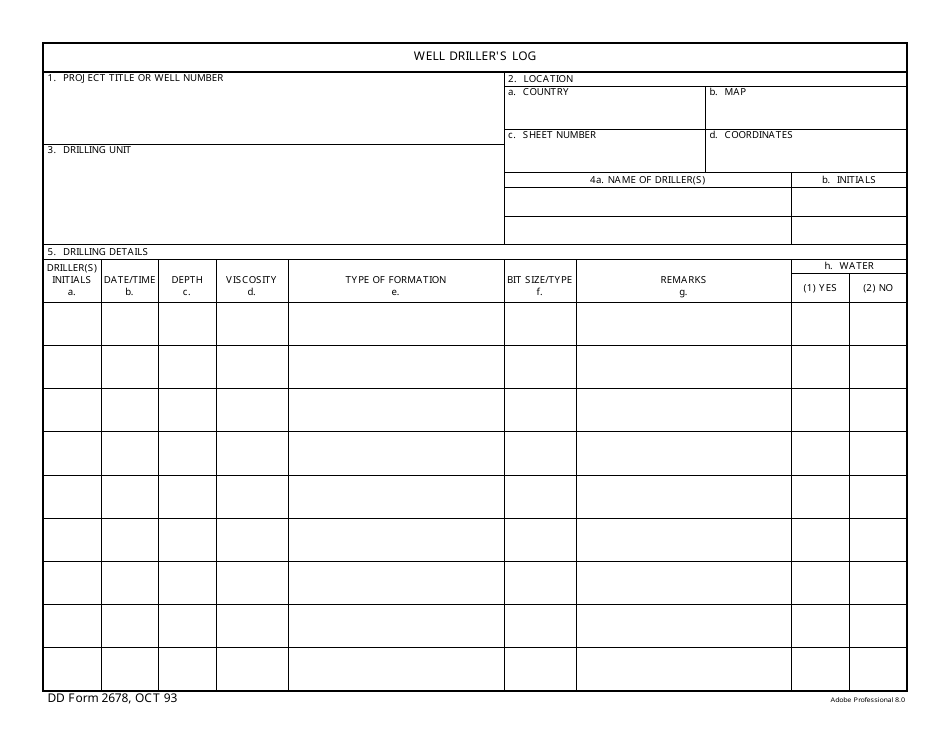

DD Form 2678 Download Fillable PDF or Fill Online Well Driller's Log

Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes, railroad retirement tax act (rrta) taxes, income tax withholding (itw), or backup withholding; The agent may contract with a third party, such as a reporting agent or certified public accountant, to prepare or file the returns covered by this appointment,.

Web The Notice Makes Clear That The Common Law Employer Is Eligible To Claim The Credit, Even Though Wages Are Paid By A Certified Professional Employer Organization (“Cpeo”) Or An Agent Of The Employer Designated As Such On A Form 2678, Employer/Payer Appointment Of Agent.

With this form, you delegate the employer tax responsibility. The agent may contract with a third party, such as a reporting agent or certified public accountant, to prepare or file the returns covered by this appointment, or to make any required. Request approval to have an agent file returns and make deposits or payments of federal insurance contributions act (fica) taxes, railroad retirement tax act (rrta) taxes, income tax withholding (itw), or backup withholding; Web employer/payer appointment of agent 2678 (rev.

August 2014) Department Of The Treasury — Internal Revenue Service Omb No.

Web an appointed agent acts as the employer, assuming liability along with the employer for the employer’s social security, medicare and federal income tax withholding responsibilities. You can print other federal tax forms here. Web irs form 2678 employer appointment of agent. Web about form 2678, employer/payer appointment of agent.

Web We Last Updated The Employer/Payer Appointment Of Agent In February 2023, So This Is The Latest Version Of Form 2678, Fully Updated For Tax Year 2022.

By signing this form, you authorize ppl to withhold taxes from your employees’ paychecks and deposit those taxes with the irs. October 2012) department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or if you want to for irs use: August 2014)department of the treasury — internal revenue service use this form if you want to request approval to have an agent file returns and make deposits or payments of employment or other withholding taxes or. Web appointment, including disclosures required to process form 2678.

Web Aggregate Filers Appointed By An Employer On Irs Form 2678, Employer/Payer Appointment Of Agent, Assume Liability Along With The Employer For The Employer’s Social Security, Medicare, And Federal Income Tax Withholding.

This form tells the irs that you give ppl permission to act as your fiscal/employment agent.

.jpg)