Hcc Tax Form

Hcc Tax Form - If you are required to submit a copy of an irs tax transcript, you can request an irs tax. When to file (tax due dates and extensions) how to file. Students who file an amended return (irs form 1040x) must provide the following documents to complete verification: • a signed copy of the 1040x. Our 1040 solutions integrate with your existing tax software to boost efficiency. Check here if you (student) filed taxes for 2018. Virtual lobby for current/former students: File form 207/207 hcc ext and pay all the tax you expect to owe. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. If there are differences between taxes and the fafsa reported data, hcc will make the corrections.

Web addresses for forms beginning with the letter c; Attach a copy of student’s 2019 tax transcript/return) check here if you. Web people needing free help to complete their federal tax forms have a resource at housatonic community college (hcc). File this form if you received any advance payments during the calendar year of qualified. Web __ amended tax return: It shows various amounts of tuition charged,. If there are differences between taxes and the fafsa reported data, hcc will make the corrections. Students who file an amended return (irs form 1040x) must provide the following documents to complete verification: Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Web select a year.

Our 1040 solutions integrate with your existing tax software to boost efficiency. Check here if you (student) filed taxes for 2018. Form name (for a copy of form, instruction, or publication) address to mail form to irs: Web statement of student eligibility texas form. If there are differences between taxes and the fafsa reported data, hcc will make the corrections. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web addresses for forms beginning with the letter c; Attach a copy of student’s 2019 tax transcript/return) check here if you. Send all information returns filed on paper to the following. Web student services contact center.

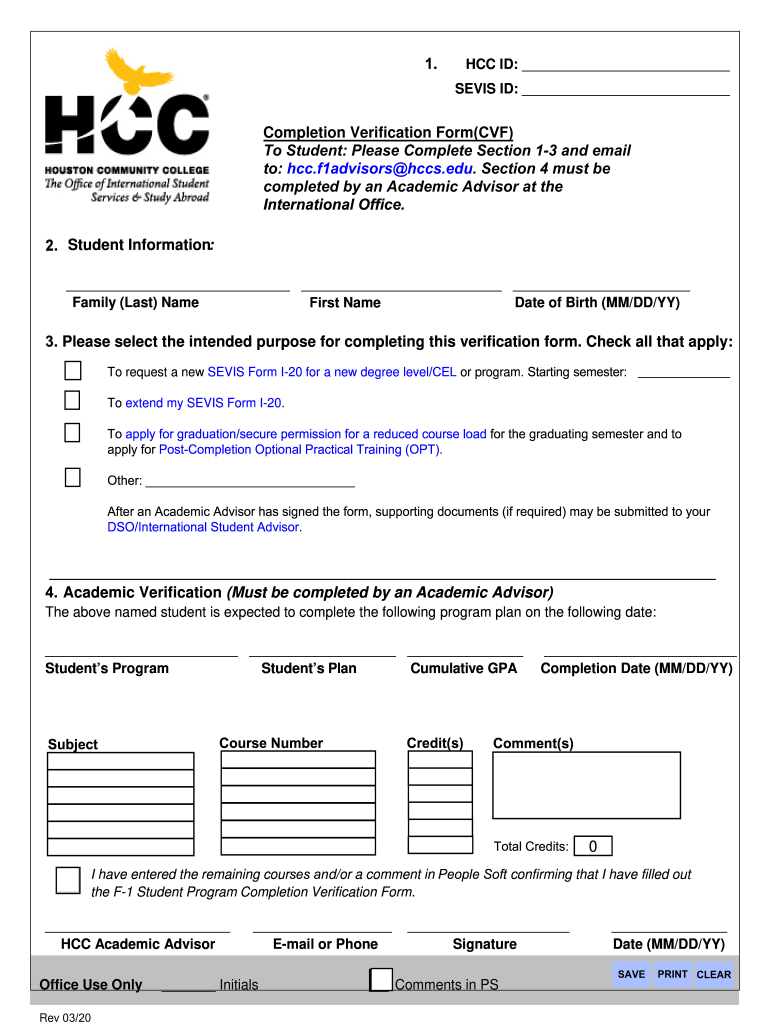

HCC Completion Verification Form 2020 Fill and Sign Printable

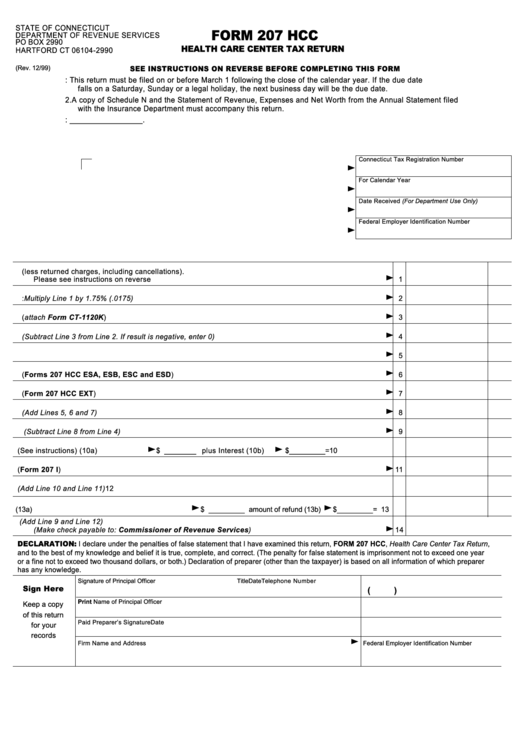

(attach a copy of student’s 2018 tax transcript/return) check here if you. Resident income tax return instructions. When to file (tax due dates and extensions) how to file. Our 1040 solutions integrate with your existing tax software to boost efficiency. Web health care center tax information.

HCC CSA 600E 20132021 Fill and Sign Printable Template Online US

Send all information returns filed on paper to the following. If there are differences between taxes and the fafsa reported data, hcc will make the corrections. (attach a copy of student’s 2018 tax transcript/return) check here if you. Our 1040 solutions integrate with your existing tax software to boost efficiency. Web people needing free help to complete their federal tax.

HCC AE 4000 20152021 Fill and Sign Printable Template Online US

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web health care center tax information. Who must file a health care center tax return. Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. Check here if you (student).

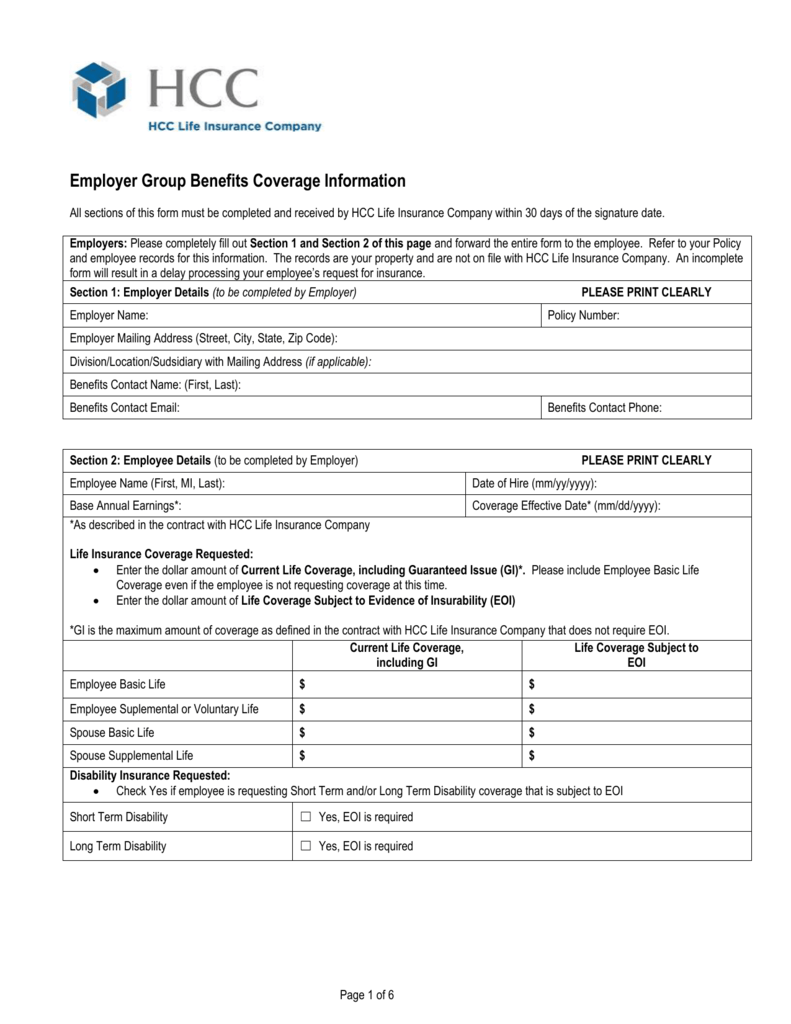

sections of this form must be completed and received by HCC Life

Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Web student services contact center. Web addresses for forms beginning with the letter c; All loan paperwork [revision requests, master promissory note, and loan entrance. Claim for refund of estimated gross income tax payment required on the sale of real property located in new.

Form 207 Hcc Health Care Center Tax Return printable pdf download

Virtual lobby for current/former students: Web student services contact center. Web select a year. Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. Form name (for a copy of form, instruction, or publication) address to mail form to irs:

2019 Form 990 for Holy Cross College (HCC) Cause IQ

It shows various amounts of tuition charged,. File form 207/207 hcc ext and pay all the tax you expect to owe. Attach a copy of student’s 2019 tax transcript/return) check here if you. Who must file a health care center tax return. Web applicable, spouse’s irs tax transcript(s) for tax year 2019.

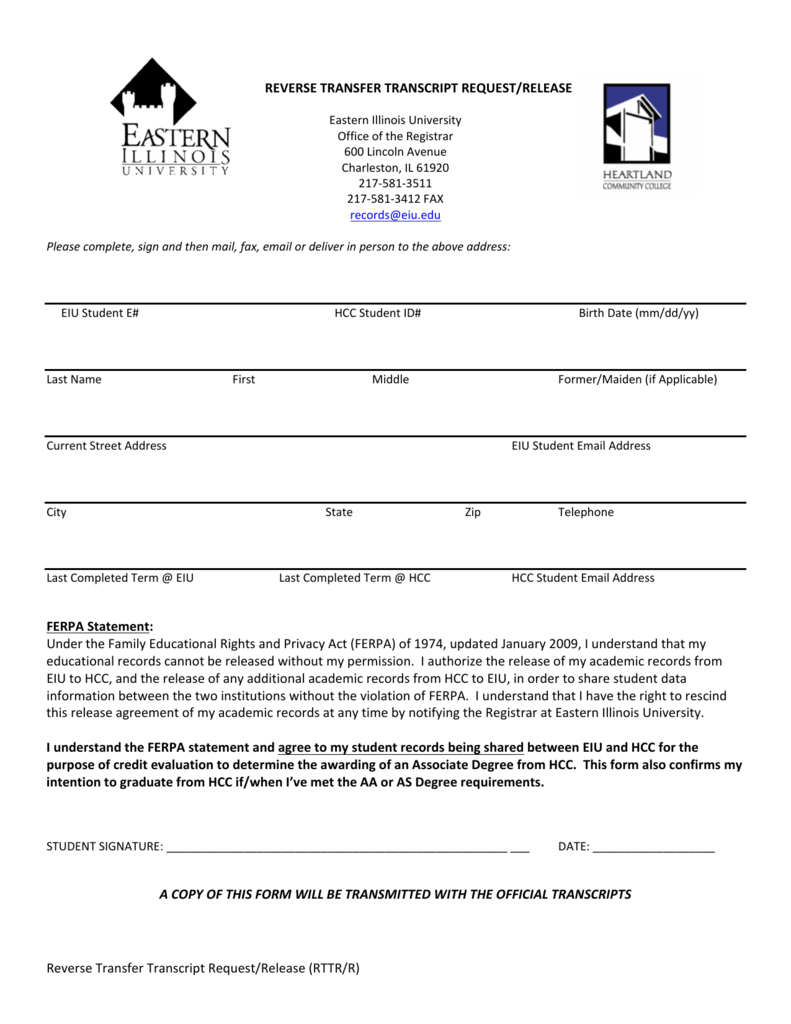

HCC Reverse Transfer Credit Form

(attach a copy of student’s 2018 tax transcript/return) check here if you. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. All loan paperwork [revision requests, master promissory note, and loan.

Ferpa Form Hcc Five Ferpa Form Hcc Rituals You Should Know In 9 AH

• a signed copy of the 1040x. Web health care center tax information. Resident income tax return instructions. Web student tax filing information check only one box below: All loan paperwork [revision requests, master promissory note, and loan entrance.

Kirkwood Community College Tax Form 19 Discover beautiful designs and

Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Web statement of student eligibility texas form. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. • a signed.

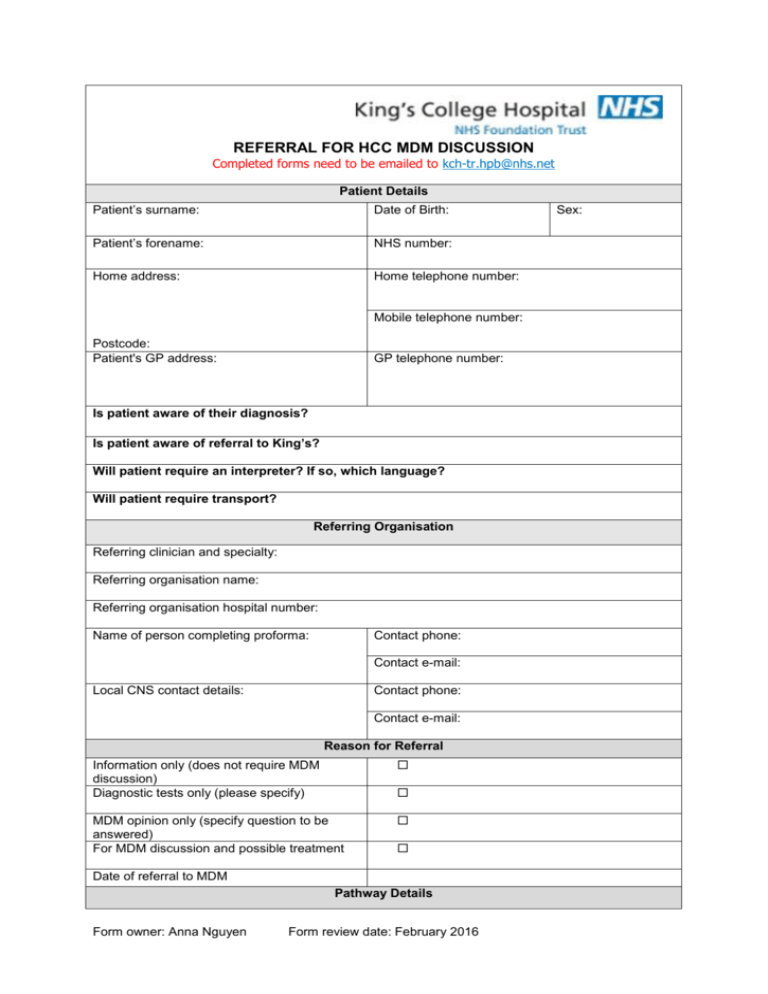

HCC referral form King's College Hospital

Web statement of student eligibility texas form. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. • a signed copy of the 1040x. Send all information returns filed on paper to the following. Attach a copy of student’s 2019 tax transcript/return) check here if you.

Check Here If You (Student) Filed Taxes For 2019.

File this form if you received any advance payments during the calendar year of qualified. Web health care center tax information. • a signed copy of the 1040x. Web • failure to provide no tax due letter from state of missouri (if applicable) 3.

Claim For Refund Of Estimated Gross Income Tax Payment Required On The Sale Of Real Property Located In New.

Web student tax filing information check only one box below: Resident income tax return instructions. File form 207/207 hcc ext and pay all the tax you expect to owe. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,.

Attach A Copy Of Student’s 2019 Tax Transcript/Return) Check Here If You.

Students who file an amended return (irs form 1040x) must provide the following documents to complete verification: Who must file a health care center tax return. Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Web addresses for forms beginning with the letter c;

Web Select A Year.

Web __ amended tax return: Web student services contact center. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web statement of student eligibility texas form.