Illinois Form St 556

Illinois Form St 556 - Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. If you are a lessor leasing an item that must be titled or registered and if you sell that item in illinois at the. Edit your st556 il form online type text, add images, blackout confidential details, add comments, highlights and more. Web find and fill out the correct illinois form 556. Web form st‑556‑d must be filed electronically using mytax illinois, available on our website at mytax.illinois.gov. If you are already registered to file form st‑556, you are. Get the sample you want in our collection of templates. Web iftitled you or sell registered items at retailby an in agency illinois of that illinois are ofstate the governmenttype that must ( be i.e., vehicles, watercraft, aircraft, trailers, and mobile. Form st‐556‐lse can be filed electronically by using mytax illinois, available. Sales & use tax forms.

Sign it in a few clicks draw your signature, type it,. Open the document in the online editing. Do i need to file form st‑556‑lse if no tax is due? Show details we are not affiliated with. If you have not already done so, you will need to activate your. Web vehicles purchased from an illinois dealer. Get the sample you want in our collection of templates. Choose the correct version of the editable pdf form from the list. If you are already registered to file form st‑556, you are. Web form st‑556 instructions for leasing companies selling at retail (st‑556[2]), available on our website at tax.illinois.gov.

Form st‐556‐lse can be filed electronically by using mytax illinois, available. Get the sample you want in our collection of templates. The dealer from whom you purchased your vehicle must submit the following items to the secretary of state on your behalf: Web form st‑556 instructions for leasing companies selling at retail (st‑556[2]), available on our website at tax.illinois.gov. Preprinted paper forms can also be issued. Choose the correct version of the editable pdf form from the list. If your sales location is in. If you have not already done so, you will need to activate your. Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. Web iftitled you or sell registered items at retailby an in agency illinois of that illinois are ofstate the governmenttype that must ( be i.e., vehicles, watercraft, aircraft, trailers, and mobile.

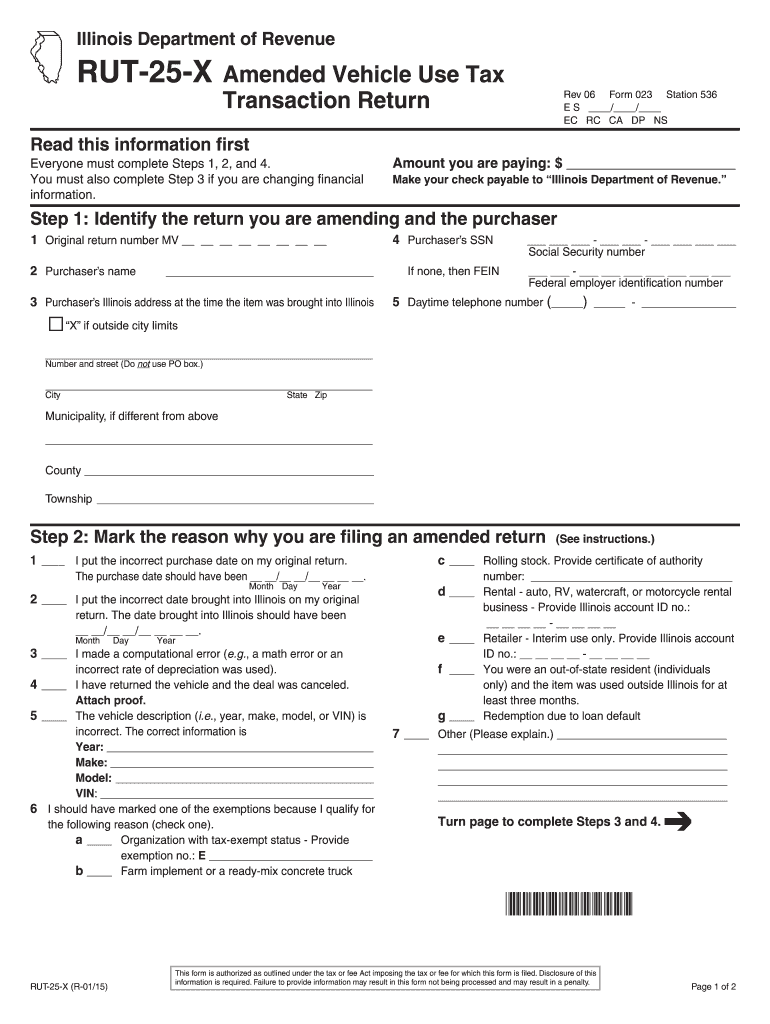

2010 Form IL RUT25X Fill Online, Printable, Fillable, Blank pdfFiller

Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. Web vehicles purchased from an illinois dealer. Preprinted paper forms can also be issued. Do i need to file form st‑556‑lse if no tax is due? Edit your st556 il form online type text, add images, blackout confidential details,.

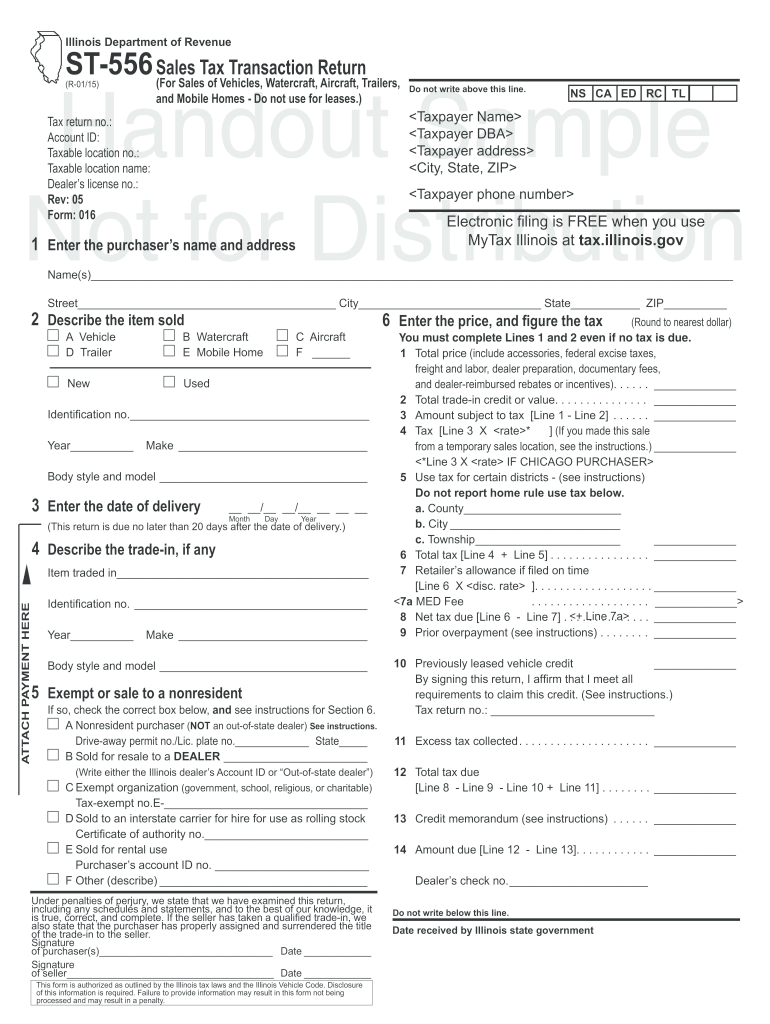

Printable Il St 556 Form 20202022 US Legal Forms

Edit your st556 il form online type text, add images, blackout confidential details, add comments, highlights and more. Web find and fill out the correct illinois form 556. Open the document in the online editing. Sales & use tax forms. Web form st‑556‑d must be filed electronically using mytax illinois, available on our website at mytax.illinois.gov.

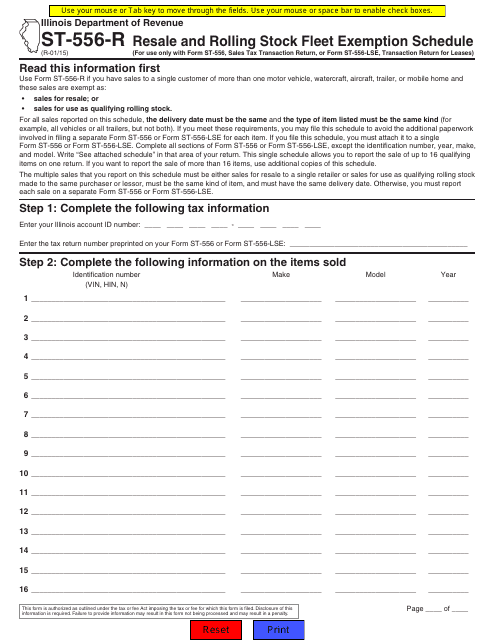

Form ST556R Download Fillable PDF or Fill Online Resale and Rolling

If you are a lessor leasing an item that must be titled or registered and if you sell that item in illinois at the. Web iftitled you or sell registered items at retailby an in agency illinois of that illinois are ofstate the governmenttype that must ( be i.e., vehicles, watercraft, aircraft, trailers, and mobile. Get the sample you want.

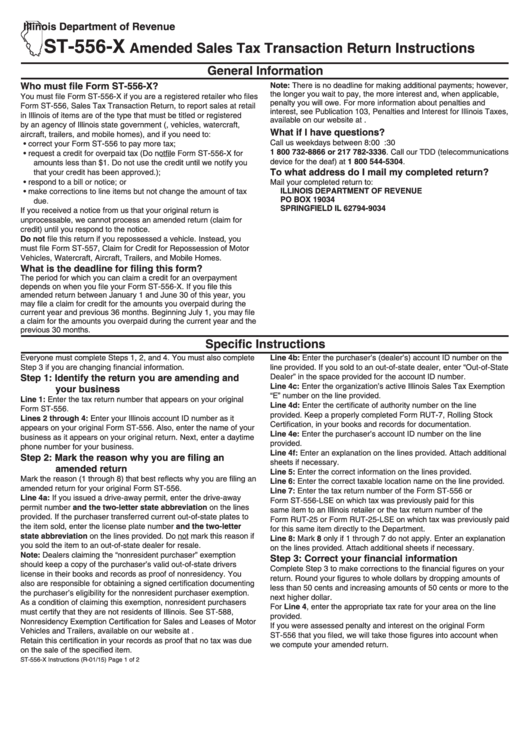

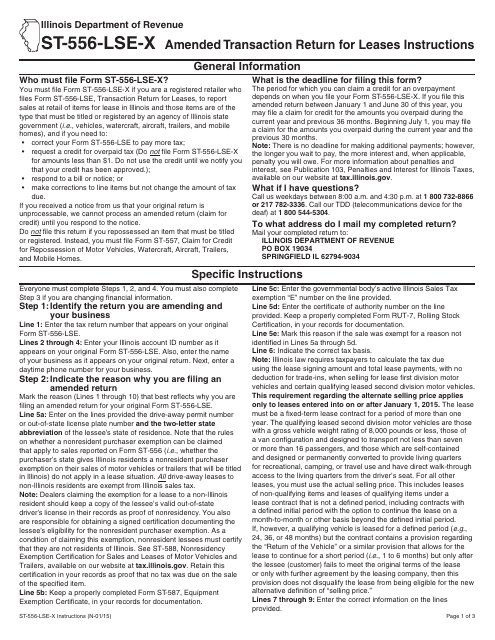

2010 Form IL ST556X Fill Online, Printable, Fillable, Blank pdfFiller

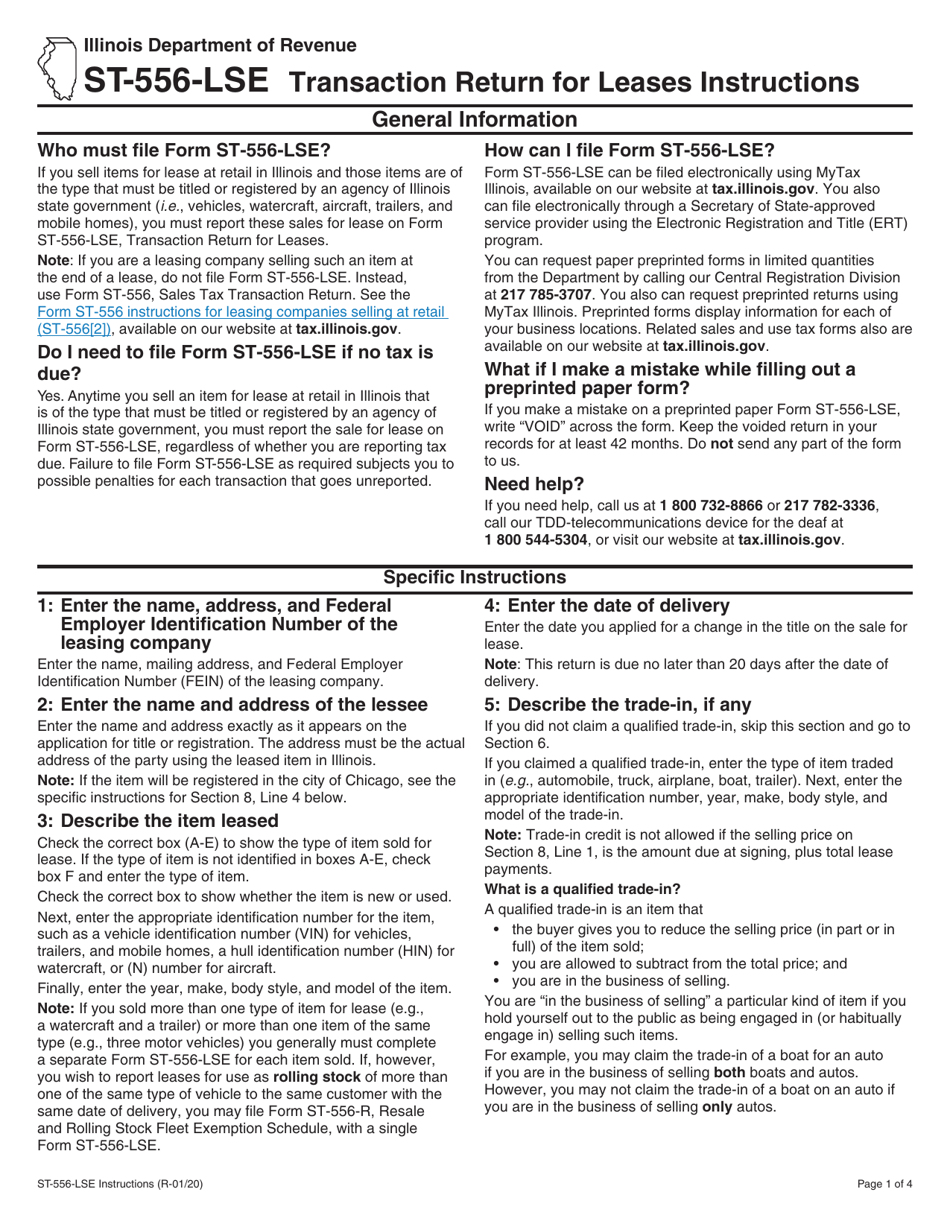

Web these sales on form st‑556‑lse, transaction return for leases. Web form st‑556‑d must be filed electronically using mytax illinois, available on our website at mytax.illinois.gov. Open the document in the online editing. Choose the correct version of the editable pdf form from the list. Sign it in a few clicks draw your signature, type it,.

Instructions For Form St 556X Amended Sales Tax Transaction Return

Preprinted paper forms can also be issued. Form st‐556‐lse can be filed electronically by using mytax illinois, available. Choose the correct version of the editable pdf form from the list. Web find and fill out the correct illinois form 556. Sign it in a few clicks draw your signature, type it,.

Download Instructions for Form ST556LSEX Amended Transaction Return

Web form st‑556‑d must be filed electronically using mytax illinois, available on our website at mytax.illinois.gov. Web these sales on form st‑556‑lse, transaction return for leases. Sales & use tax forms. If you are already registered to file form st‑556, you are. Form st‐556‐lse can be filed electronically by using mytax illinois, available.

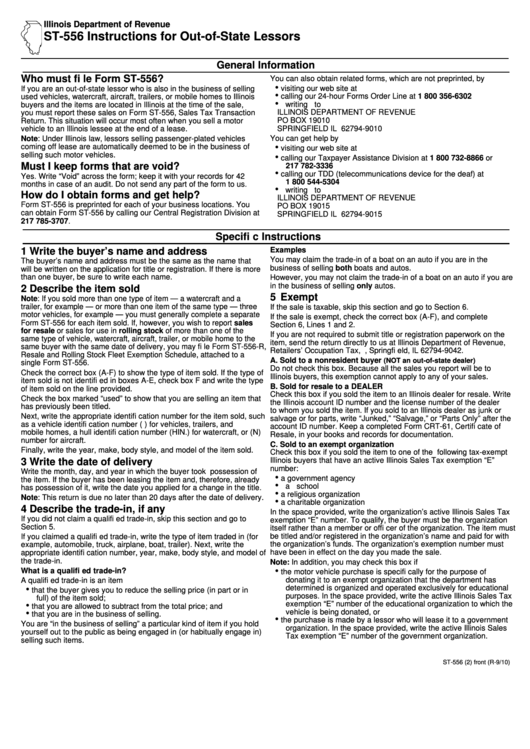

Form St556 Instructions For OutOfState Lessors printable pdf download

Sales & use tax forms. If you are already registered to file form st‑556, you are. Show details we are not affiliated with. Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. Web these sales on form st‑556‑lse, transaction return for leases.

Download Instructions for Form ST556LSE Transaction Return for Leases

If you are a lessor leasing an item that must be titled or registered and if you sell that item in illinois at the. Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. Web iftitled you or sell registered items at retailby an in agency illinois of that.

Download Illinois Form ILW4 for Free FormTemplate

Choose the correct version of the editable pdf form from the list. Web illinois department of revenue st556 transaction return form use a st 556 template to make your document workflow more streamlined. Get the sample you want in our collection of templates. Preprinted paper forms can also be issued. Web form st‑556 instructions for leasing companies selling at retail.

Rut 25 X Form Fill Online, Printable, Fillable, Blank pdfFiller

The dealer from whom you purchased your vehicle must submit the following items to the secretary of state on your behalf: Get the sample you want in our collection of templates. Open the document in the online editing. Edit your st556 il form online type text, add images, blackout confidential details, add comments, highlights and more. Form st‐556‐lse can be.

If You Are A Lessor Leasing An Item That Must Be Titled Or Registered And If You Sell That Item In Illinois At The.

Web find and fill out the correct illinois form 556. Open the document in the online editing. If you have not already done so, you will need to activate your. Do i need to file form st‑556‑lse if no tax is due?

If You Are Already Registered To File Form St‑556, You Are.

Web vehicles purchased from an illinois dealer. If your sales location is in. Web form st‑556‑d must be filed electronically using mytax illinois, available on our website at mytax.illinois.gov. Show details we are not affiliated with.

Form St‐556‐Lse Can Be Filed Electronically By Using Mytax Illinois, Available.

Web these sales on form st‑556‑lse, transaction return for leases. Get the sample you want in our collection of templates. Sign it in a few clicks draw your signature, type it,. Edit your st556 il form online type text, add images, blackout confidential details, add comments, highlights and more.

Web Form St‑556 Instructions For Leasing Companies Selling At Retail (St‑556[2]), Available On Our Website At Tax.illinois.gov.

The dealer from whom you purchased your vehicle must submit the following items to the secretary of state on your behalf: Choose the correct version of the editable pdf form from the list. Preprinted paper forms can also be issued. Web iftitled you or sell registered items at retailby an in agency illinois of that illinois are ofstate the governmenttype that must ( be i.e., vehicles, watercraft, aircraft, trailers, and mobile.