Instructions For Form 8815

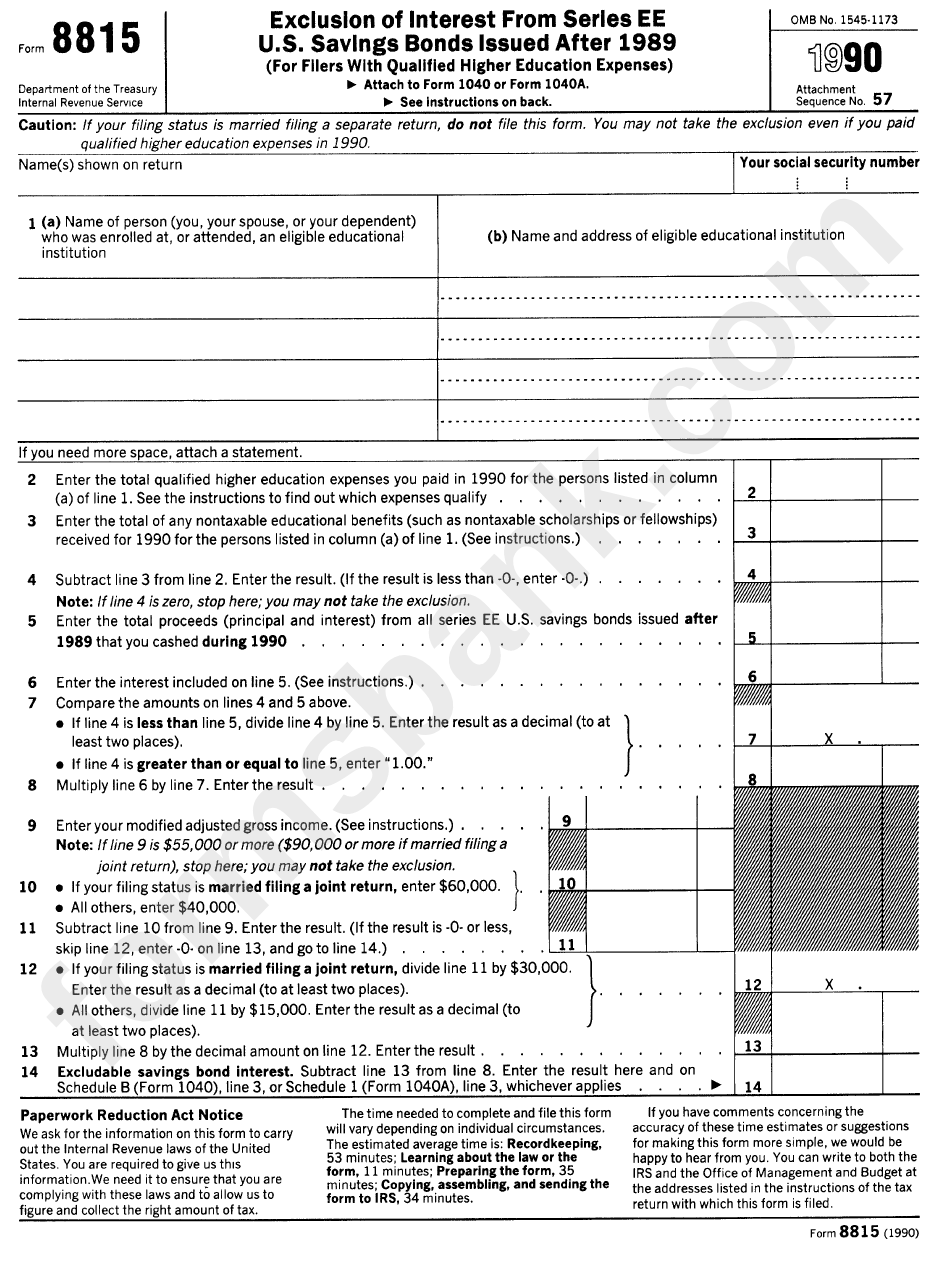

Instructions For Form 8815 - Web these forms are not provided in taxslayer pro and must be mailed to the irs separate from the tax return. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and iu.s. Try it for free now! For paperwork reduction act notice, see your tax. From the main menu of the tax return (form 1040) select; Savings bonds issued after 1989 (for filers with qualified. Find a suitable template on the internet. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Complete, edit or print tax forms instantly. Read all the field labels carefully.

For paperwork reduction act notice, see your tax. You can add form 8815 in your turbotax by following these steps: See the form 3520 instructions to determine if it is needed. From the main menu of the tax return (form 1040) select; Subtract from line 2c of your foreign earned income tax worksheet the excess, if any, of the amount on line 5. Savings bonds issued after 1989 (for filers with qualified. Upload, modify or create forms. If filing before 10/1/2011, report the. Complete, edit or print tax forms instantly. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s.

Savings bonds issued after 1989, the cashed us savings bonds must meet these criteria: When individuals aren?t connected to document administration and lawful operations, completing irs docs can be quite stressful. From the main menu of the tax return (form 1040) select; Savings bonds issued after 1989 (for filers. Get ready for tax season deadlines by completing any required tax forms today. Web video instructions and help with filling out and completing form 8815 instructions. Fill out the necessary boxes that are. Read all the field labels carefully. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Savings bonds issued after 1989 (for filers with qualified.

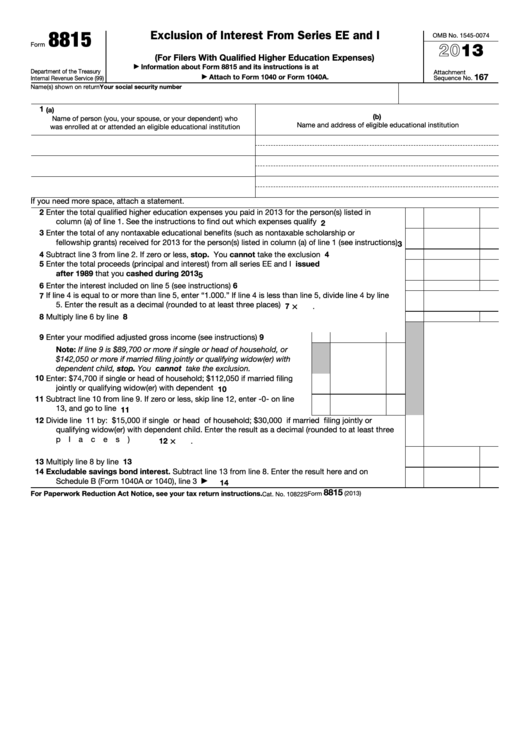

Form 8815 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. While in your return, click federal taxes > wages & income > i'll choose what i. When individuals aren?t connected to document administration and lawful operations, completing irs docs can be quite stressful. Exclusion of interest from series ee and i u.s. Web form 8815 department of the treasury internal revenue service (99).

Form 8815 ≡ Fill Out Printable PDF Forms Online

Web the tips below will allow you to fill in irs 8815 quickly and easily: Savings bonds issued after 1989, the cashed us savings bonds must meet these criteria: If filing before 10/1/2011, report the. Find a suitable template on the internet. Savings bonds issued after 1989 (for filers with qualified.

Form 8815 Edit, Fill, Sign Online Handypdf

From the main menu of the tax return (form 1040) select; Savings bonds issued after 1989 (for filers with qualified. See the form 3520 instructions to determine if it is needed. Complete, edit or print tax forms instantly. Web these forms are not provided in taxslayer pro and must be mailed to the irs separate from the tax return.

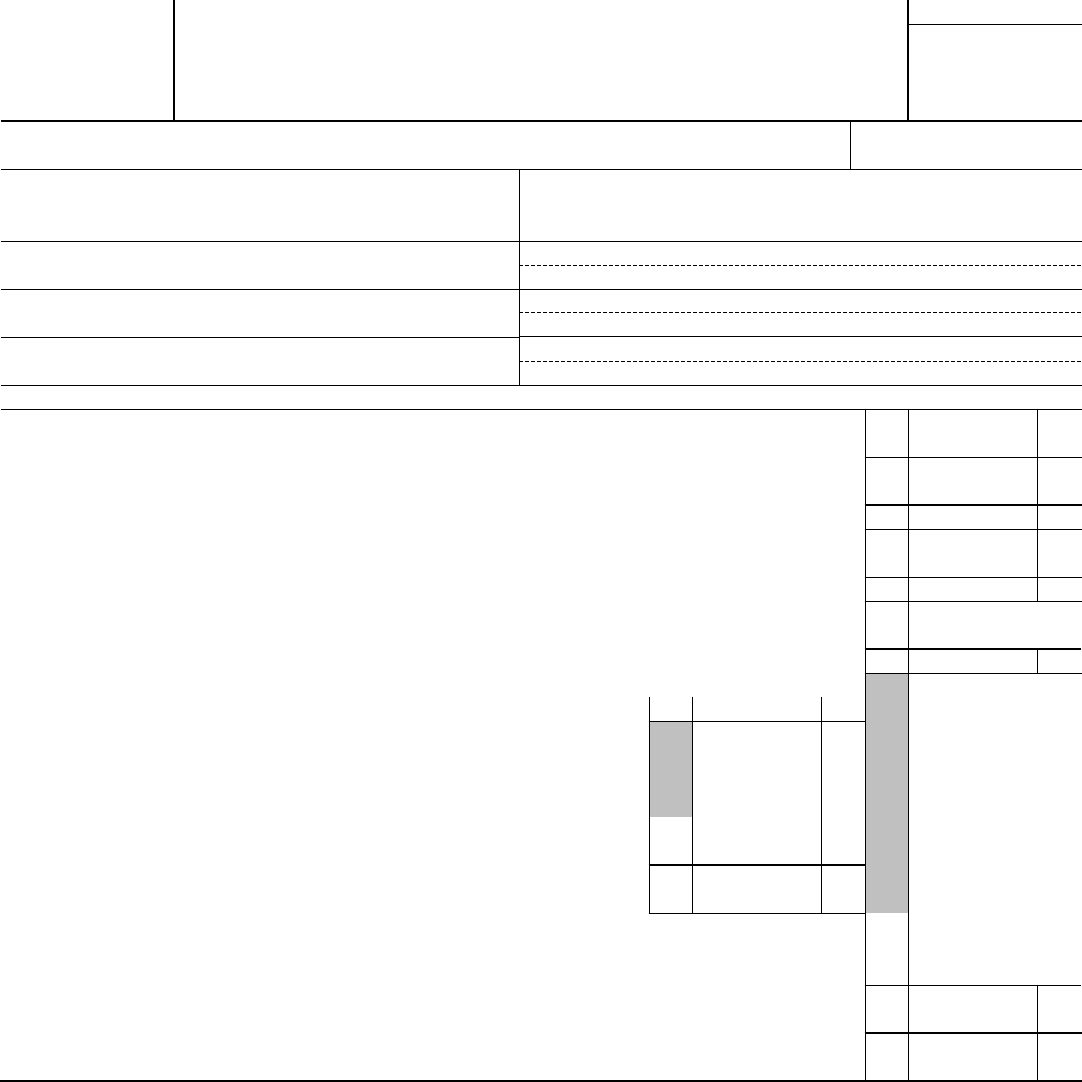

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Savings bonds issued after 1989, the cashed us savings bonds must meet these criteria: Get ready for tax season deadlines by completing any required tax forms today. Savings bonds issued after 1989 (for filers with qualified. Web irs form 8815 titled exclusion of interest from series ee and i u.s. Web video instructions and help with filling out and completing.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Web video instructions and help with filling out and completing form 8815 instructions. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and iu.s. Savings bonds issued after 1989 (for filers. While in your return, click federal taxes > wages & income > i'll choose what i. See the form 3520 instructions.

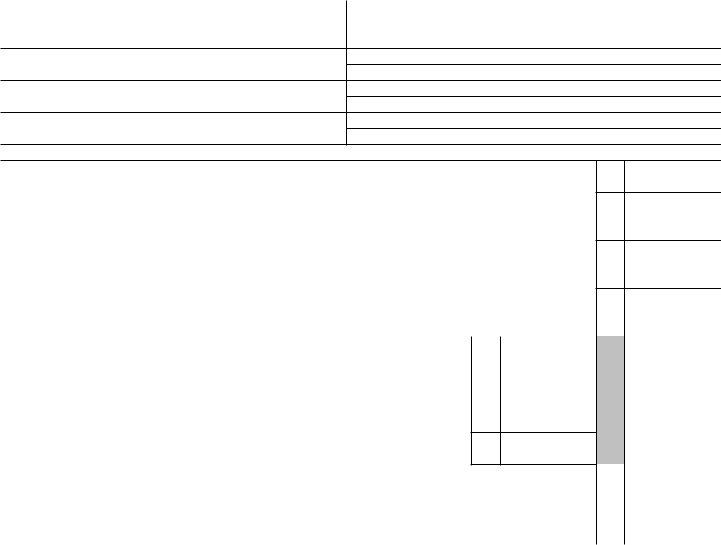

Fillable Form 8815 Exclusion Of Interest From Series Ee And I U.s

Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and iu.s. Savings bonds issued after 1989 (for filers. Web these forms are not provided in taxslayer pro and must be mailed to the irs separate from the tax return. Web form 8815 department of the treasury internal revenue service (99) exclusion of.

Building instructions for LEGO set number 8815 8815 main.ldr

Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and iu.s. Web follow the simple instructions below: Savings bonds issued after 1989 (for filers with qualified. Try it for free now! If filing before 10/1/2011, report the.

8815PL Timely Hardware

Subtract from line 2c of your foreign earned income tax worksheet the excess, if any, of the amount on line 5. Web these forms are not provided in taxslayer pro and must be mailed to the irs separate from the tax return. While in your return, click federal taxes > wages & income > i'll choose what i. Get ready.

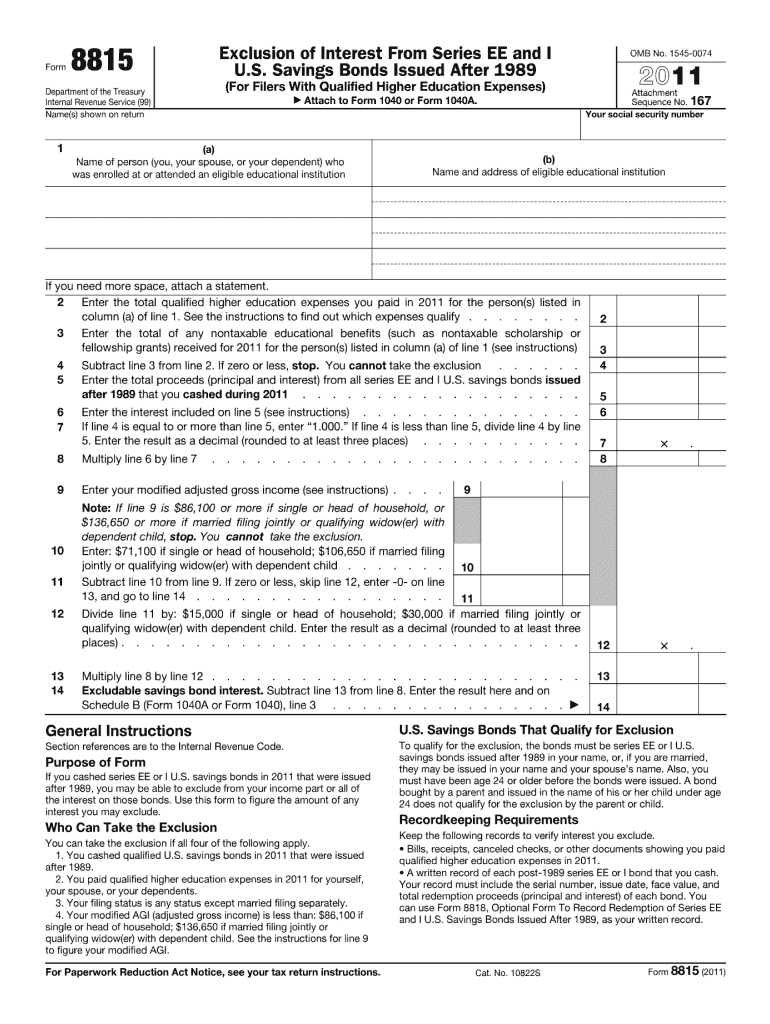

Form 8815 Instructions Fill Out and Sign Printable PDF Template signNow

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. See the form 3520 instructions to determine if it is needed. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. Web these forms are not provided in taxslayer pro and must be.

Form 8815 Exclusion Of Interest printable pdf download

Web the tips below will allow you to fill in irs 8815 quickly and easily: Subtract from line 2c of your foreign earned income tax worksheet the excess, if any, of the amount on line 5. Savings bonds issued after 1989 (for filers with qualified. Web this is an early release draft of an irs tax form, instructions, or publication,.

Web Video Instructions And Help With Filling Out And Completing Form 8815 Instructions.

While in your return, click federal taxes > wages & income > i'll choose what i. If filing before 10/1/2011, report the. Savings bonds issued after 1989 2022 11/29/2022 Upload, modify or create forms.

When Individuals Aren?T Connected To Document Administration And Lawful Operations, Completing Irs Docs Can Be Quite Stressful.

Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Savings bonds issued after 1989, the cashed us savings bonds must meet these criteria: Try it for free now! Find a suitable template on the internet.

Web If The Result Is Zero Or Less, There Is No Line 14 Capital Gain Excess.

Fill out the necessary boxes that are. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and iu.s. Get ready for tax season deadlines by completing any required tax forms today. See the form 3520 instructions to determine if it is needed.

Subtract From Line 2C Of Your Foreign Earned Income Tax Worksheet The Excess, If Any, Of The Amount On Line 5.

Complete, edit or print tax forms instantly. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. Read all the field labels carefully. Savings bonds issued after 1989 (for filers with qualified.