How To Read A Loss Run Report

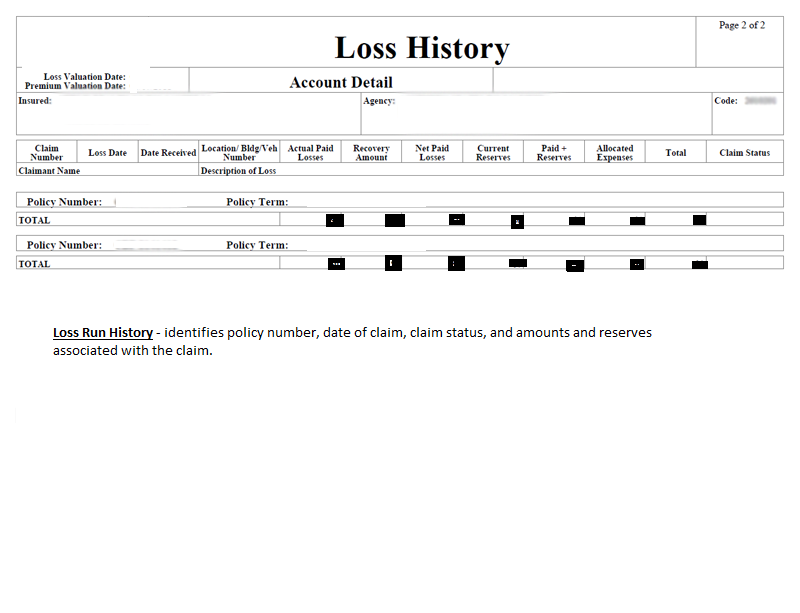

How To Read A Loss Run Report - Date of injury, report to employer, carrier notified, and carrier entry. Web with this information, the picture takes clearer shape and can be examined, understood and used to make. It took some drama, but the kids from media, pa are still alive in williamsport. What is an insurance loss run? Web a loss run is a document that records the history of claims made against a commercial insurance policy. Web first, there are four dates: As a dsp owner, it. As a business owner, it’s important to. Web loss run reports are official documentation provided by insurance companies. Web a loss run report is a document that summarizes the insurance losses of a policyholder.

Web the term “loss run” or “loss run report” is commonly used in the insurance industry. It took some drama, but the kids from media, pa are still alive in williamsport. Web a loss run report is an official review of your company’s past claims history, including details regarding each. Web with this information, the picture takes clearer shape and can be examined, understood and used to make. Web how do i get a loss run report? Web the lower the risk, the lower your insurance premiums will be. Web loss run reports are official documentation provided by insurance companies. They indicate all claim activity for each of your. A loss run is a report that. As a business owner, it’s important to.

It is analogous to a. Web how do i get a loss run report? Web with this information, the picture takes clearer shape and can be examined, understood and used to make. As a dsp owner, it. Web a loss run report is an official review of your company’s past claims history, including details regarding each. It took some drama, but the kids from media, pa are still alive in williamsport. Date of injury, report to employer, carrier notified, and carrier entry. To request a loss run report, you’ll need to contact your insurance carrier or agent directly. Web a loss run is a document that records the history of claims made against a commercial insurance policy. How do i get an insurance loss run?

What Are Loss Run Reports?

Web with this information, the picture takes clearer shape and can be examined, understood and used to make. Web the lower the risk, the lower your insurance premiums will be. What is an insurance loss run? Web first, there are four dates: They indicate all claim activity for each of your.

A "LOSS RUNS" IS... Florida Construction Legal Updates

Web first, there are four dates: Web the term “loss run” or “loss run report” is commonly used in the insurance industry. It took some drama, but the kids from media, pa are still alive in williamsport. Web how do i read a loss run report? Web a loss run report shows your business's liability insurance policies claim activity.

Insurance Loss Runs How do I upload my Loss Run Report? / Flatworld

Web first, there are four dates: Web a loss run report is a document that summarizes the insurance losses of a policyholder. Web what is a loss run report, and why should you care? How do i get an insurance loss run? A loss run is a report that.

Loss Run Reports What are they and what do they mean for your business

Web a loss run report shows your business's liability insurance policies claim activity. Web what is a loss run report, and why should you care? A loss run report allows the provider to decide how high the risk is. Web a loss run report is a document that summarizes the insurance losses of a policyholder. Web how do i get.

🚧 How to Get a Loss Run Report Hourly, Inc.

A loss run is a report that. Web the lower the risk, the lower your insurance premiums will be. Web loss run reports are official documentation provided by insurance companies. Web a loss run report is an official review of your company’s past claims history, including details regarding each. Web your loss run report is a snapshot of claims filed.

Rolling 13 Month Profit & Loss Report Example, Uses

Web first, there are four dates: Web a loss run report is a document that summarizes the insurance losses of a policyholder. A loss run report allows the provider to decide how high the risk is. Web with this information, the picture takes clearer shape and can be examined, understood and used to make. Web loss run reports are official.

Insurance Carrier Loss Runs Key to Underwriting Legal Malpractice Insurance

Web a very basic loss run report offers minimal information (the name of the injured employee, the total cost incurred. Web what is a loss run report, and why should you care? Web a loss run report is a document that summarizes the insurance losses of a policyholder. Web your loss run report is a snapshot of claims filed against.

Loss Run Form Fill Out and Sign Printable PDF Template signNow

He was flying over the tver region near moscow with other senior wagner leaders when his private jet. They indicate all claim activity for each of your. It is analogous to a. Web a loss run is a document that records the history of claims made against a commercial insurance policy. Web loss run reports are official documentation provided by.

Process Automation in Loss Run Reports ByteScout

Web with this information, the picture takes clearer shape and can be examined, understood and used to make. He was flying over the tver region near moscow with other senior wagner leaders when his private jet. Date of injury, report to employer, carrier notified, and carrier entry. A loss run report allows the provider to decide how high the risk.

Why Split Testing is Killing Your Conversion Rate

As a dsp owner, it. Web the lower the risk, the lower your insurance premiums will be. Web what is a loss run report, and why should you care? He was flying over the tver region near moscow with other senior wagner leaders when his private jet. Web first, there are four dates:

Web Your Loss Run Report Is A Snapshot Of Claims Filed Against Your Dsp Business Which Can Affect Your Bottom Line.

Web a loss run is a document that records the history of claims made against a commercial insurance policy. Web first, there are four dates: What is an insurance loss run? Web how do i read a loss run report?

Web A Very Basic Loss Run Report Offers Minimal Information (The Name Of The Injured Employee, The Total Cost Incurred.

Web a loss run report is an official review of your company’s past claims history, including details regarding each. A loss run report allows the provider to decide how high the risk is. Web with this information, the picture takes clearer shape and can be examined, understood and used to make. Web a loss run report is a document that summarizes the insurance losses of a policyholder.

Date Of Injury, Report To Employer, Carrier Notified, And Carrier Entry.

Web how do i get a loss run report? A loss run is a report that. Web the term “loss run” or “loss run report” is commonly used in the insurance industry. Web what is a loss run report, and why should you care?

How Do I Get An Insurance Loss Run?

He was flying over the tver region near moscow with other senior wagner leaders when his private jet. They indicate all claim activity for each of your. As a business owner, it’s important to. To request a loss run report, you’ll need to contact your insurance carrier or agent directly.