Idaho Withholding Form

Idaho Withholding Form - Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. Over $24,800 but not over $27,936. Over $27,936 but not over $31,072. Web you may apply for the following: Web the amount of idaho tax withholding should be: For real estate transactions, item 2 does not apply. Sign the form and give it to your employer. Web calculate your idaho net pay or take home pay by entering your pay information, w4, and idaho state w4 information. We’ve updated the income tax withholding tables for 2023 due to. Employers engaged in a trade or business who.

For real estate transactions, item 2 does not apply. You can do this either. Sign the form and give it to your employer. Sign the form and give it to your employer. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Web eligible homeowners can now apply online for property tax deferral. Employers are required by idaho law to withhold income tax from their employees’ wages. Over $0 but not over $24,800. Web withholding tables updated for 2023. 11/2022 page 1 of 1.

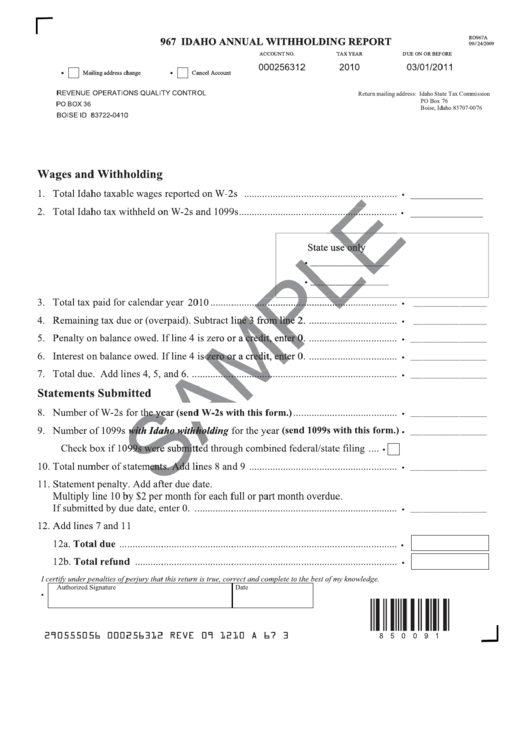

Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. You may obtain the following forms at unemployment insurance tax. Web download or print the 2022 idaho (idaho annual withholding report instructions ) (2022) and other income tax forms from the idaho state tax commission. Over $24,800 but not over $27,936. We’ve updated the income tax withholding tables for 2023 due to. Web eligible homeowners can now apply online for property tax deferral. If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4 Web calculate your idaho net pay or take home pay by entering your pay information, w4, and idaho state w4 information. Web the amount of idaho tax withholding should be: Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year.

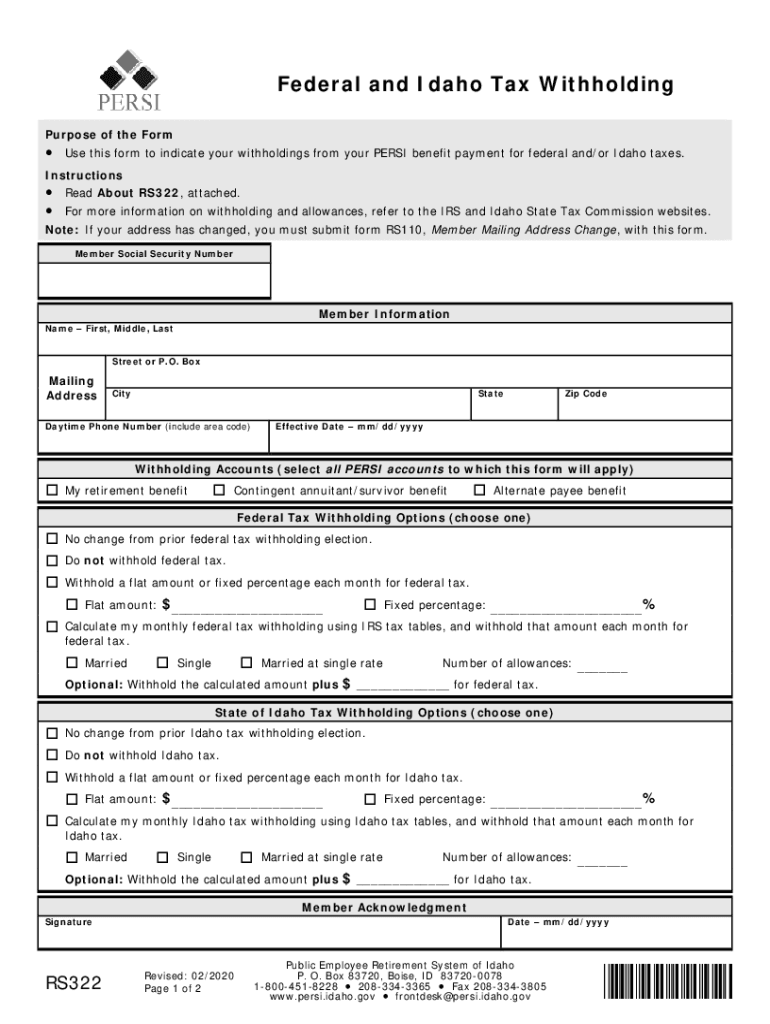

Federal & Idaho Tax Withholding Form Fill Out and Sign Printable PDF

Over $27,936 but not over $31,072. Calculate idaho employer payroll taxes new! Web calculate your idaho allowances and any additional amount you need withheld from each paycheck. Sign the form and give it to your employer. You can do this either.

Form Ro967a Idaho Annual Withholding Report printable pdf download

If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4 The income tax withholding formula for the state of idaho has changed as follows: Over $24,800 but not over $27,936. Web the withholdings you indicate on this form will replace your current withholdings. Employee's withholding certificate form 941;

Form Ro967a Idaho Annual Withholding Report printable pdf download

Over $27,936 but not over $31,072. Employers engaged in a trade or business who. Calculate idaho employer payroll taxes new! Employers are required by idaho law to withhold income tax from their employees’ wages. Web withholding tables updated for 2023.

1+ Idaho Offer to Purchase Real Estate Form Free Download

If you’re an employee, your employer probably withholds. Web withholding because you have failed to report all interest and dividends on your tax return. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Over $27,936 but not over $31,072. 11/2022 page 1 of 1.

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

Sign the form and give it to your employer. Employers are required by idaho law to withhold income tax from their employees’ wages. You can do this either. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. Web federal employer identification.

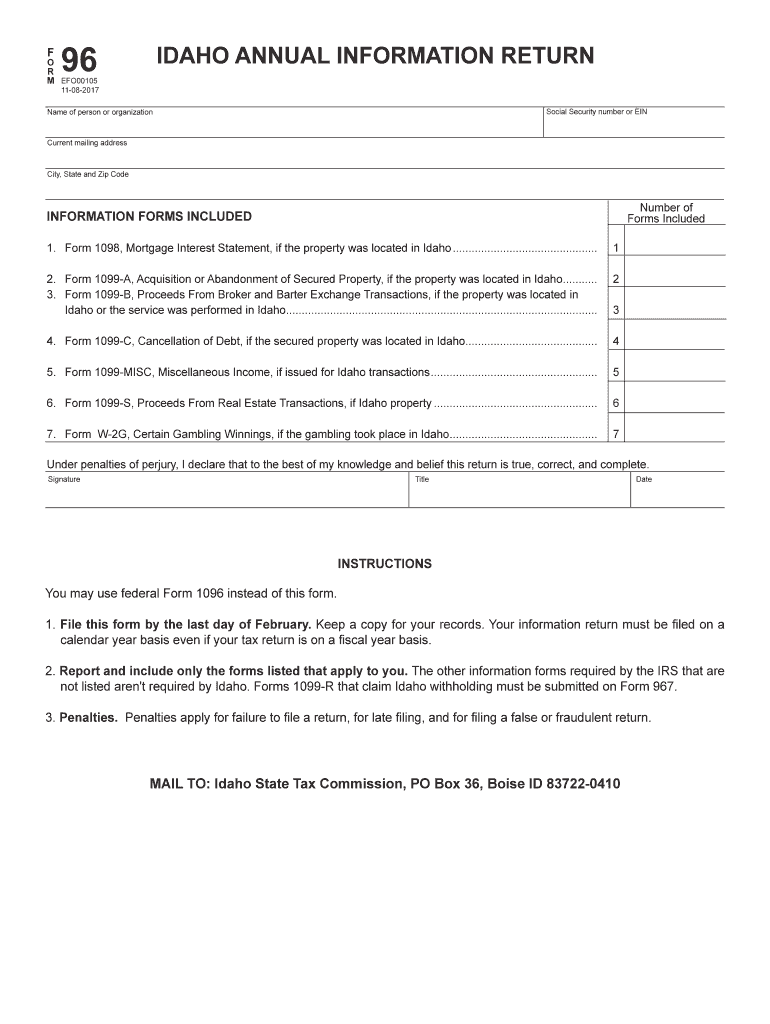

20172020 ID Form 96 Fill Online, Printable, Fillable, Blank pdfFiller

For real estate transactions, item 2 does not apply. Web calculate your idaho net pay or take home pay by entering your pay information, w4, and idaho state w4 information. Boise, idaho — august 1, 2023 — you might qualify to have your. Over $0 but not over $24,800. If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4

Idaho Tax Commission offers help calculating withholding

If you plan to itemize deductions, use the worksheet at tax.idaho.gov/w4 Employers engaged in a trade or business who. Employee's withholding certificate form 941; Sign the form and give it to your employer. Web calculate your idaho net pay or take home pay by entering your pay information, w4, and idaho state w4 information.

Idaho State Withholding Form 2022

11/2022 page 1 of 1. Employers are required by idaho law to withhold income tax from their employees’ wages. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. If you’re an employee, your employer probably withholds. Over $27,936 but not over.

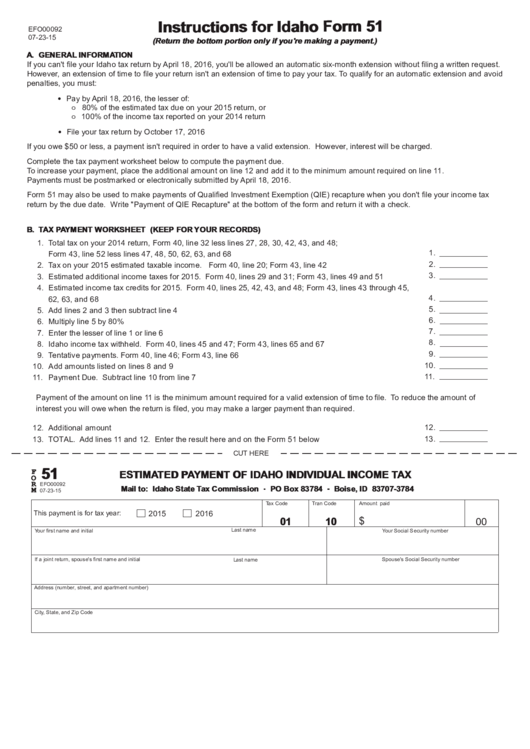

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

11/2022 page 1 of 1. You can do this either. Employee's withholding certificate form 941; Sign the form and give it to your employer. Web download or print the 2022 idaho (idaho annual withholding report instructions ) (2022) and other income tax forms from the idaho state tax commission.

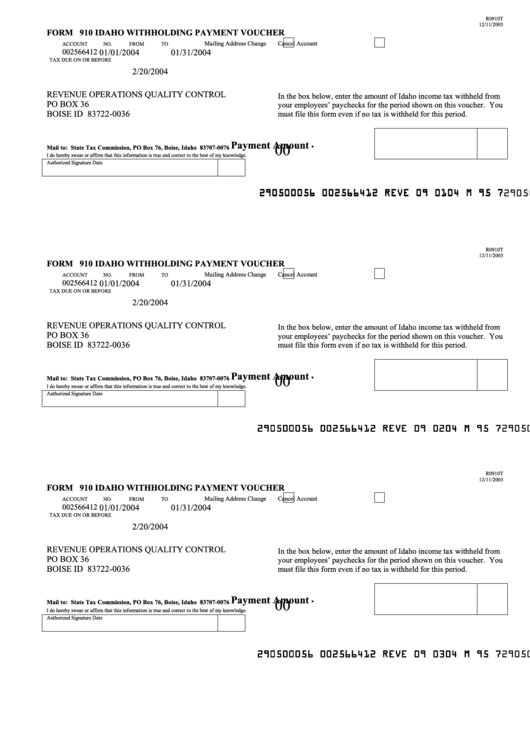

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

You may obtain the following forms at unemployment insurance tax. You can do this either. The income tax withholding formula for the state of idaho has changed as follows: Web you may apply for the following: Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip.

Calculate Idaho Employer Payroll Taxes New!

Sign the form and give it to your employer. Web the amount of idaho tax withholding should be: Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit. Sign the form and give it to your employer.

11/2022 Page 1 Of 1.

Web payments made throughout the year must be reconciled on form 967, idaho annual withholding report, at the end of the year. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Over $0 but not over $24,800. Employers engaged in a trade or business who.

Web You May Apply For The Following:

Sign the form and give it to your employer. Employee's withholding certificate form 941; Over $27,936 but not over $31,072. If you’re an employee, your employer probably withholds.

Web Withholding Because You Have Failed To Report All Interest And Dividends On Your Tax Return.

You may obtain the following forms at unemployment insurance tax. For real estate transactions, item 2 does not apply. The income tax withholding formula for the state of idaho has changed as follows: We’ve updated the income tax withholding tables for 2023 due to.