Ga Estimated Tax Form

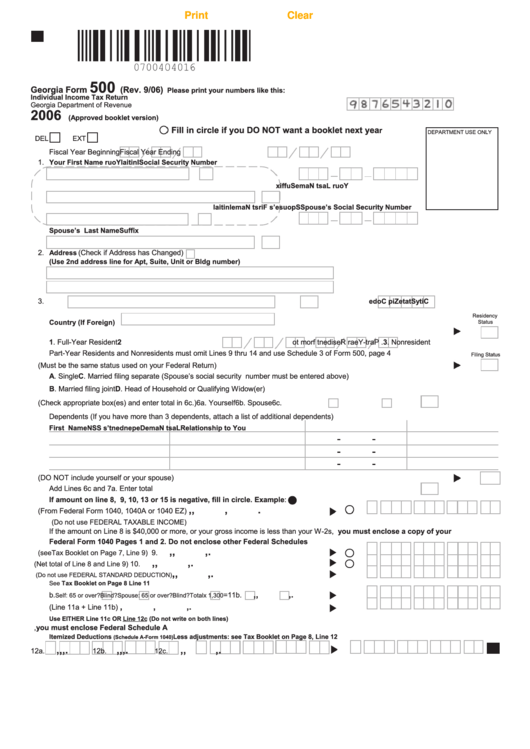

Ga Estimated Tax Form - Web print blank form > georgia department of revenue save form. Web georgia depreciation and amortization form, includes information on listed property. While the state sets a minimal property tax rate, each county and municipality sets its own rate. Complete, edit or print tax forms instantly. Web georgia — estimated quarterly tax return download this form print this form it appears you don't have a pdf plugin for this browser. Download or email 500 es & more fillable forms, register and subscribe now! Web georgia form 500 (rev. Amount due (add lines 6, 8, 9 and 10). Credits and payments of estimated tax. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal.

Web 600 corporation tax return: Information and form for filing georgia corporation tax return. 08/02/21) individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal. Web you may be required to file estimated taxes if your gross income exceeds the sum of the following amounts: Every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a. Web georgia form 500 (rev. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. 602 es corporate estimated tax: Apply for a homestead exemption. Download or email 500 es & more fillable forms, register and subscribe now!

Corporate and partnership estimated tax form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If you’re not yet registered with the gtc, simply. Please use the link below to. Download or email 500 es & more fillable forms, register and subscribe now! Web 600 corporation tax return: 602 es corporate estimated tax: Complete, edit or print tax forms instantly. Follow all instructions to complete the form and be sure to verify that all your information is correct before. Complete, edit or print tax forms instantly.

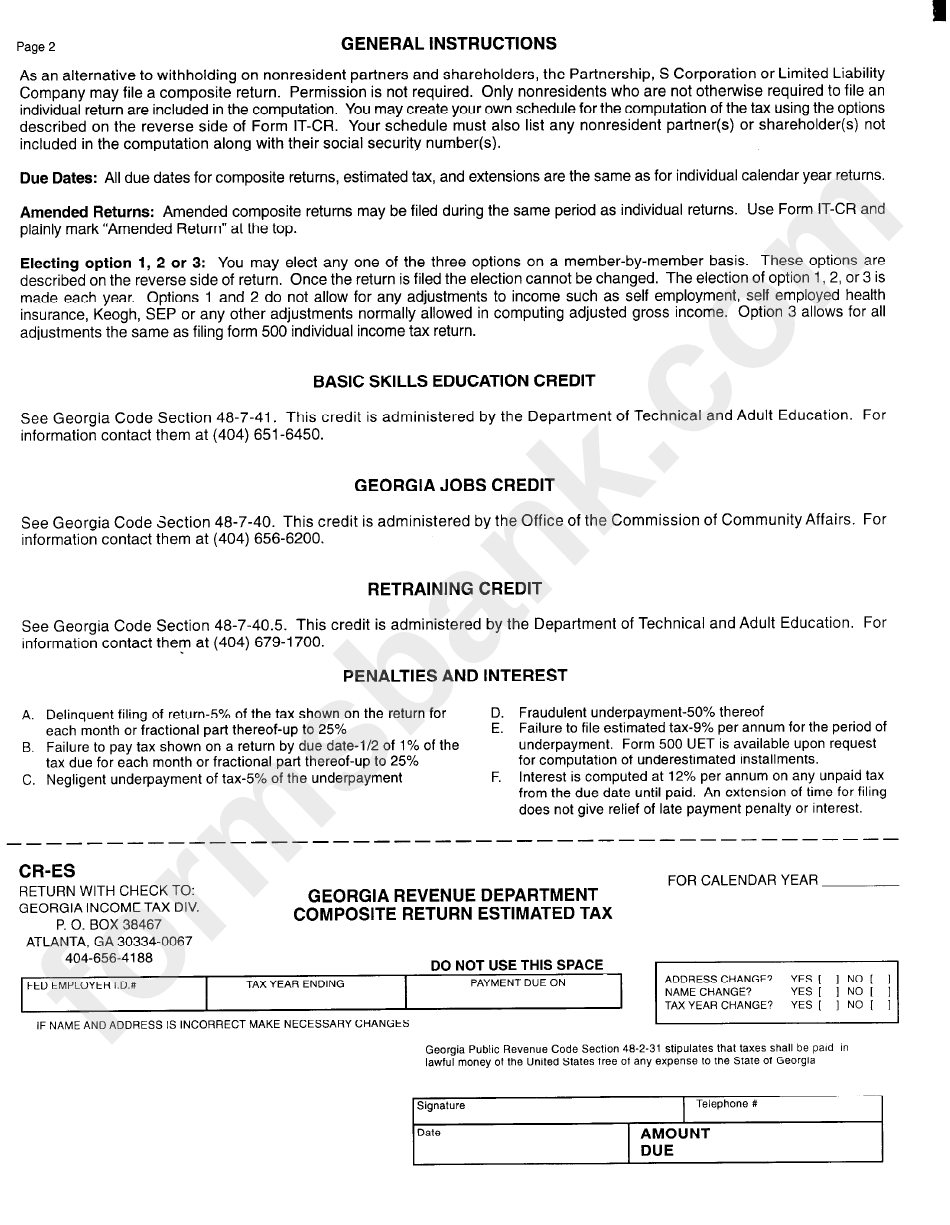

Form CrEs Revenue Department Composite Return Estimated Tax

Complete, save and print the form online. Web georgia form 500 (rev. Web form 500 is the general income tax return form for all georgia residents. Web fill out and submit a form 500 individual income tax return. Web 600 corporation tax return:

Maryland Estimated Tax Form 2020

Web georgia depreciation and amortization form, includes information on listed property. If you’re not yet registered with the gtc, simply. Quickly add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your. Web fill out and submit a form 500 individual income tax return. 500 individual income tax return what's new?

FREE 7+ Sample Federal Tax Forms in PDF

Download or email 500 es & more fillable forms, register and subscribe now! Search sales tax distributions and accounts or verify a georgia sales tax number. Quickly add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your. Web georgia form 500 (rev. Complete, edit or print tax forms instantly.

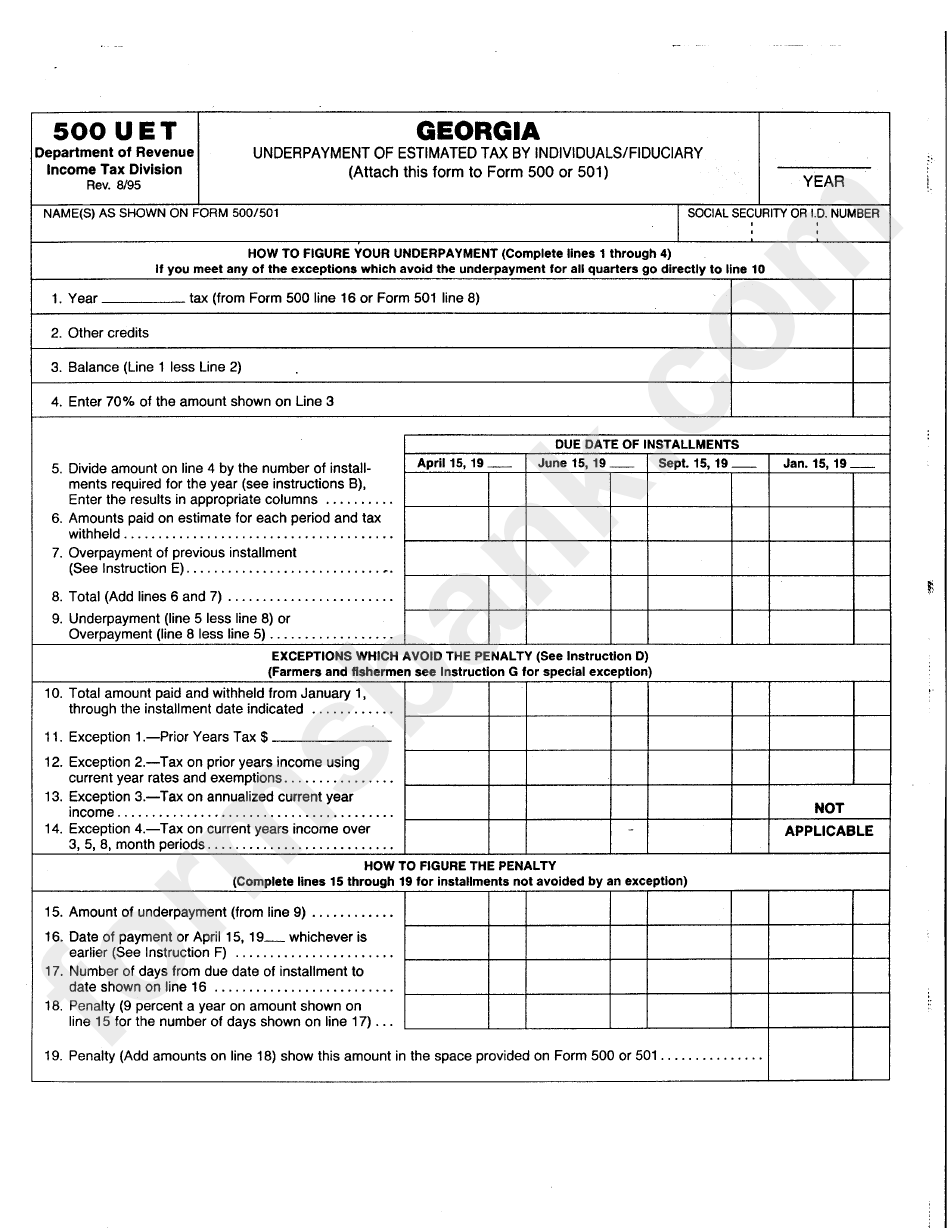

Fillable Form 500uet Underpayment Of Estimated Tax By

Every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal. Credits and payments of estimated tax. 08/02/21) individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal.

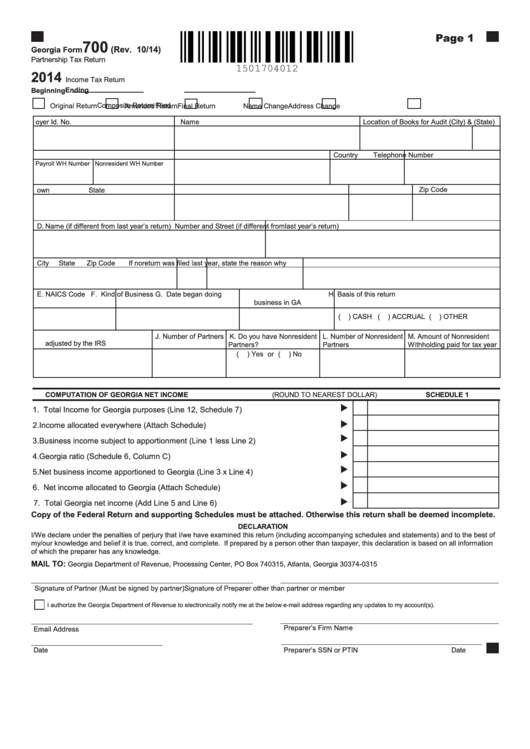

Fillable Form 700 Partnership Tax Return 2014 printable pdf

Apply for a homestead exemption. Download or email 500 es & more fillable forms, register and subscribe now! Corporate and partnership estimated tax form. Total tax (schedule 1, line 8, and schedule 2, line 7). Quickly add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your.

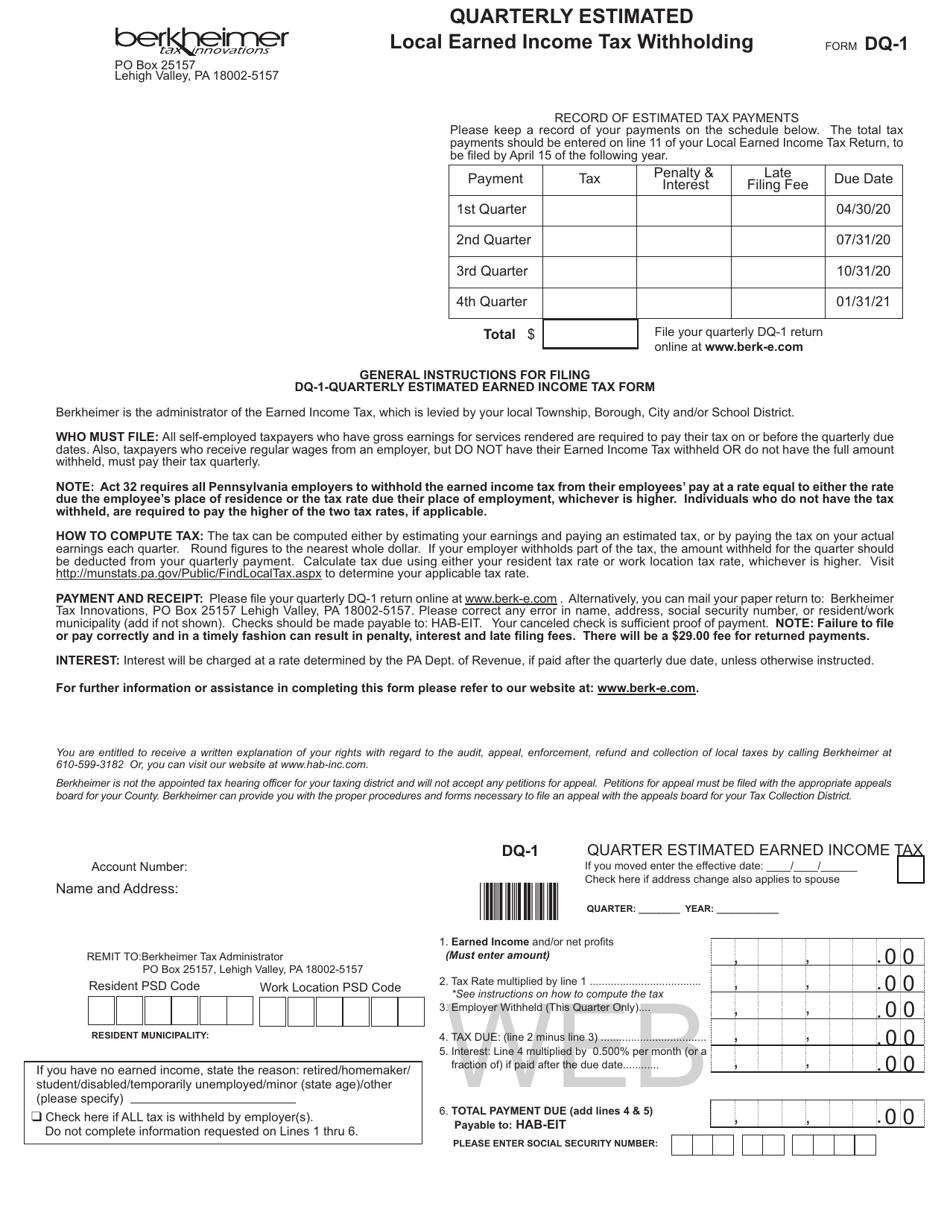

Form DQ1 Download Fillable PDF or Fill Online Quarterly Estimated

Quickly add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your. Credits and payments of estimated tax. Web edit georgia 500 es estimated tax. Please use the link below to. Web fill out and submit a form 500 individual income tax return.

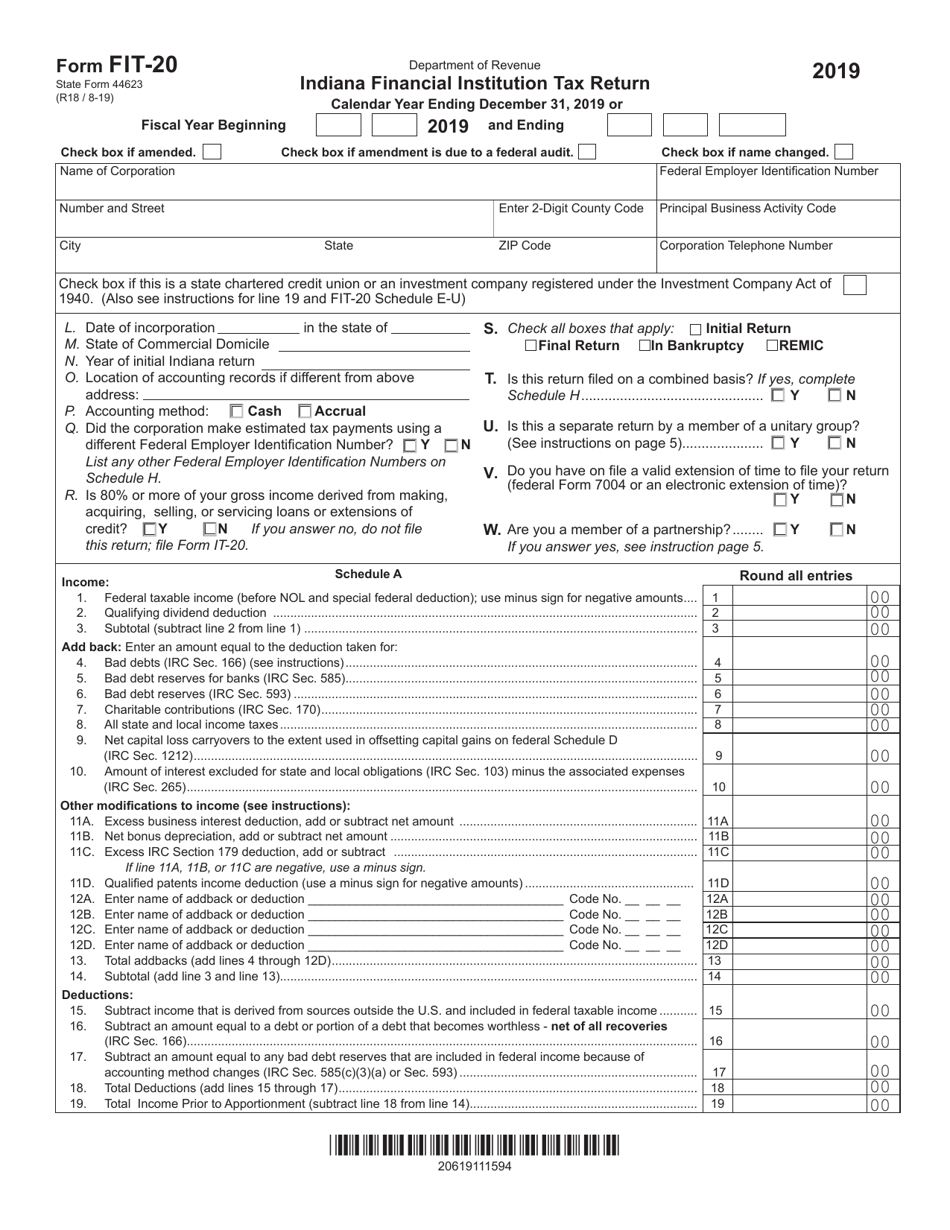

Form FIT20 (State Form 44623) Download Fillable PDF or Fill Online

While the state sets a minimal property tax rate, each county and municipality sets its own rate. Download or email 500 es & more fillable forms, register and subscribe now! Total tax (schedule 1, line 8, and schedule 2, line 7). Please use the link below to. 500 individual income tax return what's new?

FREE 7+ Sample Tax Forms in PDF

Complete, edit or print tax forms instantly. 602 es corporate estimated tax: 500 individual income tax return what's new? Download or email 500 es & more fillable forms, register and subscribe now! Web form 500 es and submit to the georgia department of revenue.

Irs estimated tax payment form

Amount due (add lines 6, 8, 9 and 10). While the state sets a minimal property tax rate, each county and municipality sets its own rate. Download or email 500 es & more fillable forms, register and subscribe now! 08/02/21) individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal. Information and form for.

Web Print Blank Form > Georgia Department Of Revenue Save Form.

Complete, edit or print tax forms instantly. Apply for a homestead exemption. Complete, edit or print tax forms instantly. 602 es corporate estimated tax:

06/20/20) Individual Income Tax Return Georgia Department Of Revenue 2020(Approved Web Vers Ion) Pag E1 Fiscal Yearbeginning Rfission)Cal.

If you’re not yet registered with the gtc, simply. Quickly add and highlight text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your. Web georgia form 500 (rev. While the state sets a minimal property tax rate, each county and municipality sets its own rate.

Web Fill Out And Submit A Form 500 Individual Income Tax Return.

Information and form for filing georgia corporation tax return. Web form 500 is the general income tax return form for all georgia residents. Follow all instructions to complete the form and be sure to verify that all your information is correct before. Amount due (add lines 6, 8, 9 and 10).

Complete, Save And Print The Form Online.

Web georgia depreciation and amortization form, includes information on listed property. Web you may be required to file estimated taxes if your gross income exceeds the sum of the following amounts: Download or email 500 es & more fillable forms, register and subscribe now! Every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a.