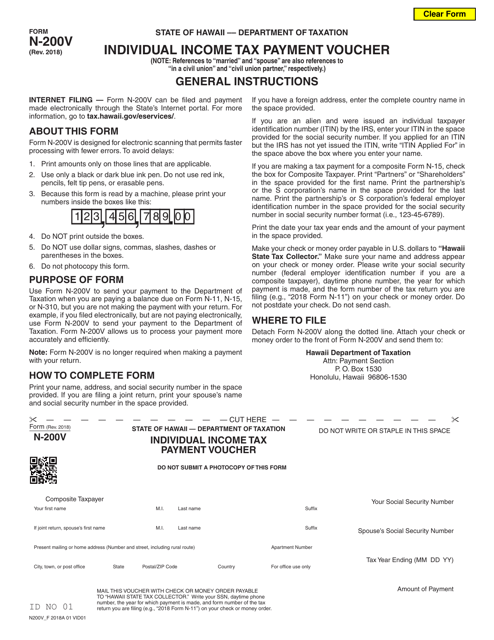

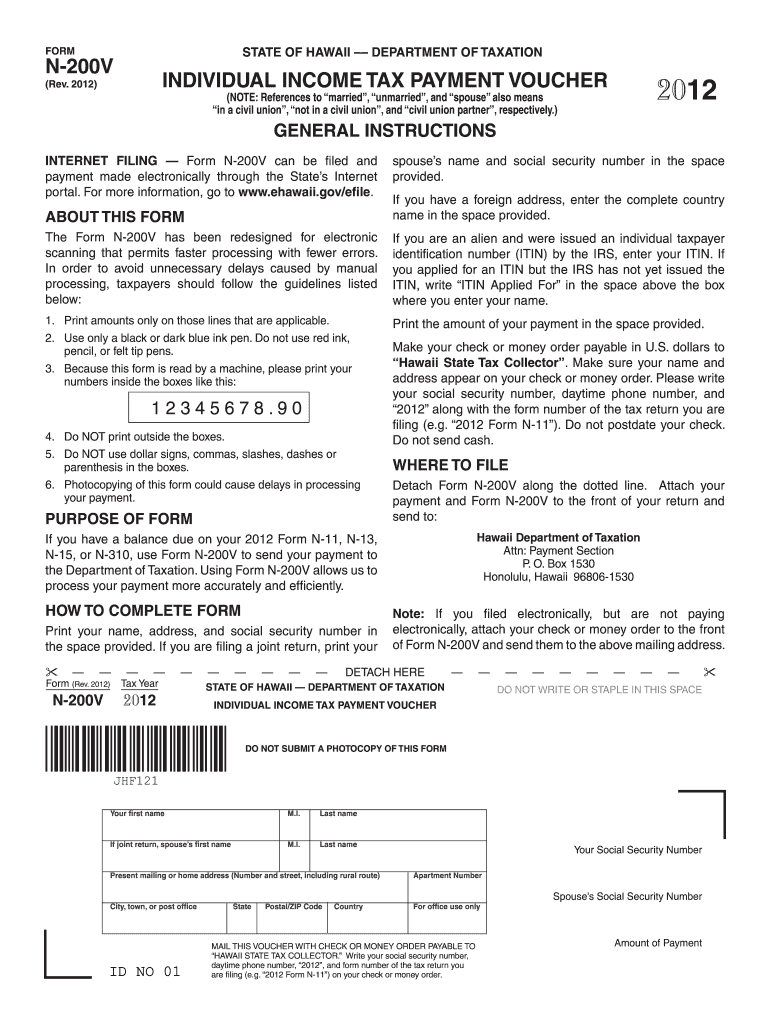

Hawaii Form N 200V

Hawaii Form N 200V - Reference sheet with hawaii tax schedule and credits. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v or save rate the hawaii tax form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. If you cannot pay the full amount of taxes you owe, you should still file. Web what makes the hawaii form n 200v legally binding? For more information, go to. Individual income tax payment voucher : Do not postdate your check. Form made electronically through the state’s internet portal. Web click on new document and choose the file importing option:

Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web what makes the hawaii form n 200v legally binding? Web form n200v is a hawaii other form. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v or save rate the hawaii tax form. Do not postdate your check. If you cannot pay the full amount of taxes you owe, you should still file. Web click on new document and choose the file importing option: Form made electronically through the state’s internet portal. Fast tax reference guide 2017 4 pages, 227 kb, 02/16/2018.

Web what makes the hawaii form n 200v legally binding? Fast tax reference guide 2017 4 pages, 227 kb, 02/16/2018. Reference sheet with hawaii tax schedule and credits. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v or save rate the hawaii tax form. Do not postdate your check. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: Form made electronically through the state’s internet portal. This form is for income earned in tax year 2022, with tax returns due in april. Web form n200v is a hawaii other form.

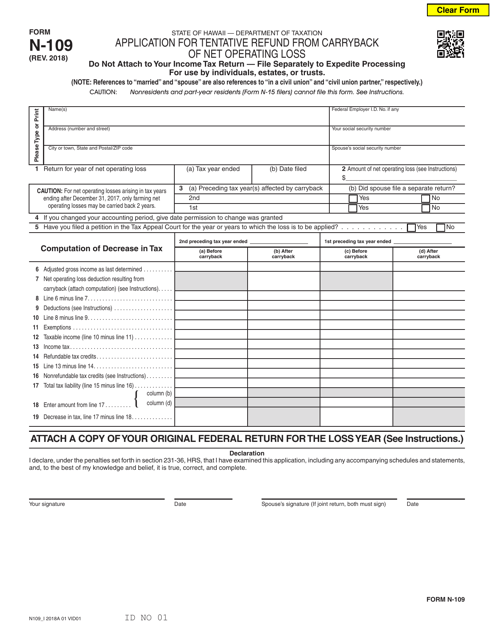

Form N109 Download Fillable PDF or Fill Online Application for

Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Form made electronically through the state’s internet portal. Web click on new document and choose the file importing option: If you cannot.

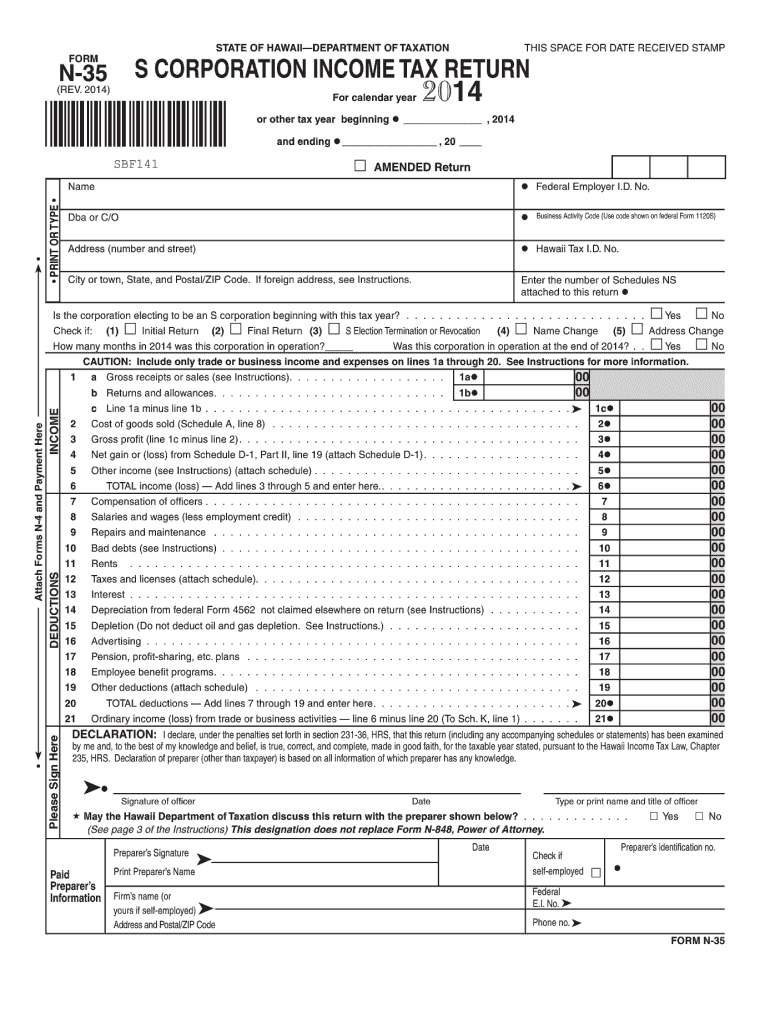

Hawaii Form N 35 Instructions 2019 Fill Out and Sign Printable PDF

Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: Do not postdate your check. Reference sheet with hawaii tax schedule and credits. Web click on new document and choose the file importing option: Web form n200v is a hawaii other form.

Form N200V Download Fillable PDF or Fill Online Individual Tax

Web form n200v is a hawaii other form. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v or save rate the hawaii tax form. Form made electronically through the state’s internet portal. Fast tax reference guide 2017 4 pages,.

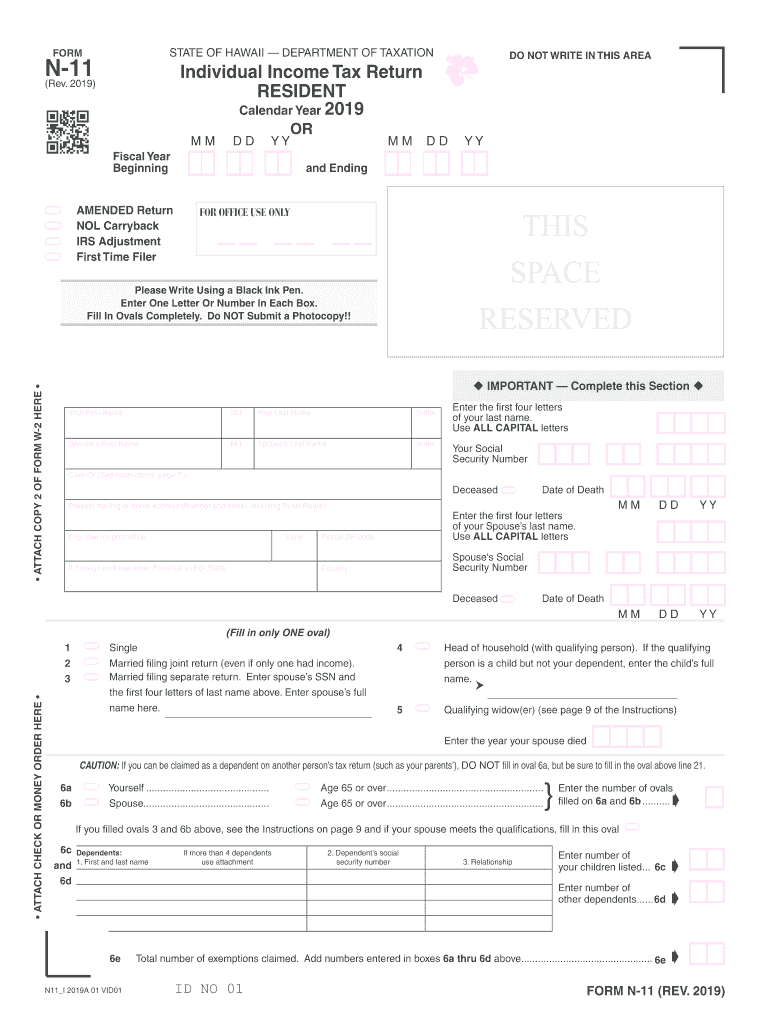

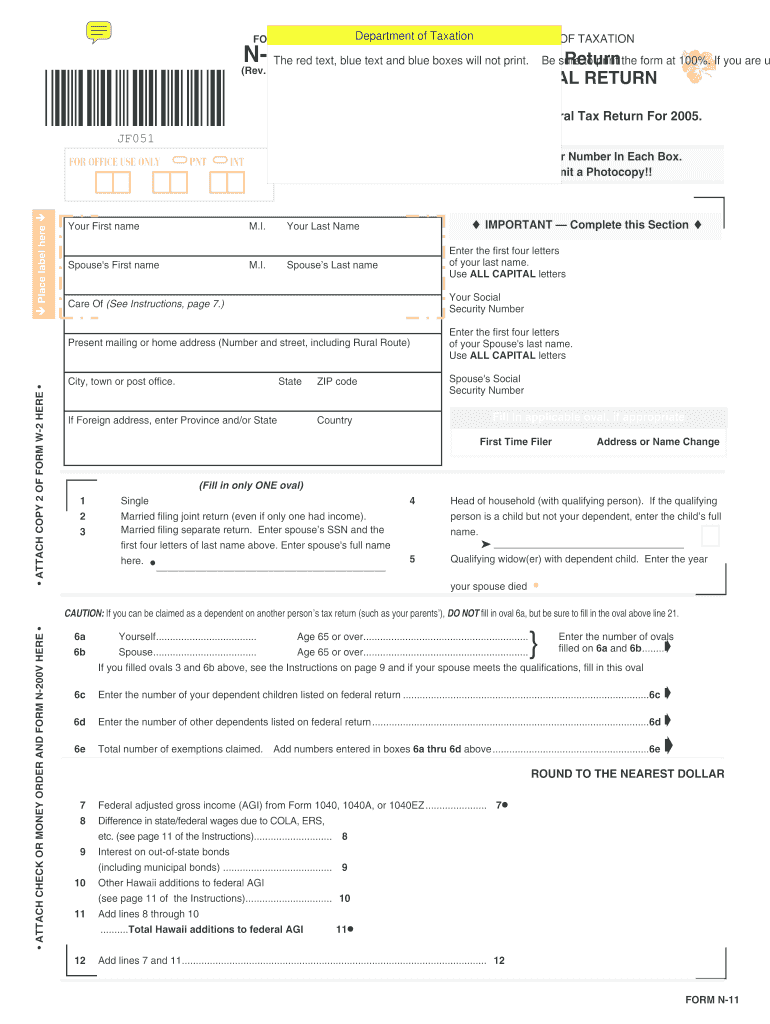

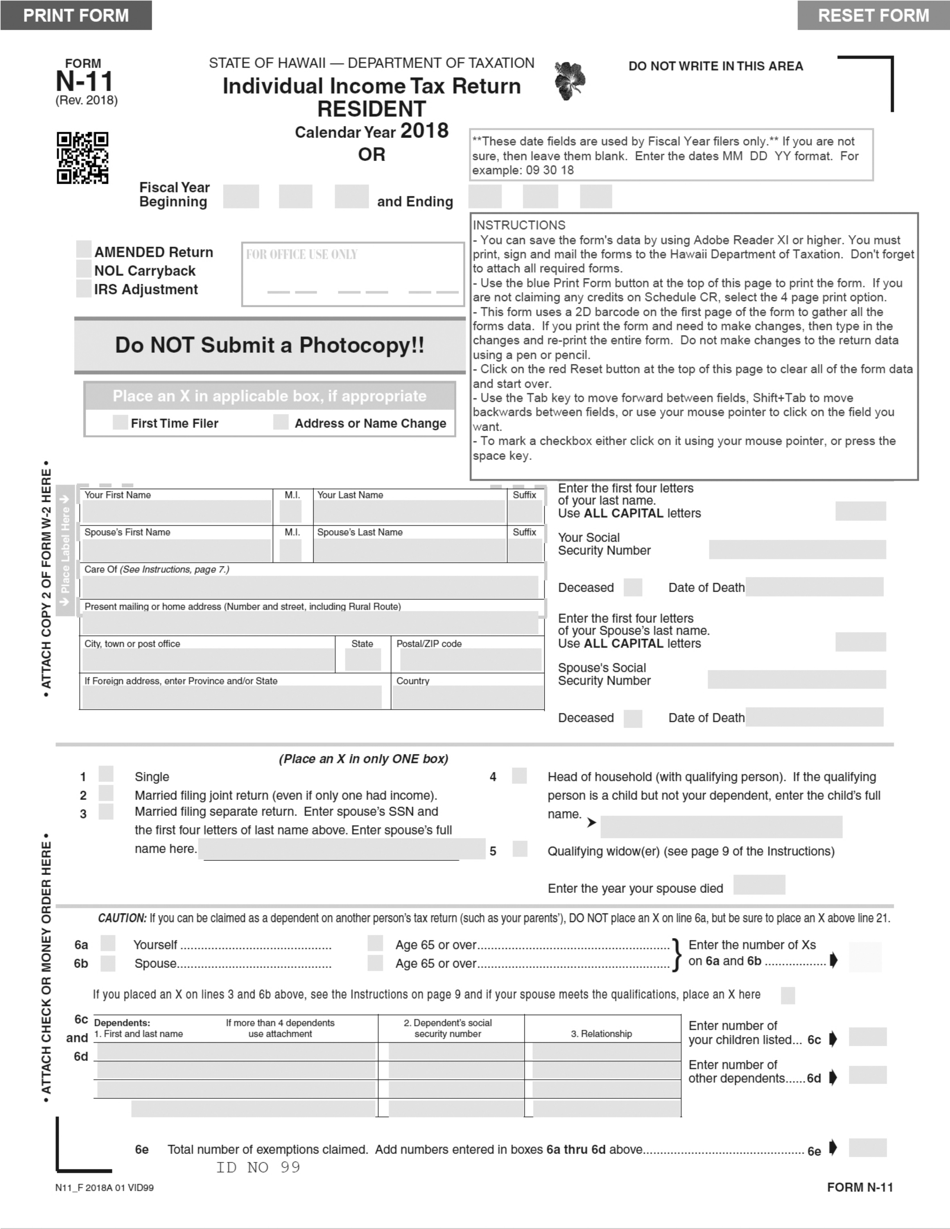

2019 N11 Form Fill Out and Sign Printable PDF Template signNow

Individual income tax payment voucher : Web form n200v is a hawaii other form. This form is for income earned in tax year 2022, with tax returns due in april. Reference sheet with hawaii tax schedule and credits. Do not postdate your check.

2019 Form HI DoT N288C Fill Online, Printable, Fillable, Blank PDFfiller

Web form n200v is a hawaii other form. Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: For more information, go to. Web click on new document and choose the file importing option: Form made electronically through the state’s internet portal.

Hawaii Form N 200v 2021 Fill Out and Sign Printable PDF Template

This form is for income earned in tax year 2022, with tax returns due in april. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v or save rate the hawaii tax form. Payment vouchers are provided to accompany checks.

Form N163 Download Fillable PDF or Fill Online Fuel Tax Credit for

Web what makes the hawaii form n 200v legally binding? Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. This form is for income earned in tax year 2022, with tax returns due in april. Web how it works open the form n 200v and follow.

Hawaii Form N 11 Fill Out and Sign Printable PDF Template signNow

Individual income tax payment voucher (tax return payment, estimated tax payment, extension payment) form link: If you cannot pay the full amount of taxes you owe, you should still file. Web how it works open the form n 200v and follow the instructions easily sign the hawaii form n 200v with your finger send filled & signed hawaii n 200v.

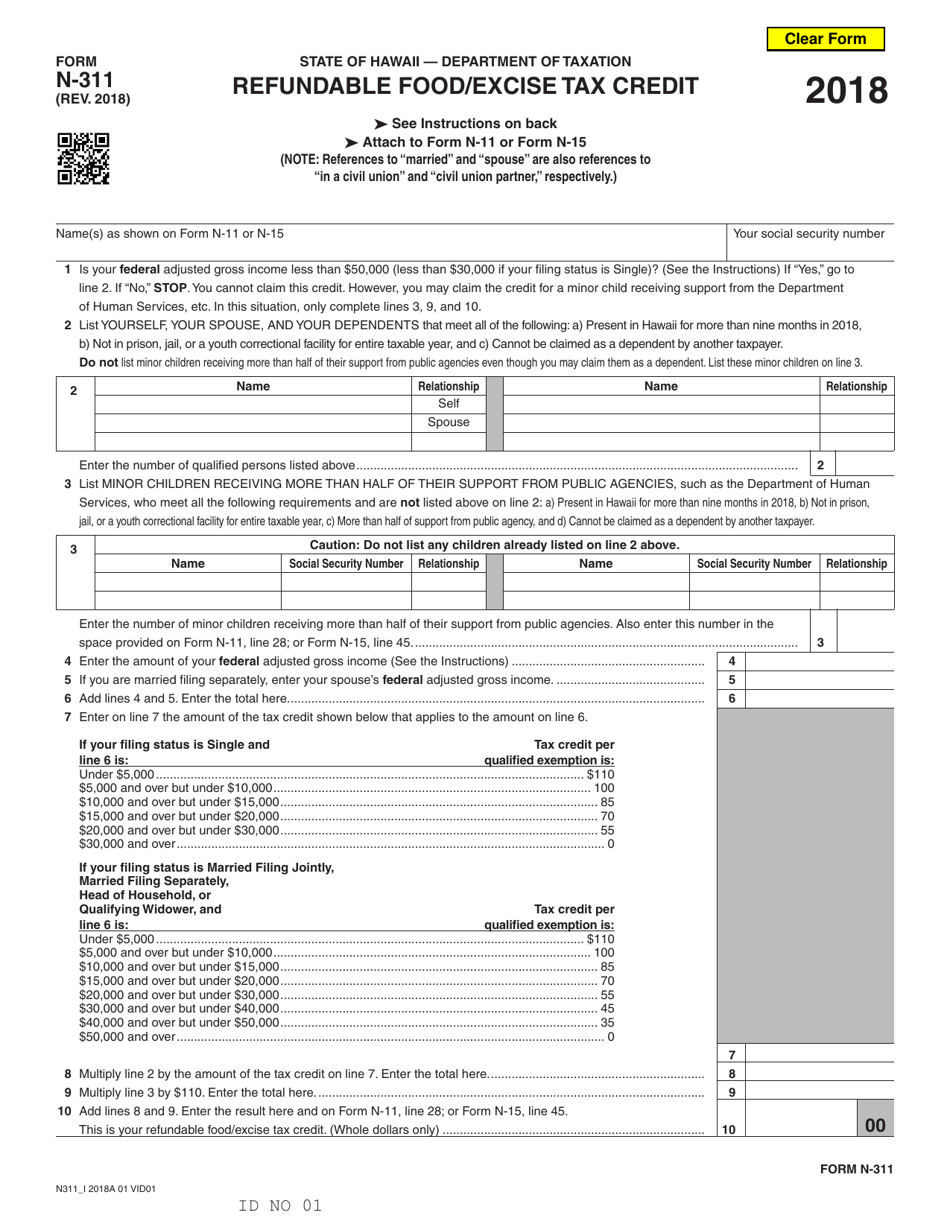

Form N311 Download Fillable PDF or Fill Online Refundable Food/Excise

Web form n200v is a hawaii other form. Fast tax reference guide 2017 4 pages, 227 kb, 02/16/2018. Do not postdate your check. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web what makes the hawaii form n 200v legally binding?

Form N11 Download Fillable PDF or Fill Online Individual Tax

If you cannot pay the full amount of taxes you owe, you should still file. Web form n200v is a hawaii other form. Form made electronically through the state’s internet portal. Web click on new document and choose the file importing option: Web how it works open the form n 200v and follow the instructions easily sign the hawaii form.

Individual Income Tax Payment Voucher (Tax Return Payment, Estimated Tax Payment, Extension Payment) Form Link:

Web click on new document and choose the file importing option: Web what makes the hawaii form n 200v legally binding? Do not postdate your check. For more information, go to.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Fast tax reference guide 2017 4 pages, 227 kb, 02/16/2018. Reference sheet with hawaii tax schedule and credits. Individual income tax payment voucher : Form made electronically through the state’s internet portal.

Web How It Works Open The Form N 200V And Follow The Instructions Easily Sign The Hawaii Form N 200V With Your Finger Send Filled & Signed Hawaii N 200V Or Save Rate The Hawaii Tax Form.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. If you cannot pay the full amount of taxes you owe, you should still file. Web form n200v is a hawaii other form.