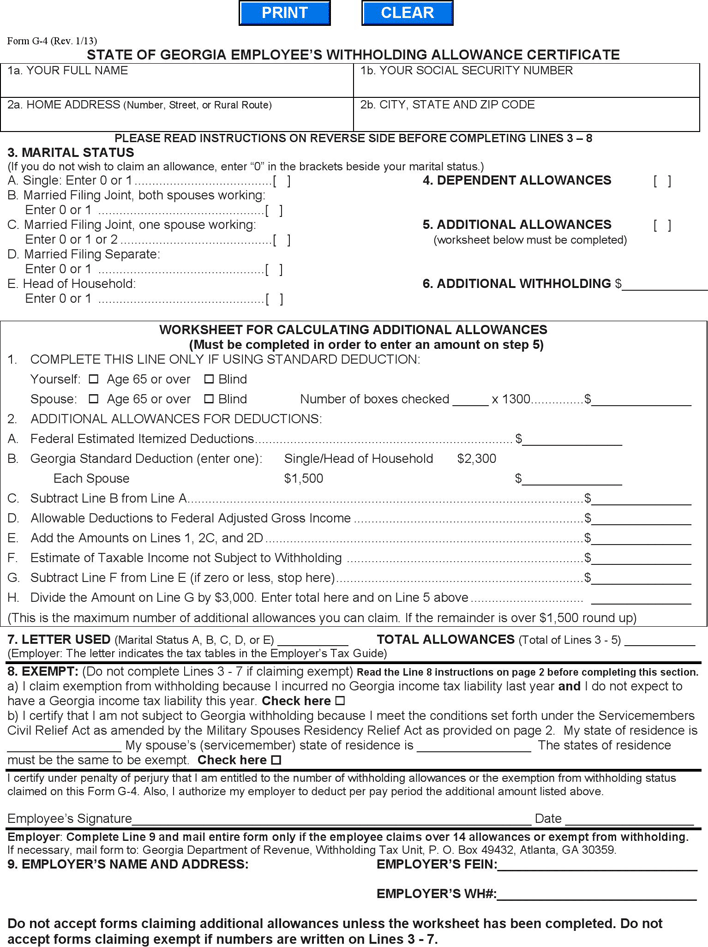

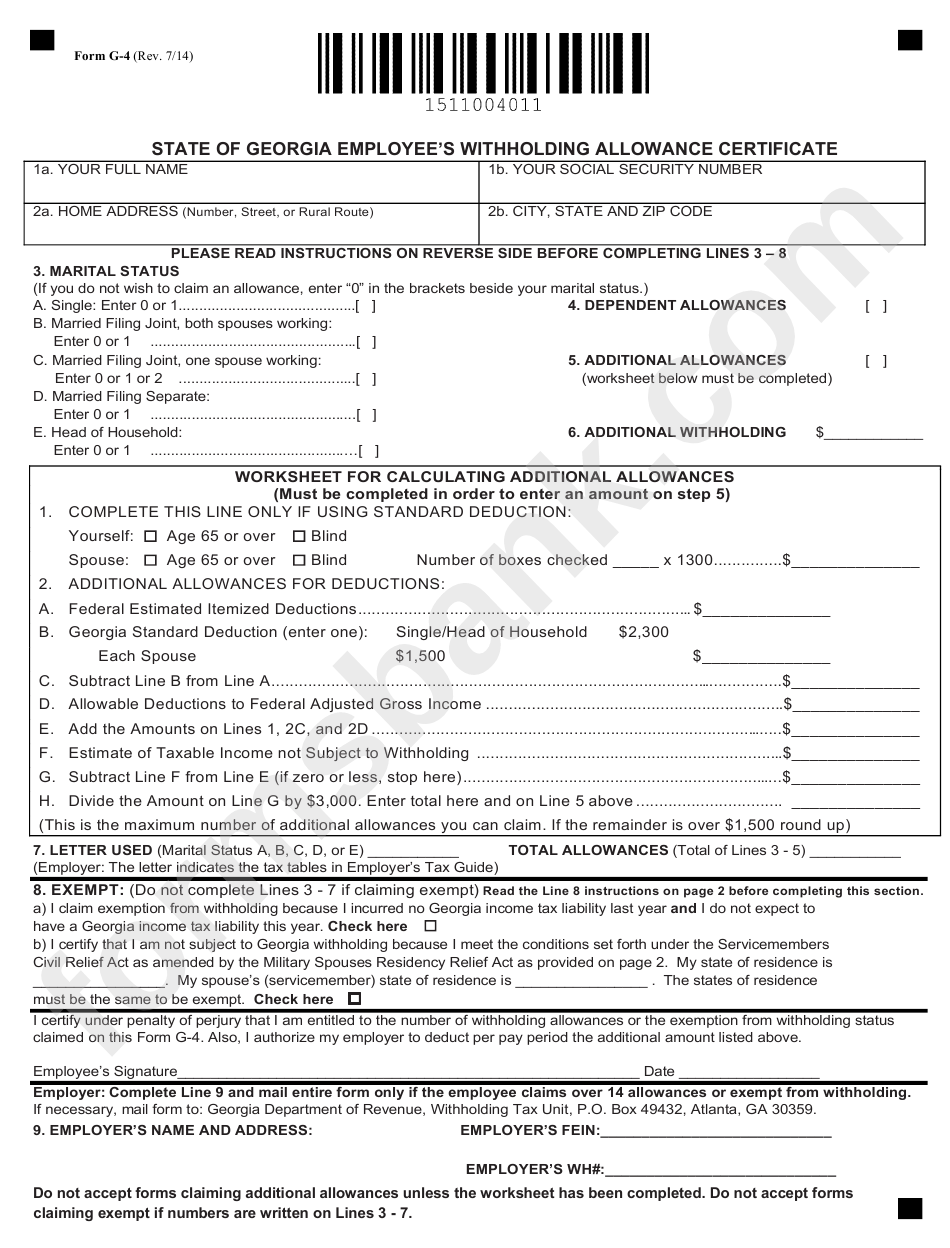

Georgia Form G 4

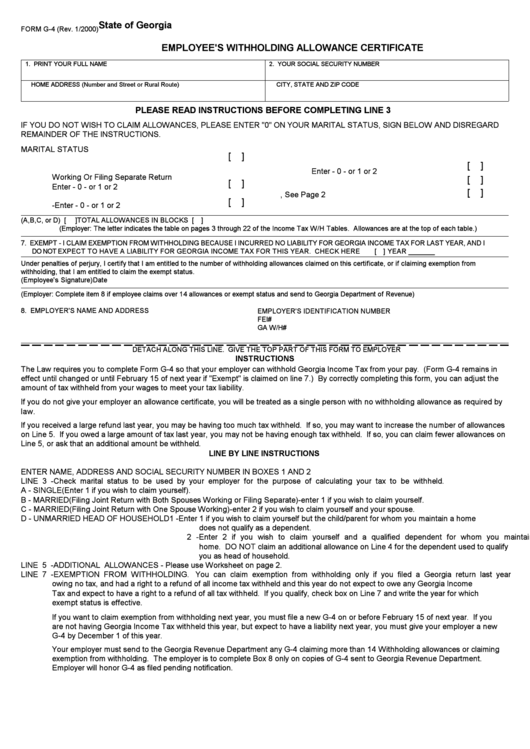

Georgia Form G 4 - Use this form to tell. By correctly completing this form, you can. This form is for income earned in tax year 2022, with tax returns due in april. All retirees age 62 and. Indicate the appropriate tax filing options. Easily fill out pdf blank, edit, and sign them. The forms will be effective with the first paycheck. Georgia department of revenue, taxpayer services division, p.o. Withholding certificate for pension or annuity payment. Use this form to tell.

If you do not provide. Web if necessary, mail form to: Use this form to tell. Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Georgia department of revenue, taxpayer services division, p.o. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Box 105499, atlanta, ga 30359. All retirees age 62 and. Complete, edit or print tax forms instantly. The forms will be effective with the first paycheck.

Use this form to tell. By correctly completing this form, you can. If you do not provide. Your tax liability is the amount on. Save or instantly send your ready documents. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Web if necessary, mail form to: Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. Use this form to tell.

Free Form G PDF 194KB 2 Page(s)

Withholding certificate for pension or annuity payment. All retirees age 62 and. Georgia department of revenue, taxpayer services division, p.o. Do not withhold georgia state income tax from my monthly. Web if necessary, mail form to:

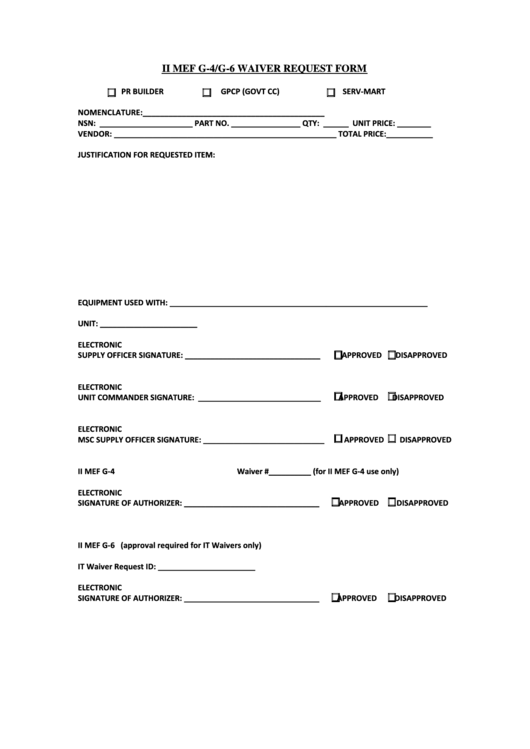

Ii Mef G4 G6 Waiver Request Form printable pdf download

Web your employer withheld $500 of georgia income tax from your wages. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. The forms will be effective with the first paycheck. Use this form to tell.

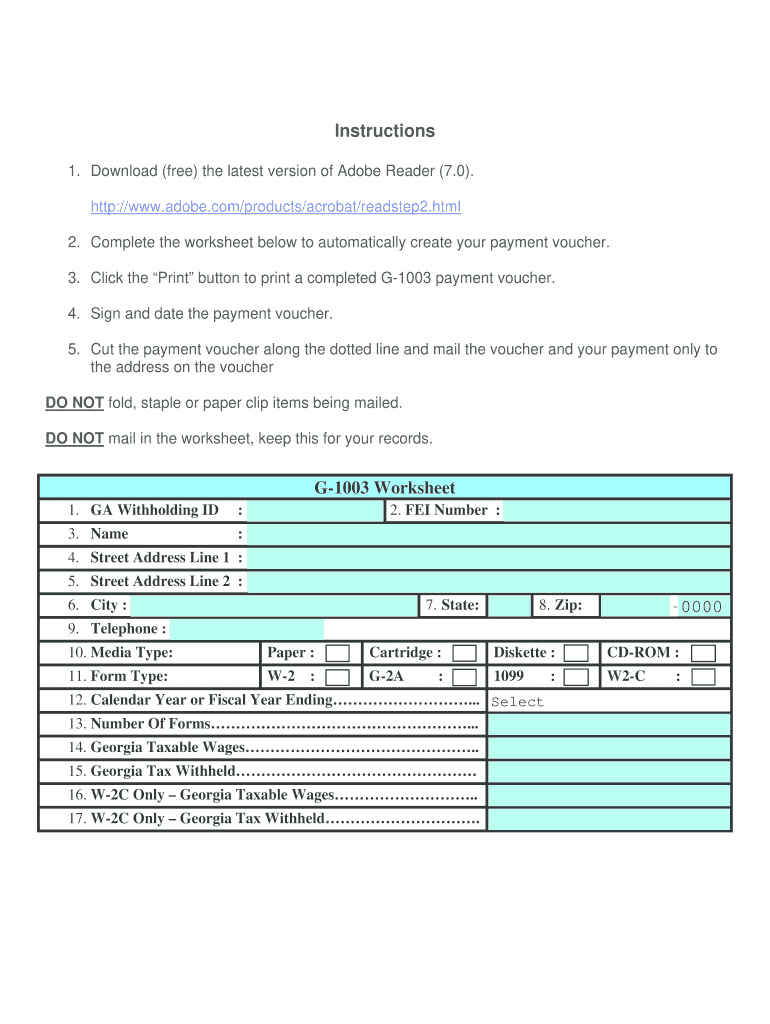

2006 Form GA DoR G1003 Fill Online, Printable, Fillable, Blank PDFfiller

For recipients of income from annuities, pensions, and certain other deferred compensation plans. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). By correctly completing this form, you can. Register and edit, fill, sign now your ga withholding allowance certificate. Use this form to tell.

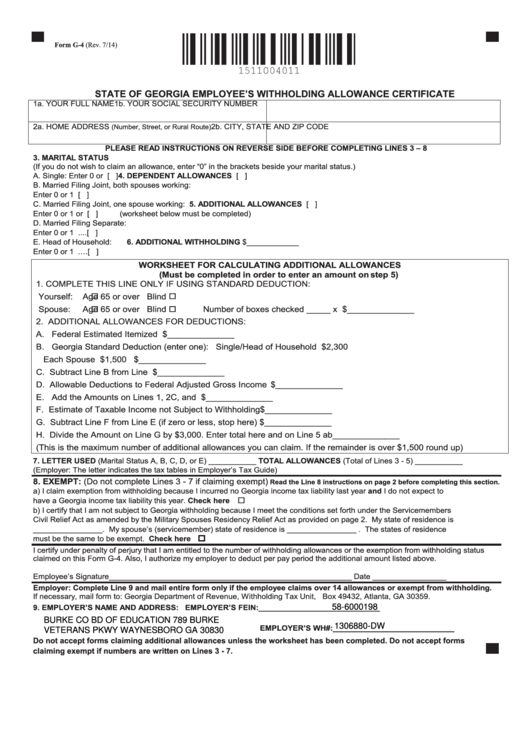

Fillable Form G4 Employee'S Withholding Allowance Certificate

Web your employer withheld $500 of georgia income tax from your wages. If you do not provide. Web if necessary, mail form to: The forms will be effective with the first paycheck. All retirees age 62 and.

1+ Do Not Resuscitate Form Free Download

Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Box 105499, atlanta, ga 30359. All retirees age 62 and.

G4 Form

Use this form to tell. Save or instantly send your ready documents. The forms will be effective with the first paycheck. Do not withhold georgia state income tax from my monthly. Web your employer withheld $500 of georgia income tax from your wages.

LOGO

Register and edit, fill, sign now your ga withholding allowance certificate. Web if necessary, mail form to: Complete, edit or print tax forms instantly. Use this form to tell. Do not withhold georgia state income tax from my monthly.

Form G4 State Of Employee'S Withholding Allowance

If you do not provide. Indicate the appropriate tax filing options. The forms will be effective with the first paycheck. For recipients of income from annuities, pensions, and certain other deferred compensation plans. By correctly completing this form, you can.

Withholding Tax Tables 2018

Use this form to tell. Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Easily fill out pdf blank, edit, and sign them. Register and edit, fill, sign now your ga withholding allowance certificate. Indicate the appropriate tax filing options.

Form G4 Employee'S Withholding Allowance Certificate January 2000

Box 105499, atlanta, ga 30359. Georgia department of revenue, taxpayer services division, p.o. Indicate the appropriate tax filing options. Do not withhold georgia state income tax from my monthly. Save or instantly send your ready documents.

Register And Edit, Fill, Sign Now Your Ga Withholding Allowance Certificate.

For recipients of income from annuities, pensions, and certain other deferred compensation plans. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on. Web if necessary, mail form to: All retirees age 62 and.

The Amount On Line 4 Of Form 500Ez (Or Line 16 Of Form 500) Was $0 (Zero).

By correctly completing this form, you can. Georgia department of revenue, taxpayer services division, p.o. Your tax liability is the amount on. The forms will be effective with the first paycheck.

Box 105499, Atlanta, Ga 30359.

Indicate the appropriate tax filing options. By correctly completing this form, you can. Use this form to tell. Save or instantly send your ready documents.

Withholding Certificate For Pension Or Annuity Payment.

Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Do not withhold georgia state income tax from my monthly. Web your employer withheld $500 of georgia income tax from your wages. Easily fill out pdf blank, edit, and sign them.