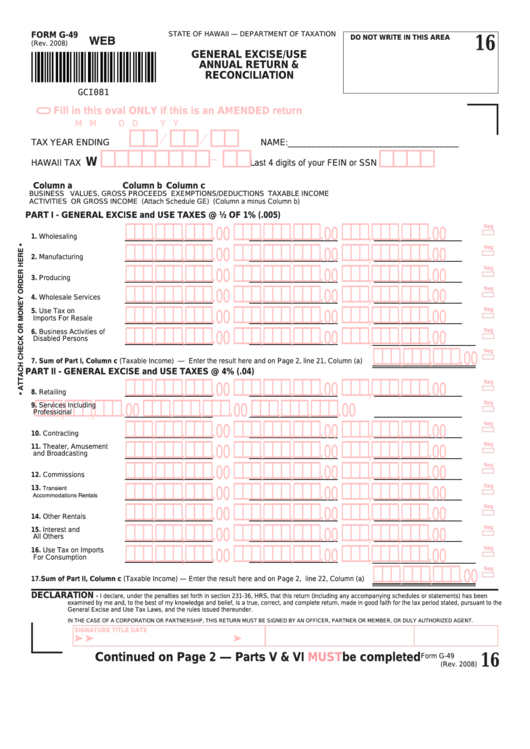

Form G 49

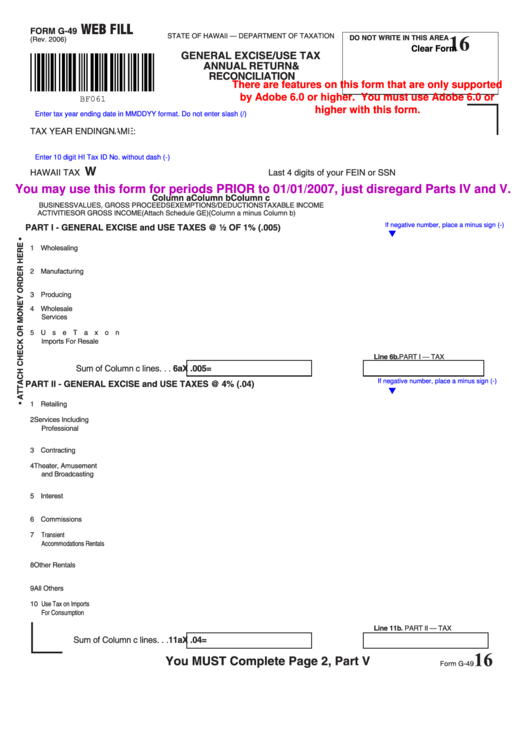

Form G 49 - Web to “hawaii state tax collector” in u.s. If you’ve already filed and reported accurately. This form is used to report the. The form must be filed within fifteen days of the sale or transfer. Start completing the fillable fields. G 49 form is a form that's used to report the amount of taxable income earned by individuals in canada. On your check or money order. The g stands for gross,. Web edit your form g 49 hawaii fillable online type text, add images, blackout confidential details, add comments, highlights and more. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual.

Sign it in a few clicks draw your. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual. On your check or money order. If you’ve already filed and reported accurately. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Web to “hawaii state tax collector” in u.s. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. The g stands for gross,. Use get form or simply click on the template preview to open it in the editor. This form is used to report the.

This return is used by the taxpayer to reconcile their account for the entire. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Write “ge”, the filing period, and your hawaii tax i.d. 2019) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. If you’ve already filed and reported accurately. Start completing the fillable fields. The form must be filed within fifteen days of the sale or transfer. Sign it in a few clicks draw your. The g stands for gross,.

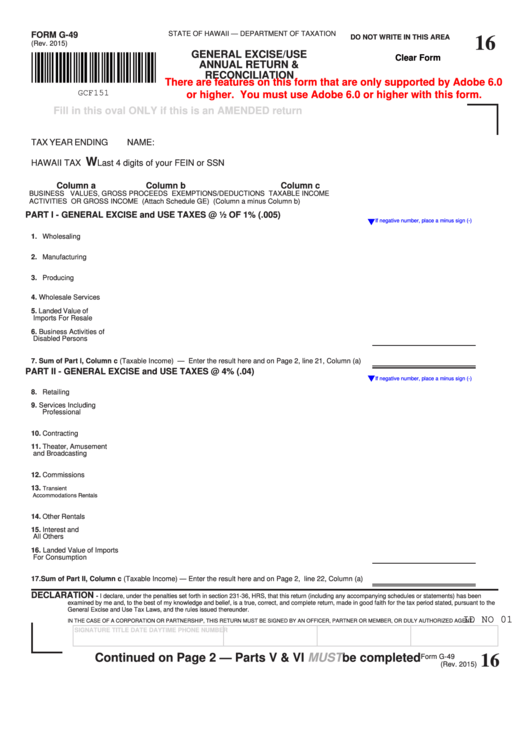

Fillable Form G49 General Excise/use Annual Return & Reconciliation

On your check or money order. The form must be filed within fifteen days of the sale or transfer. Start completing the fillable fields. Sign it in a few clicks draw your. Write “ge”, the filing period, and your hawaii tax i.d.

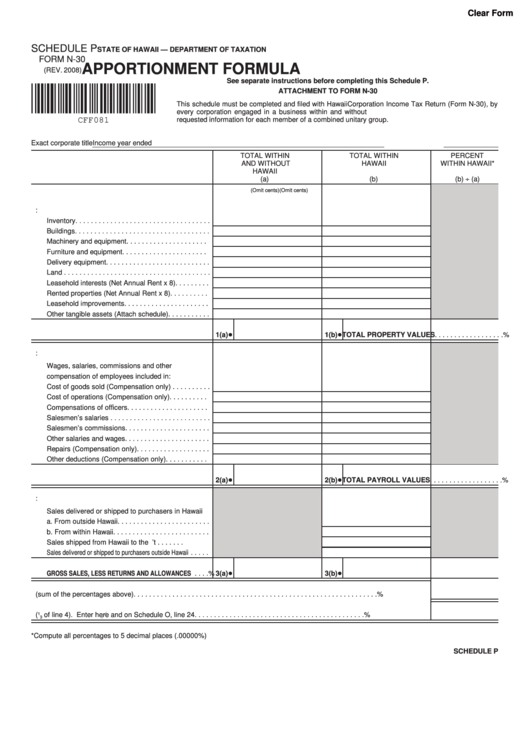

911 Hawaii Tax Forms And Templates free to download in PDF

Sign it in a few clicks draw your. This return is used by the taxpayer to reconcile their account for the entire. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. If you’ve already filed and reported accurately. Web about press copyright contact us creators advertise developers terms privacy.

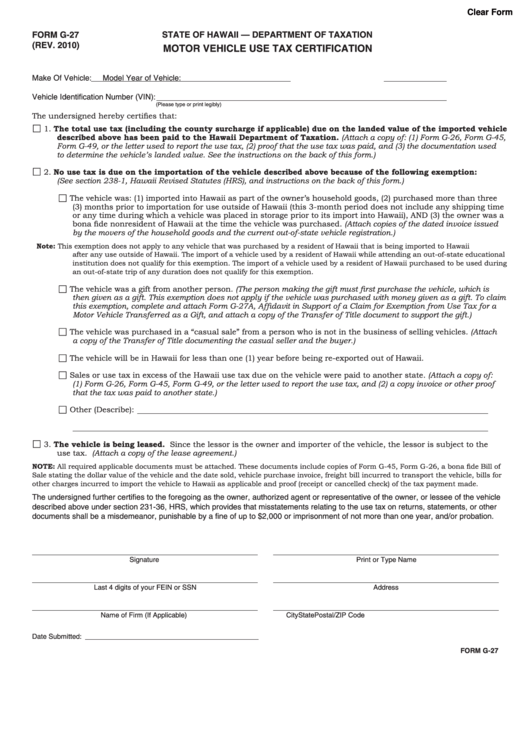

Fillable Form G27 Motor Vehicle Use Tax Certification State Of

This return is used by the taxpayer to reconcile their account for the entire. 2019) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual. Web about press copyright contact us creators advertise.

Form G Form G Locking Pins, Index Plungers Standard Parts Brauer

Write “ge”, the filing period, and your hawaii tax i.d. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. If you’ve already filed and reported accurately. The form must be filed within fifteen days of the sale or transfer. Sign it in a few clicks draw your.

G 49 Form Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks draw your. Web form g 49 is used to report the sale or transfer of a foreign corporation's shares. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. G 49 form is a form that's used to report.

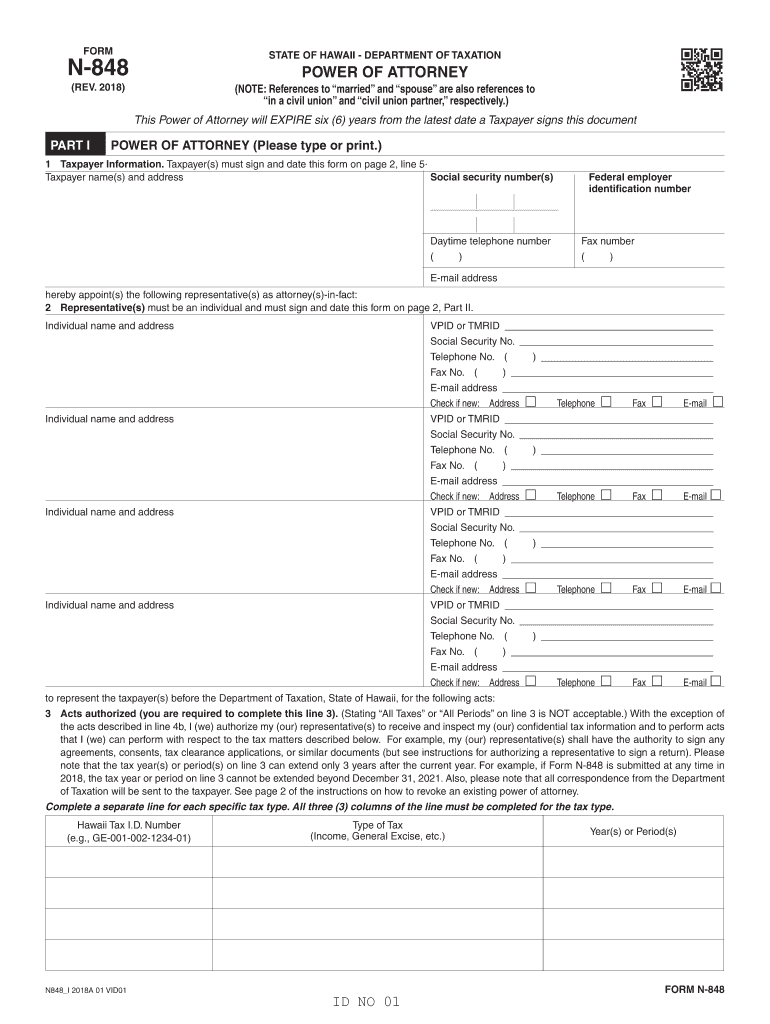

HI DoT N848 2018 Fill out Tax Template Online US Legal Forms

This return is used by the taxpayer to reconcile their account for the entire. If you’ve already filed and reported accurately. Sign it in a few clicks draw your. The g stands for gross,. Web edit your form g 49 hawaii fillable online type text, add images, blackout confidential details, add comments, highlights and more.

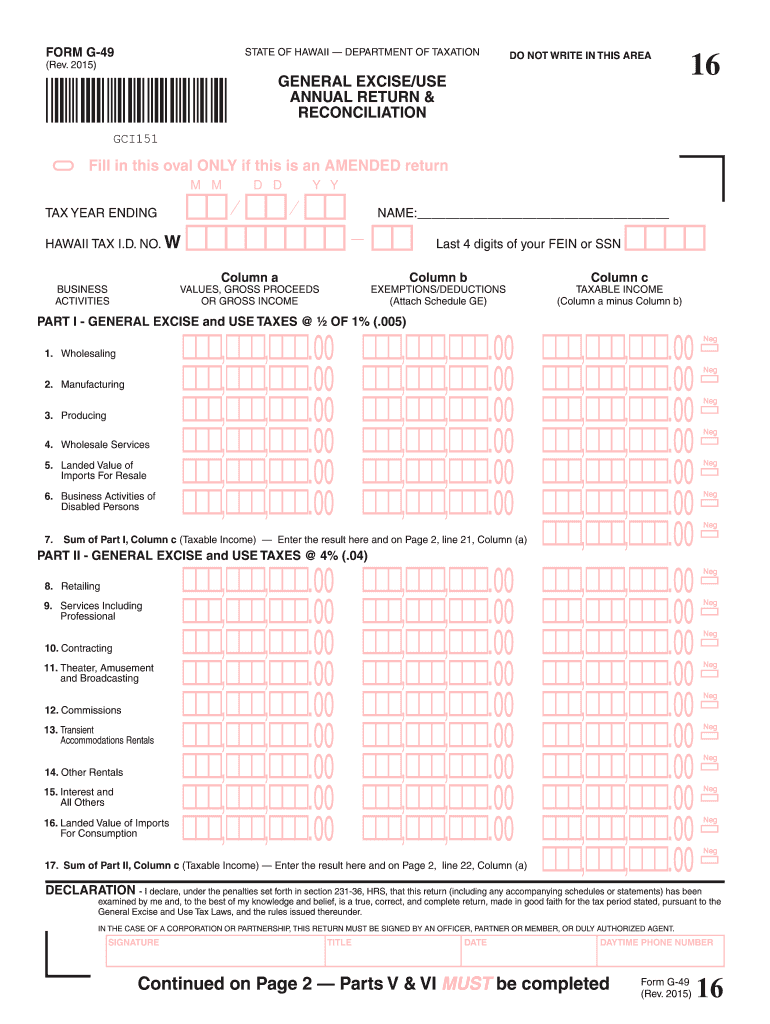

Fillable Form G49 General Excise/use Annual Return & Reconciliation

Use get form or simply click on the template preview to open it in the editor. This form is used to report the. 2019) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. Start completing the fillable fields. Web form g 49 is used to report the sale or transfer.

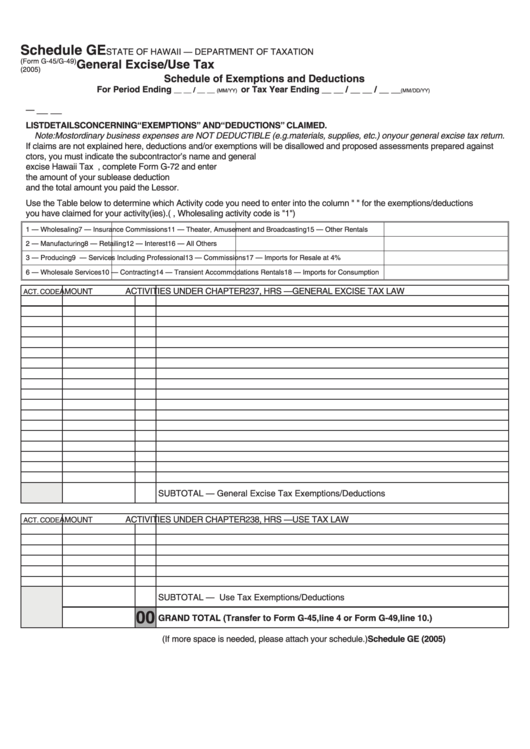

Form G45/g49 Schedule Ge General Excise/use Tax printable pdf

Start completing the fillable fields. Web edit your form g 49 hawaii fillable online type text, add images, blackout confidential details, add comments, highlights and more. If you’ve already filed and reported accurately. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual. 2019) state of hawaii — department of taxation do.

Fillable Form G49 General Excise/use Tax Annual Return

This form is used to report the. Start completing the fillable fields. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. Sign it in a few clicks draw your. 2019) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &.

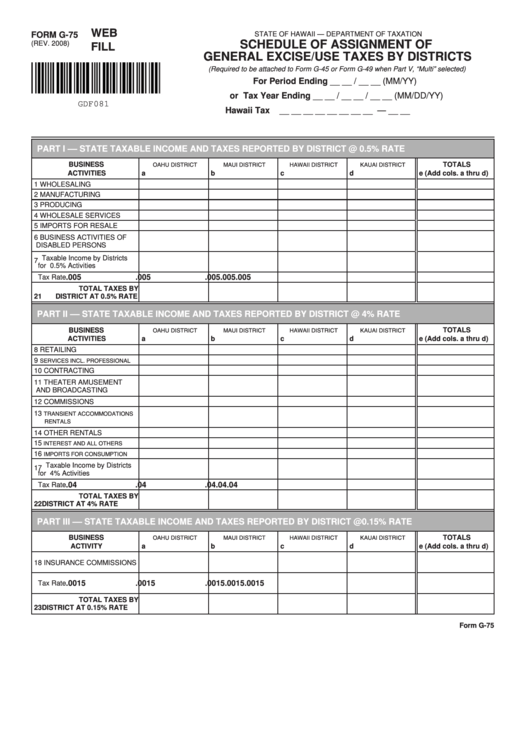

Fillable Form G75 Schedule Of Assignment Of General Excise/use Taxes

This form is used to report the. Sign it in a few clicks draw your. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual. 2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. The g stands for gross,.

The Form Must Be Filed Within Fifteen Days Of The Sale Or Transfer.

2017) state of hawaii — department of taxation do not write in this area 16 general excise/use annual return &. Web to “hawaii state tax collector” in u.s. This form is used to report the. 2015) gci151 = state of hawaii — department of taxationdo not write in this area 16 general excise/useannual.

2019) State Of Hawaii — Department Of Taxation Do Not Write In This Area 16 General Excise/Use Annual Return &.

Write “ge”, the filing period, and your hawaii tax i.d. On your check or money order. This return is used by the taxpayer to reconcile their account for the entire. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Sign it in a few clicks draw your. Web form g 49 is used to report the sale or transfer of a foreign corporation's shares. Web edit your form g 49 hawaii fillable online type text, add images, blackout confidential details, add comments, highlights and more. G 49 form is a form that's used to report the amount of taxable income earned by individuals in canada.

Start Completing The Fillable Fields.

The g stands for gross,. If you’ve already filed and reported accurately.