How To Form A 501C3 In Texas

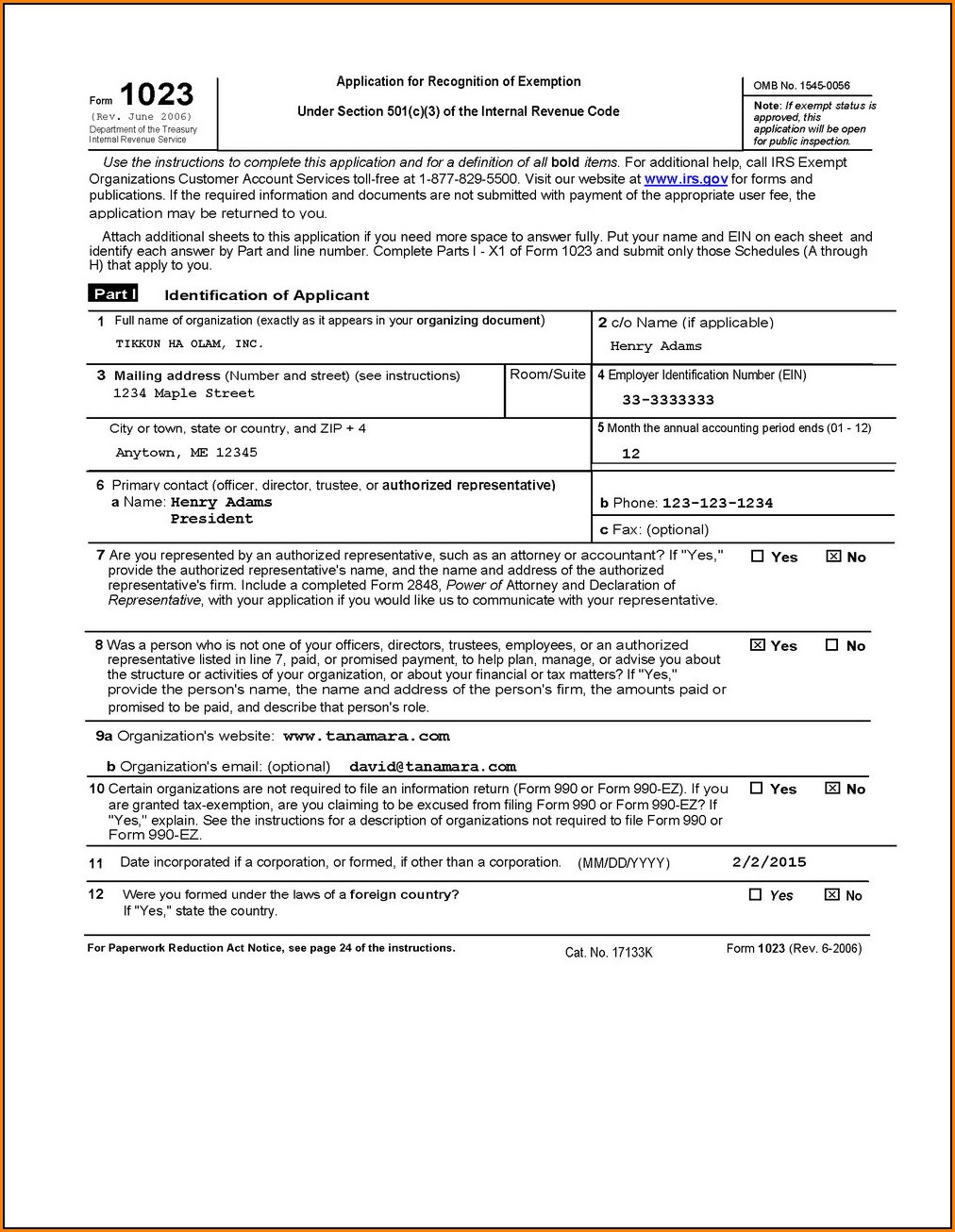

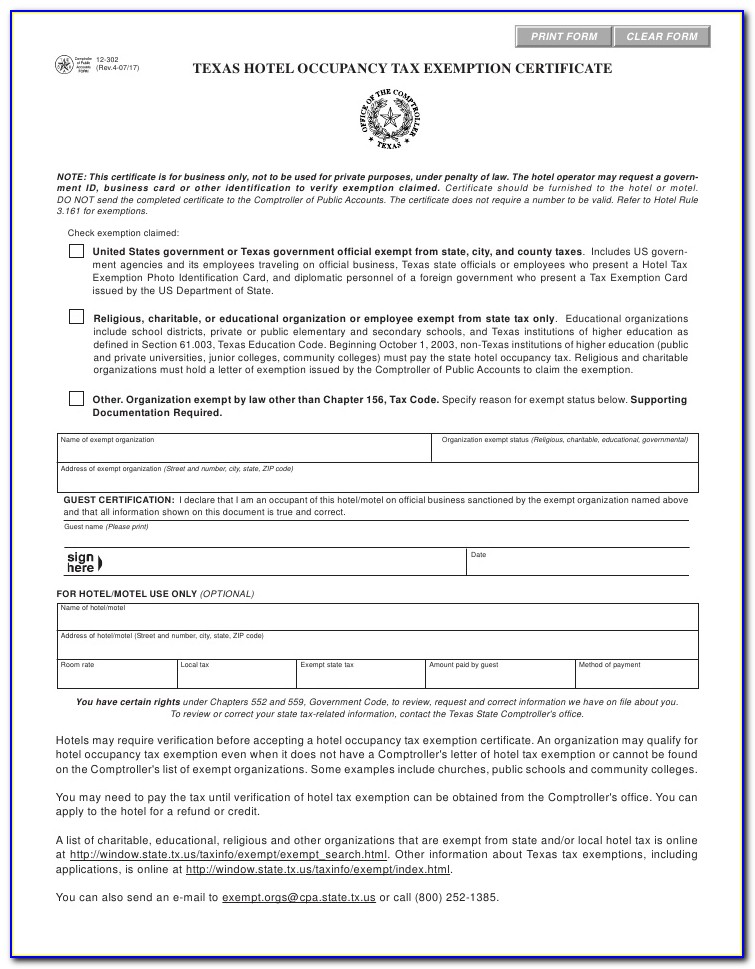

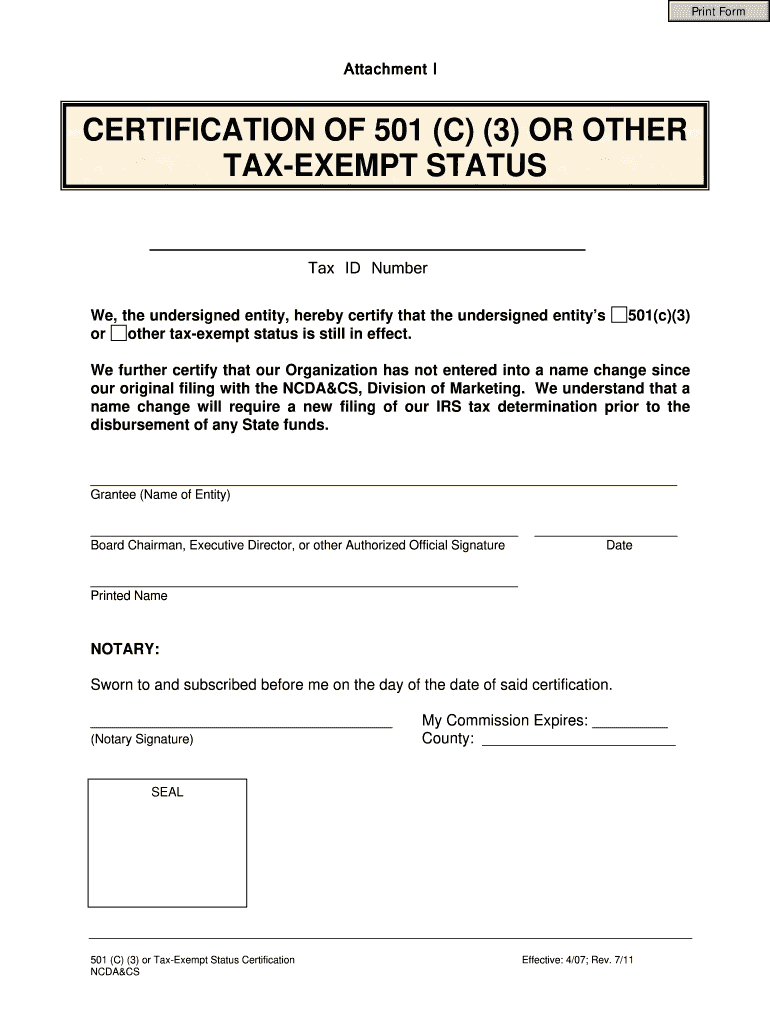

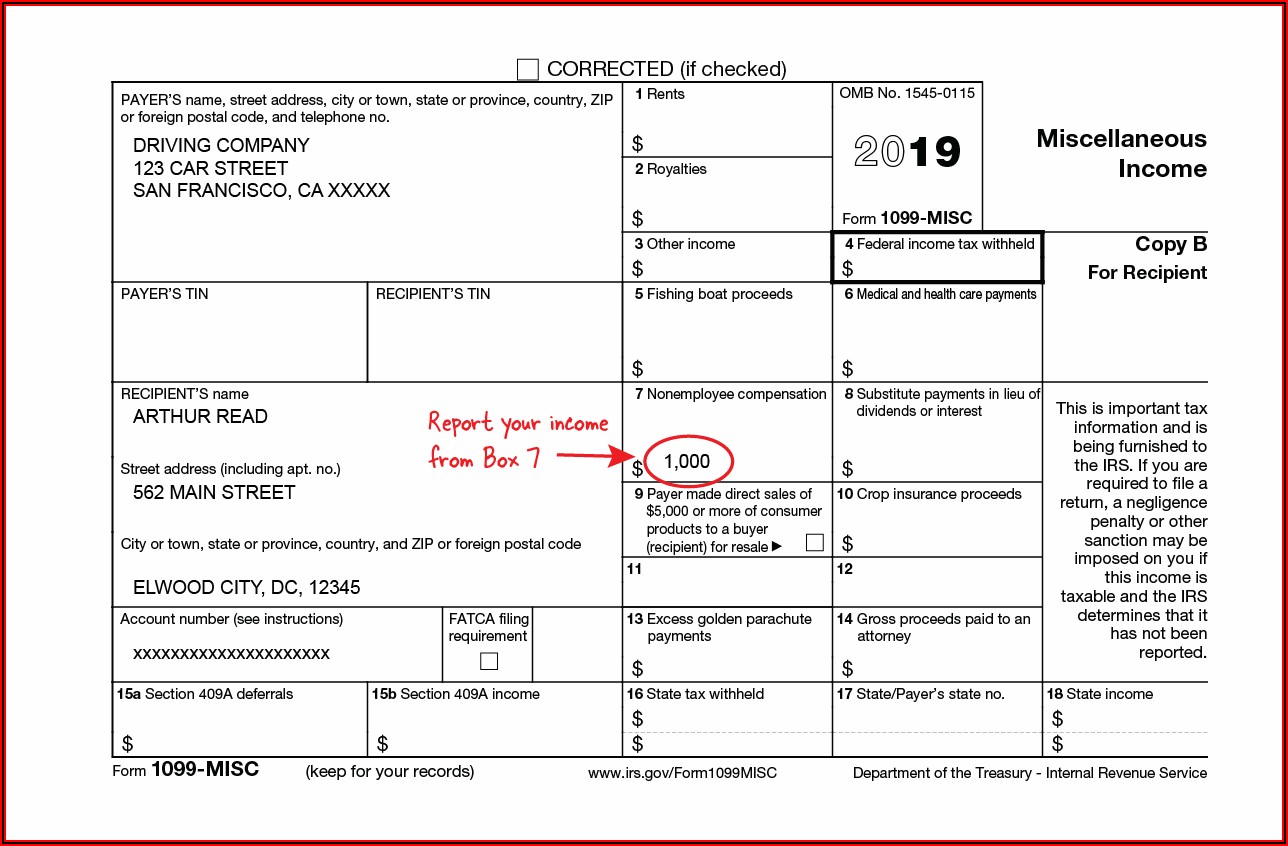

How To Form A 501C3 In Texas - A federal tax exemption only applies to the specific organization to which it is granted. Adopt bylaws & conflict of interest policy. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Web there are nine steps to starting a nonprofit in texas. See form 202 (word 152kb, pdf 142kb). If the entity name does not meet the standard for availability, the document will not be filed. A nonprofit corporation may be created for any lawful purpose, which purpose. Lifecycle of an exempt organization. File the certificate of formation. Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax.

Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. If the entity name does not meet the standard for availability, the document will not be filed. File the certificate of formation. Web to start a nonprofit in texas and get 501c3 status, you must: * online filing available through sosdirect. A nonprofit corporation is created by filing a certificate of formation with the secretary of state. The nonprofit’s name should comply with texas naming rules and requirements and should also be easily searchable by both members and donors. Select your board members & officers. Depends on type of organization: Lifecycle of an exempt organization.

See form 202 (word 152kb, pdf 142kb). Web formation of business entities and nonprofit corporations under the texas business organizations code: A nonprofit corporation is created by filing a certificate of formation with the secretary of state. Select your board members & officers. If the entity name does not meet the standard for availability, the document will not be filed. You must also file key. Lifecycle of an exempt organization. Web there are nine steps to starting a nonprofit in texas. Depends on type of organization: Web to start a nonprofit in texas and get 501c3 status, you must:

N 400 Form Sample Form Resume Examples ojYqb6JOVz

Select your board members & officers. Lifecycle of an exempt organization. File the certificate of formation. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Web there are nine steps to starting a nonprofit in texas.

501c3 Application Form Forms ODg2OA Resume Examples

Lifecycle of an exempt organization. A nonprofit corporation may be created for any lawful purpose, which purpose. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. The nonprofit’s name should comply with texas naming rules and requirements and.

Forming A 501c3 In Florida Form Resume Examples A19XxQN94k

Web a “nonprofit corporation” is a corporation no part of the income of which is distributable to members, directors, or officers. Lifecycle of an exempt organization. A nonprofit corporation is created by filing a certificate of formation with the secretary of state. Web to start a nonprofit in texas and get 501c3 status, you must: Irs form 1023 (pdf) application.

Forming A 501c3 In Texas Form Resume Examples aEDvyP0k1Y

Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Web to start a nonprofit in texas and get 501c3 status, you must: Web a “nonprofit corporation” is a corporation no part of the income of which is distributable to members, directors, or officers. The nonprofit’s name should comply with texas naming rules and requirements and should also.

501c3 Articles Of Incorporation Template Template 1 Resume Examples

Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. File the certificate of formation. Lifecycle of an exempt organization. Select your board members & officers. They include setting up your nonprofit with a name, directors, an incorporator, a registered agent and bylaws.

501(c)(3) Letter MASTERthese

* online filing available through sosdirect. Lifecycle of an exempt organization. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Select your board members & officers. A nonprofit corporation may be created for any lawful purpose, which purpose.

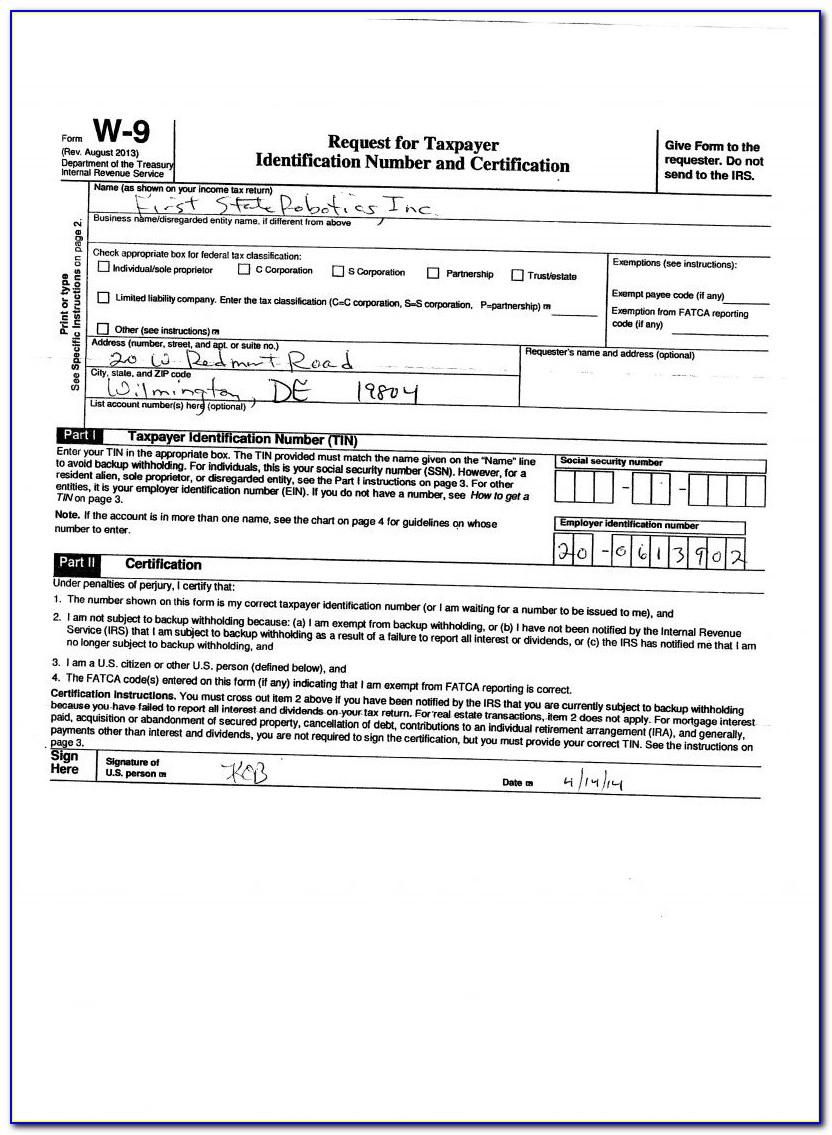

501c Form Fill Out and Sign Printable PDF Template signNow

Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. * online filing available through sosdirect. Lifecycle of an exempt organization. Depends on type of organization: The nonprofit’s name should comply with texas naming rules and requirements and should also be easily searchable by both members and donors.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Web there are nine steps to starting a nonprofit in texas. Adopt bylaws & conflict of interest policy. Lifecycle of an exempt organization. You must also file key. If the entity name does not meet the standard for availability, the document will not be filed.

Free 501c3 Form Download Form Resume Examples gzOe4lM5Wq

Select your board members & officers. Depends on type of organization: Web formation of business entities and nonprofit corporations under the texas business organizations code: Web to start a nonprofit in texas and get 501c3 status, you must: Web a “nonprofit corporation” is a corporation no part of the income of which is distributable to members, directors, or officers.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

See form 202 (word 152kb, pdf 142kb). Web there are nine steps to starting a nonprofit in texas. * online filing available through sosdirect. A nonprofit corporation may be created for any lawful purpose, which purpose. They include setting up your nonprofit with a name, directors, an incorporator, a registered agent and bylaws.

Select Your Board Members & Officers.

File the certificate of formation. Irs form 1023 (pdf) application for recognition of exemption and instructions (pdf). Lifecycle of an exempt organization. * online filing available through sosdirect.

See Form 202 (Word 152Kb, Pdf 142Kb).

A federal tax exemption only applies to the specific organization to which it is granted. Depends on type of organization: Web there are nine steps to starting a nonprofit in texas. The nonprofit’s name should comply with texas naming rules and requirements and should also be easily searchable by both members and donors.

A Nonprofit Corporation May Be Created For Any Lawful Purpose, Which Purpose.

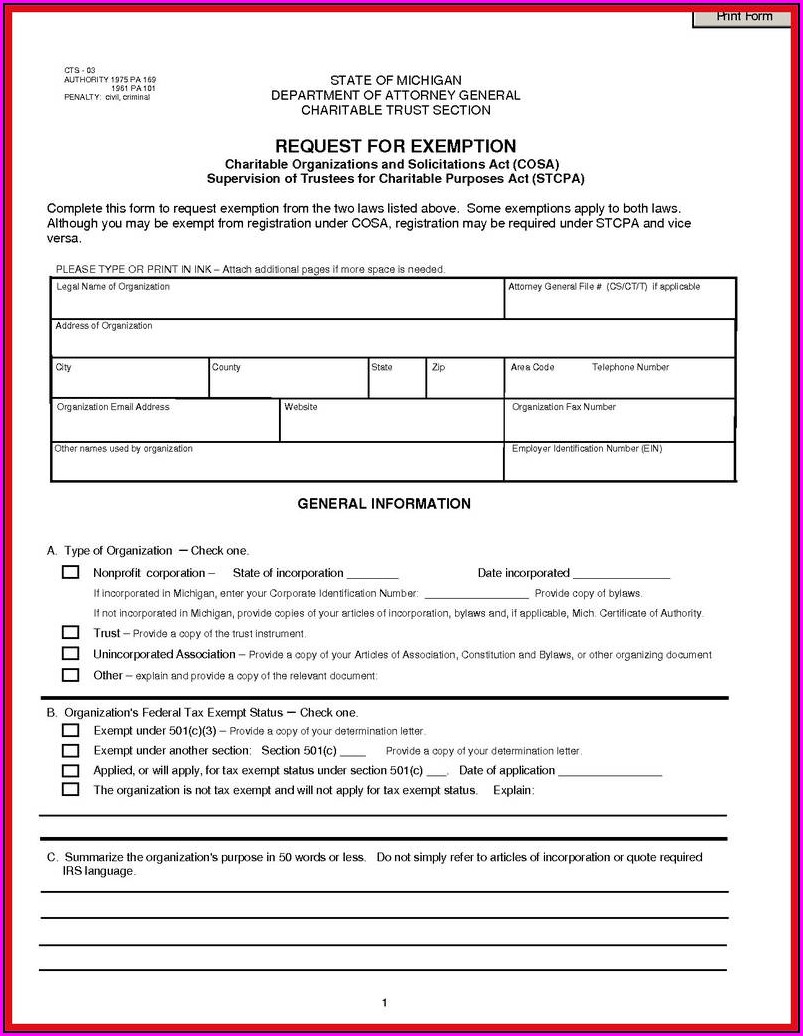

Adopt bylaws & conflict of interest policy. Web 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. Web a “nonprofit corporation” is a corporation no part of the income of which is distributable to members, directors, or officers. Web formation of business entities and nonprofit corporations under the texas business organizations code:

If The Entity Name Does Not Meet The Standard For Availability, The Document Will Not Be Filed.

You must also file key. A nonprofit corporation is created by filing a certificate of formation with the secretary of state. Web to start a nonprofit in texas and get 501c3 status, you must: They include setting up your nonprofit with a name, directors, an incorporator, a registered agent and bylaws.