How To File Form 8938

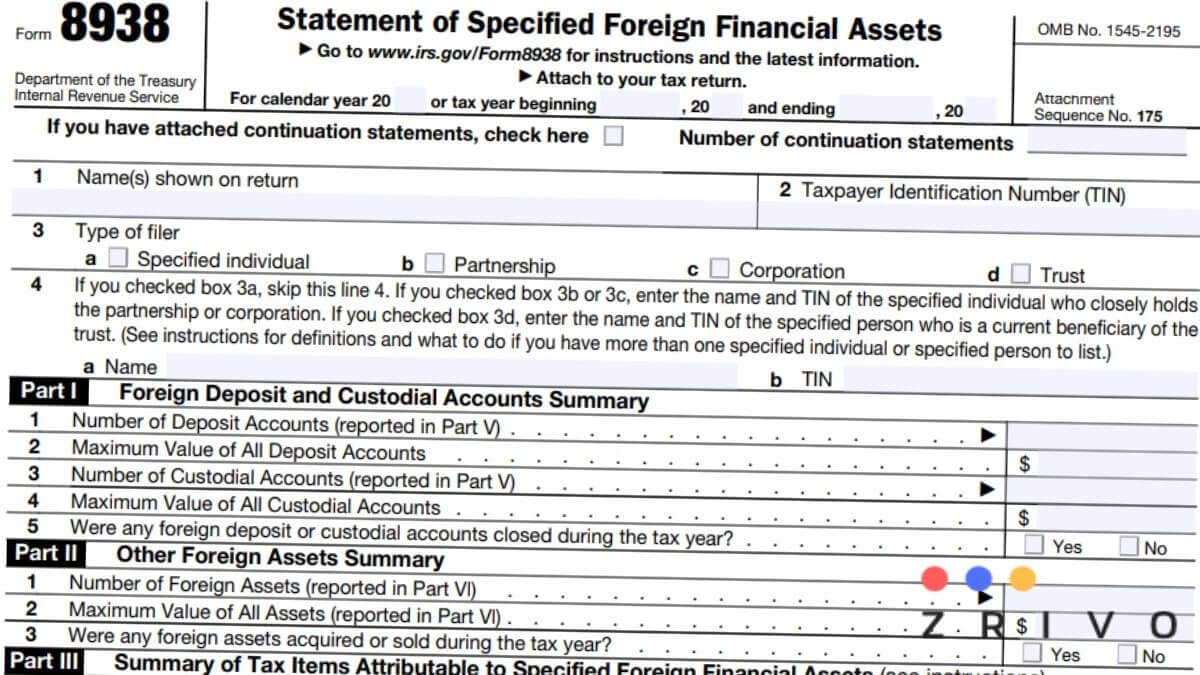

How To File Form 8938 - Web if you fail to timely file a correct form 8938 or if you have an understatement of tax relating to an undisclosed specified foreign financial asset. You are married filing a joint income tax return and the total value of your specified foreign financial assets is. Web when you have a domestic trust and at least one specific beneficiary, you need to fill out form 8938. Web up to $40 cash back how to fill out form 8938 turbotax: Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Get ready for tax season deadlines by completing any required tax forms today. Web if you have a requirement to make a report of your foreign assets and/or accounts under fatca, then you will need to file the irs form 8938 with your federal. Web filing form 8938 is only available to those using turbotax deluxe or higher. Get ready for tax season deadlines by completing any required tax forms today. Web generally, you’ll need to file form 8938 if you’re an american citizen or a resident alien (also known as a green card holder) for any part of the tax year.

Web if you have a requirement to make a report of your foreign assets and/or accounts under fatca, then you will need to file the irs form 8938 with your federal. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web you must file a form 8938 if you must file an income tax return and: Select your tax module below for steps: Turbotax is really easy and nice tool. June 6, 2019 4:57 am. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. You are a specified person (either a specified individual or a specified domestic entity). Web you must file form 8938 if: Get ready for tax season deadlines by completing any required tax forms today.

Web you must file form 8938 if: In recent years, the irs has increased offshore enforcement of foreign. Use form 8938 to report your. Web up to $40 cash back how to fill out form 8938 turbotax: If you’re one of the people who doesn’t need to file tax returns. Web generally, you’ll need to file form 8938 if you’re an american citizen or a resident alien (also known as a green card holder) for any part of the tax year. Web how do i acess form 8938 in proseries? June 6, 2019 4:57 am. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Start by logging in to your turbotax account or creating a new account if you don't have one.

Form 8938 Who Has to Report Foreign Assets & How to File

Web when you have a domestic trust and at least one specific beneficiary, you need to fill out form 8938. Start by logging in to your turbotax account or creating a new account if you don't have one. Web if you have a requirement to make a report of your foreign assets and/or accounts under fatca, then you will need.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

If the irs needs you to. If you’re one of the people who doesn’t need to file tax returns. Follow these steps access form 8938 in an individual return: Use form 8938 to report your. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file.

8938 Form 2021

Start by logging in to your turbotax account or creating a new account if you don't have one. From the forms menu, choose select. If the irs needs you to. Web for additional information, also refer to about form 8938, statement of specified foreign financial assets. You are a specified person (either a specified individual or a specified domestic entity).

Form 8938 FATCA for expats explained Expatfile

Web for additional information, also refer to about form 8938, statement of specified foreign financial assets. June 6, 2019 4:57 am. Web generally, you’ll need to file form 8938 if you’re an american citizen or a resident alien (also known as a green card holder) for any part of the tax year. Get ready for tax season deadlines by completing.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web get started > makoto1 level 1 form 8938 after efile i start tax filling by free version of turbotax. Get ready for tax season deadlines by completing any required tax forms today. Web if you fail to timely file a correct form 8938 or if you have an understatement of tax relating to an undisclosed specified foreign financial asset..

Who is Required to File Form 8938 International Tax Lawyer New York

To get to the 8938 section in turbotax, refer to the following instructions: Web up to $40 cash back how to fill out form 8938 turbotax: Web when you have a domestic trust and at least one specific beneficiary, you need to fill out form 8938. Web how do i file form 8938, statement of specified foreign financial assets? Web.

Philadelphia Estate Planning, Tax, Probate Attorney Law Practice

Web if you have a requirement to make a report of your foreign assets and/or accounts under fatca, then you will need to file the irs form 8938 with your federal. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. June 6, 2019 4:57 am. Web up to.

What is form 8938 and why do you need to file it? Expat US Tax

Web in general, form 8938 penalties will be $10,000 per year. To get to the 8938 section in turbotax, refer to the following instructions: Web there are several ways to submit form 4868. Web generally, you’ll need to file form 8938 if you’re an american citizen or a resident alien (also known as a green card holder) for any part.

Do YOU need to file Form 8938? “Statement of Specified Foreign

In recent years, the irs has increased offshore enforcement of foreign. Web if you have a requirement to make a report of your foreign assets and/or accounts under fatca, then you will need to file the irs form 8938 with your federal. Complete, edit or print tax forms instantly. Follow these steps access form 8938 in an individual return: If.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web there are several ways to submit form 4868. If you’re one of.

Use Form 8938 To Report Your.

Web filing form 8938 is only available to those using turbotax deluxe or higher. Web how do i acess form 8938 in proseries? You are married filing a joint income tax return and the total value of your specified foreign financial assets is. Web get started > makoto1 level 1 form 8938 after efile i start tax filling by free version of turbotax.

Ad Access Irs Tax Forms.

Web generally, you’ll need to file form 8938 if you’re an american citizen or a resident alien (also known as a green card holder) for any part of the tax year. Web you must file form 8938 if: Taxpayers to report specified foreign financial assets each year on a form 8938. Web for additional information, also refer to about form 8938, statement of specified foreign financial assets.

Web The Irs Requires U.s.

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114.

Web When You Have A Domestic Trust And At Least One Specific Beneficiary, You Need To Fill Out Form 8938.

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more. If you’re one of the people who doesn’t need to file tax returns. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Start by logging in to your turbotax account or creating a new account if you don't have one.