Indiana W4 Printable

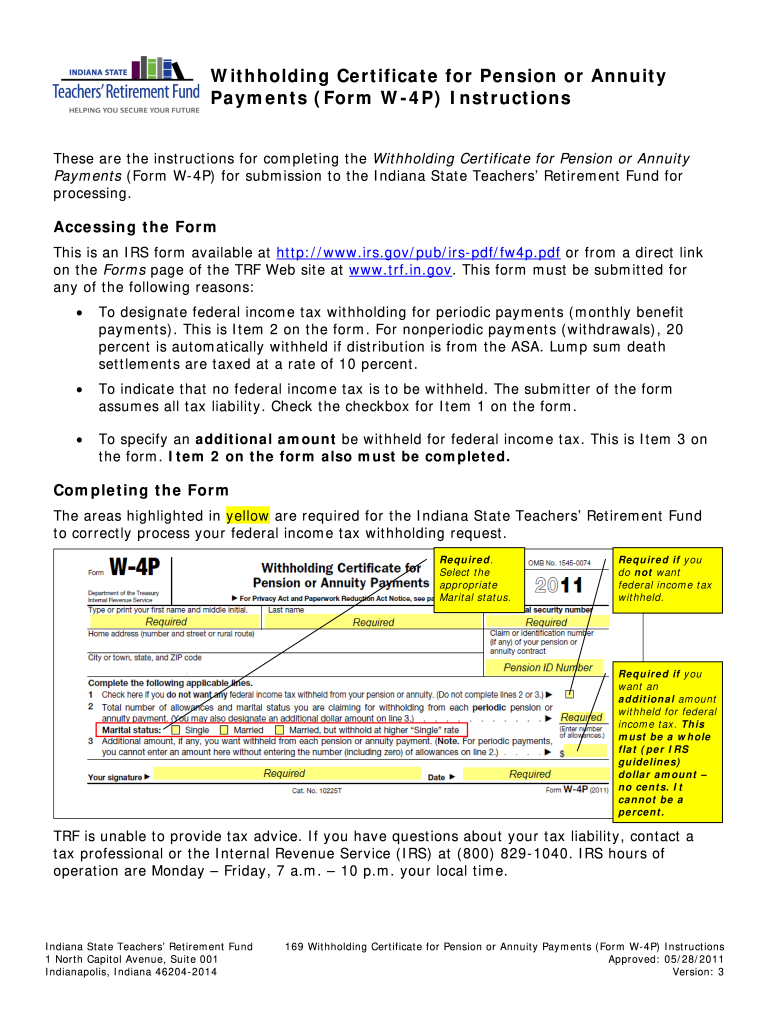

Indiana W4 Printable - Intime allows you to file and pay your business taxes (including sales and withholding); You can also download it, export it or print it out. Upload w2s, w2gs, and 1099rs; Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. Web follow the simple instructions below: It is charged at a flat rate of 3.23% and, in addition, there is a county income tax where every county has its allocated tax rate. Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Web indiana withholding tax voucher register and file this tax online via intime. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Handy tips for filling out w 4 indiana.

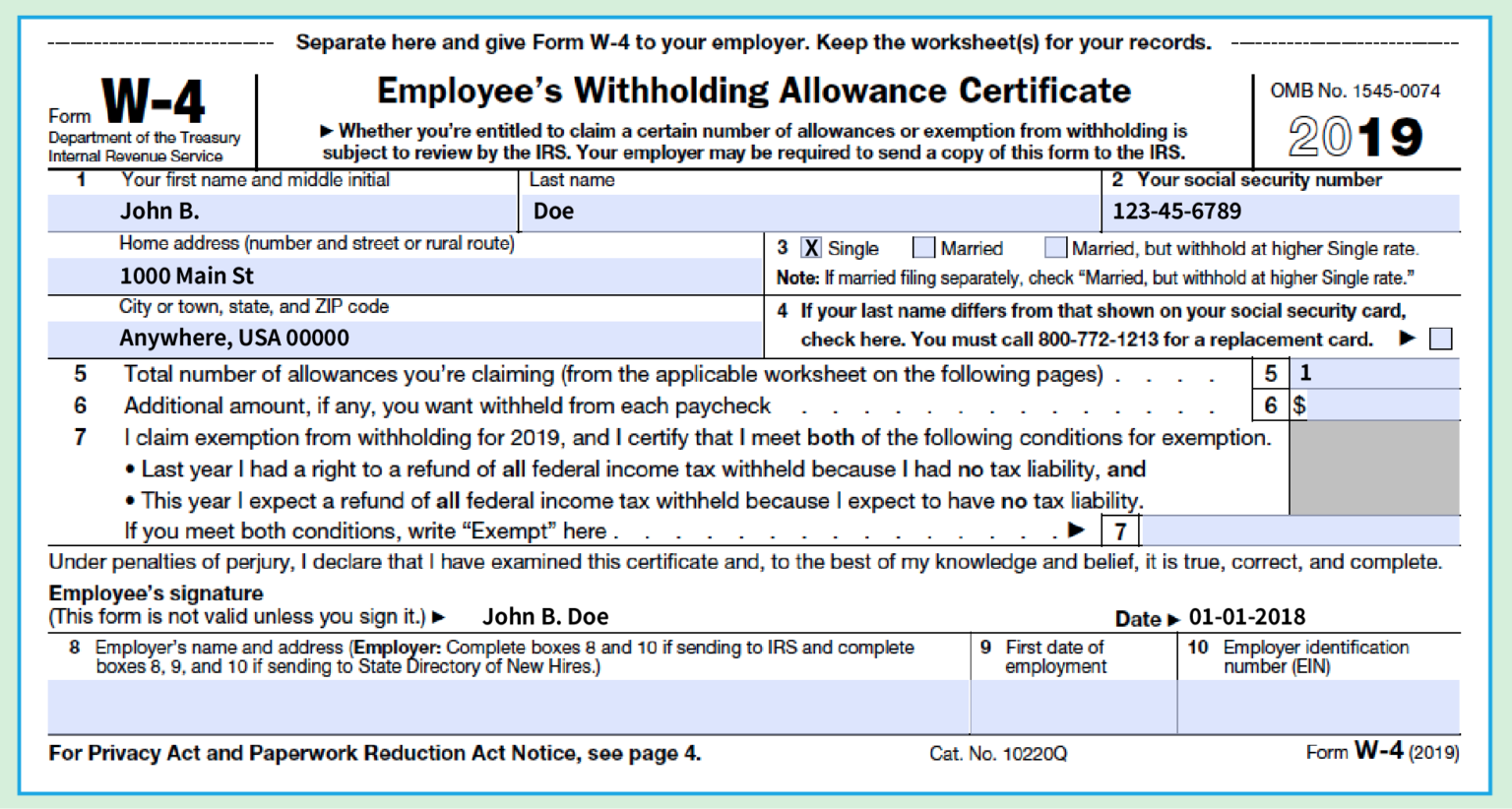

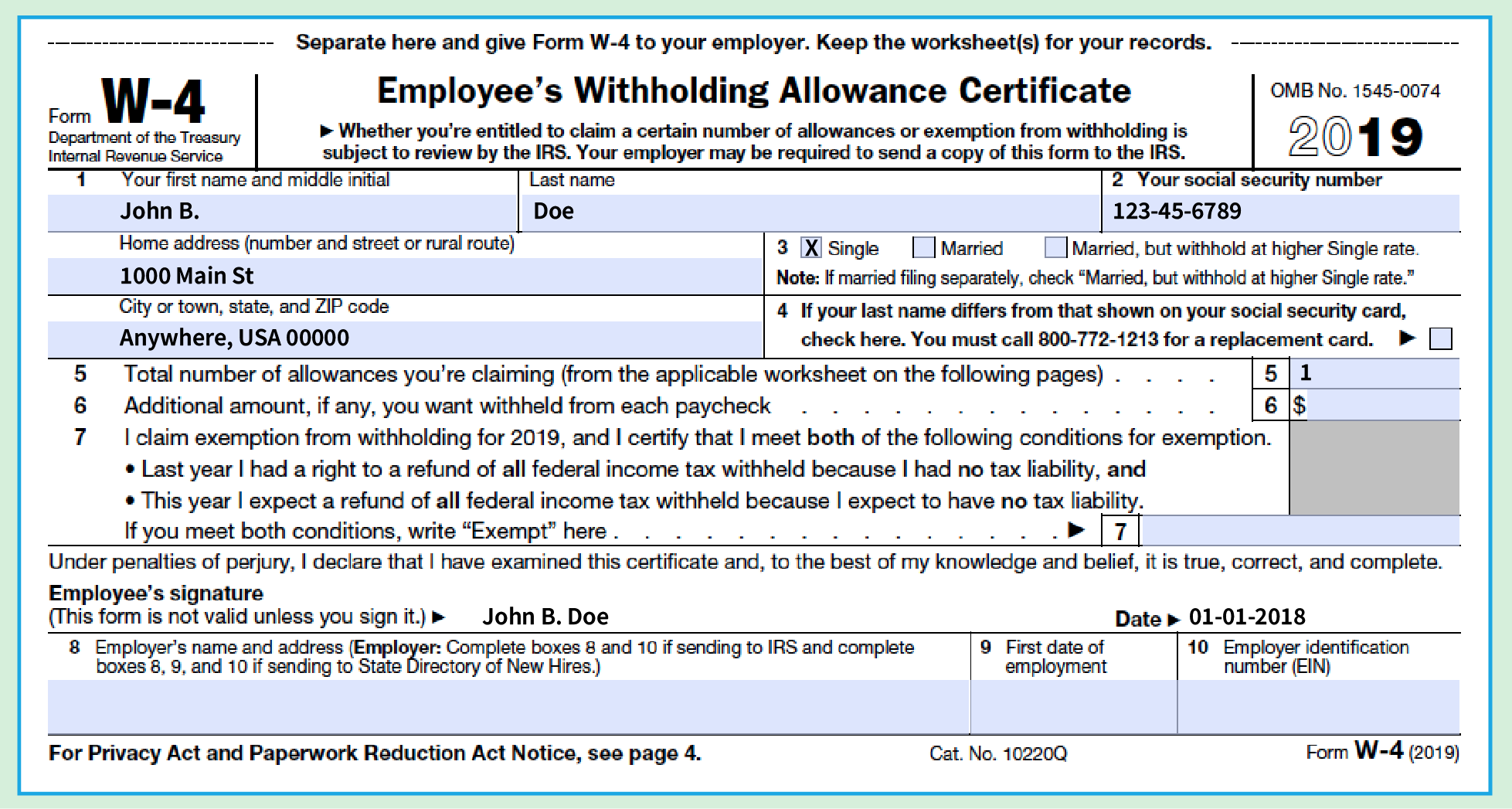

Print or type your full name, social. Read all the field labels carefully. Intime allows you to file and pay your business taxes (including sales and withholding); Finding a legal specialist, making a scheduled appointment and coming to the business office for a personal conference makes completing a w4 indiana from beginning to end stressful. If line 1 is less than line 2,. Web video instructions and help with filling out and completing indiana w4 printable form. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. You can also download it, export it or print it out. Web 1 type or print your first name and middle initiallast name 2 your social security number home address (number and street or rural route).

Print or type your full name, social. It is charged at a flat rate of 3.23% and, in addition, there is a county income tax where every county has its allocated tax rate. You can download and print a. If line 1 is less than line 2,. Web indiana withholding tax voucher register and file this tax online via intime. Print or type your full name, social security number or itin and home address. Start filling out the blanks according to the instructions: Register a new tax type and more. You can also download it, export it or print it out. Read all the field labels carefully.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

Print or type your full name, social. Find a suitable template on the internet. Web send wh 4 form 2019 via email, link, or fax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Handy tips for filling out w 4 indiana.

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Underpayment of indiana withholding filing register and file this tax online via. Web video instructions and help with filling out and completing indiana w4 printable form. Edit your 2019 indiana state withholding form online. Web this form should.

Sample Of W 4 2021 Filled Out 2022 W4 Form

Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Handy tips for filling out w 4 indiana. Depending on the county in which you reside, you may have also have county tax.

Build an Accurate W4 Form 2023

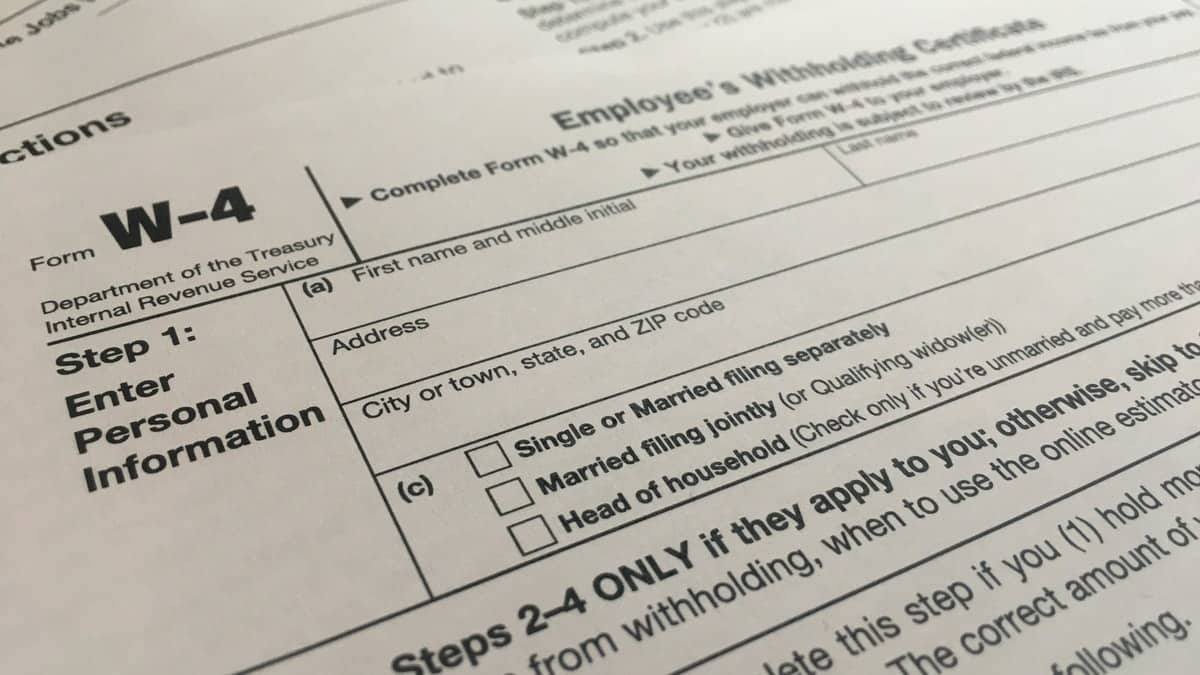

Handy tips for filling out w 4 indiana. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Finding a legal specialist, making a scheduled appointment and coming to the business office for a personal conference makes completing a w4 indiana from beginning to end stressful. Edit your.

Indiana W4 App

Handy tips for filling out w 4 indiana. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Find a suitable template on the internet. Web indiana withholding tax voucher register and file this tax online via intime. Upload w2s, w2gs, and 1099rs;

IRS Form W4 2022 W4 Form 2022 Printable

Web follow the simple instructions below: Edit your 2019 indiana state withholding form online. Web send wh 4 form 2019 via email, link, or fax. Find a suitable template on the internet. Handy tips for filling out w 4 indiana.

Federal W4 2022 W4 Form 2022 Printable

It is charged at a flat rate of 3.23% and, in addition, there is a county income tax where every county has its allocated tax rate. Enter your indiana county of residence and count y of principal employment as of january 1 of the current year. Web you may select any amount over $10.00 to be withheld from your annuity.

2022 Federal W4 Form To Print W4 Form 2022 Printable

Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Underpayment of indiana withholding filing register and file this tax online via. Web 1 type or print your first name and middle initiallast name 2 your social security number home address (number and street or rural route). If line 1 is less than.

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Upload w2s, w2gs, and 1099rs; Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Edit your 2019 indiana state withholding form online. Enter your indiana county of residence and count y of principal employment as of january 1 of the current year. Web this form should be completed by all resident and nonresident employees.

W4 Form 2022 Instructions

Read all the field labels carefully. Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. Depending on the county in which you reside, you may have also have county tax withheld from your pay. Web follow the simple instructions below: If line 1 is less than line.

Web This Form Should Be Completed By All Resident And Nonresident Employees Having Income Subject To Indiana State And/Or County Income Tax.

Handy tips for filling out w 4 indiana. Start filling out the blanks according to the instructions: Web send wh 4 form 2019 via email, link, or fax. Web this forms part of indiana’s state payroll taxes every employee is liable to pay.

Web Submitting The Indiana W4 Printable With Signnow Will Give Better Confidence That The Output Document Will Be Legally Binding And Safeguarded.

Intime allows you to file and pay your business taxes (including sales and withholding); Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social security number or itin and home address. Web 1 type or print your first name and middle initiallast name 2 your social security number home address (number and street or rural route).

Depending On The County In Which You Reside, You May Have Also Have County Tax Withheld From Your Pay.

Register a new tax type and more. Upload w2s, w2gs, and 1099rs; Find a suitable template on the internet. Overall, an employer is eligible to register for withholding tax if the business has:

Print Or Type Your Full Name, Social.

Web follow the simple instructions below: Enter your indiana county of residence and count y of principal employment as of january 1 of the current year. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. If line 1 is less than line 2,.