How To Read A Business Tax Return

How To Read A Business Tax Return - Web analyzing business financial statements and tax returns suite. Web reading a filed corporate tax return acquaints the reader with the taxable activities conducted by the corporation during the tax year. Web add up the extra $55 over 12 months and some could be looking at an extra $660 a year. Payroll taxes and federal income tax. Understand the type of form you have. Web thus, the goal of this practice point is to provide you with an overview of the following business tax returns, so that you can (a) understand the forms; I will have your company up within 24 hours. Next, you’re going to add the amount on form 1040, line 12 (either your standard or itemized deduction) and your qualified business income deduction (from form 8995 or. Web business taxes are an inevitable part of owning any business. Understanding the basics of business tax on the state and federal level will save you time, money, and frustration later down the line.

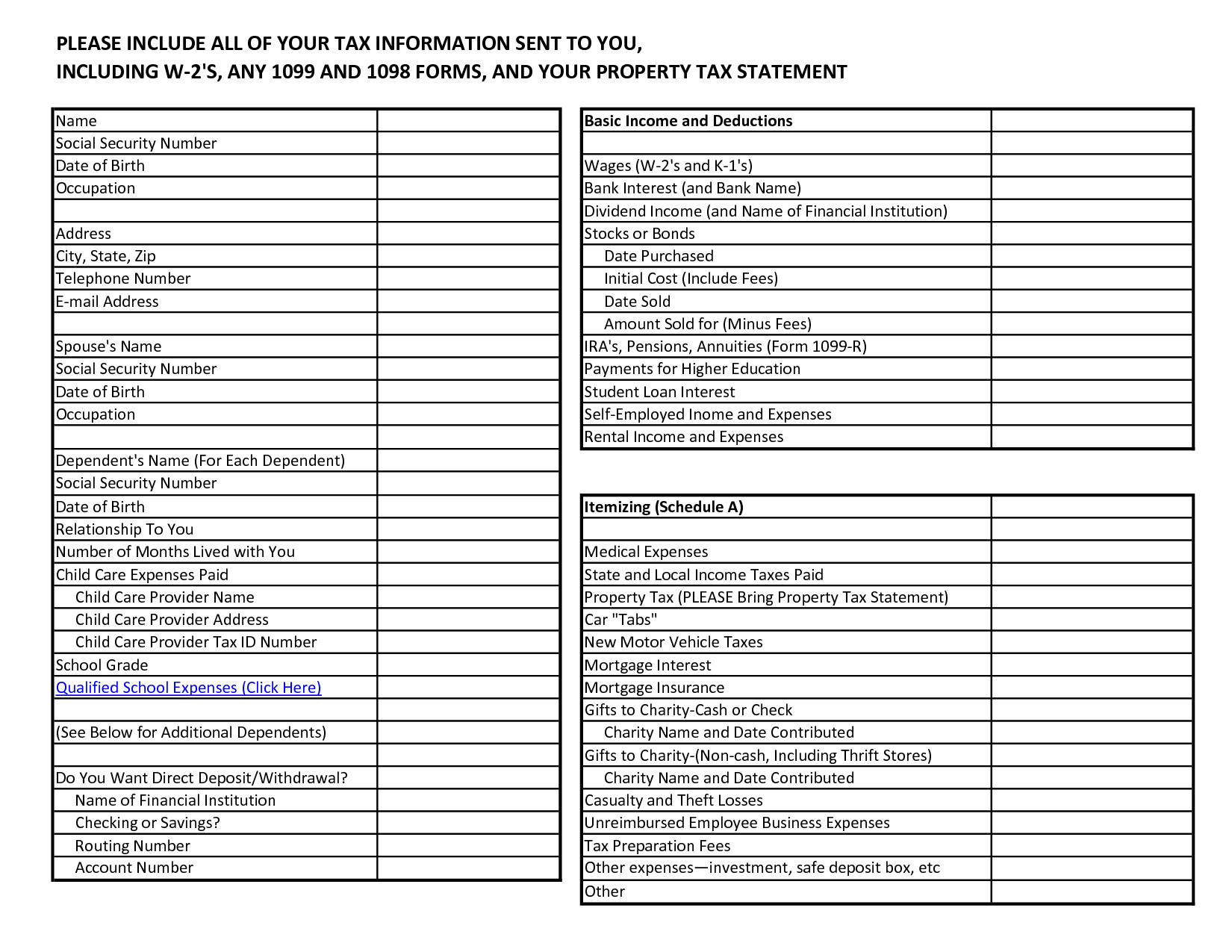

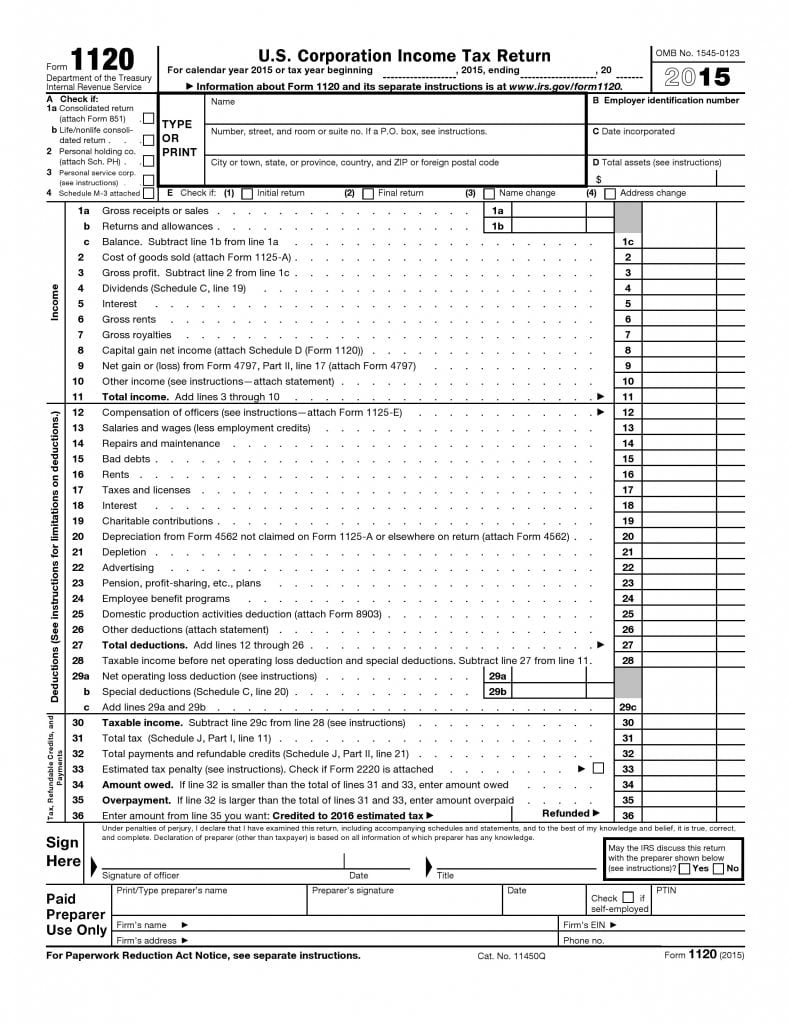

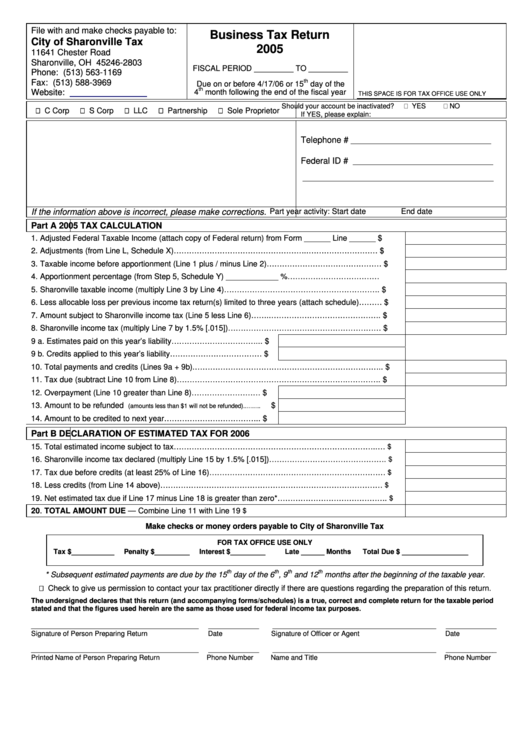

Depending on the type of business you own, you will be required to submit different forms. Understand the type of form you have. The corporate tax rate is a flat 21%. Find the correct forms, given the structure of your business. Publication 15, (circular e), employer's tax. (top 5 tips) how do you prepare business taxes? Web reading a filed corporate tax return acquaints the reader with the taxable activities conducted by the corporation during the tax year. If you look at your. Visit our get transcript frequently asked questions (faqs) for more information. File an expected taxable income form.

The corporate tax rate is a flat 21%. Web how to read a business tax return? (top 5 tips) how do you prepare business taxes? Web if they amended and filed separate tax returns, the lower earner would have a tax of about $12,787 and the higher earner would have $31,809 of tax — for a total federal tax liability of $44,596. I can get you 50% off for the first year. There are many types of tax returns, but we are only looking at form 1040. Payroll taxes and federal income tax. All may be downloaded in adobe pdf format and printed. Web business taxes are an inevitable part of owning any business. Today the rules of thumb blog from moneythumb would like to share what lenders look for when they check out your business tax return as they consider your request for a business.

A Guide To Business Tax Returns US Tax Filing

Web reading a filed corporate tax return acquaints the reader with the taxable activities conducted by the corporation during the tax year. Your average tax rate is 11.67% and your. If you're trying to get a transcript to complete fafsa, refer to tax. If you make $70,000 a year living in michigan you will be taxed $10,930. (top 5 tips).

How to File Your LLC Tax Return The Tech Savvy CPA

Review the top section of the return for significant details, including the business. I will have your company up within 24 hours. These seven courses explore how to analyze and interpret business financial statements and tax returns, including cash flow statements. File an expected taxable income form. Web analyzing business financial statements and tax returns suite.

Do I Need To File A Tax Return? Forbes Advisor

Web if they amended and filed separate tax returns, the lower earner would have a tax of about $12,787 and the higher earner would have $31,809 of tax — for a total federal tax liability of $44,596. Getting organized consider consulting an accountant to help you get organized. Review the top section of the return for significant details, including the.

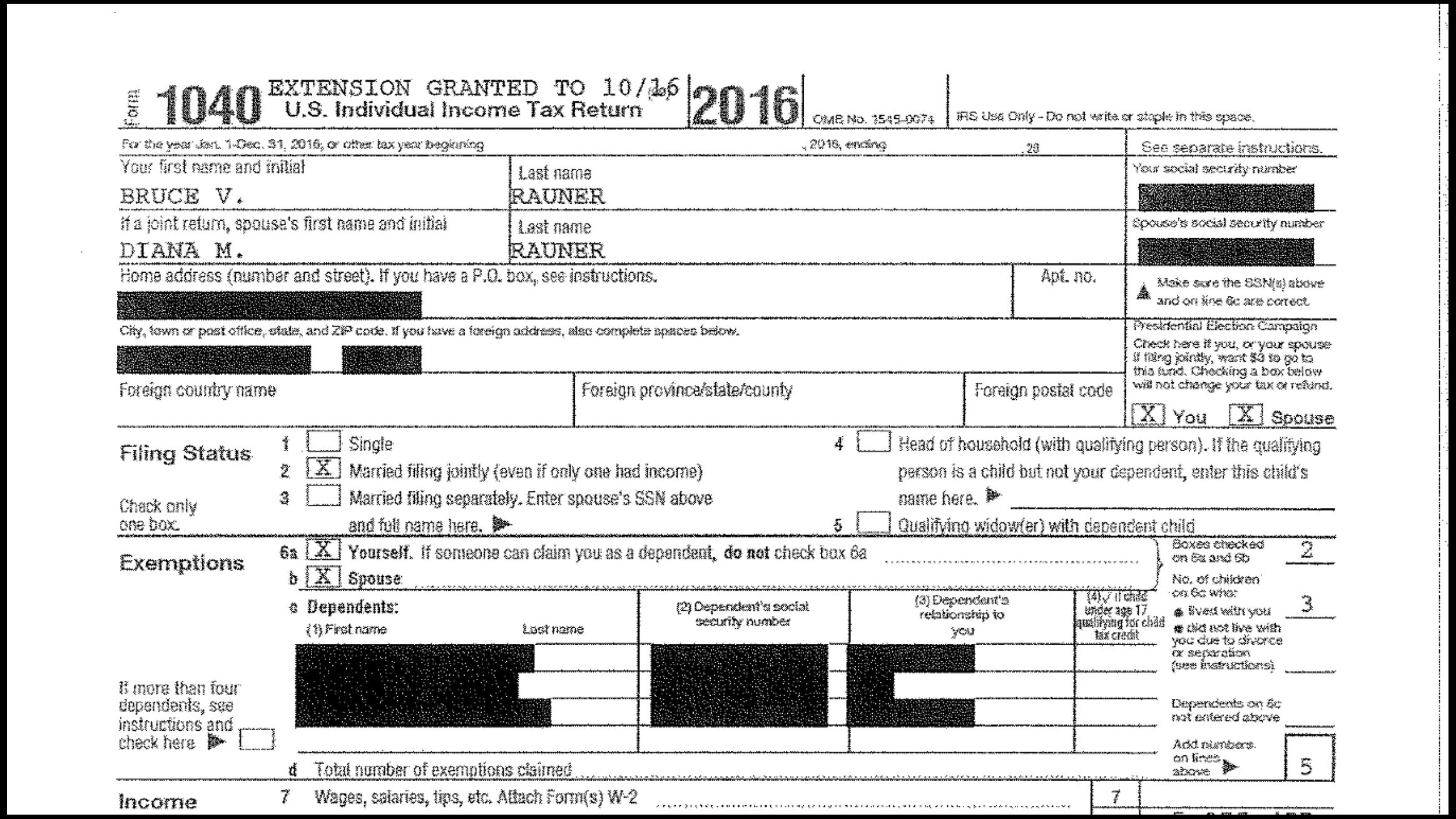

Gov. Bruce Rauner Earned 91 Million in 2016, Tax Returns Show

Income tax return for an s corporation. (b) identify pertinent financial information; Web how to read a business tax return? If you earn less than that. 15, 2024, to file various federal individual and business tax returns and make tax payments.

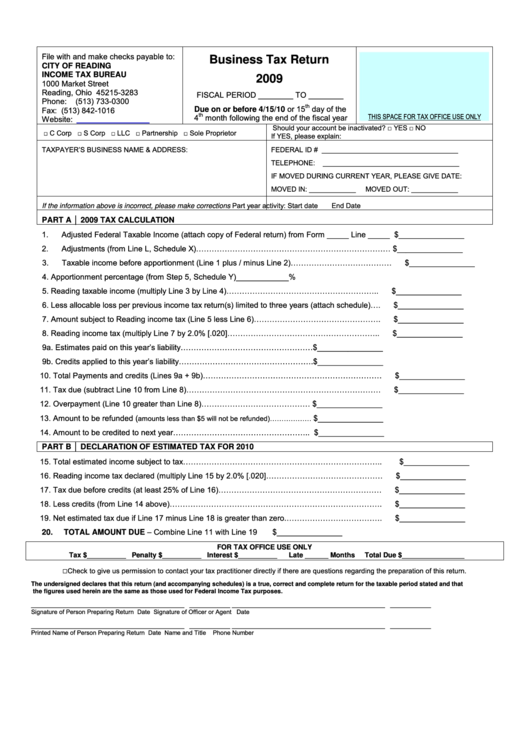

Business Tax Return Form City Of Reading Tax Bureau 2009

Income tax return for an s corporation. Getting organized consider consulting an accountant to help you get organized. Web how to read a business tax return? Web how to read a business tax return. Web the only difference is that the font is larger, so it is easier to read.

Small business tax return JG Accountants

And (c) enable you to. Web the only difference is that the font is larger, so it is easier to read. Web need to set up a new company in quickbooks online? The corporate tax rate is a flat 21%. Web save increases the amount of income protected from repayment to 225 percent of the federal poverty guidelines, roughly equivalent.

Small Business Tax Preparation Spreadsheet for Business Tax Deductions

Web an agreement with the free file alliance prevented the irs from creating its own free tax return filing system in exchange for the companies providing free services to taxpayers making $73,000 or. Web recommended reading for small businesses a comprehensive list of helpful publications for small businesses. Most are available to browse online. Obtain a copy of a corporate.

Free U.S. Corporation Tax Return Form 1120 PDF Template

Visit our get transcript frequently asked questions (faqs) for more information. Web reading a filed corporate tax return acquaints the reader with the taxable activities conducted by the corporation during the tax year. Most are available to browse online. Find the correct forms, given the structure of your business. File an expected taxable income form.

Business Tax Return Form City Of Cincinnati 2005 printable pdf download

Understand the type of form you have. Web if they amended and filed separate tax returns, the lower earner would have a tax of about $12,787 and the higher earner would have $31,809 of tax — for a total federal tax liability of $44,596. In 2023, the cola adjustment added up to an extra $146 a month based on an.

Corporate Tax Return Form Maryland Free Download

File an expected taxable income form. Obtain a copy of a corporate tax return filed from a previous year. Publication 15, (circular e), employer's tax. Web these 14 tax tutorials will guide you through the basics of tax preparation, giving you the background you need to electronically file your tax return. Web the only difference is that the font is.

Find The Correct Forms, Given The Structure Of Your Business.

Next, you’re going to add the amount on form 1040, line 12 (either your standard or itemized deduction) and your qualified business income deduction (from form 8995 or. Today the rules of thumb blog from moneythumb would like to share what lenders look for when they check out your business tax return as they consider your request for a business. Web what your business tax return says about the health of your business and its finances will be a big issue for the lender you choose to ask for a loan. Web reading a filed corporate tax return acquaints the reader with the taxable activities conducted by the corporation during the tax year.

If You're Trying To Get A Transcript To Complete Fafsa, Refer To Tax.

Web save increases the amount of income protected from repayment to 225 percent of the federal poverty guidelines, roughly equivalent to $15 an hour for a single borrower. These seven courses explore how to analyze and interpret business financial statements and tax returns, including cash flow statements. Visit our get transcript frequently asked questions (faqs) for more information. If you earn less than that.

Learn More About Business Tax In The Hartford Business.

The corporate tax rate is a flat 21%. Web business taxes are an inevitable part of owning any business. 14, 2018, file photo, h&r block signs are displayed in jackson, miss. Publication 15, (circular e), employer's tax.

In 2023, The Cola Adjustment Added Up To An Extra $146 A Month Based On An Average Benefit Of.

Form 1040 is your individual income tax return. Most are available to browse online. Web an agreement with the free file alliance prevented the irs from creating its own free tax return filing system in exchange for the companies providing free services to taxpayers making $73,000 or. Web if they amended and filed separate tax returns, the lower earner would have a tax of about $12,787 and the higher earner would have $31,809 of tax — for a total federal tax liability of $44,596.