How To File 941 Form Online

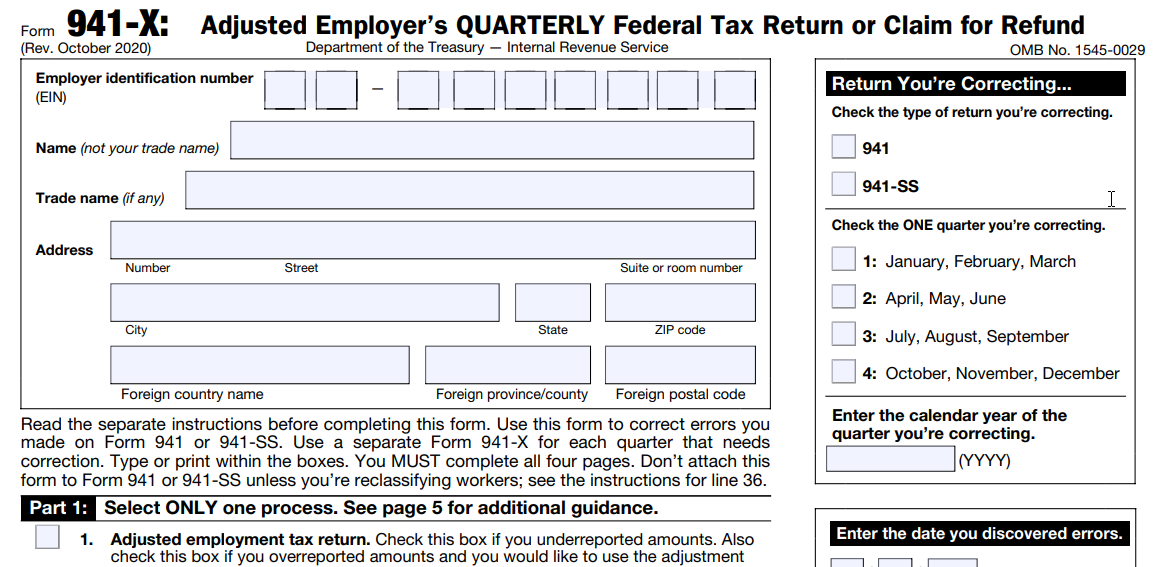

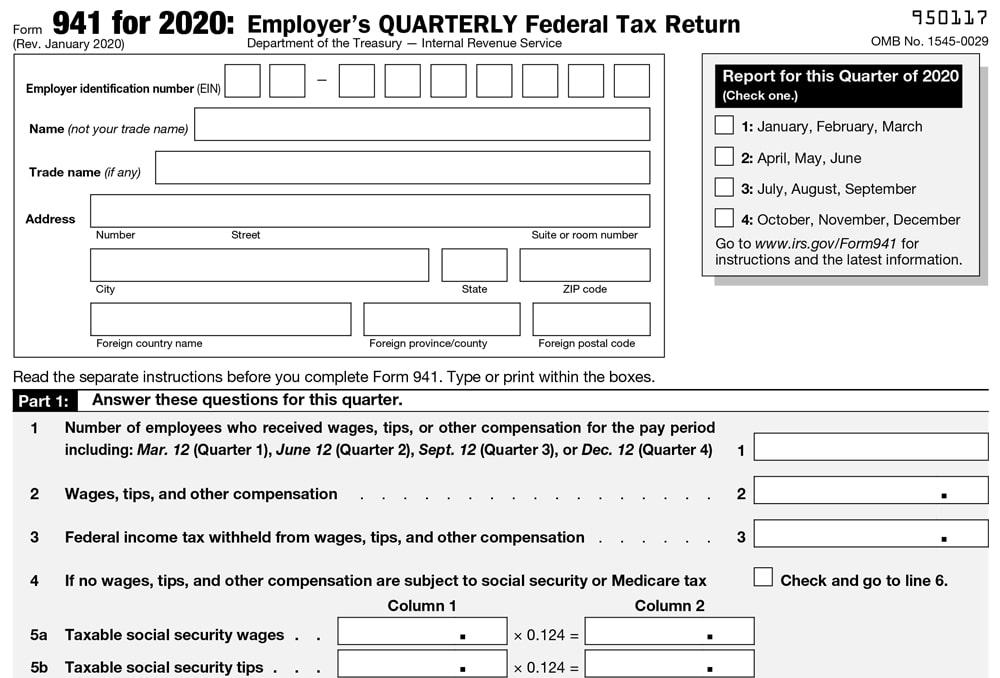

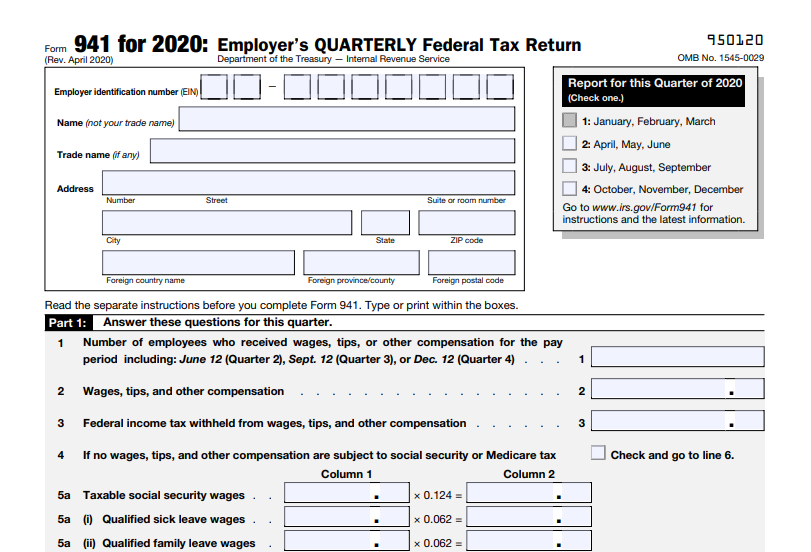

How To File 941 Form Online - Web employers use this form to report their withholding amounts for federal income taxes and fica taxes (social security and medicare) from employees paychecks along with the. Connecticut, delaware, district of columbia, georgia,. Form 940, employer's federal unemployment (futa) tax return; Web mailing addresses for forms 941. Web march 28, 2019. I'm glad that you posted here in the community. Employers must file a quarterly form 941 to report. Form 941 is used by employers. Ad we simplify complex tasks to give you time back and help you feel like an expert. Select the 941 form from the list.

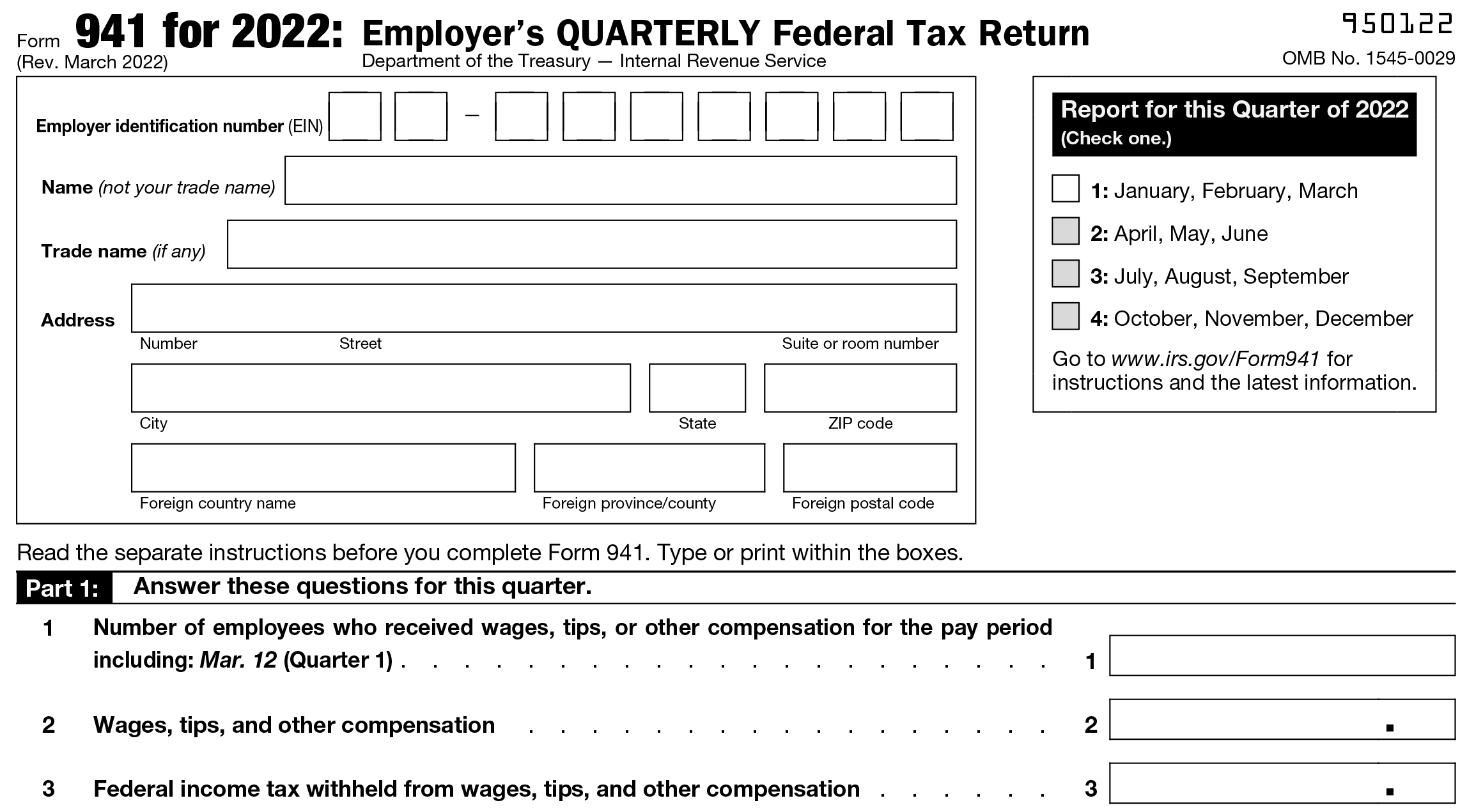

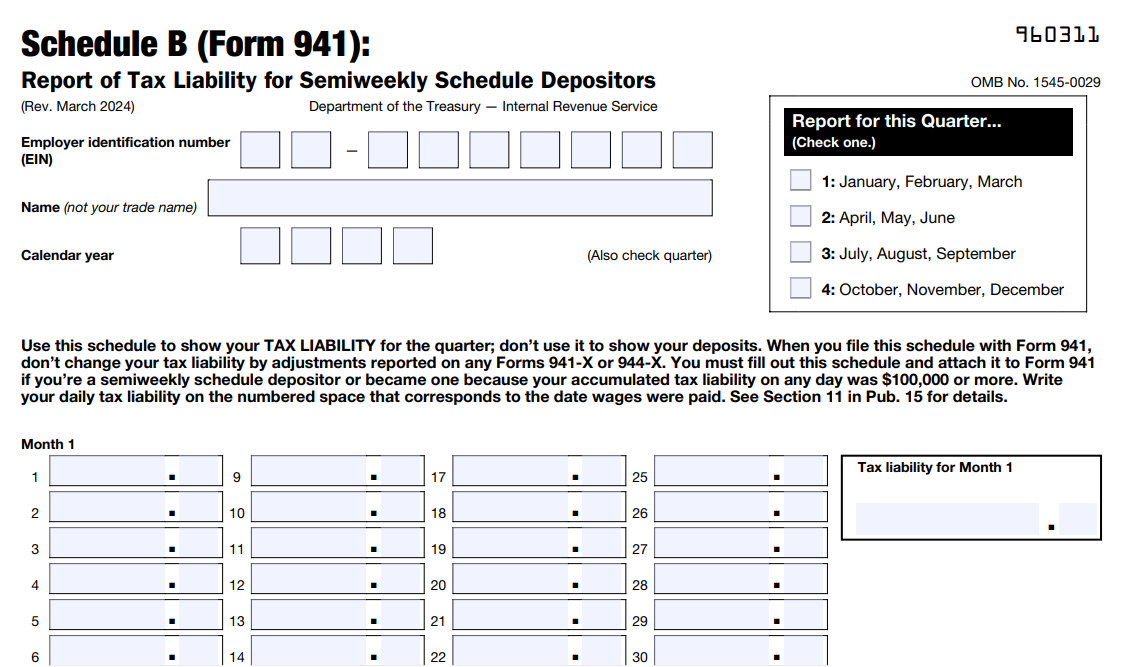

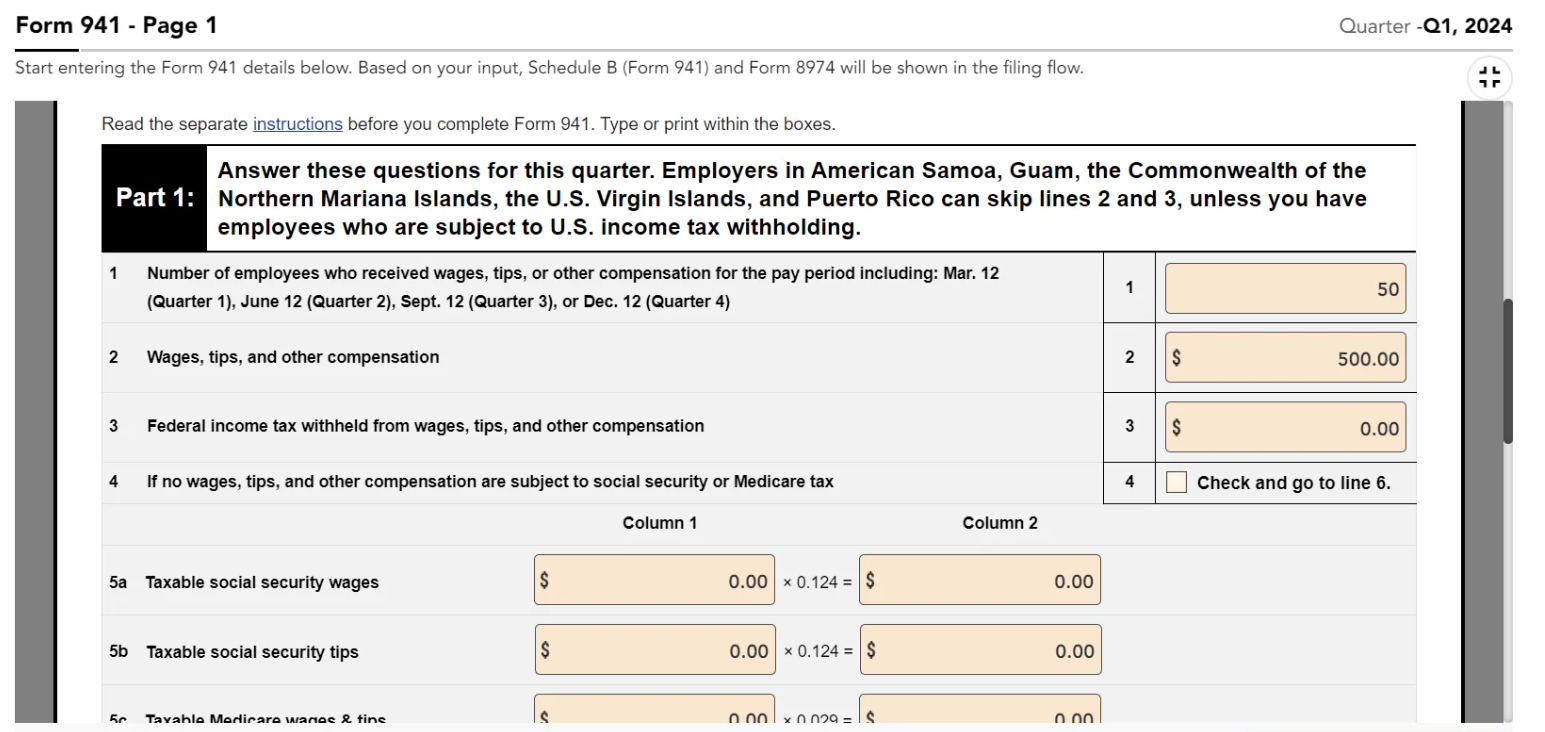

Form 940, employer's federal unemployment (futa) tax return; Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your. Ad access irs tax forms. I'm glad that you posted here in the community. Off to the right side,. Employers use this form to report income. Sign up & make payroll a breeze. Web employers use this form to report their withholding amounts for federal income taxes and fica taxes (social security and medicare) from employees paychecks along with the. Simply the best payroll service for small business. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Electronic filing options for employment taxes: Web fill out business information. I'm glad that you posted here in the community. Web employers use this form to report their withholding amounts for federal income taxes and fica taxes (social security and medicare) from employees paychecks along with the. Form 940, employer's federal unemployment (futa) tax return; Based upon irs sole proprietor data as of 2022, tax year 2021. Click the payroll tab, then file forms. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Learn how quickbooks online and desktop populates the lines on the form 941. Sign up & make payroll a breeze.

Where To File Form 941?

Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. It should just take a few minutes to complete, and then we’ll. Electronic filing options for employment taxes: Ad irs 941 inst & more fillable forms, register and subscribe now! Simply the best payroll service for small.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web click the employees menu. Simply the best payroll service for small business. Sign up & make payroll a breeze. How to file 941 instructions for easy to use. Web employers use this form to report their withholding amounts for federal income taxes and fica taxes (social security and medicare) from employees paychecks along with the.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Web visit eftps.gov to enroll. Sign up & make payroll a breeze. Complete, edit or print tax forms instantly. I'm glad that you posted here in the community. Off to the right side,.

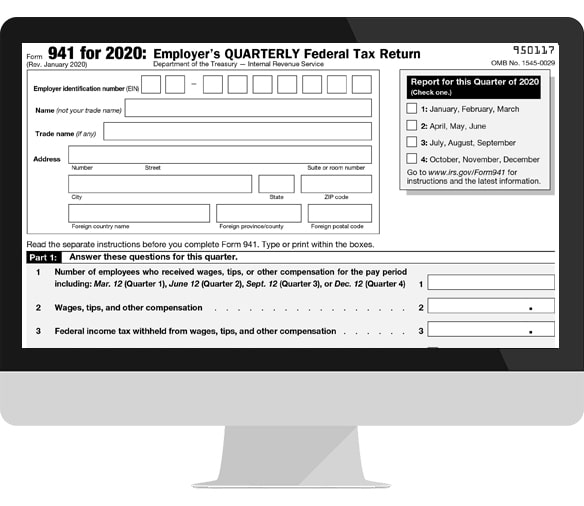

File Form 941 Online for 2019 Express941

At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. Complete your tax setup before you can pay or file payroll taxes, make sure you complete your tax setup. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability.

File 941 Online How to File 2023 Form 941 electronically

I'll be happy to walk you through the process of. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your. Web click the employees menu. Connecticut, delaware, district of columbia, georgia,. How to file 941 instructions for easy to use.

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form

Sign up & make payroll a breeze. Employers use this form to report income. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Complete your tax setup before you can pay or file payroll taxes, make sure you complete.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Based upon irs sole proprietor data as of 2022, tax year 2021. Web visit eftps.gov to enroll. Web how quickbooks populates form 941. How to file 941 instructions for easy to use. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer.

12 Form Irs Seven Ways On How To Prepare For 12 Form Irs AH STUDIO Blog

Simply the best payroll service for small business. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer. Web click the employees menu. Click the payroll tab, then file forms. Connecticut, delaware, district of columbia, georgia,.

File 941 Online Efile 941 for 4.95 Form 941 for 2020

Learn how quickbooks online and desktop populates the lines on the form 941. Ad access irs tax forms. Simply the best payroll service for small business. Web how quickbooks populates form 941. Sign up & make payroll a breeze.

EFile your IRS Form 941 for the tax year 2020

Ad access irs tax forms. Employers use this form to report income. Learn how quickbooks online and desktop populates the lines on the form 941. Complete your tax setup before you can pay or file payroll taxes, make sure you complete your tax setup. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter.

Sign Up & Make Payroll A Breeze.

Off to the right side,. Web mailing addresses for forms 941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Sign up & make payroll a breeze.

Web Click The Employees Menu.

Form 941 is used by employers. Form 941 is a internal revenue service (irs) tax form for employers in the u.s. How to file 941 instructions for easy to use. Web march 28, 2019.

Based Upon Irs Sole Proprietor Data As Of 2022, Tax Year 2021.

Web how quickbooks populates form 941. Web visit eftps.gov to enroll. Employers use this form to report income. Click the payroll tab, then file forms.

Electronic Filing Options For Employment Taxes:

Complete, edit or print tax forms instantly. Ad we simplify complex tasks to give you time back and help you feel like an expert. Web fill out business information. I'll be happy to walk you through the process of.