How To Form A Nonprofit In Illinois

How To Form A Nonprofit In Illinois - Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois. To maintain a 501 (c) (3) nonprofit corporation in illinois. Ad we’re here to help you navigate through nonprofit regulatory compliance. Web guide for organizing nfp corporations Web up to 24% cash back your articles should include and name the following: Web 8 steps to keep your nonprofit compliant. Prepare and file articles of incorporation with the secretary of state. In order to qualify for 501(c)(3) status, the. Articles of incorporation for nonprofit corporations explains what to include in your. Your nonprofit’s name is also its brand and must meet illinois state requirements.

Avoid errors in your partnership agreement. Web should you decide to apply you will use either form 1023 or form 1024. These entities range from hospital systems with over 1,000 employees to high school robotics teams. Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois. In order to qualify for 501(c)(3) status, the. Apply for exemption from state taxes. Web up to 24% cash back your articles should include and name the following: Web to start a nonprofit in illinois and get 501c3 status, follow these steps: Our easy online form can be completed in just 10 minutes or less. Select a name for your organization.

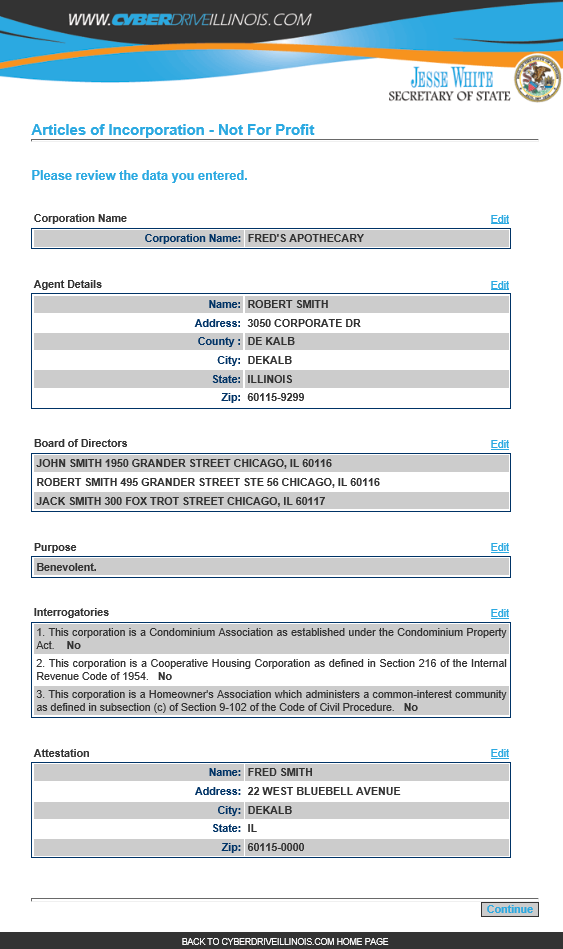

Articles of incorporation for nonprofit corporations explains what to include in your. To maintain a 501 (c) (3) nonprofit corporation in illinois. Ad we’re here to help you navigate through nonprofit regulatory compliance. Our business specialists help you incorporate your business. A board of directors, consisting of three to seven people. Web to start a nonprofit corporation in illinois, you must file nonprofit articles of incorporation with the illinois secretary of state. These entities range from hospital systems with over 1,000 employees to high school robotics teams. Apply for exemption from state taxes. In order to qualify for 501(c)(3) status, the. You can file your articles online, in person, or by.

Attn. Illinois nonprofits Could your organization use an extra 21,659

Register your nonprofit & get access to grants reserved just for nonprofits. Avoid errors in your partnership agreement. In order to qualify for 501(c)(3) status, the. Apply for exemption from state taxes. A board of directors, consisting of three to seven people.

Free Illinois Articles of Incorporation Nonprofit Corporation Form

A board of directors, consisting of three to seven people. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an illinois nonprofit. In order to qualify for 501(c)(3) status, the. Ad use our simple online nonprofit registration process & give your good cause a great start. Articles of incorporation for nonprofit.

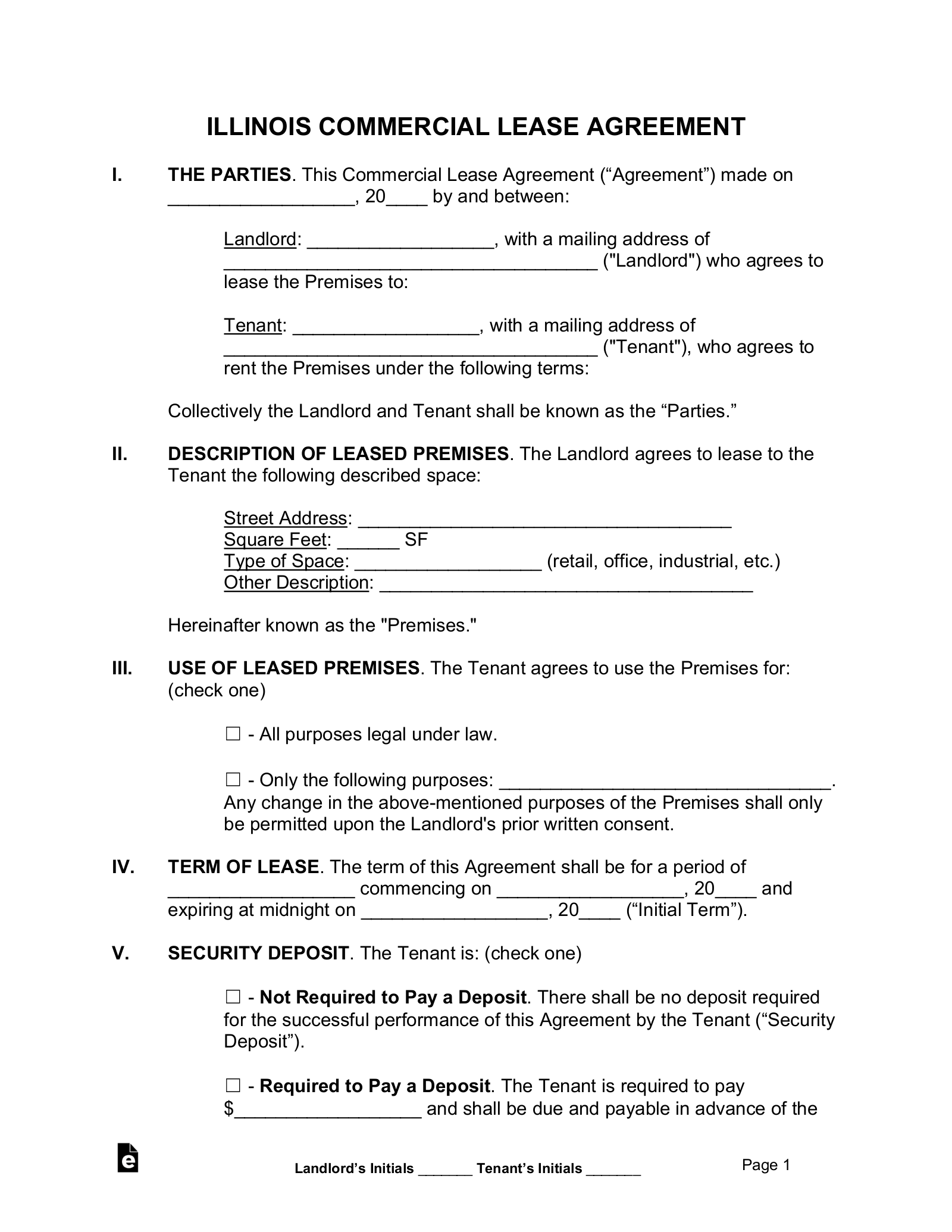

Free Illinois Commercial Lease Agreement Template Word PDF eForms

Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois. Bylaws setting out the rules. Prepare and file articles of incorporation with the secretary of state. Your nonprofit’s name is also its brand and must meet illinois state requirements. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an.

Free Illinois Articles of Incorporation Nonprofit Corporation Form

Web a nonprofit is an organization created for a purpose other than making money. Web welcome to the registration and compliance page for illinois nonprofit organizations. Articles of incorporation for nonprofit corporations explains what to include in your. Ad we’re here to help you navigate through nonprofit regulatory compliance. Web guide for organizing nfp corporations

How to start a nonprofit in Illinois 501c3 Organization YouTube

Web 8 steps to keep your nonprofit compliant. A board of directors, consisting of three to seven people. Web the board must consist of competent, responsible, and knowledgeable people. You can file your articles online, in person, or by. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an illinois nonprofit.

Michigan Nonprofit Form Form Resume Examples GM9OLwlYDL

These entities range from hospital systems with over 1,000 employees to high school robotics teams. Web 8 steps to keep your nonprofit compliant. Below you will find information on initial filings required when starting a nonprofit organization in. Web the board must consist of competent, responsible, and knowledgeable people. In order to qualify for 501(c)(3) status, the.

Michigan Nonprofit Form Form Resume Examples GM9OLwlYDL

Web welcome to the registration and compliance page for illinois nonprofit organizations. Web to start a nonprofit in illinois and get 501c3 status, follow these steps: Web up to 24% cash back your articles should include and name the following: In order to qualify for 501(c)(3) status, the. Ad get exactly what you want at the best price.

How to Form an Illinois Nonprofit Corporation in 2022

Web welcome to the registration and compliance page for illinois nonprofit organizations. Web how to start a nonprofit in illinois. Ad we’re here to help you navigate through nonprofit regulatory compliance. Select a name for your organization. Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois.

Illinois Corporate Charter Number Lookup Best Picture Of Chart

Web 8 steps to keep your nonprofit compliant. Apply for exemption from state taxes. Web welcome to the registration and compliance page for illinois nonprofit organizations. In order to qualify for 501(c)(3) status, the. These entities range from hospital systems with over 1,000 employees to high school robotics teams.

503 Nonprofit Form Form Resume Examples Pw1gZ2Y8YZ

Register your nonprofit & get access to grants reserved just for nonprofits. You can file your articles online, in person, or by. Ad we’re here to help you navigate through nonprofit regulatory compliance. Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois. Web guide for organizing nfp corporations

Find Startup Costs Research Your.

Web should you decide to apply you will use either form 1023 or form 1024. Web to start a nonprofit in illinois and get 501c3 status, follow these steps: Web to start a nonprofit corporation in illinois, you must file nonprofit articles of incorporation with the illinois secretary of state. Apply for exemption from state taxes.

Rely On Our Charitable Registration Expertise.

Web welcome to the registration and compliance page for illinois nonprofit organizations. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an illinois nonprofit. In order to qualify for 501(c)(3) status, the. A board of directors, consisting of three to seven people.

Ad We’re Here To Help You Navigate Through Nonprofit Regulatory Compliance.

Web introduction as of 2016, there were 22,743 nonprofit organizations in illinois. These entities range from hospital systems with over 1,000 employees to high school robotics teams. Web up to 24% cash back your articles should include and name the following: Web guide for organizing nfp corporations

Articles Of Incorporation For Nonprofit Corporations Explains What To Include In Your.

Web a nonprofit is an organization created for a purpose other than making money. Web how to start a nonprofit in illinois. Our business specialists help you incorporate your business. Avoid errors in your partnership agreement.