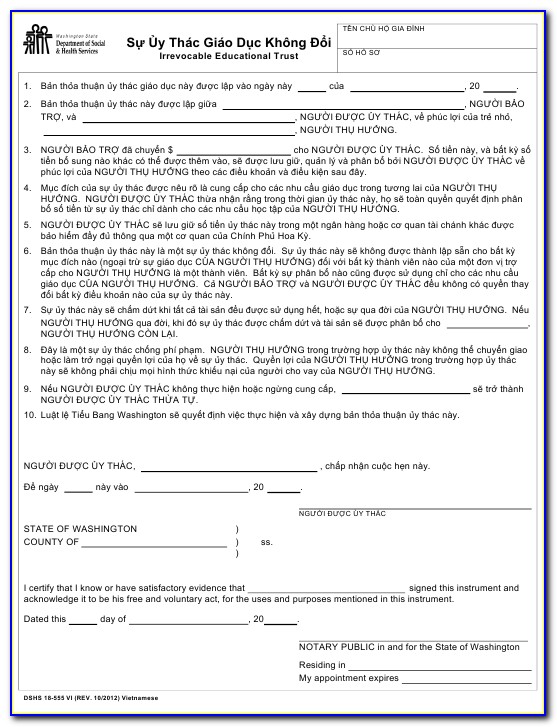

Irrevocable Life Insurance Trust Form

Irrevocable Life Insurance Trust Form - Intended to primarily benefit the. Web in addition to the net income, if in the sole and absolute discretion of the trustees, circumstances have arisen which make it desirable for the comfort, support, education, maintenance, health and welfare of any beneficiary, the trustees shall distribute to, or for the benefit of, any such beneficiary of the trust (or to the surviving children. The book contains these sample forms: Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the solo/small firm practitioner in mind. It differentiates between the two types of trusts you may use, identifying the best one that will work for your client. Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or policies. Web according to § 633a.2101 , a trust can be created by the authorization of a revocable or irrevocable trust.

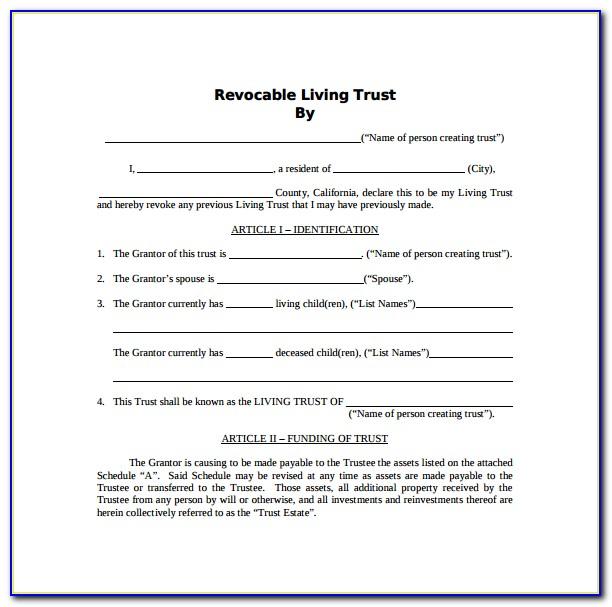

The grantor is often the person whose life is insured by the life insurance policies held within the trust. Web an ilit is an irrevocable trust primarily created and administered to be both owner and beneficiary of life insurance policies. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or policies. It differentiates between the two types of trusts you may use, identifying the best one that will work for your client. With respect to the state statutes, the trust is only valid if the grantor is competent and indicates clearly their intent to establish the entity. Your preferred form (irrevocable or revocable) should then be filled in with the mention. These documents are from the publication estate planning forms. Web according to § 633a.2101 , a trust can be created by the authorization of a revocable or irrevocable trust. Save or instantly send your ready documents. Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the solo/small firm practitioner in mind.

Web according to § 633a.2101 , a trust can be created by the authorization of a revocable or irrevocable trust. Web irrevocable life insurance trust worksheet; Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or policies. Web an irrevocable life insurance trust (ilit) is a tool that is used to protect assets—specifically a large life insurance death benefit—from being subject to estate taxes. Web an ilit is an irrevocable trust primarily created and administered to be both owner and beneficiary of life insurance policies. Easily fill out pdf blank, edit, and sign them. Intended to primarily benefit the. Web an irrevocable life insurance trust, or ilit, is a financial tool used to manage life insurance policies and allocate benefits when you pass away. These documents are from the publication estate planning forms. Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the solo/small firm practitioner in mind.

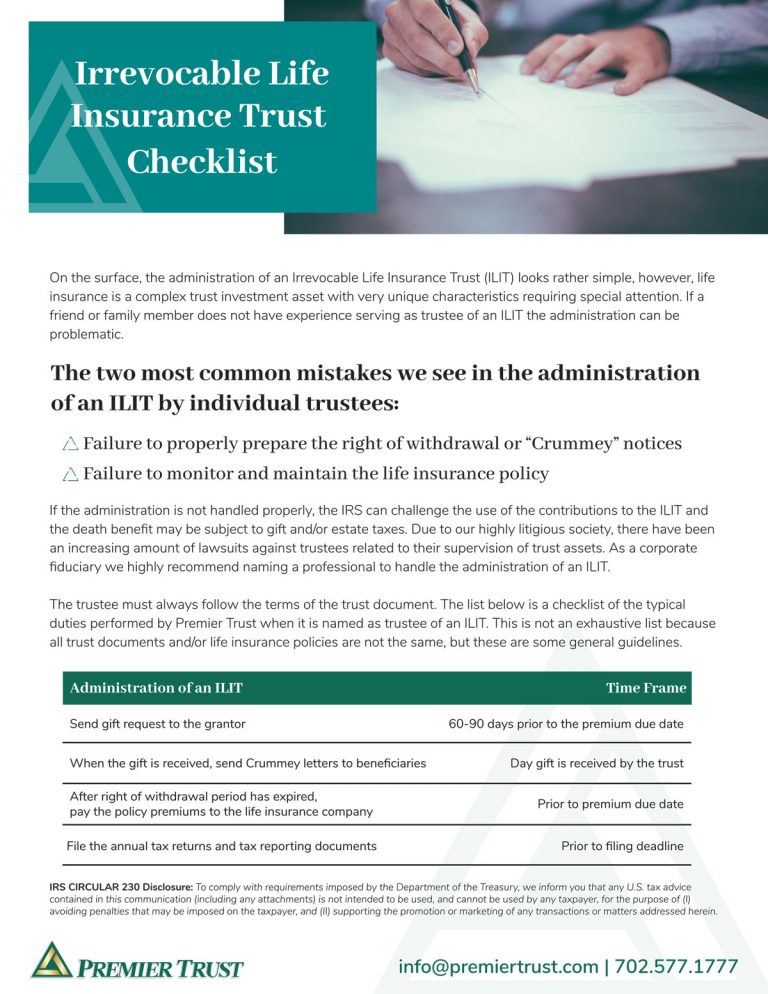

irrevocablelifeinsurancetrustschecklist Premier Trust

Easily fill out pdf blank, edit, and sign them. Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Web according to § 633a.2101 , a.

Irrevocable Life Insurance Trusts Graves Dougherty Hearon & Moody

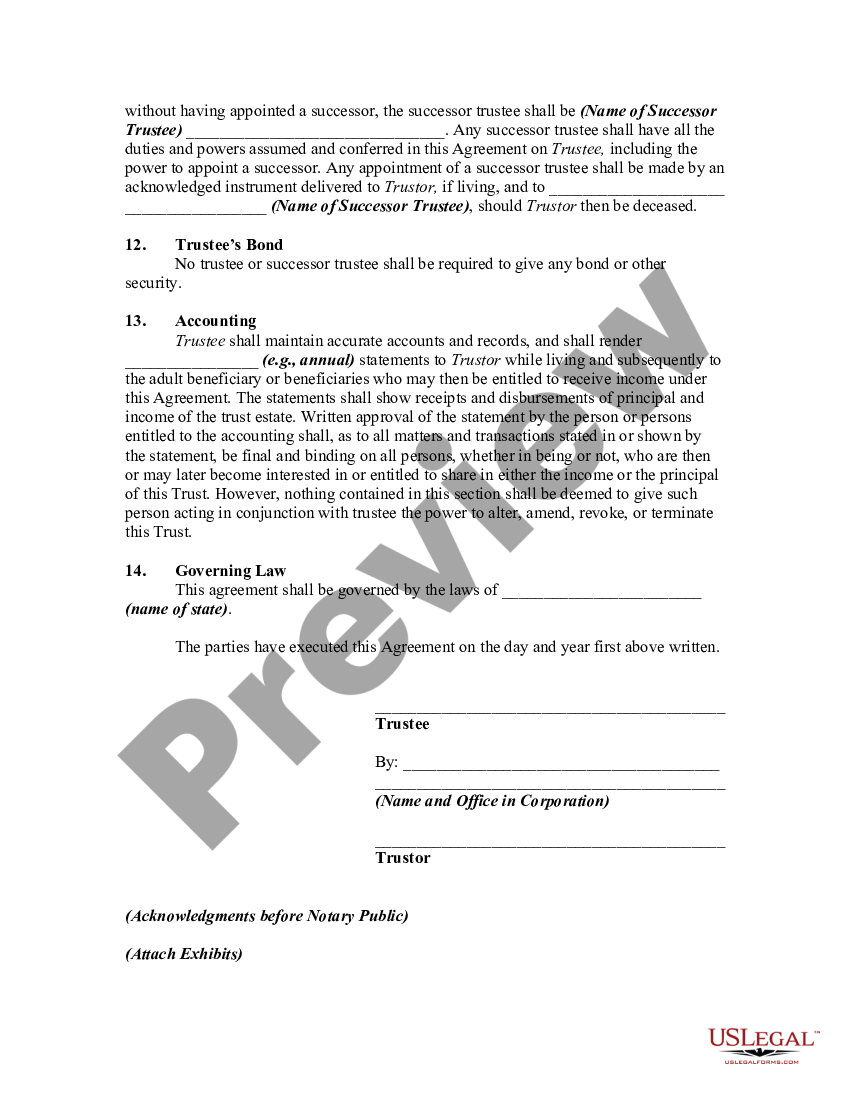

Web clear and concise, the irrevocable life insurance trust will help you protect your clients' estate and assets from taxation. Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the solo/small firm practitioner in mind. Ilits are generally used by families with a high net worth and gross estate value. Web in addition to the net.

Irrevocable Trust Form Michigan Forms NDg5MA Resume Examples

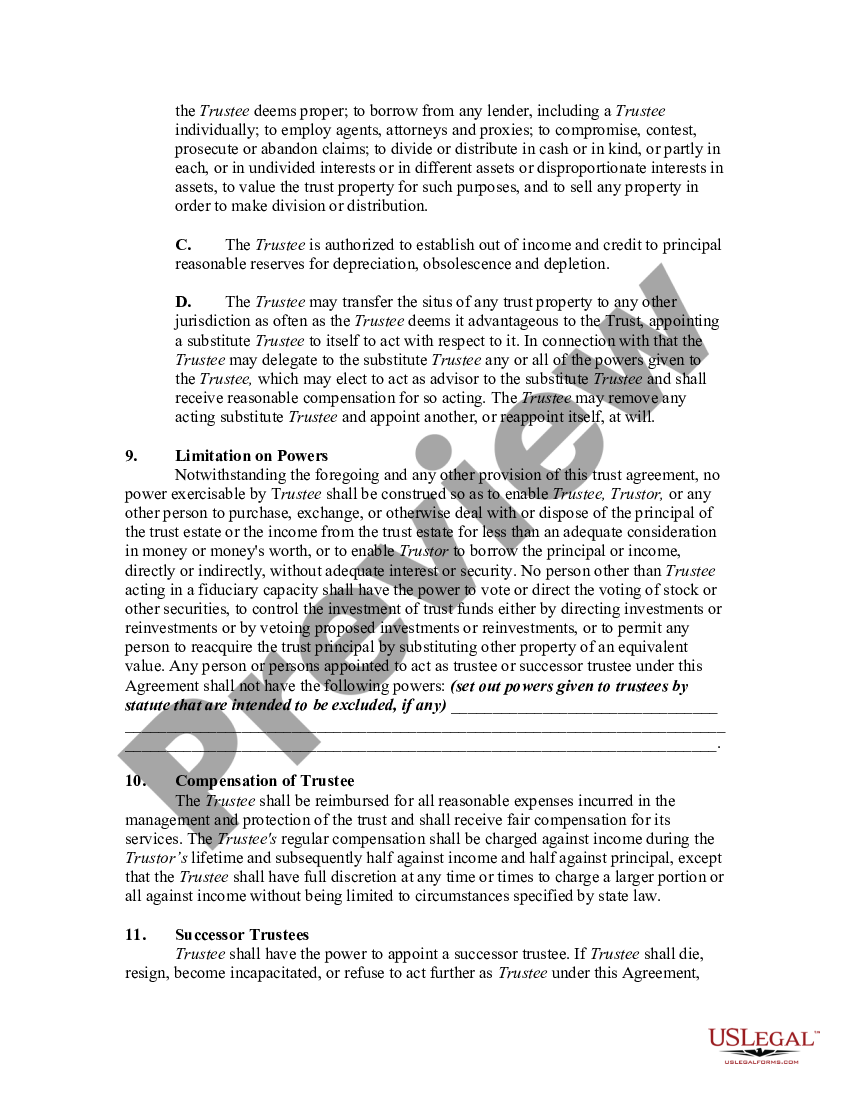

Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the solo/small firm practitioner in mind. Web in addition to the net income, if in the sole and absolute discretion of the trustees, circumstances have arisen which make it desirable for the comfort, support, education, maintenance, health and welfare of any beneficiary, the trustees shall distribute to,.

Irrevocable Living Trust Form Arizona

Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Web in addition to the net income, if in the sole and absolute discretion of the.

Irrevocable Life Insurance Trust Form With Crummey Powers US Legal Forms

The book contains these sample forms: Save or instantly send your ready documents. Intended to primarily benefit the. Easily fill out pdf blank, edit, and sign them. It differentiates between the two types of trusts you may use, identifying the best one that will work for your client.

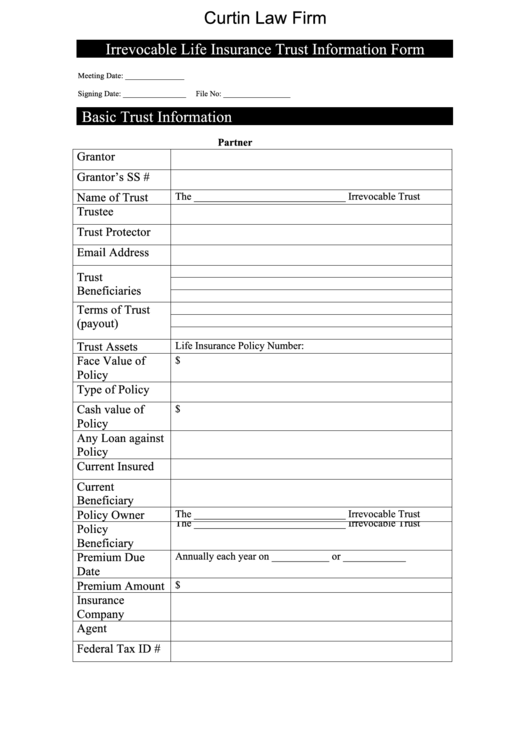

Irrevocable Life Insurance Trust Information Form Curtin Law Firm

These documents are from the publication estate planning forms. Web an ilit is an irrevocable trust primarily created and administered to be both owner and beneficiary of life insurance policies. Web irrevocable life insurance trust worksheet; With respect to the state statutes, the trust is only valid if the grantor is competent and indicates clearly their intent to establish the.

Irrevocable Life Insurance Trust Form 1041

Ilits are generally used by families with a high net worth and gross estate value. Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Web.

Irrevocable Trust Funded by Life Insurance Life Insurance Trust US

It differentiates between the two types of trusts you may use, identifying the best one that will work for your client. These documents are from the publication estate planning forms. Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as.

Irrevocable Life Insurance Trust Blake Harris Law

Intended to primarily benefit the. The book contains these sample forms: Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Your preferred form (irrevocable or.

Introduction to Irrevocable Life Insurance Trusts (ILIT) YouTube

The book contains these sample forms: Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death. Ilits are generally used by families with a high net.

With Respect To The State Statutes, The Trust Is Only Valid If The Grantor Is Competent And Indicates Clearly Their Intent To Establish The Entity.

Web irrevocable life insurance trust worksheet; The grantor is often the person whose life is insured by the life insurance policies held within the trust. Easily fill out pdf blank, edit, and sign them. These documents are from the publication estate planning forms.

The Book Contains These Sample Forms:

Web according to § 633a.2101 , a trust can be created by the authorization of a revocable or irrevocable trust. Web an irrevocable life insurance trust, or ilit, is a financial tool used to manage life insurance policies and allocate benefits when you pass away. Web an ilit is an irrevocable trust primarily created and administered to be both owner and beneficiary of life insurance policies. The person who initially creates and funds the ilit is known as the grantor or settler.

It Differentiates Between The Two Types Of Trusts You May Use, Identifying The Best One That Will Work For Your Client.

Intended to primarily benefit the. Save or instantly send your ready documents. Web in addition to the net income, if in the sole and absolute discretion of the trustees, circumstances have arisen which make it desirable for the comfort, support, education, maintenance, health and welfare of any beneficiary, the trustees shall distribute to, or for the benefit of, any such beneficiary of the trust (or to the surviving children. Web an irrevocable life insurance trust (ilit) is created to own and control a term or permanent life insurance policy or policies while the insured is alive, as well as to manage and distribute the proceeds that are paid out upon the insured's death.

Ilits Are Generally Used By Families With A High Net Worth And Gross Estate Value.

Web clear and concise, the irrevocable life insurance trust will help you protect your clients' estate and assets from taxation. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or policies. Web an irrevocable life insurance trust (ilit) is a tool that is used to protect assets—specifically a large life insurance death benefit—from being subject to estate taxes. Your preferred form (irrevocable or revocable) should then be filled in with the mention.