Instructions Form 8615

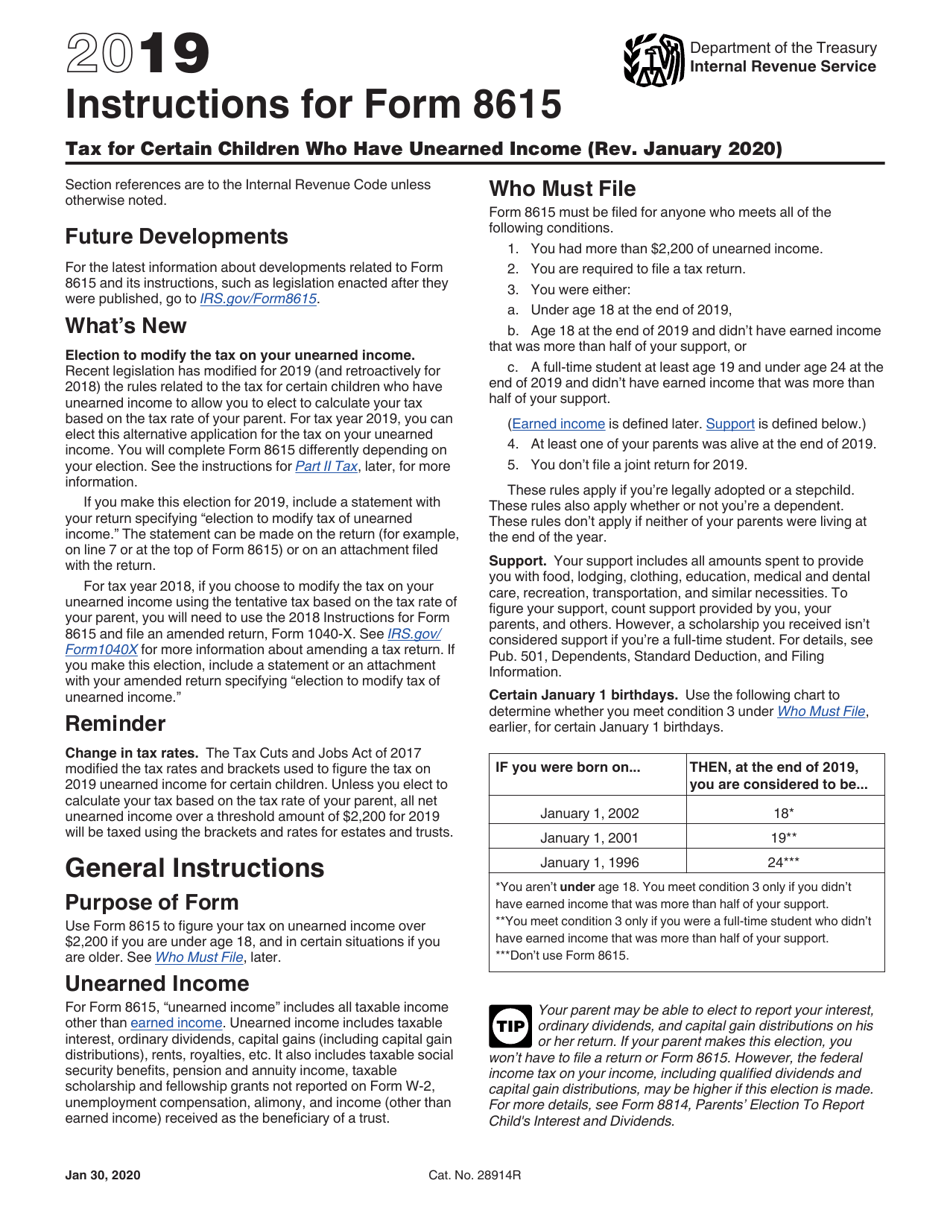

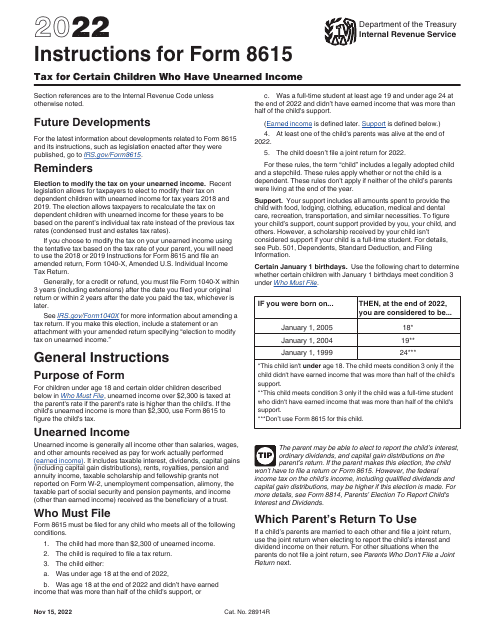

Instructions Form 8615 - Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. You had more than $2,300 of unearned income. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615. If applicable, include this amount on your form 1040, line. Register and subscribe now to work on your irs form 8615 & more fillable forms. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web march 14, 2023. You are required to file a tax return. The service delivery logs are available for the documentation of a service event for individualized skills and socialization.

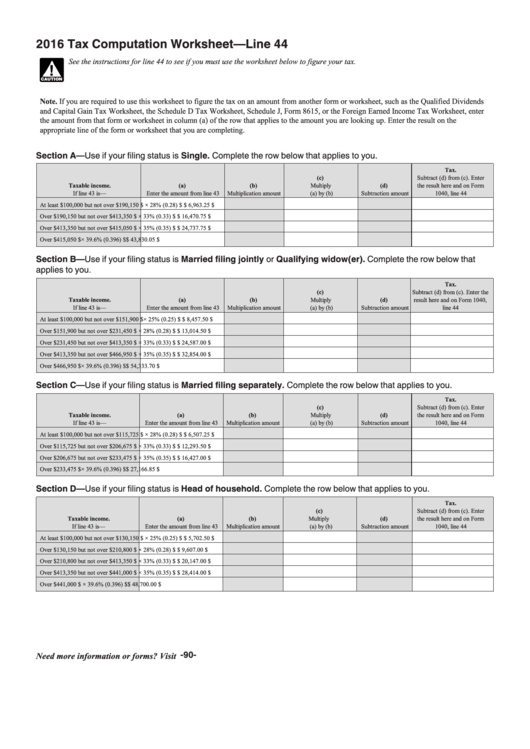

When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web march 14, 2023. Web form 8615 must be filed with the child’s tax return if all of the following apply: The service delivery logs are available for the documentation of a service event for individualized skills and socialization. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Web enter the parent’s tax from form 1040, line 44; Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older.

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Complete, edit or print tax forms instantly. Web march 14, 2023. Register and subscribe now to work on your irs form 8615 & more fillable forms. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Form 1040a, line 28, minus any alternative minimum tax; When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web form 8615, tax for certain children who have unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older.

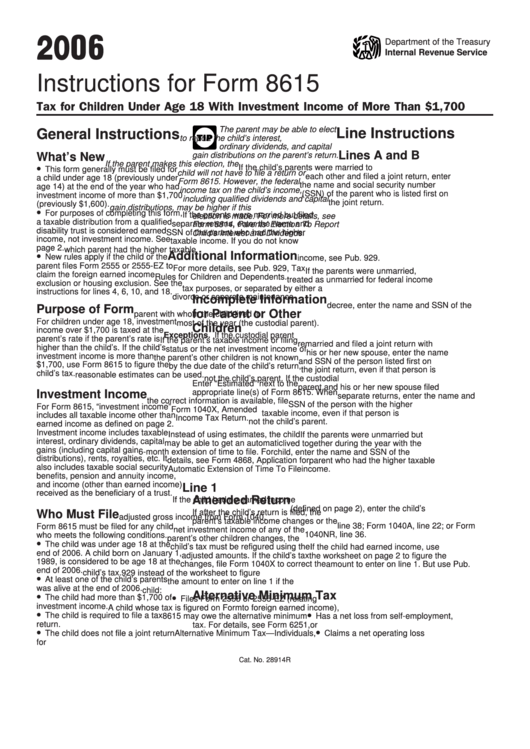

Instructions For Form 8615 Tax For Children Under Age 18 With

When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Complete, edit or print tax forms instantly. The service delivery logs are.

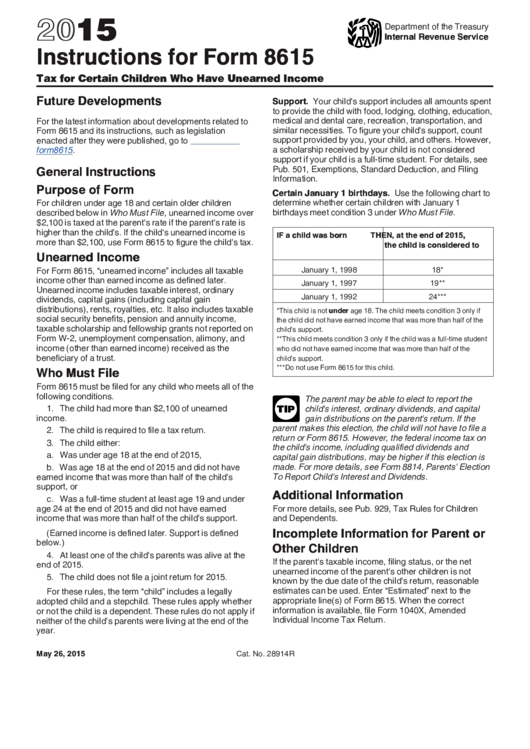

Form 8615 Instructions (2015) printable pdf download

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615, tax for certain children who have unearned income. Web march 14, 2023. When using form 8615 in proseries, you should enter the child as the.

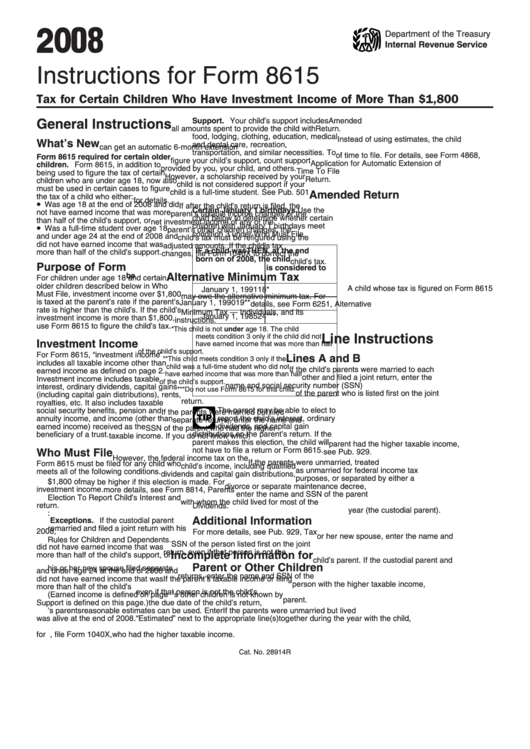

Instructions For Form 8615 Tax For Certain Children Who Have

Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Register and subscribe now to work on your irs form 8615 & more fillable forms. When using form 8615 in proseries, you should enter the child as the taxpayer on the..

Tax Computation Worksheet Line 44 2016 printable pdf download

The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web form 8615, tax for certain children who have unearned income. If applicable, include this amount on your form 1040, line. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Web march 14, 2023. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18,.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Complete, edit or print tax forms instantly. If applicable, include this amount on your form 1040, line. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Web for children under age 18 and certain older children described.

Form 568 instructions 2012

You had more than $2,300 of unearned income. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615. Form 1040a, line 28, minus any alternative minimum tax; Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200.

Form 8615 Tax Pro Community

Web march 14, 2023. You are required to file a tax return. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed with the child’s tax return if all of the following apply: If the child doesn't qualify for a form 8814 election, file.

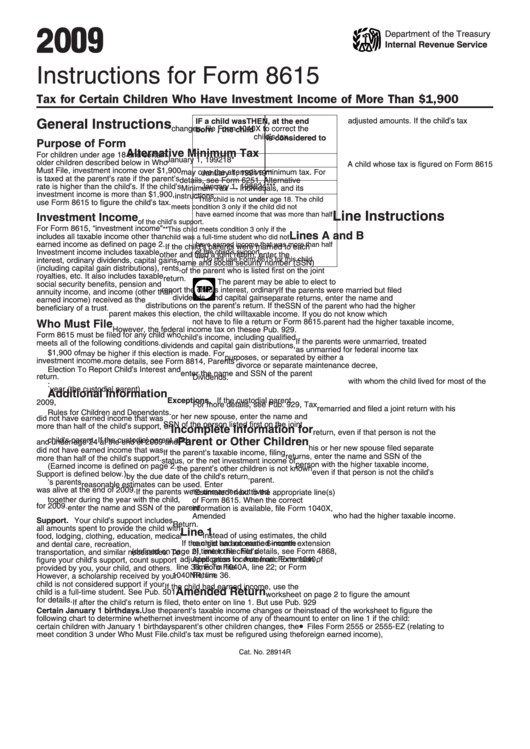

Instructions For Form 8615 Tax For Certain Children Who Have

Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are.

You Are Required To File A Tax Return.

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web march 14, 2023. Form 1040a, line 28, minus any alternative minimum tax;

Web General Instructions Purpose Of Form Use Form 8615 To Figure Your Tax On Unearned Income Over $2,100 If You Are Under Age 18, And In Certain Situations If You Are Older.

You had more than $2,300 of unearned income. When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed with the child’s tax return if all of the following apply:

The Service Delivery Logs Are Available For The Documentation Of A Service Event For Individualized Skills And Socialization.

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Complete, edit or print tax forms instantly. Web enter the parent’s tax from form 1040, line 44;

If Applicable, Include This Amount On Your Form 1040, Line.

Web form 8615, tax for certain children who have unearned income. Register and subscribe now to work on your irs form 8615 & more fillable forms. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss.jpg)