How To File Form 8862 On Turbotax

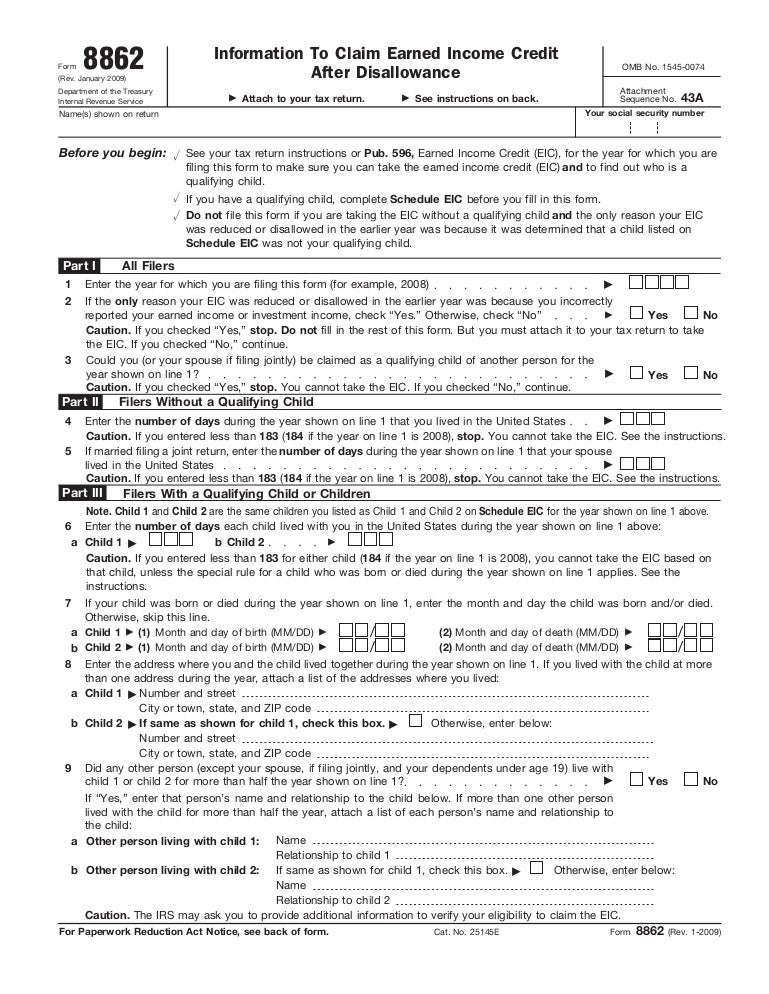

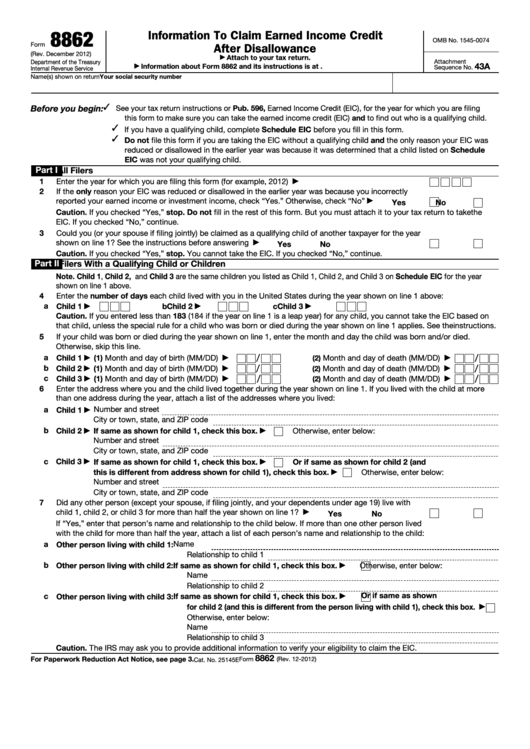

How To File Form 8862 On Turbotax - Search for 8862 and select the link to go to the section. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Click the green button to add information to claim a certain credit after disallowance. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Your ctc, rctc, actc, or odc for a year after 2015 was reduced or disallowed for any reason other than a math or clerical error: Answer the questions accordingly, and we’ll include form 8862 with your return. Web you can fill turbotax form 2106 by entering your details in the two given parts of the form. Ad get your taxes done right & maximize your refund with turbotax®. (to do this, sign in to turbotax and click the orange take me to.

Web it’s easy to do in turbotax. Search for 8862 and select the link to go to the section. Your ctc, rctc, actc, or odc for a year after 2015 was reduced or disallowed for any reason other than a math or clerical error: From within your taxact return ( online or desktop), click. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. To add form 8862 to your taxact ® return: Web information about form 8862, information to claim certain credits after disallowance, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Open your return if you don't already have it open. How do i enter form 8862?.

You won't be able to file this form or claim the credits for up to 10 years if. How do i enter form 8862?. Click the green button to add information to claim a certain credit after disallowance. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad access irs tax forms. It is when your eic is disallowed or reduced for some type of clerical or mat. Web users who have earned income credit (eic) may sometimes need to file form 8862. Form 8862 turbotax is only applicable to the american. We have thousands of employers on file to help you easily import your tax forms. Open your return if you don't already have it open.

Fillable Form 8862 Information To Claim Earned Credit After

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad access irs tax forms. Complete, edit or print tax forms instantly. From within your taxact return ( online or desktop), click. Edit, sign or email irs 8862 & more fillable forms, register and subscribe.

How Do You Fill Out A Power Of Attorney Form

Web follow these steps to add it to your taxes. How do i enter form 8862?. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Fill in the applicable credit. It is meant for.

Top 14 Form 8862 Templates free to download in PDF format

Web you can download form 8862 from the irs website and file it electronically or by mail. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Click the green button to add information to.

How To File Form 8862 On Turbotax House for Rent

Complete, edit or print tax forms instantly. Web sign in to efile.com. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web for the latest information about developments related to form 8862 and.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Click the green button to add information to claim a certain credit after disallowance. Web you can download form 8862 from the irs website and file it electronically or by mail. You won't be able to file this form or claim the credits for up to 10 years if. Web show details we are not affiliated with any brand or.

Form 8862 Edit, Fill, Sign Online Handypdf

Ad get your taxes done right & maximize your refund with turbotax®. Web 1 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. We have thousands of employers on file to help you easily import your tax forms. It is meant for tax.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Web show details we are not affiliated with any brand or entity on this form. Web follow these steps to add it to your taxes. Your ctc, rctc, actc, or odc for a year after 2015 was reduced or disallowed for any reason other than a math or clerical error: Web 1 18 13,264 reply 1 best answer andreac1 level.

How to file form 8862 on TurboTax ? MWJ One News Page VIDEO

Web users who have earned income credit (eic) may sometimes need to file form 8862. Click the green button to add information to claim a certain credit after disallowance. How it works open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your. From within your taxact return ( online or desktop), click. Your.

How to claim an earned credit by electronically filing IRS Form 8862

From within your taxact return ( online or desktop), click. Ad get ready for tax season deadlines by completing any required tax forms today. It is meant for tax filers who cannot get the full amount of credit using. You won't be able to file this form or claim the credits for up to 10 years if. Form 8862 turbotax.

Form 8862Information to Claim Earned Credit for Disallowance

Ad get your taxes done right & maximize your refund with turbotax®. Web 1 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. We have thousands of employers on file to help you easily import your tax forms. Contact us you will have.

Your Ctc, Rctc, Actc, Or Odc For A Year After 2015 Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error:

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web users who have earned income credit (eic) may sometimes need to file form 8862. Web follow these steps to add it to your taxes. It is when your eic is disallowed or reduced for some type of clerical or mat.

Click The Green Button To Add Information To Claim A Certain Credit After Disallowance.

Complete, edit or print tax forms instantly. Web information about form 8862, information to claim certain credits after disallowance, including recent updates, related forms and instructions on how to file. Web sign in to efile.com. (to do this, sign in to turbotax and click the orange take me to.

We Have Thousands Of Employers On File To Help You Easily Import Your Tax Forms.

Web this rejection will instruct you to attach form 8862 to your return and refile. Web you can download form 8862 from the irs website and file it electronically or by mail. Web you can fill turbotax form 2106 by entering your details in the two given parts of the form. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than.

Web It’s Easy To Do In Turbotax.

Form 8862 turbotax is only applicable to the american. Web show details we are not affiliated with any brand or entity on this form. Ad access irs tax forms. File an extension in turbotax online before the deadline to avoid a late filing penalty.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)