How To Fill Out Homestead Exemption Form Florida

How To Fill Out Homestead Exemption Form Florida - The postmarked filing must be. Web homeowners can download the homestead application below and fill it out before coming in or complete the application in person at one of our four office locations. All aspirants must send in their applications by march 1, post, in person, or virtual. If you don’t have your pid, please use our search feature to locate it. Web write your signature and the date on the appropriate line. There are two ways to apply, depending on certain criteria. The statutory filing deadline is march 1. The property appraiser is responsible for property tax exemptions, such as: Web in palm beach county florida there are 3 ways to apply for the florida homestead exemption: Send this form with a copy of the original.

To file for lake county fl homestead exemption by mail, click here to download and print the. Web the login to file online will be your parcel identification number (pid) and your email address. Web florida homestead properties receive up to a $50,000 exemption from property taxes. Web to file for lake county fl homestead exemption online, click here. Complete, edit or print tax forms instantly. Widow and widower exemptions, and, disability. The postmarked filing must be. If it falls on a weekend or legal. There are two ways to apply, depending on certain criteria. If you don’t have your pid, please use our search feature to locate it.

Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. To file for lake county fl homestead exemption by mail, click here to download and print the. Complete the form as follows: Web how to file your florida homestead exemption. Complete, edit or print tax forms instantly. There are two ways to apply, depending on certain criteria. Widow and widower exemptions, and, disability. Web to file for lake county fl homestead exemption online, click here. The postmarked filing must be. Note that florida requires new residents apply for a driver’s license within 30 days of establishing residency and register.

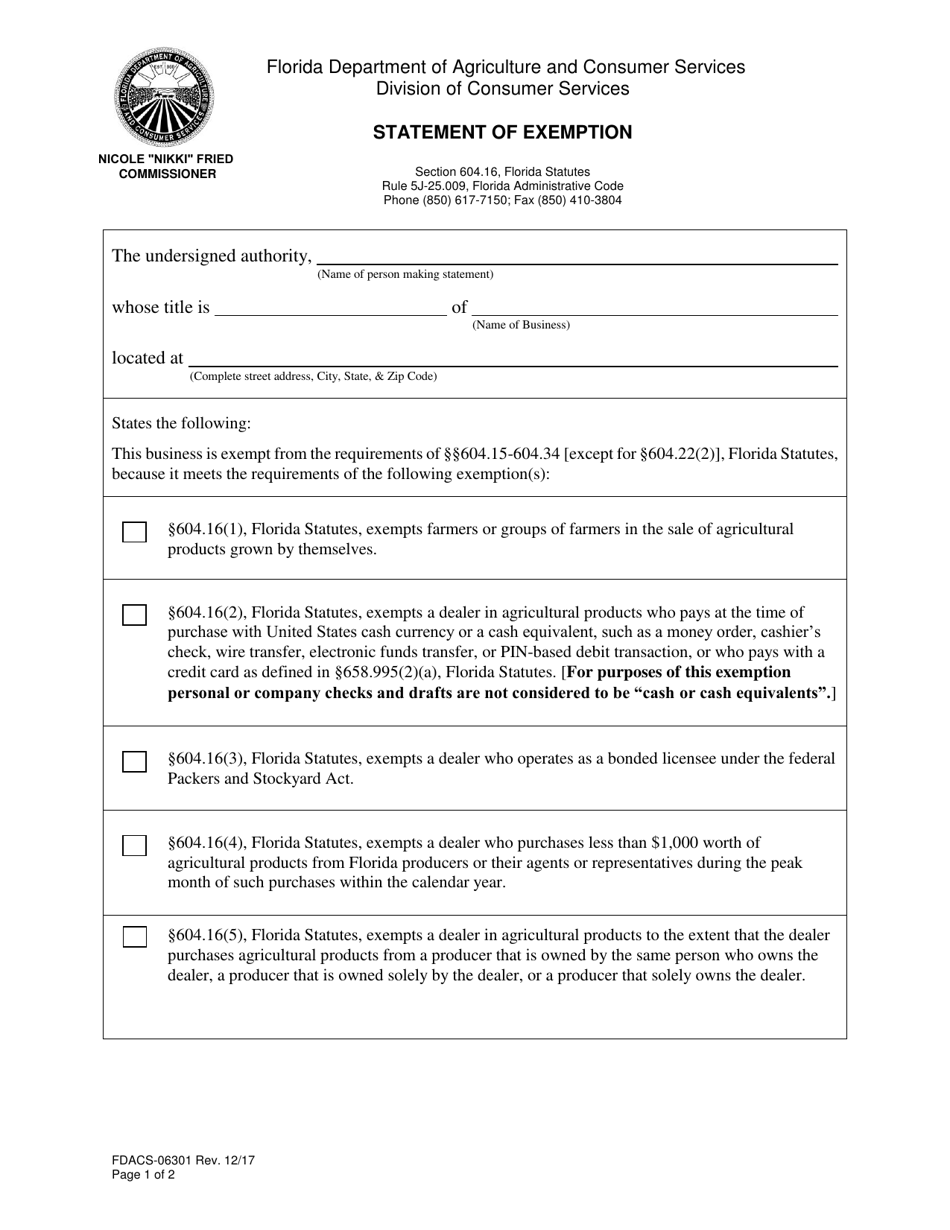

Form FDACS06301 Download Fillable PDF or Fill Online Statement of

Send this form with a copy of the original. To file for lake county fl homestead exemption by mail, click here to download and print the. Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. If you don’t have your pid, please use our search feature to locate it. Web.

How To Fill Out Homestead Exemption Form in Texas Homestead Exemption

Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. Web the login to file online will be your parcel identification number (pid) and your email address. Note that florida requires new residents apply for a driver’s license within 30 days of establishing residency and register. Web write your signature and.

Help filling out Homestead exemption form houston

Get ready for tax season deadlines by completing any required tax forms today. All aspirants must send in their applications by march 1, post, in person, or virtual. Complete the form as follows: If you don’t have your pid, please use our search feature to locate it. Print it out and mail to the palm beach county property appraiser's office,.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube

If it falls on a weekend or legal. Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. Web in palm beach county florida there are 3 ways to apply for the florida homestead exemption: All aspirants must send in their applications by march 1, post, in person, or virtual. To.

Montgomery County Homestead Exemption

To file for lake county fl homestead exemption by mail, click here to download and print the. Complete the form as follows: The property appraiser is responsible for property tax exemptions, such as: Web write your signature and the date on the appropriate line. Complete, edit or print tax forms instantly.

Homestead Exemption Form Fill Out and Sign Printable PDF Template

If you don’t have your pid, please use our search feature to locate it. Send this form with a copy of the original. Widow and widower exemptions, and, disability. The statutory filing deadline is march 1. The postmarked filing must be.

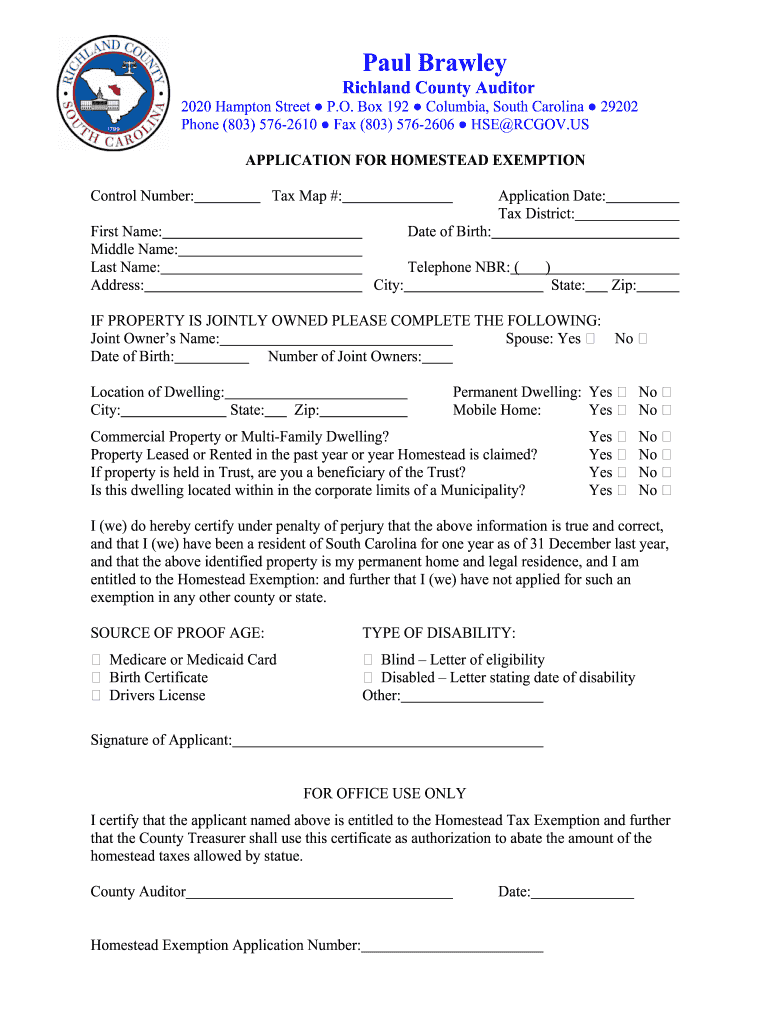

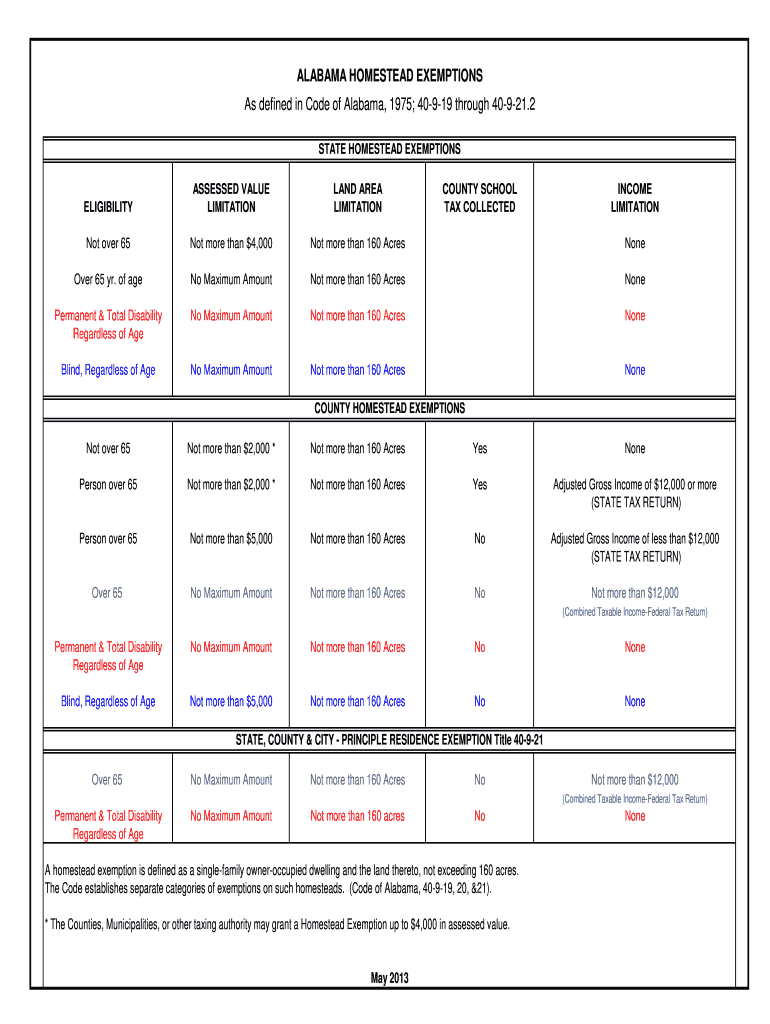

Alabama Homestead Exemption Fill Online, Printable, Fillable, Blank

If it falls on a weekend or legal. Complete the form as follows: Web to file for lake county fl homestead exemption online, click here. Get ready for tax season deadlines by completing any required tax forms today. Web in palm beach county florida there are 3 ways to apply for the florida homestead exemption:

Gustavo A. Fernandez, P.A. Homestead Exemption Filing Deadline

To file for lake county fl homestead exemption by mail, click here to download and print the. Web homeowners can download the homestead application below and fill it out before coming in or complete the application in person at one of our four office locations. Note that florida requires new residents apply for a driver’s license within 30 days of.

2022 Update Houston Homestead Home Exemptions StepByStep Guide

Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. Get ready for tax season deadlines by completing any required tax forms today. All aspirants must send in their applications by march 1, post, in person, or virtual. Web write your signature and the date on the appropriate line. Web you.

How to Apply for a Homestead Exemption in Florida 15 Steps

Web requirements the owner must have legal or beneficial title by january 1 of the year of the application. All aspirants must send in their applications by march 1, post, in person, or virtual. The property appraiser is responsible for property tax exemptions, such as: Web registration can be accomplished online. Web you have three options to submit your application:

The Statutory Filing Deadline Is March 1.

Send this form with a copy of the original. Web you have three options to submit your application: Web how to file your florida homestead exemption. If you don’t have your pid, please use our search feature to locate it.

Web Signature, Property Appraiser Or Deputy County Date If The Previous Homestead Was In A Different County, Add Your Contact Information.

Widow and widower exemptions, and, disability. All aspirants must send in their applications by march 1, post, in person, or virtual. Web homeowners can download the homestead application below and fill it out before coming in or complete the application in person at one of our four office locations. Web in palm beach county florida there are 3 ways to apply for the florida homestead exemption:

Web To File For Lake County Fl Homestead Exemption Online, Click Here.

Get ready for tax season deadlines by completing any required tax forms today. Print it out and mail to the palm beach county property appraiser's office,. Web florida homestead properties receive up to a $50,000 exemption from property taxes. Web the login to file online will be your parcel identification number (pid) and your email address.

The Property Appraiser Is Responsible For Property Tax Exemptions, Such As:

The postmarked filing must be. The exemption is subtracted from the assessed value of your home. Complete, edit or print tax forms instantly. Web write your signature and the date on the appropriate line.