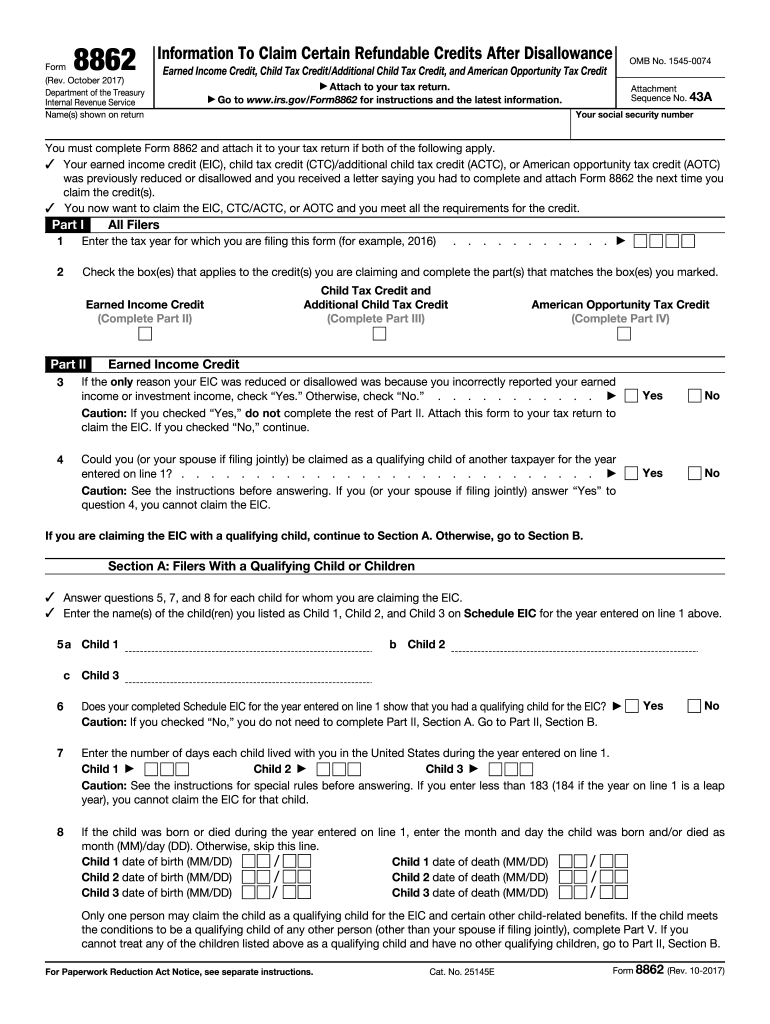

How Do You Fill Out Form 8862

How Do You Fill Out Form 8862 - Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Web taxpayers complete form 8862 and attach it to their tax return if: You won't be able to file this form or claim the credits for up to 10 years if. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! If you do, attach a statement that is the same size as form 8862. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. File an extension in turbotax online before the deadline to avoid a late filing penalty. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits;

Complete, edit or print tax forms instantly. Web you can download form 8862 from the irs website and file it electronically or by mail. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Enter the year for which you are filing this form to claim the credit(s) (for. The earned income credit, or eic, is. Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Specific instructions need more space for an item? Start completing the fillable fields and. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than.

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Easily fill out pdf blank, edit, and sign them. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. If you do, attach a statement that is the same size as form 8862. Enter the year for which you are filing this form to claim the credit(s) (for. Web correspond with the line number on form 8862. Web if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. How do i enter form 8862?. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. File an extension in turbotax online before the deadline to avoid a late filing penalty.

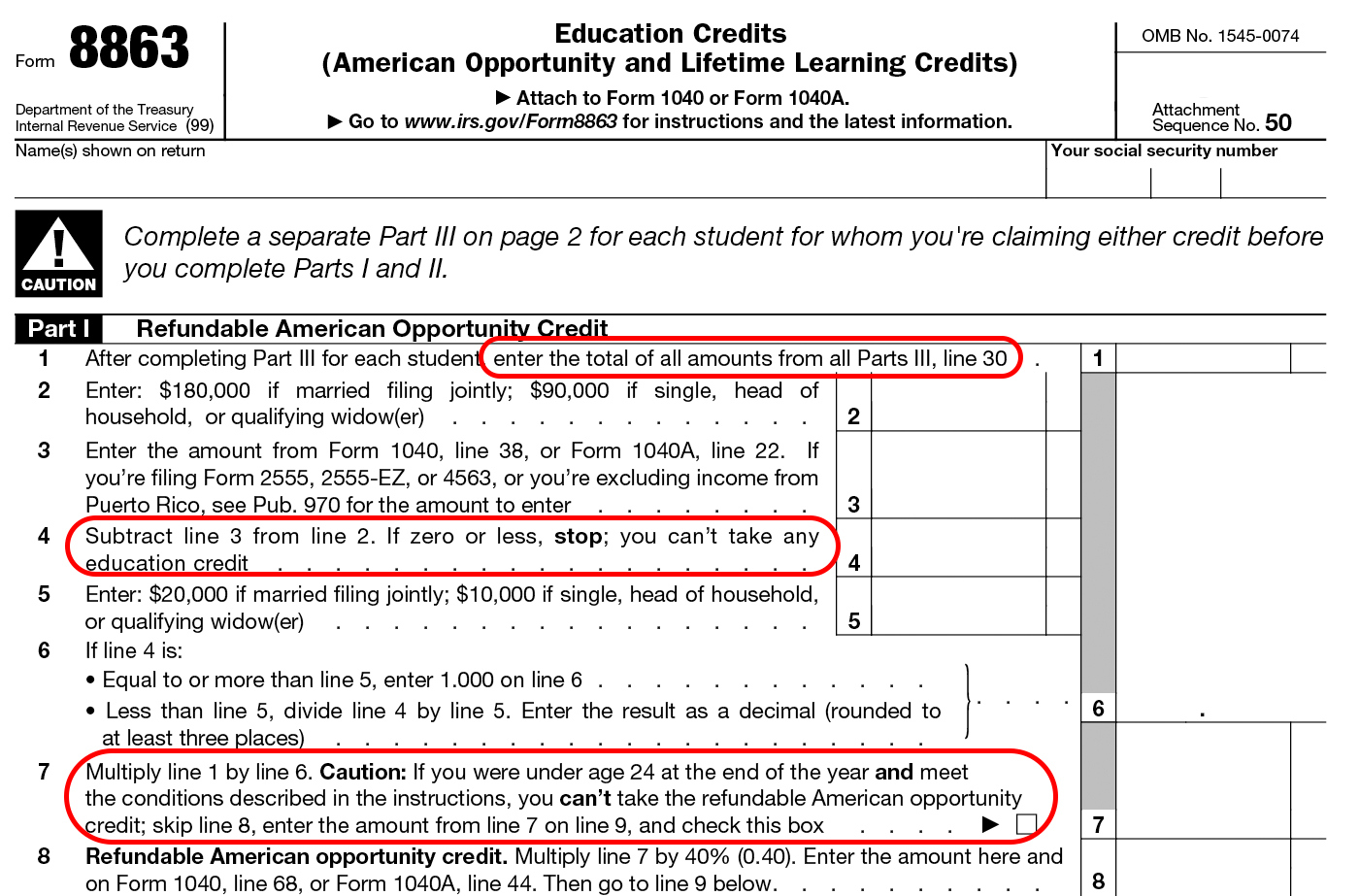

Learn How to Fill the Form 8863 Education Credits YouTube

Specific instructions need more space for an item? This form comes in pdf format and is automatically downloaded. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Start completing the fillable fields and..

Form 8863 Instructions Information On The Education 1040 Form Printable

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! How do i enter form 8862?. Web how do i file an irs extension (form 4868) in turbotax online? Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. Web you can download form.

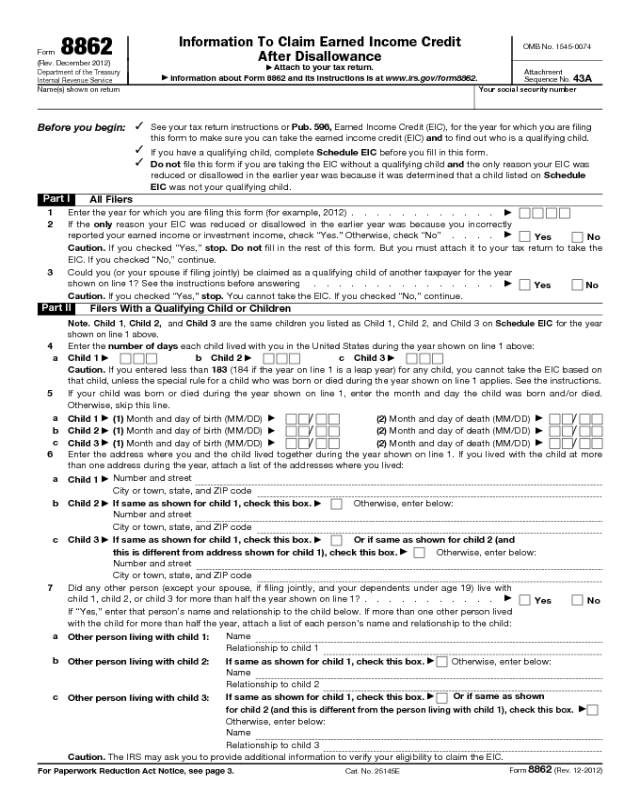

Form 8862 Information to Claim Earned Credit After

Web more about the federal form 8862 tax credit. Specific instructions need more space for an item? Ad download or email irs 8862 & more fillable forms, try for free now! Web how do i file an irs extension (form 4868) in turbotax online? We last updated federal form 8862 in december 2022 from the federal internal revenue service.

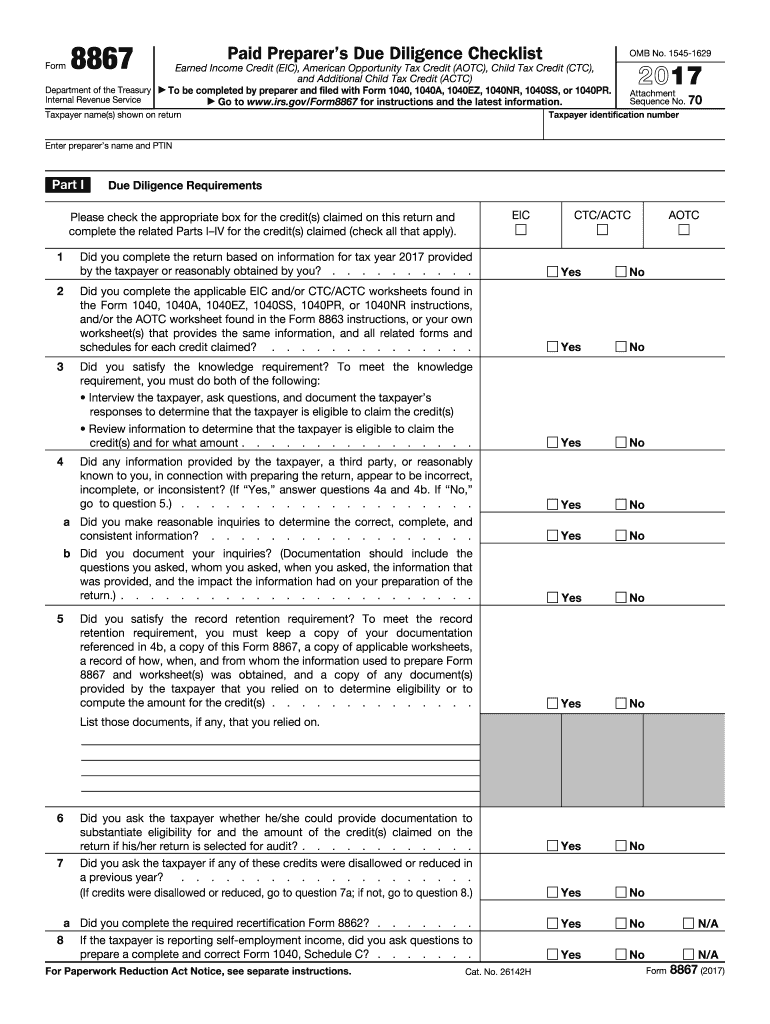

Form 8867 Fill Out and Sign Printable PDF Template signNow

Video of the day step 2 enter the year for the tax year you. Specific instructions need more space for an item? Enter the year for which you are filing this form to claim the credit(s) (for. The earned income credit, or eic, is. Web 1 best answer andreac1 level 9 you can use the steps below to help you.

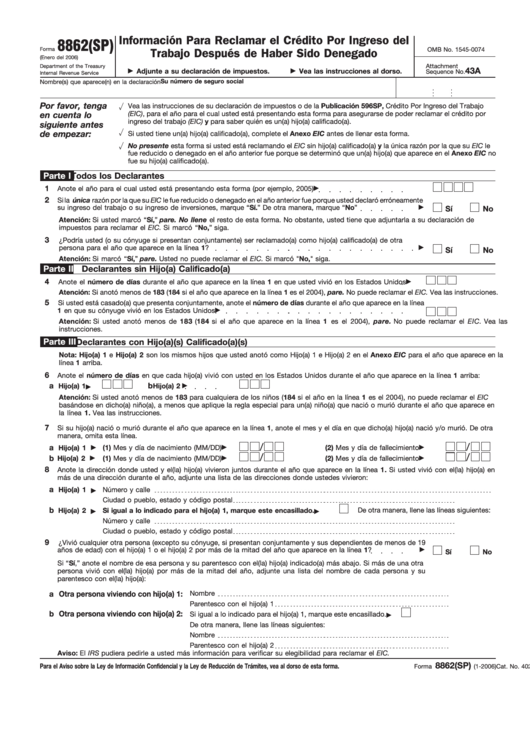

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

Specific instructions need more space for an item? Ad download or email irs 8862 & more fillable forms, try for free now! Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; Start completing the fillable fields and. Web here's how to file form 8862 in turbotax.

Irs Form 8862 Printable Master of Documents

Ad register and subscribe now to work on your irs form 8862 & more fillable forms. Use get form or simply click on the template preview to open it in the editor. Web here's how to file form 8862 in turbotax. Web how do i file an irs extension (form 4868) in turbotax online? Web step 1 using a suitable.

Fillable Form 8862(Sp) Informacion Para Reclamar El Credito Por

How do i enter form 8862?. Web if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Video of the day step 2 enter the year for the tax year you. Web here's how to file form 8862 in turbotax. Web if this happens, you then must fill out.

Form 8862 Edit, Fill, Sign Online Handypdf

Enter the year for which you are filing this form to claim the credit(s) (for. Web 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. The earned income credit, or eic, is. Web if this happens, you then must fill out form 8862 when reapplying for.

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. File an extension in turbotax online before the deadline to.

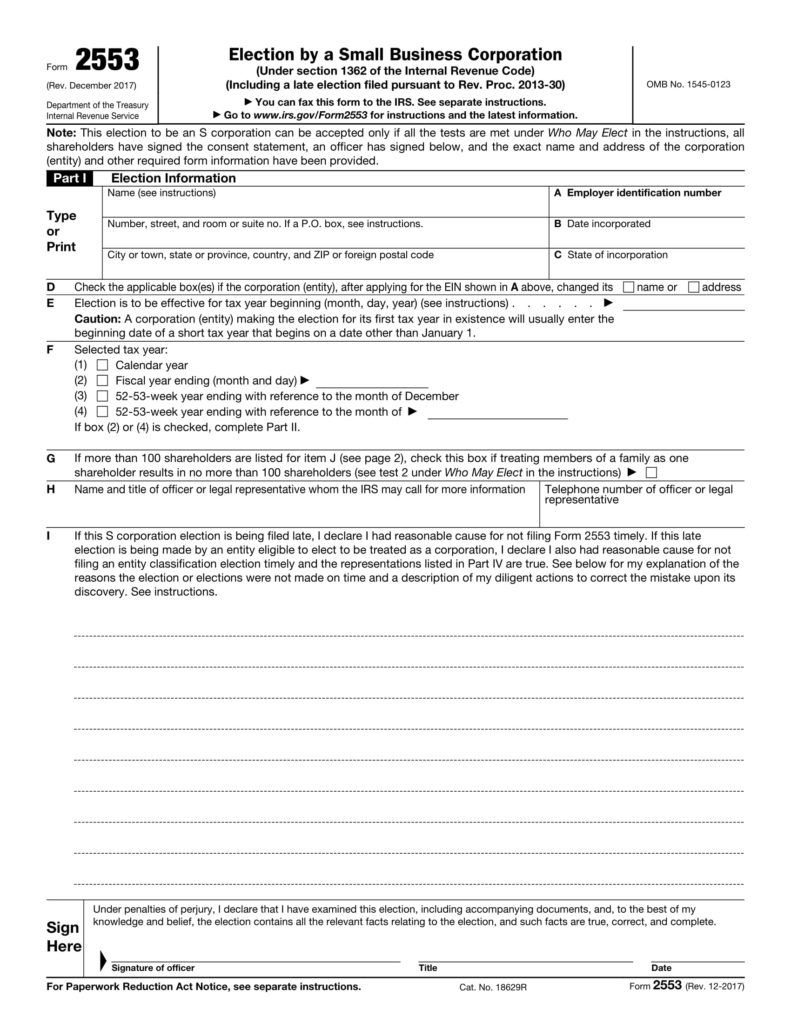

How Do You Fill Out Form 2553 Get Help Tax Remote Tax Accountants

Web here's how to file form 8862 in turbotax. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. File an extension in turbotax online before the deadline to avoid a late filing penalty. Enter the.

Web Taxpayers Complete Form 8862 And Attach It To Their Tax Return If:

How do i enter form 8862?. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; We last updated federal form 8862 in december 2022 from the federal internal revenue service. Video of the day step 2 enter the year for the tax year you.

Web More About The Federal Form 8862 Tax Credit.

Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. This form comes in pdf format and is automatically downloaded.

Web File Form 8862 If We Denied Or Reduced Your Eitc For A Tax Year After 1996 (Ctc, Actc, Odc Or Aotc For A Tax Year After 2015) For Any Reason Other Than A Math.

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. This form is for income. Web 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862.

Web Irs Form 8862 Is Used To Claim The Earned Income Tax Credit (Eitc), It The Eitc Was Disallowed Or Reduced, For Reasons Other Than Math Or Clerical Errors, After.

The earned income credit, or eic, is. Ad register and subscribe now to work on your irs form 8862 & more fillable forms. The notice instructs you to file form 8862 for any future years you are. Ad download or email irs 8862 & more fillable forms, try for free now!