Inheritance Tax Waiver Form Pa

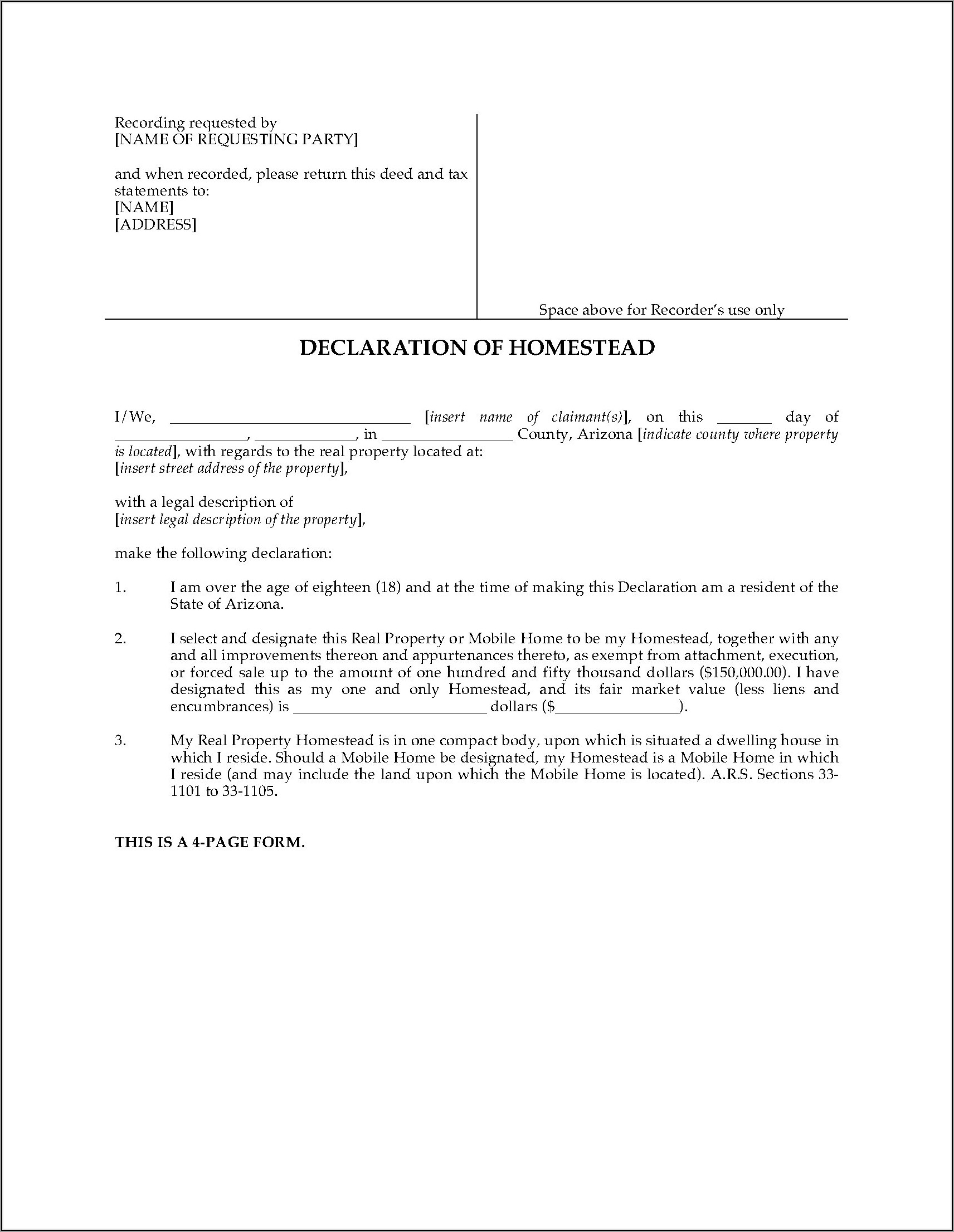

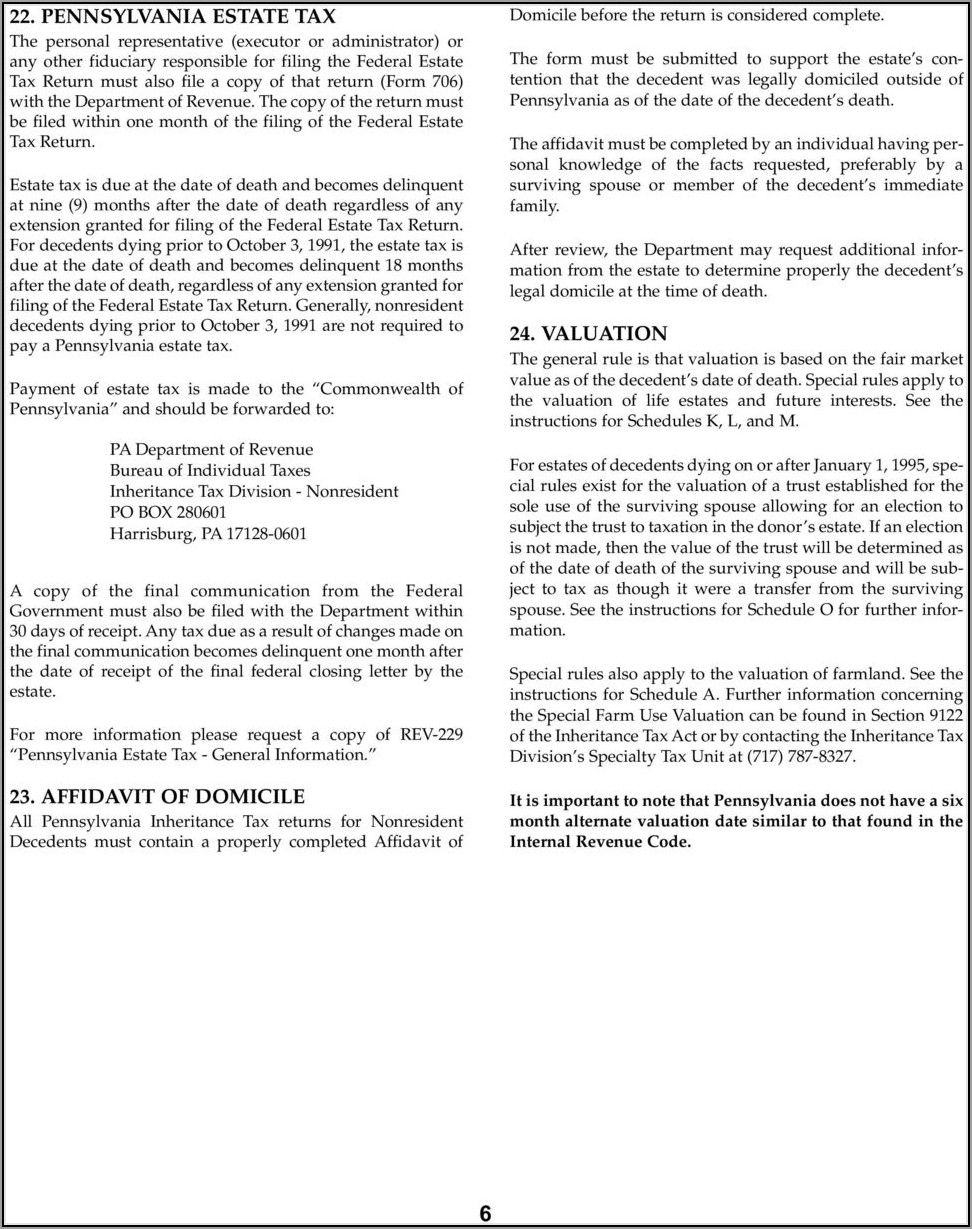

Inheritance Tax Waiver Form Pa - Effective for estates of decedents dying after june 30,. However, the amount is added to the income. You do not need to draft another document. Property owned jointly between spouses is exempt from inheritance tax. Web does it affect tax forgiveness? Web the ira will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time of death (for traditional iras). Web what property is subject to inheritance tax? Sign up and log in to your account. Two cousins who inherited the money in a man’s retirement. Web purpose of instructions section 6411 of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of.

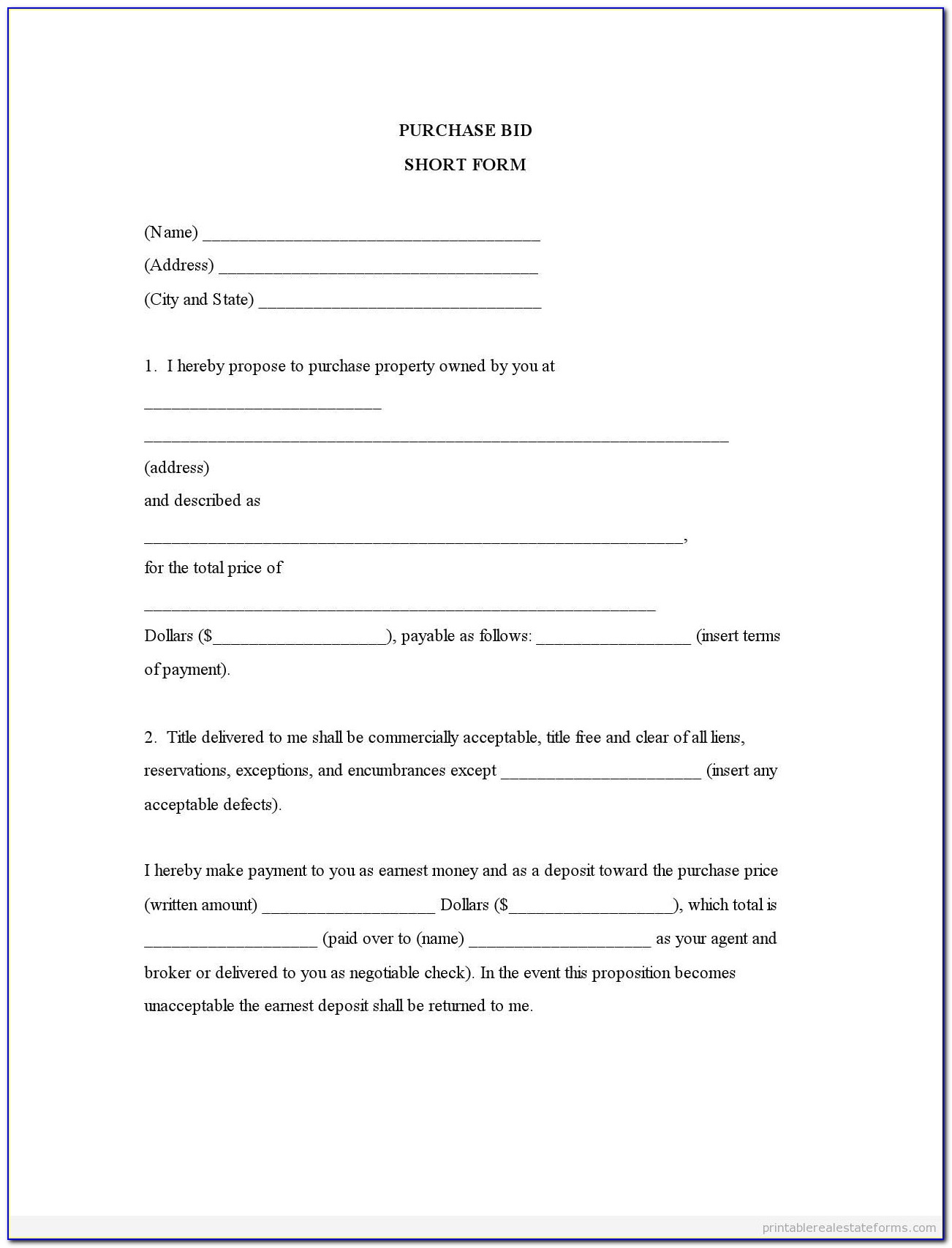

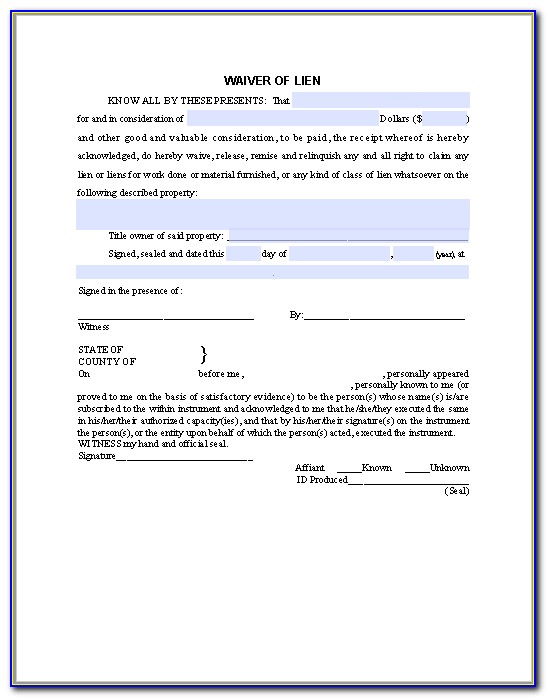

Web what property is subject to inheritance tax? Effective for estates of decedents dying after june 30,. Web does it affect tax forgiveness? Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. However, if you are the surviving spouse you or you. However, the amount is added to the income. $ requesting a refund of taxes reported as due on the: Cousins, not estate, must pay taxes on distributions. Web follow these fast steps to modify the pdf pa inheritance tax waiver form online free of charge: It’s usually issued by a state tax authority.

The net value subject to. Web to effectuate the waiver you must complete the pa form rev 516; You do not need to draft another document. Web follow these fast steps to modify the pdf pa inheritance tax waiver form online free of charge: However, the amount is added to the income. Web what is thequestionspennsylvaniahomeowners inheritancetax?beginning this process the pennsylvania inheritance tax is a tax on the total assets owned by a decedent at. Web what is an inheritance tax waiver in pa? Web does it affect tax forgiveness? Property owned jointly between spouses is exempt from inheritance tax. Effective for estates of decedents dying after june 30,.

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Web what is an inheritance tax waiver in pa? Web bureau of individual taxes. Web what property is subject to inheritance tax? Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Effective for estates of decedents dying after june 30,.

Missouri State Inheritance Tax Waiver Form 1+ Missouri POLST Form

All real property and all tangible personal property of a resident decedent, including but not limited to cash, automobiles,. Web purpose of instructions section 6411 of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of. Web the probate process might require a tax return filed, but the end result will be.

Inheritance Tax Waiver Form Az Form Resume Examples N8VZwyM2we

It’s usually issued by a state tax authority. However, if you are the surviving spouse you or you. Property owned jointly between spouses is exempt from inheritance tax. November 2, 2018 © 2018 fox rothschild pa is one of the few states that still has an inheritance tax nj also has inheritance tax most states adopted a pick. Web bureau.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Sign up and log in to your account. Web the probate process might require a tax return filed, but the end result will be no tax due if the entire estate passes to only exempt beneficiaries. Web 1 day agoretirement account gifts weren’t listed in the will. Web up to 25% cash back her sister claire must pay the sibling.

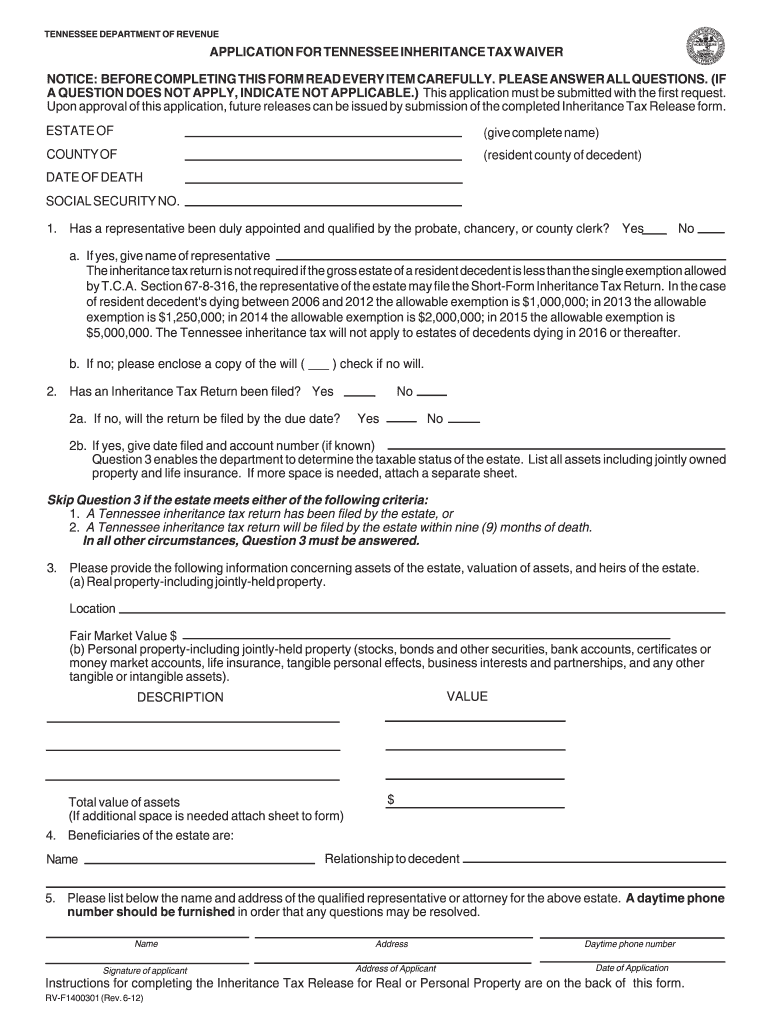

Tennessee Inheritance Tax Waiver Form Fill Out and Sign Printable PDF

Web 1 day agoretirement account gifts weren’t listed in the will. Web up to 25% cash back her sister claire must pay the sibling tax of 12% on the $20,000 she inherits, or $2,400. Web follow these fast steps to modify the pdf pa inheritance tax waiver form online free of charge: Property owned jointly between spouses is exempt from.

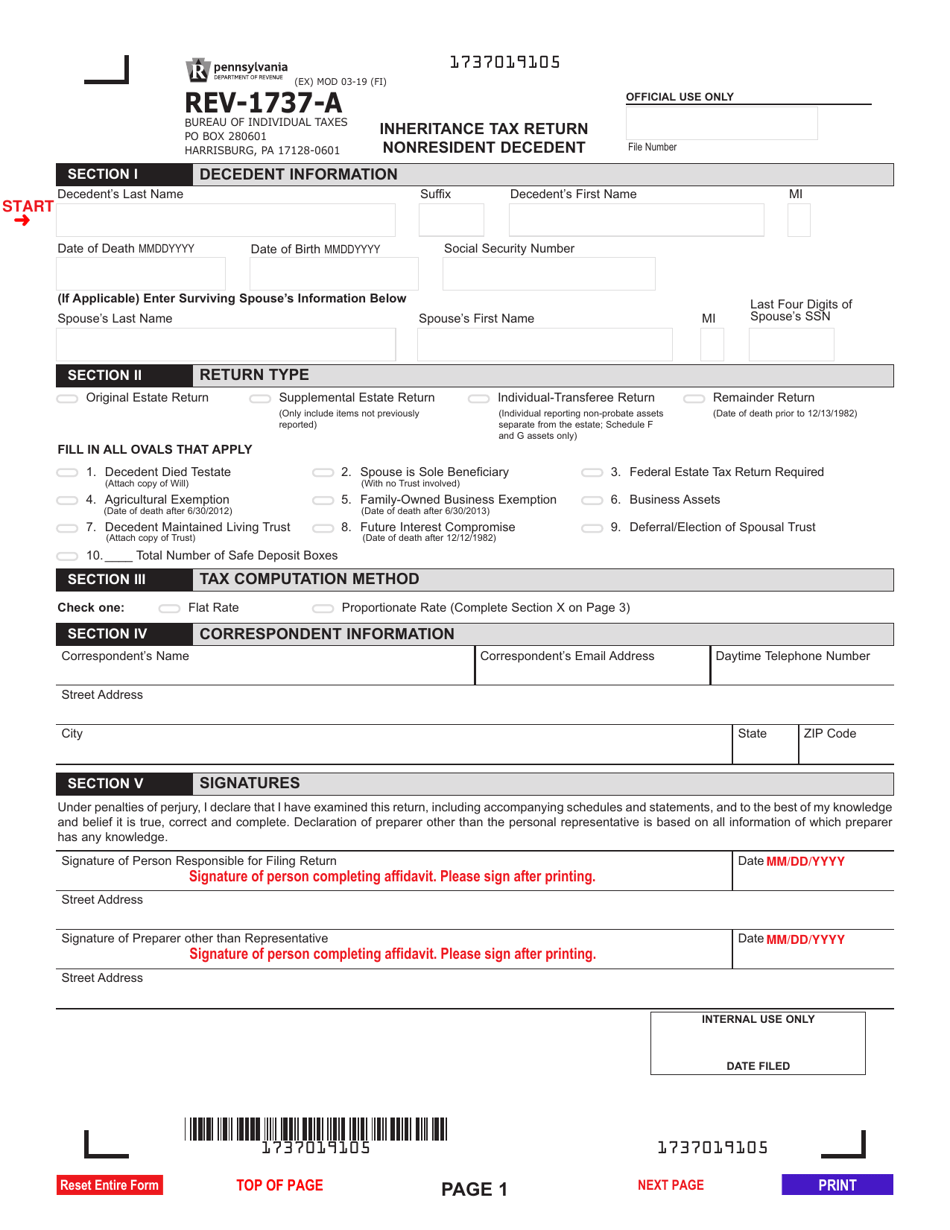

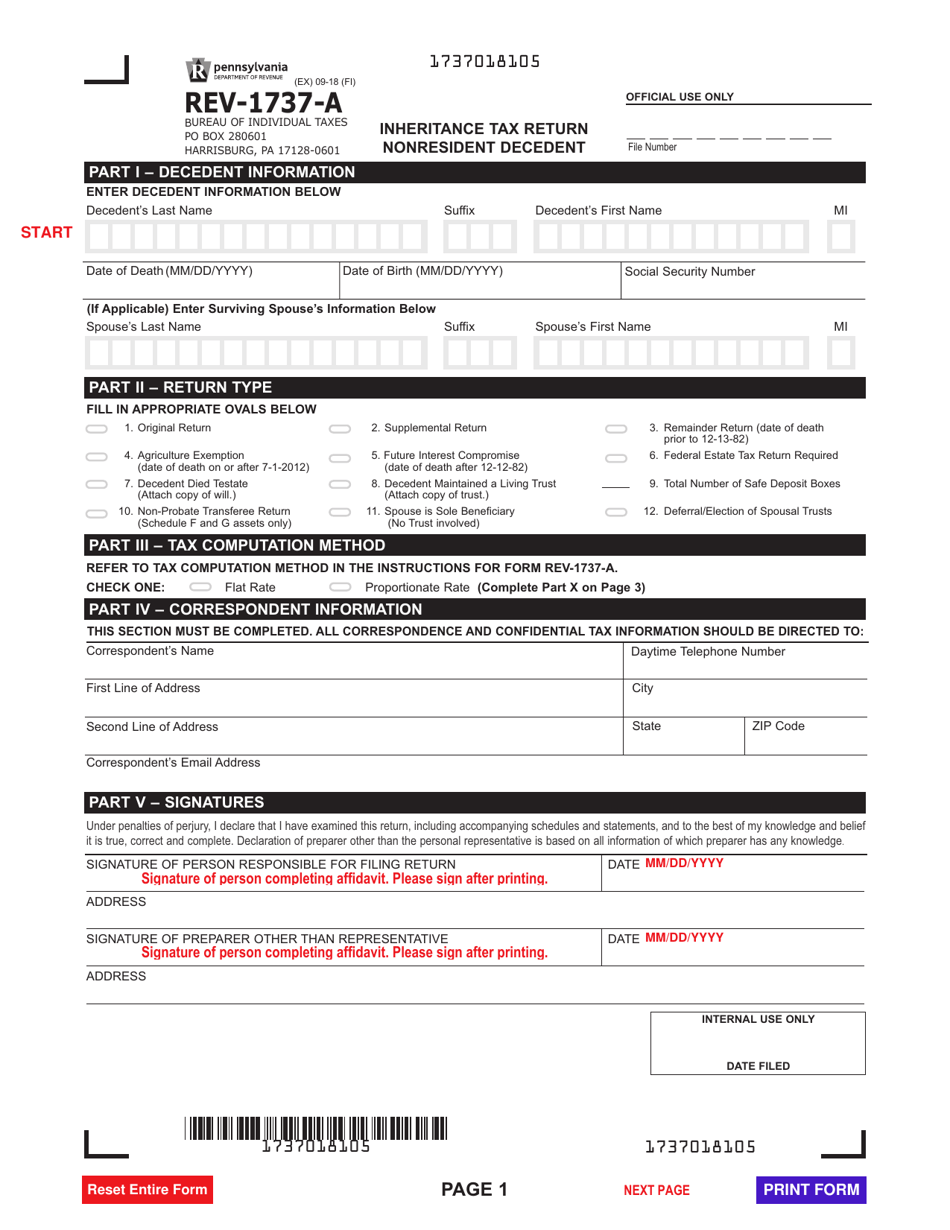

Form REV1737A Download Fillable PDF or Fill Online Inheritance Tax

Web follow these fast steps to modify the pdf pa inheritance tax waiver form online free of charge: Web bureau of individual taxes. Property owned jointly between spouses is exempt from inheritance tax. Web what is an inheritance tax waiver in pa? However, if you are the surviving spouse you or you.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

These include assets owned jointly with someone other than a surviving spouse, assets. The net value subject to. Web the probate process might require a tax return filed, but the end result will be no tax due if the entire estate passes to only exempt beneficiaries. Web up to 25% cash back her sister claire must pay the sibling tax.

Form REV1737A Download Fillable PDF or Fill Online Inheritance Tax

Web up to 25% cash back her sister claire must pay the sibling tax of 12% on the $20,000 she inherits, or $2,400. Web the ira will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time of death (for traditional iras). $ requesting a refund of taxes reported as due on the:.

Inheritance Tax Waiver Form Puerto Rico Form Resume Examples

These include assets owned jointly with someone other than a surviving spouse, assets. Roth iras are always taxable. Two cousins who inherited the money in a man’s retirement. Sign up and log in to your account. Web to effectuate the waiver you must complete the pa form rev 516;

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

Web purpose of instructions section 6411 of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of. It’s usually issued by a state tax authority. The net value subject to. Web what is an inheritance tax waiver in pa? Her nephew allen must pay 15% tax on the $10,000 he inherits, or.

Sign Up And Log In To Your Account.

However, if you are the surviving spouse you or you. Web what property is subject to inheritance tax? These include assets owned jointly with someone other than a surviving spouse, assets. Effective for estates of decedents dying after june 30,.

Web What Is Thequestionspennsylvaniahomeowners Inheritancetax?Beginning This Process The Pennsylvania Inheritance Tax Is A Tax On The Total Assets Owned By A Decedent At.

Web up to 25% cash back her sister claire must pay the sibling tax of 12% on the $20,000 she inherits, or $2,400. Web 1 day agoretirement account gifts weren’t listed in the will. Web what is an inheritance tax waiver in pa? Web purpose of instructions section 6411 of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of.

Web Bureau Of Individual Taxes.

Property owned jointly between spouses is exempt from inheritance tax. Sign in to the editor with your credentials or. $ requesting a refund of taxes reported as due on the: Two cousins who inherited the money in a man’s retirement.

You Do Not Need To Draft Another Document.

November 2, 2018 © 2018 fox rothschild pa is one of the few states that still has an inheritance tax nj also has inheritance tax most states adopted a pick. Cousins, not estate, must pay taxes on distributions. Web does it affect tax forgiveness? Her nephew allen must pay 15% tax on the $10,000 he inherits, or $1,500.