How Long Does It Take To Process Form 15111

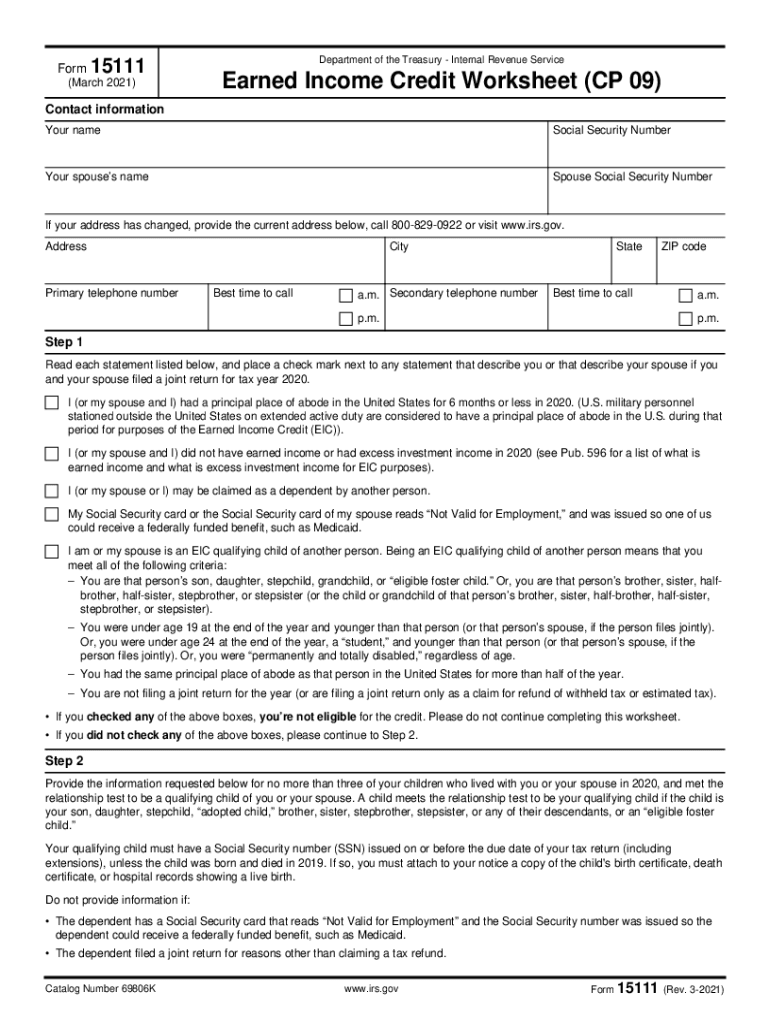

How Long Does It Take To Process Form 15111 - Web that notice could very well be a scam since there is no such irs form 15111. Web if you mail your paper return, it may take up to 4 weeks to get processed. Web received a form 15111 for eitc. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device. Web irs form 15111 2022 irs form 15111 status 2022 form 15111 march 2022 form 15111 instructions where to mail form 15111 how long does it take to process form 15111. Web how long does it take to get my refund? Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Earned income credit worksheet (cp 09). Web the form does not exist on the irs website. This is an irs internal form.

Web the form does not exist on the irs website. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Form 15111 is a worksheet to help you determine. Web that notice could very well be a scam since there is no such irs form 15111. This is an irs internal form. If your friend received a notice from the irs then they should call the irs using the phone number on the notice. Makes sense, i was so confused on how we only got 2k. Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6.

Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Enter the access code from your notice to use the tool. Send us your documents using the documentation upload toolwithin 30 days from the date of this notice. Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web that notice could very well be a scam since there is no such irs form 15111. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the. Web received a form 15111 for eitc. Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Earned income credit worksheet (cp 09). Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic.

How Long Does the Probate Process Take? Hopler, Wilms, & Hanna

Web received a form 15111 for eitc. The irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much. Earned income credit worksheet (cp 09). Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web the irs will use the.

Tax Return For Expats In Germany Wallpaper

Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the. This is an irs.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

Web how long does it take to process form 15111? Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see.

How Long Does It Take to Process a Rental Application? (Answered by a

Enter the access code from your notice to use the tool. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. If your friend received a notice from the irs then they should call the irs using the phone number.

How long does it normally take for the IRS to proc... Fishbowl

They will expect you to. Earned income credit worksheet (cp 09). Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the. Mid march i recieved a letter from the irs about submitting a form 15111 for.

How Long Does An Unemployment Claim Take Need to know how to claim

I already filed an amended return to claim it before this form was sent. Send us your documents using the documentation upload toolwithin 30 days from the date of this notice. The irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much. Web that notice.

How Long Does It Take to Process Tomato Sauce in Pressure Canner?

Web received a form 15111 for eitc. It’s hard to be patient but more so i’m worried because there’s no way to track it or see. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web.

Form 15111? r/IRS

Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Web the form does not exist on the irs website. Web bookmark icon lenah expert alumni turbotax will automatically calculate the earned income credit to your return and guide your through.

How Long Does it Take for YouTube to Process a Video?

I already filed an amended return to claim it before this form was sent. Web 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Web if.

How Long Does It Take to Form A Habit?

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Form 15111 is a worksheet to help you determine. Earned income credit worksheet (cp 09). Web if you amend your return to include the earned income credit, there is no reason to send back irs.

Web Irs Form 15111 2022 Irs Form 15111 Status 2022 Form 15111 March 2022 Form 15111 Instructions Where To Mail Form 15111 How Long Does It Take To Process Form 15111.

Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Web how long does it take to get my refund? Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but.

Enter The Access Code From Your Notice To Use The Tool.

Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device. This is an irs internal form. Makes sense, i was so confused on how we only got 2k.

I Already Filed An Amended Return To Claim It Before This Form Was Sent.

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Simply enter your social security. It’s hard to be patient but more so i’m worried because there’s no way to track it or see. Send us your documents using the documentation upload toolwithin 30 days from the date of this notice.

Web Bookmark Icon Lenah Expert Alumni Turbotax Will Automatically Calculate The Earned Income Credit To Your Return And Guide Your Through The Correct Screens, If.

Mid march i recieved a letter from the irs about submitting a form 15111 for our missing 6700$ of earned income credit. Web the form does not exist on the irs website. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6. They will expect you to.