How To File Form 1120-H

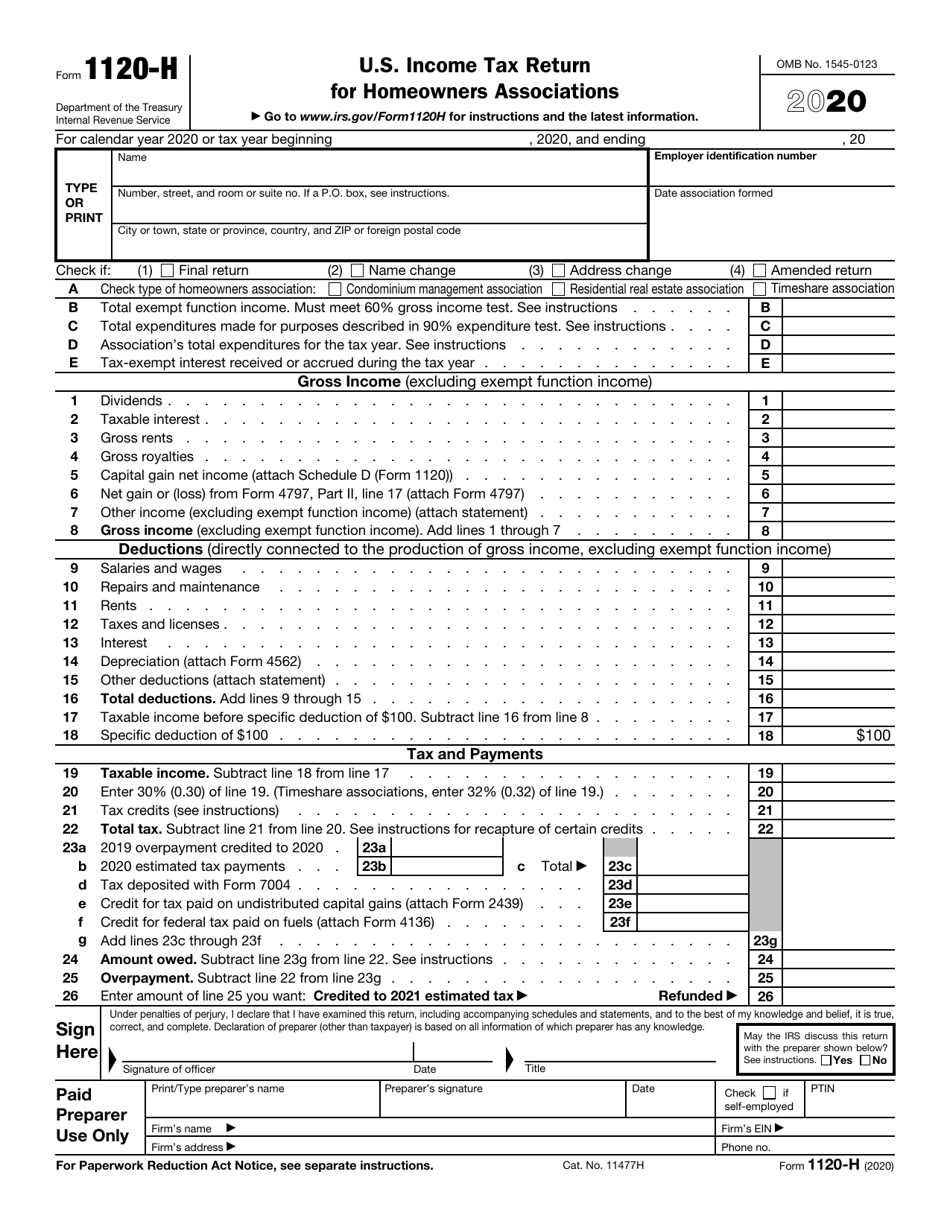

How To File Form 1120-H - Use the following irs center address. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings at least 85% of housing units should be residential A homeowners association files this form as its income tax return to take advantage of certain tax benefits. On the screen titled special filings, check homeowners association, then click continue. Domestic homeowners association to report its gross income and expenses. Top section the image above is the top section of the form. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. It details some of the basic information of the homeowners association. Web click basic information in the federal quick q&a topics menu to expand, then click special filings. For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print.

Web timeshare association there are five requirements to qualify as an hoa: Web click basic information in the federal quick q&a topics menu to expand, then click special filings. Top section the image above is the top section of the form. Web tax liability & payment section: If the association's principal business or office is located in. For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print. On the screen titled special filings, check homeowners association, then click continue. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. There are a few things you can do to make filing an hoa tax return easier. Continue with the interview process to enter all of the appropriate information.

Web click basic information in the federal quick q&a topics menu to expand, then click special filings. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Domestic homeowners association to report its gross income and expenses. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. If the association's principal business or office is located in. Use the following irs center address. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Continue with the interview process to enter all of the appropriate information. Number, street, and room or suite no. Web tax liability & payment section:

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Web click basic information in the federal quick q&a topics menu to expand, then click special.

How to File Form 1120 S U.S. Tax Return for an S Corporation

There are a few things you can do to make filing an hoa tax return easier. Top section the image above is the top section of the form. Web timeshare association there are five requirements to qualify as an hoa: Web tax liability & payment section: Domestic homeowners association to report its gross income and expenses.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

There are a few things you can do to make filing an hoa tax return easier. On the screen titled special filings, check homeowners association, then click continue. Number, street, and room or suite no. Web click basic information in the federal quick q&a topics menu to expand, then click special filings. Income tax return for homeowners associations go to.

Form 1120 Filing Instructions

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. If the association's principal business or office is located in. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Use the following irs center address. Number, street, and room.

File 1120 Extension Online Corporate Tax Extension Form for 2020

Web tax liability & payment section: Hoa's are generally only subject to corporate inc. Web there are two different forms that can be filed; Top section the image above is the top section of the form. Web timeshare association there are five requirements to qualify as an hoa:

IRS Form 7004 Automatic Extension for Business Tax Returns

If the association's principal business or office is located in. Top section the image above is the top section of the form. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings at least 85% of.

Form 1120H Example Complete in a Few Simple Steps [Infographic]

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. There are a few things you can do to make filing an hoa tax return easier. Web tax liability & payment section: Top section the image above is the top section of the.

Form 1120 Amended Return Overview & Instructions

Domestic homeowners association to report its gross income and expenses. Number, street, and room or suite no. Continue with the interview process to enter all of the appropriate information. Top section the image above is the top section of the form. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be.

How to File Form 1120H for a Homeowners Association YouTube

On the screen titled special filings, check homeowners association, then click continue. Top section the image above is the top section of the form. Continue with the interview process to enter all of the appropriate information. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. A homeowners association files this form as its income.

Do I Need to File Form 1120S if no Activity? YouTube

Web timeshare association there are five requirements to qualify as an hoa: A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Hoa's are generally only subject to corporate inc. If the association's principal business or office is located in. There are a few things you can do to make filing an.

Web Timeshare Association There Are Five Requirements To Qualify As An Hoa:

On the screen titled special filings, check homeowners association, then click continue. Top section the image above is the top section of the form. Continue with the interview process to enter all of the appropriate information. For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print.

Web Tax Liability & Payment Section:

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings at least 85% of housing units should be residential Use the following irs center address. Hoa's are generally only subject to corporate inc.

However, An Association With A Fiscal Year Ending June 30 Must File By The 15Th Day Of The 3Rd Month After The End Of Its Tax Year.

Domestic homeowners association to report its gross income and expenses. Web there are two different forms that can be filed; If the association's principal business or office is located in. Web click basic information in the federal quick q&a topics menu to expand, then click special filings.

Number, Street, And Room Or Suite No.

Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. It details some of the basic information of the homeowners association. There are a few things you can do to make filing an hoa tax return easier.

![Form 1120H Example Complete in a Few Simple Steps [Infographic]](http://hoatax.com/wp-content/uploads/2017/07/1120-h-5.png)