Form Il 1065 Instructions

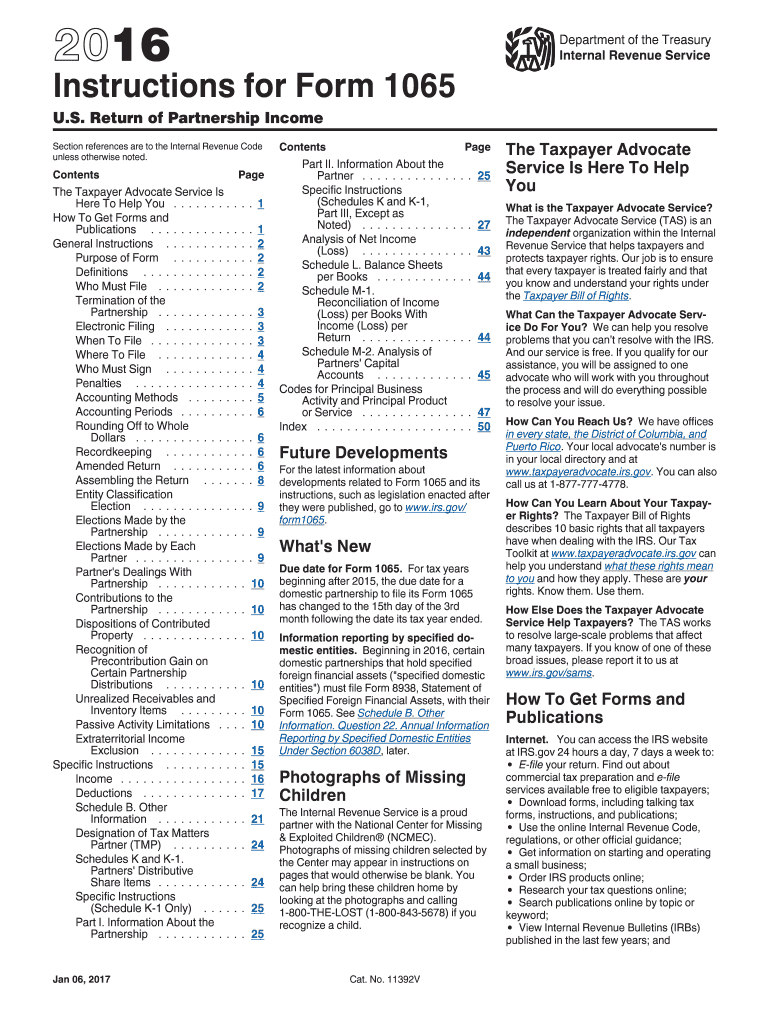

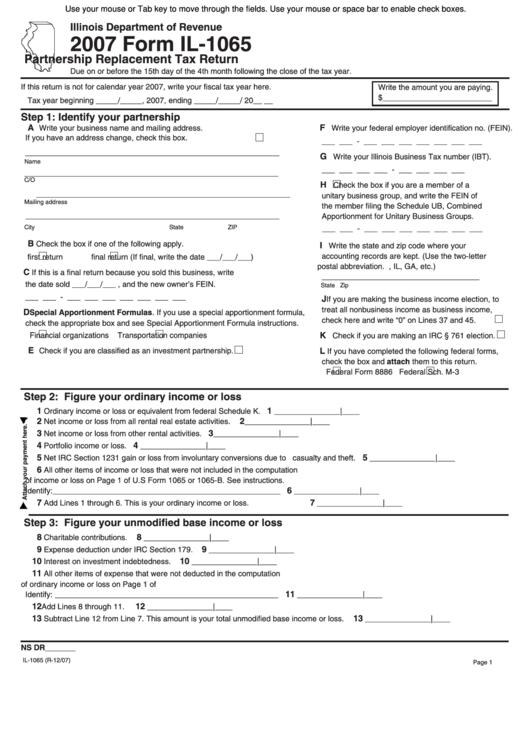

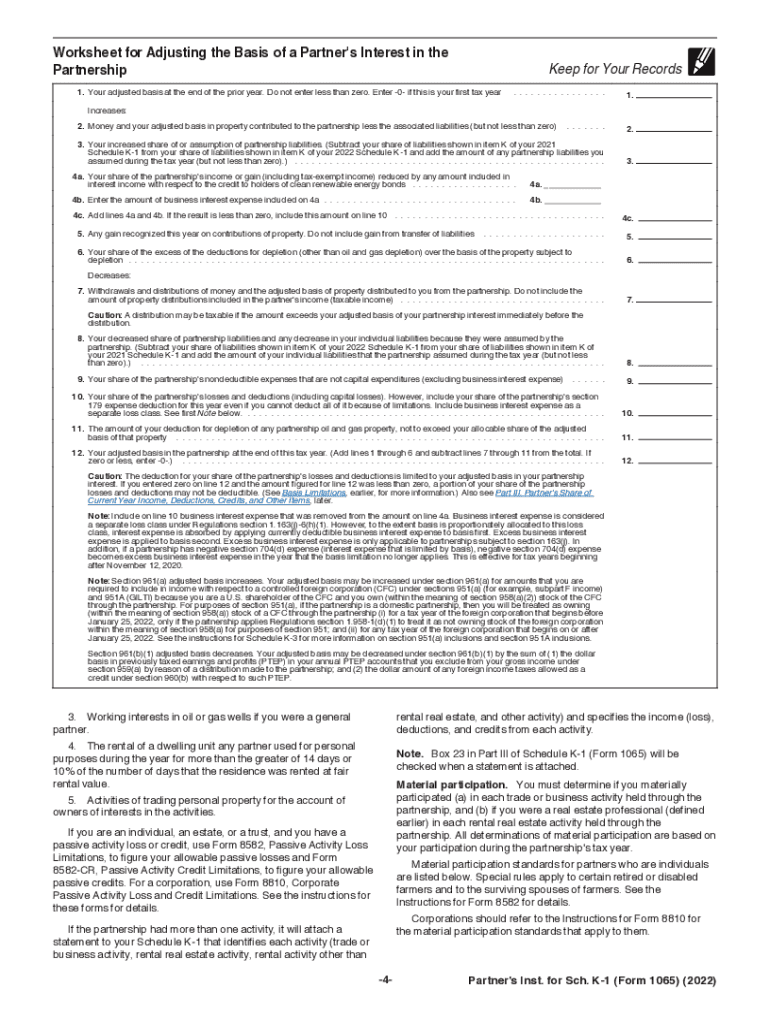

Form Il 1065 Instructions - For all other situations, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Subtract line 6 from line 5, column a. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used. All underwriters who are members of an insurance. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Payment voucher for 2022 partnership replacement.

For all other situations, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. You must round the dollar. Subtract line 6 from line 5, column a. Multiply line 5, column a, by 90% (.9). For all other situations, see instructions to determine the correct form to use. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. All underwriters who are members of an insurance. Web you may not use this form. • from trusts, estates, and.

Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. You must round the dollar. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5). Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used. For prior years, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. All underwriters who are members of an insurance.

Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Web you may not use this form. See the specific instructions for these forms. For prior years, see instructions to determine the.

Fillable Form Il1065 Partnership Replacement Tax Return 2007

You must round the dollar. For all other situations, see instructions to determine the correct form to use. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Payment voucher for 2022 partnership replacement. Enter your complete legal business name.

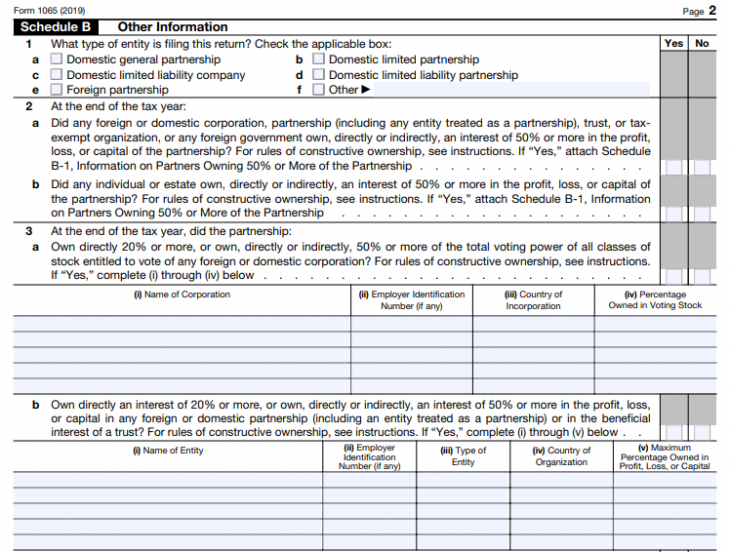

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. For prior years, see instructions to determine the correct form to use. Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment..

Tax Form 1065 Instructions

Enter your complete legal business name. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. For prior years, see instructions to determine the correct form to use. • from trusts, estates, and. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and.

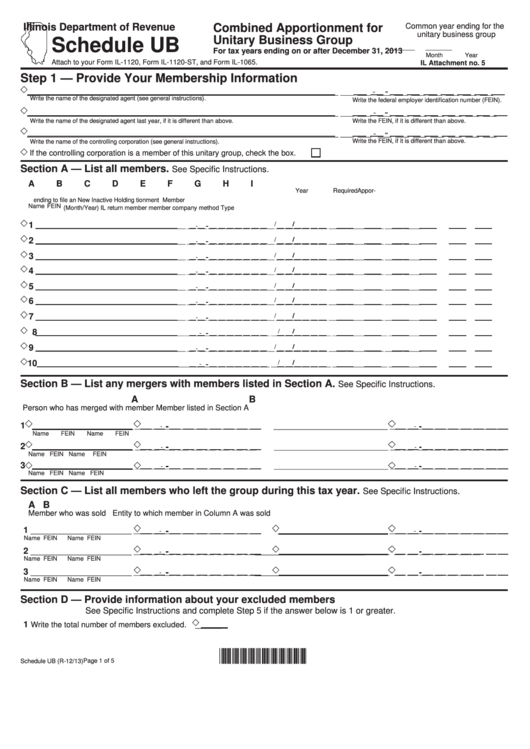

Schedule Ub Attach To Form Il1120, Form Il1120St, And Form Il1065

Enter your complete legal business name. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. You must round the dollar. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5). In addition, complete form 8082, notice of inconsistent treatment.

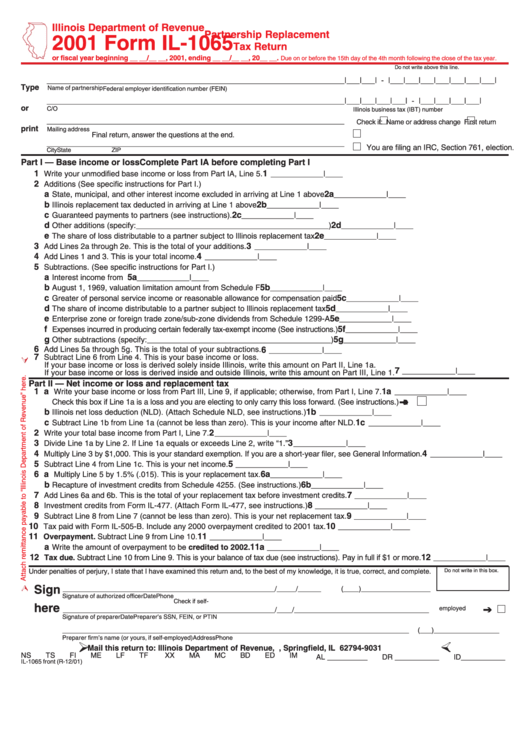

Form Il1065 Partnership Replacement Tax Return 2001 printable pdf

• from trusts, estates, and. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used. For prior years, see instructions to determine the correct form to use. For all other situations, see instructions to determine the correct form to use. See the specific instructions for these forms.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. For prior years, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. • from trusts, estates, and. Web form 1065.

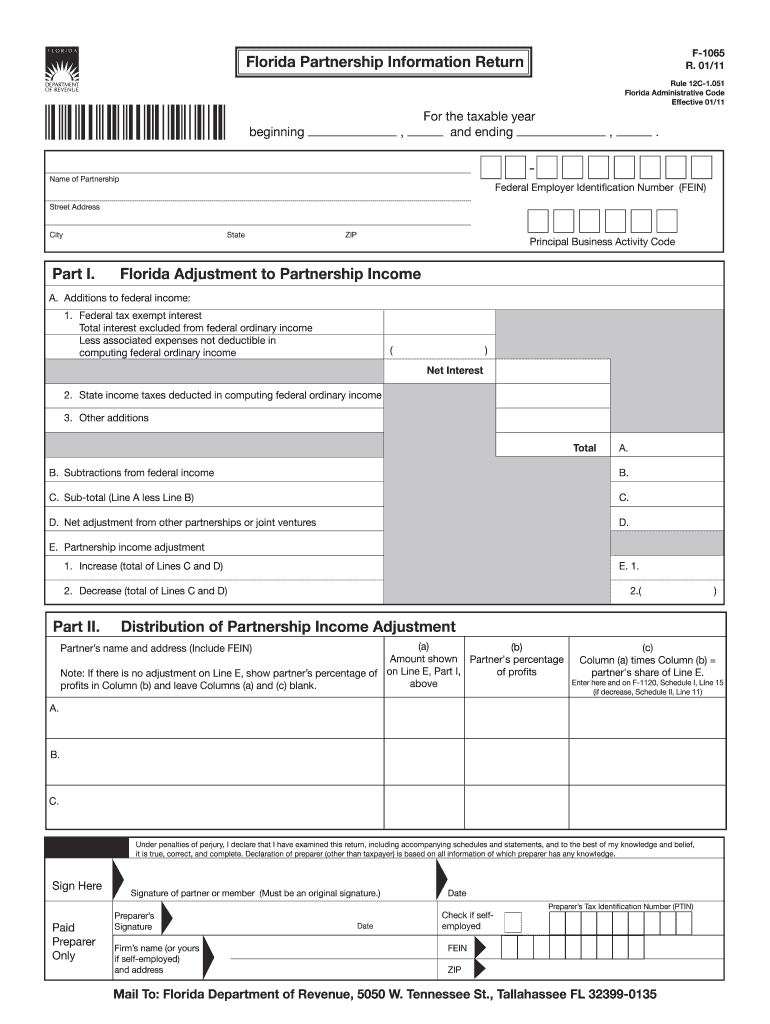

Florida Form F 1065 Instructions Fill Out and Sign Printable PDF

Subtract line 6 from line 5, column a. • from trusts, estates, and. Web you may not use this form. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5). Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065.

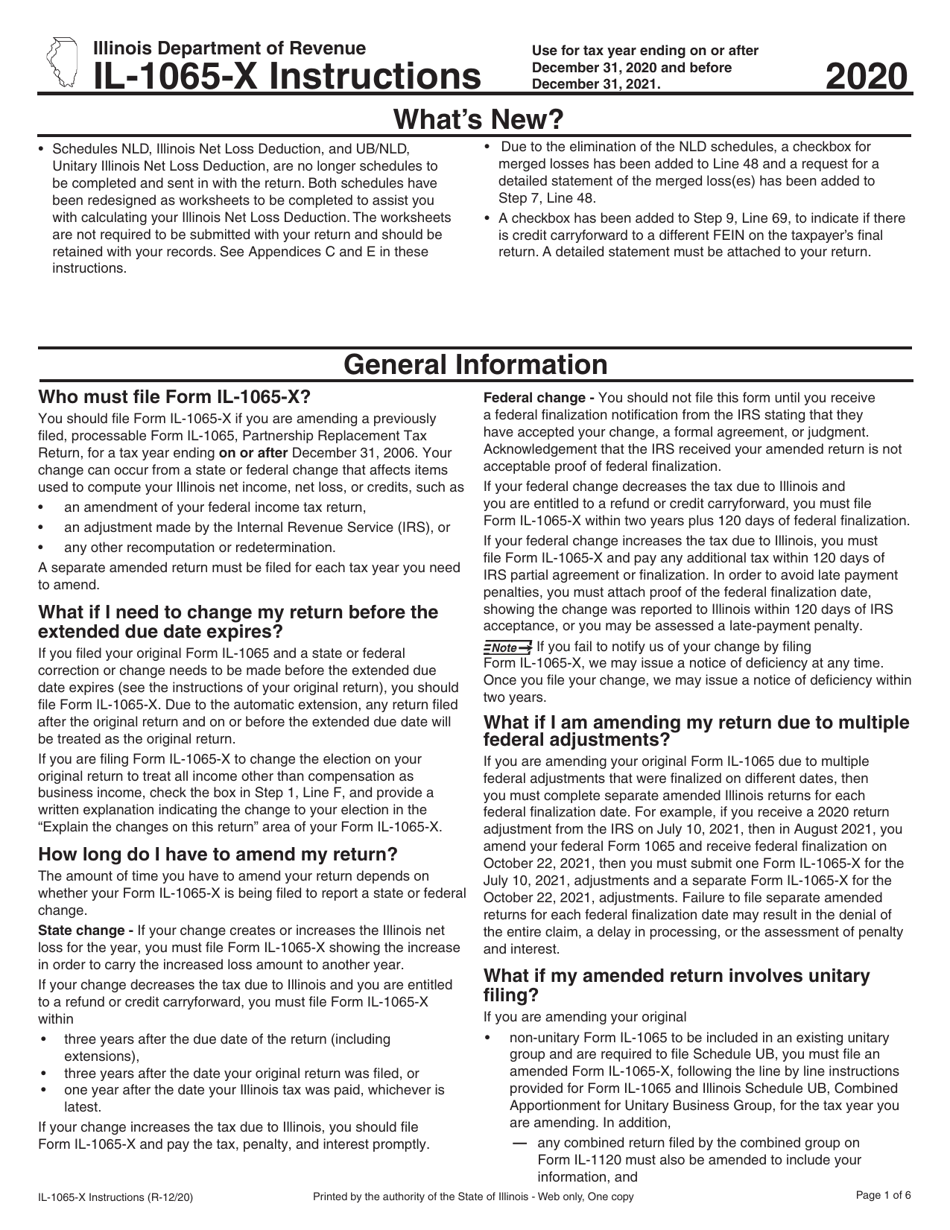

Download Instructions for Form IL1065X Amended Partnership

Enter your complete legal business name. For prior years, see instructions to determine the correct form to use. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. See the specific instructions for these forms. Multiply line 5, column a, by 90% (.9).

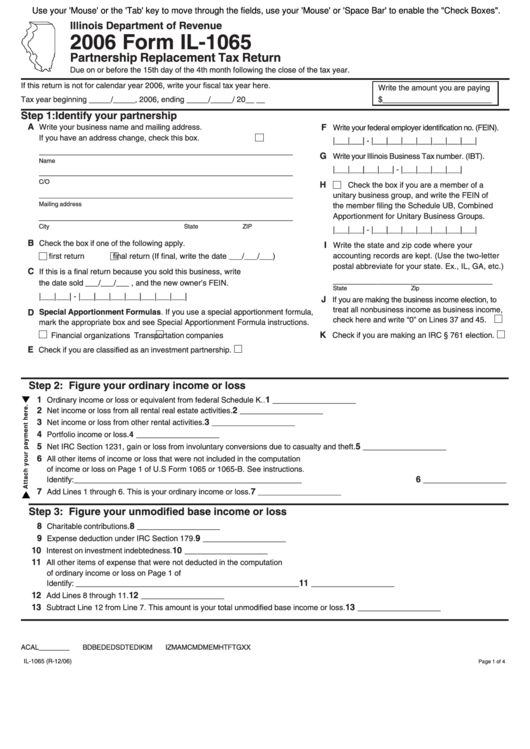

Fillable Form Il1065 Partnership Replacement Tax Return 2006

Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. In addition, complete form 8082, notice of inconsistent treatment. Payment voucher for 2022 partnership replacement. Multiply line 5, column a, by 90% (.9). For all other situations, see instructions to determine.

For All Other Situations, See Instructions To Determine The Correct Form To Use.

Multiply line 5, column a, by 90% (.9). Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. You must round the dollar. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used.

Web This Form Is For Tax Years Ending On Or After December 31, 2022, And Before December 31, 2023.

For all other situations, see instructions to determine the correct form to use. Web you may not use this form. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. All underwriters who are members of an insurance.

See The Specific Instructions For These Forms.

Money order and make it payable to “illinois department of revenue.”) yment is due or you make your payment. Subtract line 6 from line 5, column a. Enter your complete legal business name. • from trusts, estates, and.

Web This Form Is For Tax Years Ending On Or After December 31, 2021, And Before December 31, 2022.

Payment voucher for 2022 partnership replacement. In addition, complete form 8082, notice of inconsistent treatment. For prior years, see instructions to determine the correct form to use. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5).