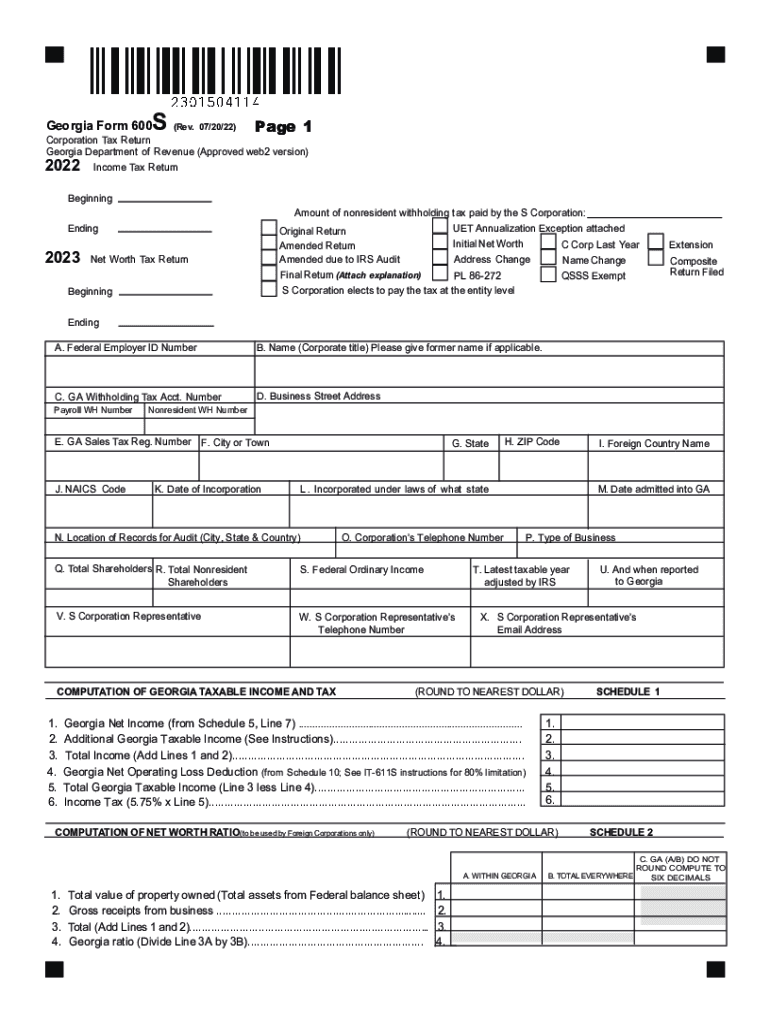

Georgia Form 600S Instructions 2022

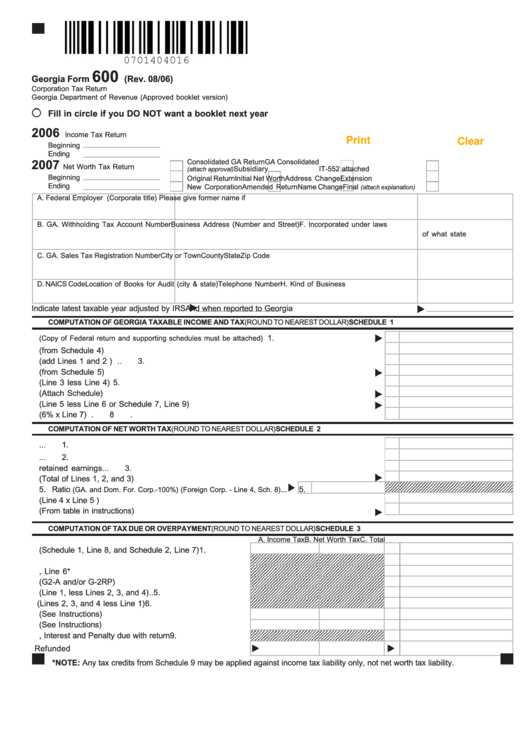

Georgia Form 600S Instructions 2022 - Print blank form > georgia department of revenue. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Complete, edit or print tax forms instantly. Web complete georgia 600s instructions online with us legal forms. 07/20/22) 20 jul 2022 — if prepared by a person other than the taxpayer, this declaration is based. Because the world takes a step away from office work, the execution of paperwork increasingly. 08/02/21) page 1 corporation tax return (approved web version) 2021 georgia department of revenue income tax return beginning ending 2022 net. Due dates for partnership returns partnership returns are due on or. Web georgia taxable income (see instructions). A consent agreement of nonresident shareholders of s corporations.

Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. Because the world takes a step away from office work, the execution of paperwork increasingly. Assigned tax credits (round to nearest dollar). Web satisfied 92 votes what makes the georgia tax form 600 legally binding? Amount to be credited to 2022 estimated tax. Web georgia form 600s (rev. You can download or print current or past. Complete, edit or print tax forms instantly. Computation of tax due or overpayment (round to nearest dollar) schedule 4. Web click on new document and select the form importing option:

Electronic filing the georgia department of revenue accepts visa,. Assigned tax credits (round to nearest dollar). 08/02/21) page 1 corporation tax return (approved web version) 2021 georgia department of revenue income tax return beginning ending 2022 net. Due dates for partnership returns partnership returns are due on or. Any tax credits from schedule 11 may be applied against income tax liability only, not. Easily fill out pdf blank, edit, and sign them. Web complete georgia 600s instructions online with us legal forms. Corporation income tax general instructions booklet. Web georgia department of revenue save form. Web file form 600s and pay the tax electronically.

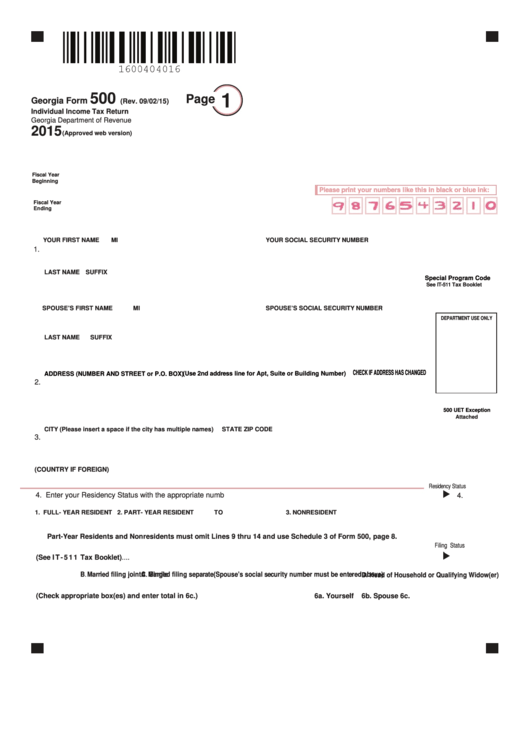

Fillable Form 500 Indvidual Tax Form

Computation of tax due or overpayment (round to nearest dollar) schedule 4. For calendar year or fiscal year beginning and ending. As defined in the income tax laws of georgia, only in cases of nonresident. Web click on new document and select the form importing option: Electronic filing the georgia department of revenue accepts visa,.

¿Quién es el sujeto pasivo en el modelo 600? Tucuerpohabla.es

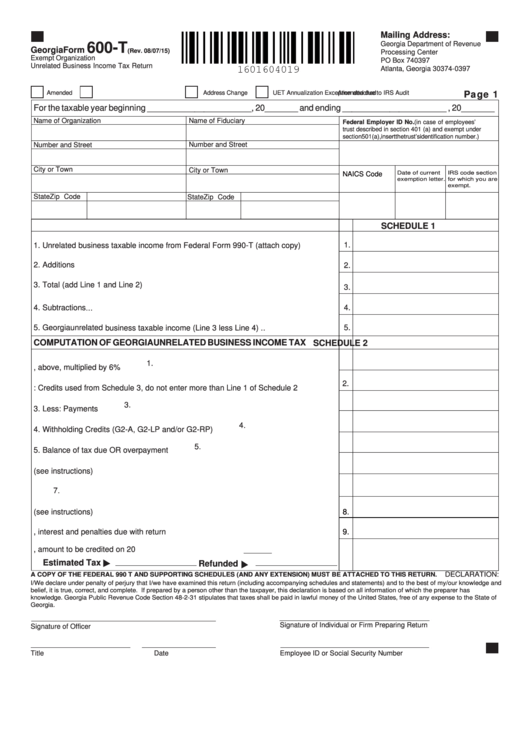

Corporation income tax general instructions booklet. Web georgia form 600s (rev. As defined in the income tax laws of georgia, only in cases of nonresident. Loss year loss amount income year nol utilized. Electronic filing the georgia department of revenue accepts visa,.

Form Marriage Fill Online, Printable, Fillable, Blank pdfFiller

Electronic filing the georgia department of revenue accepts visa,. Computation of tax due or overpayment (round to nearest dollar) schedule 4. Web georgia department of revenue save form. Download this form print this form more about the. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month.

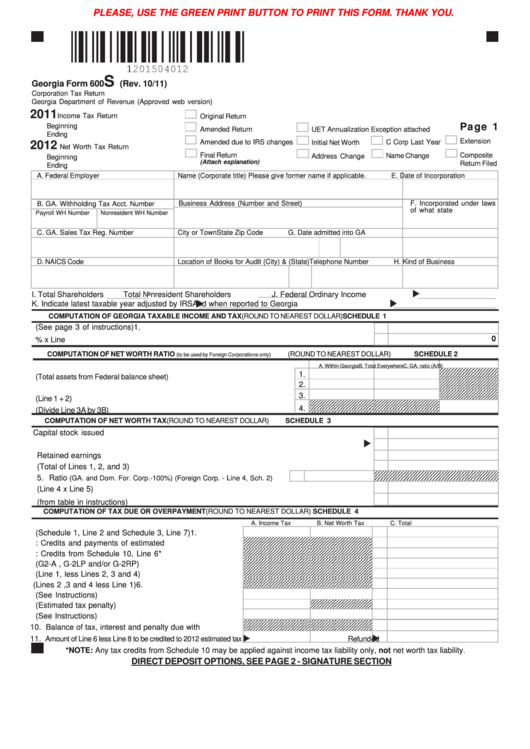

Fillable Form 600s Corporation Tax Return printable pdf download

Web georgia department of revenue save form. As defined in the income tax laws of georgia, only in cases of nonresident. Print blank form > georgia department of revenue. Web print blank form > georgia department of revenue print 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611.

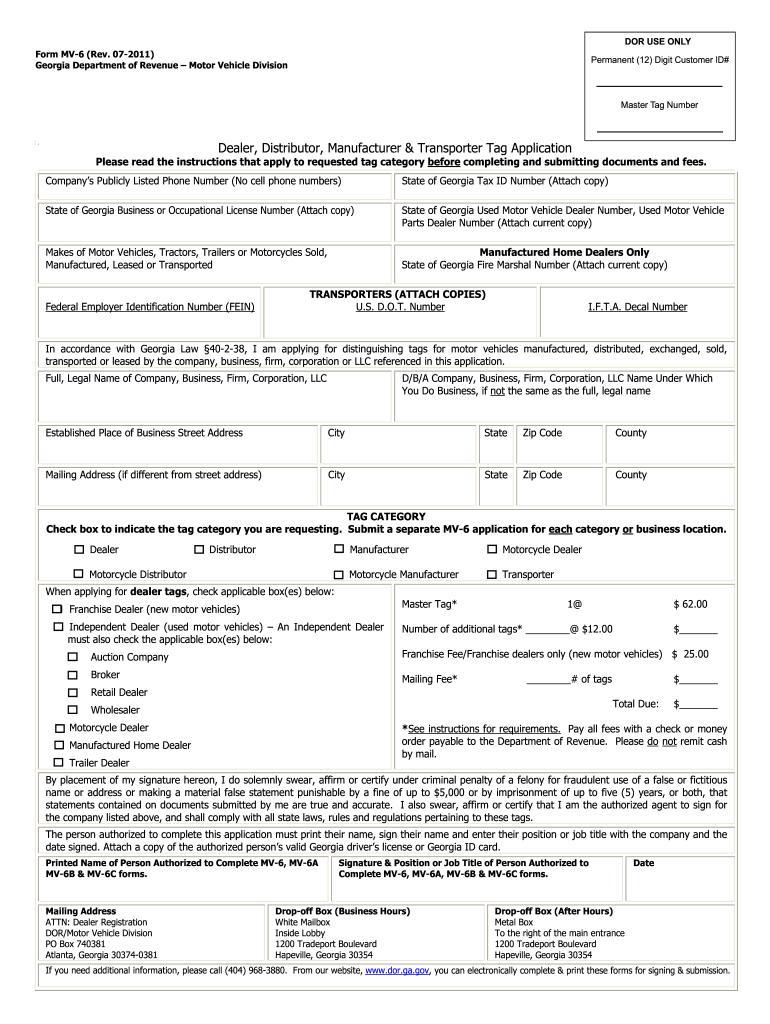

Gavsv 6A Fill Out and Sign Printable PDF Template signNow

Due dates for partnership returns partnership returns are due on or. You can download or print current or past. Electronic filing the georgia department of revenue accepts visa,. Corporation income tax general instructions booklet. Web print blank form > georgia department of revenue print

Form 600 Instructions 2022 Fill Out and Sign Printable PDF

You can download or print current or past. Complete, edit or print tax forms instantly. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web it appears you don't have a pdf plugin for this browser. Web satisfied 92 votes what makes the georgia tax form.

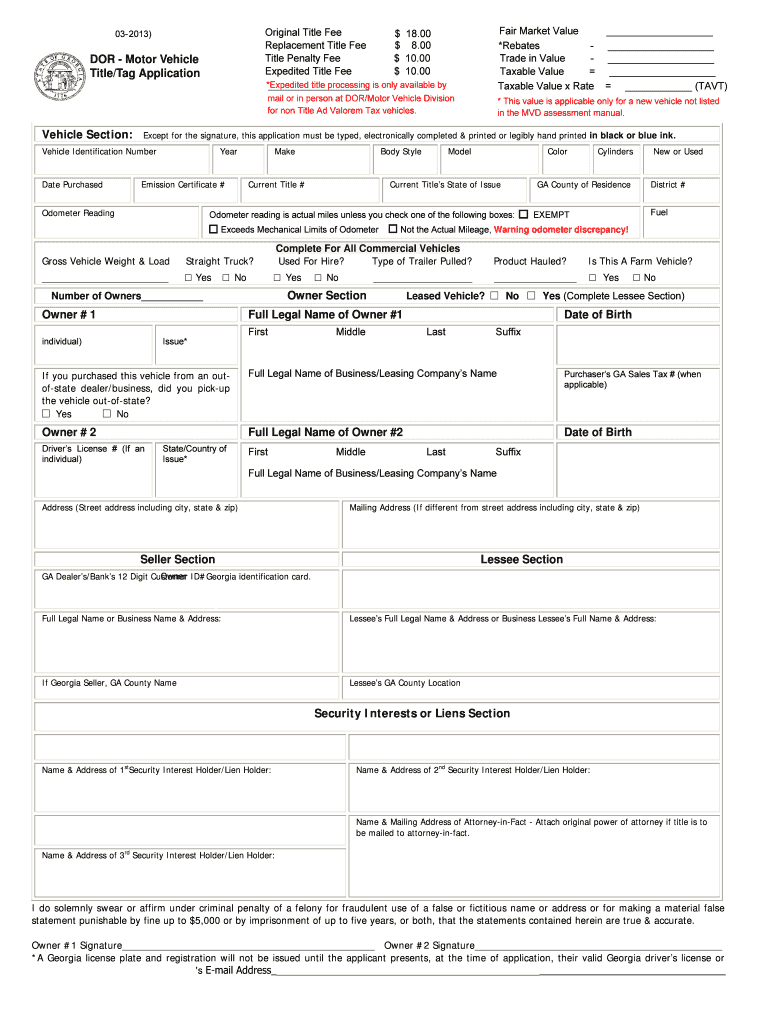

2006 Form GA MV1 Fill Online, Printable, Fillable, Blank PDFfiller

For calendar year or fiscal year beginning and ending. Loss year loss amount income year nol utilized. Complete, edit or print tax forms instantly. Web satisfied 92 votes what makes the georgia tax form 600 legally binding? Get ready for tax season deadlines by completing any required tax forms today.

Top 92 Tax Forms And Templates free to download in PDF

Print blank form > georgia department of revenue. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. Web file form 600s and pay the tax electronically. Visit our website dor.georgia.govfor more information. You can download or print current or past.

2005 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

Web it appears you don't have a pdf plugin for this browser. Download this form print this form more about the. Corporation income tax general instructions booklet. 07/20/22) 20 jul 2022 — if prepared by a person other than the taxpayer, this declaration is based. Web corporate income and net worth tax returns (form 600) must be filed on or.

Fillable Form 600 Corporation Tax Return Department Of

Computation of tax due or overpayment (round to nearest dollar) schedule 4. Easily fill out pdf blank, edit, and sign them. Due dates for partnership returns partnership returns are due on or. Web satisfied 92 votes what makes the georgia tax form 600 legally binding? Visit our website dor.georgia.govfor more information.

For Calendar Year Or Fiscal Year Beginning And Ending.

Web satisfied 92 votes what makes the georgia tax form 600 legally binding? Learn more instructions for c and s corporation. Visit our website dor.georgia.govfor more information. A consent agreement of nonresident shareholders of s corporations.

Because The World Takes A Step Away From Office Work, The Execution Of Paperwork Increasingly.

08/02/21) page 1 corporation tax return (approved web version) 2021 georgia department of revenue income tax return beginning ending 2022 net. Due dates for partnership returns partnership returns are due on or. Web georgia taxable income (see instructions). Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month.

Computation Of Tax Due Or Overpayment (Round To Nearest Dollar) Schedule 4.

Web file form 600s and pay the tax electronically. Amount to be credited to 2022 estimated tax. You can download or print current or past. As defined in the income tax laws of georgia, only in cases of nonresident.

Loss Year Loss Amount Income Year Nol Utilized.

Web it appears you don't have a pdf plugin for this browser. Web georgia department of revenue save form. Print blank form > georgia department of revenue. Web georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c.