How To Fill Out Form 990 N

How To Fill Out Form 990 N - Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. An organization’s legal name is the organization’s name as it appears in the articles of. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. Web the form 990 allows the irs to check up on a nonprofit in two capacities: Congress enacted this filing requirement in 2007 to. This will allow you to access your filing history and get. This form is due on the fifteenth day of the fifth month of the organization’s fiscal year. All you need is the following information: However, if you do not file.

Web the form 990 allows the irs to check up on a nonprofit in two capacities: Enter your ein to get started, search your organizations’ employer identification number (ein). The group return satisfies your reporting requirement. Make sure you fill out the right irs form 990. However, if you do not file. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. An organization’s legal name is the organization’s name as it appears in the articles of. This will allow you to access your filing history and get. For example, if the organization’s fiscal year is january 1 to. Congress enacted this filing requirement in 2007 to.

Web the form 990 allows the irs to check up on a nonprofit in two capacities: For example, if the organization’s fiscal year is january 1 to. Congress enacted this filing requirement in 2007 to. Enter your ein to get started, search your organizations’ employer identification number (ein). While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. The group return satisfies your reporting requirement. This form is due on the fifteenth day of the fifth month of the organization’s fiscal year. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Make sure you fill out the right irs form 990.

IRS 990 Schedule A 20202022 Fill out Tax Template Online

Congress enacted this filing requirement in 2007 to. All you need is the following information: Enter your ein to get started, search your organizations’ employer identification number (ein). While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. Web the form 990 allows the irs to check up on a nonprofit in two capacities:

IRS Form 990 (Schedule J) 2018 2019 Fill out and Edit Online PDF

Enter your ein to get started, search your organizations’ employer identification number (ein). While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. Congress enacted this filing requirement in 2007 to. An organization’s legal name is the organization’s name as it appears in the articles of. All you need is the following information:

IRS 990T 20202021 Fill out Tax Template Online US Legal Forms

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. This will allow you to access your filing history and get. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. All you need is the following information:.

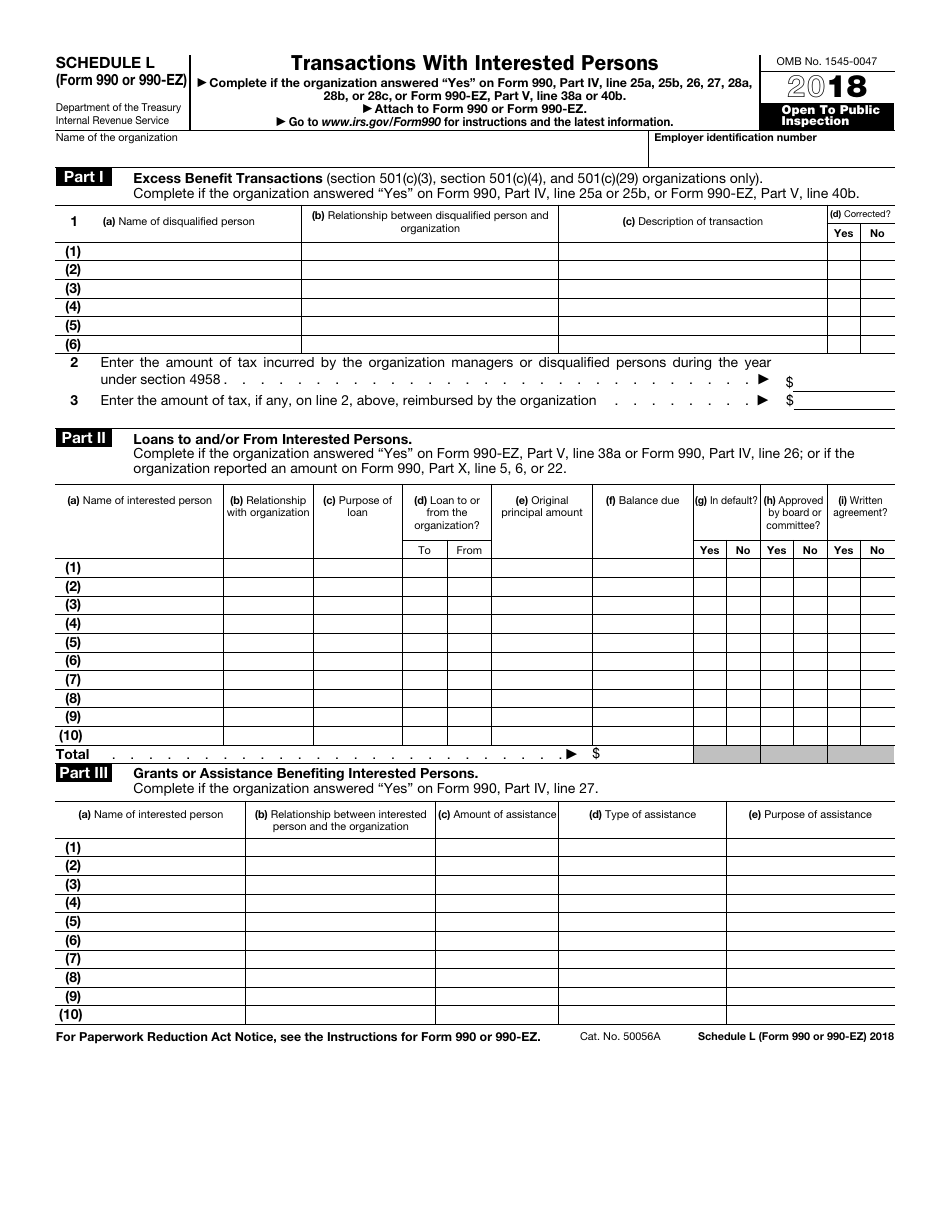

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

For example, if the organization’s fiscal year is january 1 to. This form is due on the fifteenth day of the fifth month of the organization’s fiscal year. While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. Make sure you fill out the right irs form 990. This is the shortest form, filed.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

An organization’s legal name is the organization’s name as it appears in the articles of. However, if you do not file. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. Make sure you fill out the right.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

For example, if the organization’s fiscal year is january 1 to. The group return satisfies your reporting requirement. This form is due on the fifteenth day of the fifth month of the organization’s fiscal year. This is the shortest form, filed by small organizations with less than $50,000 in gross receipts. All you need is the following information:

Pdf 2020 990 N Fill Out Fillable and Editable PDF Template

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. However, if you do not file. While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. The group return satisfies your reporting requirement. Make sure you fill out.

990 Form Fill Out and Sign Printable PDF Template signNow

Enter your ein to get started, search your organizations’ employer identification number (ein). Web the form 990 allows the irs to check up on a nonprofit in two capacities: The group return satisfies your reporting requirement. Congress enacted this filing requirement in 2007 to. Make sure you fill out the right irs form 990.

Efile Form 990N 2020 IRS Form 990N Online Filing

The group return satisfies your reporting requirement. Make sure you fill out the right irs form 990. This will allow you to access your filing history and get. An organization’s legal name is the organization’s name as it appears in the articles of. Congress enacted this filing requirement in 2007 to.

Form 990 N Pdf 20202022 Fill and Sign Printable Template Online US

However, if you do not file. For example, if the organization’s fiscal year is january 1 to. While there are some exceptions, such as religious or political groups, the majority of nonprofit organizations. This form is due on the fifteenth day of the fifth month of the organization’s fiscal year. Web form 990 department of the treasury internal revenue service.

Enter Your Ein To Get Started, Search Your Organizations’ Employer Identification Number (Ein).

Web the form 990 allows the irs to check up on a nonprofit in two capacities: For example, if the organization’s fiscal year is january 1 to. All you need is the following information: This is the shortest form, filed by small organizations with less than $50,000 in gross receipts.

While There Are Some Exceptions, Such As Religious Or Political Groups, The Majority Of Nonprofit Organizations.

Make sure you fill out the right irs form 990. An organization’s legal name is the organization’s name as it appears in the articles of. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. This will allow you to access your filing history and get.

This Form Is Due On The Fifteenth Day Of The Fifth Month Of The Organization’s Fiscal Year.

The group return satisfies your reporting requirement. However, if you do not file. Congress enacted this filing requirement in 2007 to.